Home Insurance Orlando Fl

Home insurance is a crucial aspect of protecting your largest investment: your home. In Orlando, Florida, a city known for its vibrant culture, thriving tourism, and susceptibility to natural disasters, having comprehensive home insurance coverage is paramount. This article aims to provide an in-depth exploration of home insurance in Orlando, covering everything from the unique challenges and risks specific to the area to the best practices for choosing the right coverage and providers.

Understanding Orlando’s Unique Risks and Challenges

Orlando, nestled in Central Florida, presents a unique set of circumstances when it comes to home insurance. The region is prone to various natural hazards, including hurricanes, tropical storms, tornadoes, and flooding. These frequent weather events can pose significant threats to homeowners, often resulting in extensive property damage.

Moreover, Orlando's proximity to the coast makes it vulnerable to the powerful winds and storm surges associated with hurricanes. The city's location within the Hurricane Alley increases the likelihood of experiencing these severe weather phenomena. The 2022 hurricane season, for instance, brought Category 4 Hurricane Ian, which caused unprecedented damage across Florida, highlighting the urgent need for robust home insurance coverage in the region.

Florida’s Unique Home Insurance Landscape

Florida’s home insurance market is distinct from many other states due to its high exposure to natural disasters. As a result, insurers often employ different strategies and policies to manage their risk exposure.

One common practice is the use of hurricane deductibles. These are separate deductibles that apply specifically to damage caused by hurricanes or named storms. The amount of the deductible can vary based on factors like the home's location, construction, and the insurer's risk assessment. For example, a home in Orlando might have a hurricane deductible of $2,500, which means the homeowner would pay this amount out-of-pocket before their insurance coverage kicks in for hurricane-related damages.

Another unique aspect of Florida's home insurance market is the presence of the Florida Hurricane Catastrophe Fund (FHCF). This state-run entity provides reinsurance coverage to insurance companies, helping them manage their exposure to hurricane risks. While the FHCF aims to stabilize the market and ensure coverage availability, it doesn't provide direct coverage to homeowners.

Evaluating Your Coverage Needs

When it comes to home insurance in Orlando, understanding your specific coverage needs is crucial. The right coverage ensures that you’re adequately protected without paying for unnecessary benefits.

Assessing Your Home’s Value and Replacement Cost

The first step in determining your coverage needs is to accurately assess the value of your home and its replacement cost. This value should consider the cost of rebuilding your home from the ground up, including the materials and labor required. It’s important to note that this value might differ from your home’s market value, especially if your home has unique features or is in a high-demand area.

For instance, if your Orlando home is a historic property with unique architectural details, the replacement cost could be significantly higher than the market value due to the specialized materials and craftsmanship required.

| Home Value | Replacement Cost |

|---|---|

| $350,000 | $400,000 |

Considering Additional Coverage Options

Beyond the basic coverage for your home’s structure, you’ll want to consider additional coverages that address your specific needs and risks. Here are some key considerations:

- Personal Property Coverage: This covers the contents of your home, such as furniture, electronics, and clothing. It's important to ensure you have enough coverage to replace all your belongings, taking into account their current value, not just what you paid for them.

- Liability Coverage: This protects you against claims and lawsuits if someone is injured on your property or if your actions cause damage to others. It's a crucial aspect of your policy, especially if you frequently host guests or have a pool or other potential hazards on your property.

- Additional Living Expenses: In the event your home becomes uninhabitable due to a covered loss, this coverage helps with the extra costs of temporary housing and meals.

- Flood Insurance: Orlando, like much of Florida, is prone to flooding. Standard home insurance policies typically do not cover flood damage. Therefore, purchasing separate flood insurance is often recommended to ensure comprehensive protection.

Choosing the Right Home Insurance Provider

Selecting the right home insurance provider is a critical step in ensuring you get the coverage you need at a competitive price. Here’s a closer look at some key factors to consider when choosing an insurer.

Understanding Coverage Options and Policies

Different insurance companies offer a range of coverage options and policies. It’s important to thoroughly understand what each policy covers and excludes. For instance, some policies might have more restrictive definitions of covered perils, while others might offer more comprehensive coverage for specific risks like water damage or mold.

Additionally, pay attention to the policy's limits and deductibles. Limits refer to the maximum amount the insurer will pay for a covered loss, while deductibles are the amount you must pay out-of-pocket before the insurance coverage begins. For Orlando homeowners, it's crucial to understand how these factors relate to hurricane coverage, as deductibles can be higher and limits can be more restrictive for hurricane-related claims.

Comparing Prices and Discounts

Home insurance premiums can vary significantly between providers, so it’s important to compare prices. Get quotes from multiple insurers to ensure you’re getting a competitive rate. Also, look for discounts that could lower your premiums. Many insurers offer discounts for things like:

- Bundling home and auto insurance

- Having certain safety features in your home (e.g., smoke detectors, burglar alarms)

- Being claim-free for a certain period

- Being a long-time customer

- Paying your premium in full upfront

Assessing Customer Service and Claims Handling

The quality of an insurance company’s customer service and claims handling can make a significant difference, especially in the event of a loss. Look for providers with a good reputation for prompt and fair claims processing. Consider factors like:

- Response time to claims

- Ease of communication (phone, email, online portal)

- Customer satisfaction ratings

- Reviews and testimonials from other policyholders

Protecting Your Home from Orlando’s Unique Risks

Orlando’s unique climate and susceptibility to natural disasters mean that homeowners need to take extra precautions to protect their properties.

