Home Insurance Estimator

When it comes to safeguarding your home and belongings, having the right insurance coverage is crucial. However, determining the appropriate level of coverage and estimating the associated costs can be a complex task. That's where the Home Insurance Estimator comes in – a valuable tool designed to simplify the process and provide homeowners with an accurate assessment of their insurance needs.

The Home Insurance Estimator: Unlocking Accurate Coverage and Cost Estimation

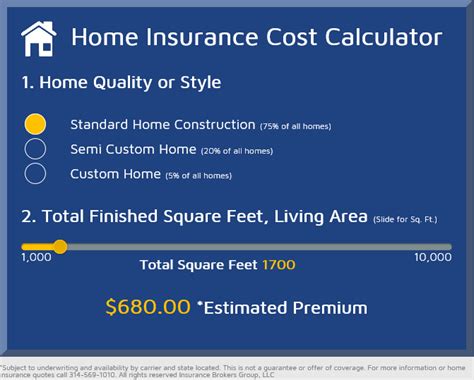

The Home Insurance Estimator is an innovative solution that leverages advanced algorithms and industry expertise to offer personalized insurance recommendations. By inputting specific details about your home, its location, and your desired coverage preferences, this estimator provides a comprehensive overview of the insurance landscape tailored to your unique circumstances.

One of the key advantages of using the Home Insurance Estimator is its ability to navigate the intricate world of insurance policies with ease. With a wide range of coverage options available, from standard home insurance to specialized plans for high-value items or unique circumstances, the estimator guides you through the process, ensuring you understand the nuances and make informed decisions.

Factors Influencing Home Insurance Costs

When estimating home insurance costs, several critical factors come into play. The estimator considers the value of your home, its location, and the specific coverage options you select. Additionally, personal factors such as your claims history, credit score, and the presence of security features can impact the final estimate.

| Factor | Description |

|---|---|

| Home Value | The replacement cost of your home, including the structure and any permanent fixtures. |

| Location | Your home's geographical location, including considerations for natural disasters, crime rates, and proximity to emergency services. |

| Coverage Options | The specific types of coverage you choose, such as liability, dwelling, personal property, and additional endorsements. |

| Personal Factors | Your individual circumstances, including claims history, credit score, and security features installed in your home. |

By analyzing these factors, the Home Insurance Estimator provides an accurate estimate of the insurance premium you can expect. It takes into account the likelihood of different risks and the potential costs associated with each, ensuring a comprehensive and realistic assessment.

The Comprehensive Coverage Options

The Home Insurance Estimator offers a wide array of coverage options to cater to the diverse needs of homeowners. Whether you’re seeking standard coverage for your dwelling, comprehensive protection for your personal belongings, or specialized insurance for unique assets, the estimator guides you through the process, explaining the nuances of each option.

- Dwelling Coverage: This covers the structure of your home, including the walls, roof, and permanent fixtures. It ensures that in the event of damage or destruction, you can rebuild or repair your home to its pre-loss condition.

- Personal Property Coverage: This provides protection for your belongings, such as furniture, electronics, and clothing. In the event of a loss, this coverage helps replace or repair your personal items.

- Liability Coverage: Protects you against legal claims and lawsuits arising from accidents or injuries that occur on your property. It covers medical expenses and potential damages, providing peace of mind.

- Additional Endorsements: For specialized needs, additional endorsements can be added to your policy. These include coverage for high-value items like jewelry, art, or collectibles, as well as unique circumstances such as water backup or identity theft protection.

The Home Insurance Estimator breaks down these coverage options, explaining the benefits and potential costs associated with each. By understanding the specific risks and protections offered, homeowners can make informed decisions about the level of coverage they require.

The Benefits of Using the Home Insurance Estimator

Utilizing the Home Insurance Estimator offers several significant advantages to homeowners. Firstly, it streamlines the insurance estimation process, providing quick and accurate results based on your unique circumstances. This saves time and effort, allowing you to focus on other aspects of homeownership.