Hurricane Preparation and Mitigation Measures

Given the high risk of hurricanes in Orlando, it’s essential to take proactive measures to prepare for and mitigate potential damage. This can include:

- Installing hurricane shutters or impact-resistant windows and doors to protect against high winds and flying debris.

- Strengthening your roof with hurricane straps or clips to prevent uplift during high winds.

- Trimming trees and removing dead branches to reduce the risk of them falling on your home during a storm.

- Investing in a generator to provide backup power during outages.

- Creating a hurricane preparedness kit with essential supplies.

Addressing Flood Risks

Orlando’s flat topography and proximity to bodies of water can make it susceptible to flooding, especially during heavy rainfall or storm surges. Here are some steps to mitigate flood risks:

- Elevate electrical outlets and appliances to reduce the risk of water damage.

- Consider installing a sump pump to help remove water from your basement or crawlspace.

- If your home is in a high-risk flood zone, consider investing in flood barriers or floodgates to prevent water from entering your home.

- Purchase flood insurance to protect your home and belongings in the event of a flood.

Navigating the Home Insurance Claims Process

In the event of a covered loss, it’s important to know how to navigate the claims process to ensure you receive the benefits you’re entitled to.

Filing a Claim: Steps and Considerations

When filing a claim, the first step is to contact your insurance provider as soon as possible. Provide them with a detailed description of the damage and any supporting documentation you have, such as photos or videos. It’s important to be thorough in your description to ensure that all the damage is accurately assessed.

You'll also want to take reasonable steps to prevent further damage and mitigate your losses. For example, if a storm has caused a tree to fall on your roof, you should remove the tree and temporarily cover the roof to prevent water damage until repairs can be made. Your insurer may have specific guidelines for what they consider reasonable mitigation measures, so it's a good idea to consult with them before taking any action.

Understanding Your Rights and Responsibilities

As a policyholder, you have certain rights and responsibilities when it comes to the claims process. Your rights typically include the right to a fair and timely assessment of your claim, as well as the right to appeal if you feel your claim has been unfairly denied or undervalued. Your responsibilities include providing accurate and complete information about the claim and cooperating with the insurer’s investigation.

It's important to review your policy documents to fully understand your rights and responsibilities. If you have any questions or concerns, don't hesitate to reach out to your insurance provider or seek legal advice if necessary.

Dealing with Disputes and Delays

Unfortunately, disputes and delays can sometimes arise during the claims process. If your claim is denied or you feel the settlement offer is insufficient, you have the right to appeal the decision. Your insurer should provide you with information on their internal appeals process. If you’re still dissatisfied, you may be able to seek mediation or arbitration, or even take legal action.

Delays in the claims process can be frustrating, especially when you're dealing with the aftermath of a loss. Common causes of delays include incomplete or inaccurate claim information, complex or extensive damage that requires more time to assess, or a high volume of claims due to a major event like a hurricane. If your claim is taking longer than you expect, reach out to your insurer to inquire about the status and potential timeline for resolution.

Conclusion: Securing Your Orlando Home with Comprehensive Insurance

Orlando, Florida, presents unique challenges when it comes to home insurance due to its vulnerability to natural disasters. However, with a thorough understanding of the risks, a careful evaluation of your coverage needs, and a strategic approach to choosing the right insurance provider, you can ensure that your home is adequately protected. By taking proactive measures to prepare for and mitigate potential damage, you can further enhance your peace of mind and financial security.

What is the average cost of home insurance in Orlando, Florida?

+

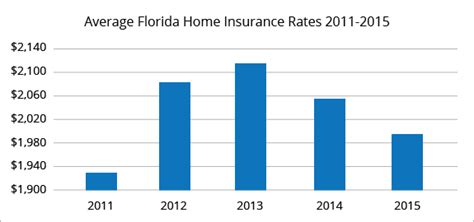

The average cost of home insurance in Orlando can vary based on factors such as the home’s value, location, and the level of coverage chosen. According to data from the Florida Office of Insurance Regulation, the average annual premium for a standard homeowners insurance policy in Florida was $2,289 in 2021. However, it’s important to note that rates can differ significantly depending on the specific circumstances of each home and the chosen insurer.

Are there any discounts available for home insurance in Orlando?

+

Yes, there are often discounts available for home insurance in Orlando. These can include discounts for bundling home and auto insurance, having certain safety features like smoke detectors or burglar alarms, being claim-free for a certain period, being a long-time customer, and paying your premium in full upfront. It’s worth discussing potential discounts with your insurance provider to see if you’re eligible for any savings.

What is a hurricane deductible, and how does it work in Orlando?

+

A hurricane deductible is a separate deductible that applies specifically to damage caused by hurricanes or named storms. In Orlando, where hurricanes are a significant risk, many insurance policies include a hurricane deductible. This means that in the event of a hurricane, you would pay this amount out-of-pocket before your insurance coverage kicks in for hurricane-related damages. The amount of the hurricane deductible can vary based on factors like the home’s location, construction, and the insurer’s risk assessment.