Secondly, the estimator empowers homeowners with knowledge. By understanding the factors that influence insurance costs and the coverage options available, you can make informed decisions about your insurance needs. This ensures you have the right level of protection without paying for unnecessary coverage.

Additionally, the Home Insurance Estimator provides a platform for comparing insurance providers and their offerings. By inputting your details, you can receive estimates from multiple insurers, allowing you to evaluate their policies, premiums, and coverage options side by side. This level of transparency enables you to choose the insurer that best aligns with your needs and budget.

Real-World Examples and Case Studies

To illustrate the effectiveness of the Home Insurance Estimator, let’s explore a few real-world examples and case studies. These scenarios showcase how the estimator provides accurate estimates and guides homeowners towards appropriate coverage.

Case Study 1: A homeowner in a high-risk area for hurricanes seeks insurance coverage. The Home Insurance Estimator considers the location's susceptibility to hurricanes, the home's value, and the desired coverage options. It provides an estimate that includes hurricane deductibles and additional coverage for wind damage, ensuring the homeowner is adequately protected.

Case Study 2: A family with high-value art collections and jewelry seeks specialized insurance coverage. The estimator takes into account the value of their possessions and recommends adding endorsements for fine arts and jewelry coverage. By following the estimator's guidance, the family secures comprehensive protection for their valuable assets.

Case Study 3: A homeowner with a long history of claims due to accidental damages seeks insurance coverage. The Home Insurance Estimator factors in their claims history and provides an estimate that includes a higher premium to account for the increased risk. This ensures the homeowner is aware of the potential costs associated with their claims history.

These real-world examples demonstrate the accuracy and practicality of the Home Insurance Estimator. By considering specific circumstances and providing tailored recommendations, the estimator ensures homeowners receive the coverage they need without overspending.

Future Implications and Industry Insights

The Home Insurance Estimator is a valuable tool that continues to evolve with advancements in technology and changes in the insurance industry. As data becomes more accessible and algorithms improve, the estimator’s accuracy and efficiency are expected to enhance further.

Looking ahead, the integration of artificial intelligence and machine learning algorithms could revolutionize the insurance estimation process. These technologies can analyze vast amounts of data, including historical claims, weather patterns, and property characteristics, to provide even more precise estimates. Additionally, the use of drones and satellite imagery for property assessments could enhance the accuracy of home insurance estimations.

Furthermore, the Home Insurance Estimator can play a pivotal role in promoting transparency and consumer education. By providing homeowners with a comprehensive understanding of insurance coverage and costs, it empowers them to make informed decisions. This, in turn, can lead to better risk management and a more efficient insurance market.

In conclusion, the Home Insurance Estimator is a powerful tool that simplifies the complex process of estimating insurance coverage and costs. By considering a range of factors and offering personalized recommendations, it ensures homeowners receive accurate and tailored insurance solutions. With its continued evolution and integration of advanced technologies, the Home Insurance Estimator will remain a valuable asset for homeowners, guiding them towards adequate protection and financial security.

How often should I review my home insurance coverage and estimate?

+It is recommended to review your home insurance coverage and estimate at least once a year. Changes in your home’s value, location, or personal circumstances may impact your insurance needs. Regular reviews ensure you have adequate coverage and that your premiums remain competitive.

Can the Home Insurance Estimator provide estimates for specialized coverage, such as flood insurance or earthquake coverage?

+Yes, the Home Insurance Estimator is designed to provide estimates for a wide range of coverage options, including specialized policies like flood insurance and earthquake coverage. It considers the unique risks associated with these natural disasters and provides tailored estimates accordingly.

What if I have multiple homes or rental properties? Can the estimator accommodate my needs?

+Absolutely! The Home Insurance Estimator is versatile and can accommodate the insurance needs of multiple properties. Whether you own a primary residence, rental properties, or vacation homes, the estimator can provide estimates for each, ensuring you have comprehensive coverage for all your assets.