Home Insurance Rankings

When it comes to safeguarding your most valuable asset, your home, having the right insurance coverage is paramount. With a plethora of insurance providers offering home insurance policies, it can be a daunting task to navigate the market and choose the best option. That's why we've put together this comprehensive guide, ranking the top home insurance companies based on a range of crucial factors.

The Importance of Home Insurance Rankings

Home insurance rankings provide an invaluable tool for homeowners seeking the best protection for their properties. These rankings consider various aspects of insurance providers, including financial stability, coverage options, customer satisfaction, claims handling, and more. By referring to these rankings, homeowners can make informed decisions, ensuring they select a reputable and reliable insurer that meets their specific needs.

Methodology Behind Our Rankings

Our home insurance rankings are derived from an extensive evaluation process, considering multiple data points and industry insights. We’ve analyzed a wide range of factors to provide an unbiased and comprehensive overview of the market. Here’s a glimpse into our methodology:

- Financial Strength: We've assessed the financial stability of each insurer, ensuring they have the resources to withstand market fluctuations and pay out claims efficiently.

- Coverage Options: A diverse range of coverage options is crucial. We've evaluated insurers based on the flexibility and customization they offer to cater to various homeowner needs.

- Customer Satisfaction: Customer feedback is invaluable. We've considered satisfaction ratings and reviews to understand the insurer's reputation and how well they meet customer expectations.

- Claims Handling: The claims process is a critical aspect. We've examined insurers' claims procedures, response times, and customer support during claim settlements.

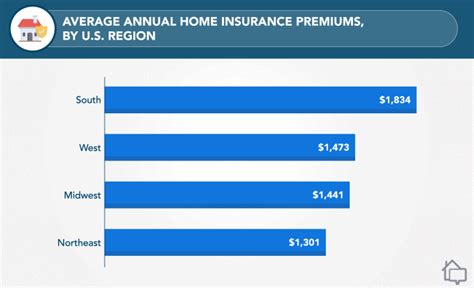

- Pricing: Affordable premiums are essential. Our rankings take into account the cost of policies, ensuring that homeowners can find competitive rates without compromising on coverage.

- Additional Benefits: We've also considered extra perks and benefits offered by insurers, such as discounts, loyalty programs, and value-added services.

Top Home Insurance Companies: A Comprehensive Overview

Now, let’s delve into the top home insurance companies based on our rigorous evaluation. We’ve categorized our findings into different sections to provide a detailed understanding of each insurer’s strengths and weaknesses.

Financial Strength and Stability

A financially stable insurer is crucial to ensure prompt claim settlements and long-term reliability. Here’s a look at the top insurers in this category:

- Allstate: Allstate boasts an exceptional financial strength rating, making it a top choice for homeowners seeking stability and security. With a strong track record, Allstate consistently delivers reliable claim settlements.

- State Farm: State Farm's financial stability is a key advantage. This insurer has demonstrated its ability to withstand market challenges, ensuring homeowners can rely on its financial strength.

- USAA: USAA is a standout in terms of financial strength, particularly for military families. With a dedicated focus on this demographic, USAA offers stability and specialized coverage options.

Coverage Options and Customization

Flexible coverage options are essential to cater to the diverse needs of homeowners. Here are the insurers excelling in this area:

- Amica: Amica offers an impressive array of coverage options, providing homeowners with the ability to customize their policies to suit their specific requirements. From standard home insurance to specialized coverage for high-value items, Amica delivers flexibility.

- Farmers Insurance: Farmers Insurance is known for its comprehensive coverage options. They provide an extensive range of add-ons and endorsements, allowing homeowners to tailor their policies to address unique risks.

- Liberty Mutual: Liberty Mutual stands out for its innovative coverage options. They offer unique policies for specific risks, such as identity theft protection and water backup coverage, providing homeowners with specialized protection.

Customer Satisfaction and Support

Positive customer experiences and efficient support are vital aspects of home insurance. The following insurers excel in this domain:

- Erie Insurance: Erie Insurance consistently ranks highly in customer satisfaction surveys. They provide personalized service, ensuring homeowners feel valued and supported throughout their insurance journey.

- Amica: Amica's focus on customer satisfaction is evident in its award-winning service. They offer 24/7 support, prompt claim handling, and a dedicated team to address customer queries, earning them a reputation for excellence.

- State Farm: State Farm's extensive network of local agents provides personalized support. They offer a seamless experience, from policy acquisition to claim settlements, ensuring customers receive the attention they deserve.

Claims Handling and Response

Efficient claims handling is critical when homeowners face unforeseen circumstances. The insurers leading in this category are:

- USAA: USAA's claims handling process is renowned for its efficiency and customer-centric approach. They prioritize prompt claim settlements, ensuring homeowners can quickly recover from losses.

- Erie Insurance: Erie Insurance's claims team is highly responsive and dedicated. They offer personalized claim assistance, providing homeowners with the support they need during challenging times.

- Farmers Insurance: Farmers Insurance excels in claims handling, offering a streamlined process and excellent customer support. They ensure a swift and stress-free experience for homeowners facing claims.

Pricing and Affordability

Competitive pricing is essential to ensure homeowners can secure adequate coverage without straining their finances. The insurers offering the best value for money include:

- GEICO: GEICO is well-known for its affordable premiums. They offer competitive rates without compromising on coverage, making home insurance accessible to a wide range of homeowners.

- State Farm: State Farm provides a balance of comprehensive coverage and competitive pricing. Their policies offer excellent value, ensuring homeowners can protect their homes without breaking the bank.

- Progressive: Progressive's innovative approach to pricing makes it a top choice for affordability. They offer flexible payment options and discounts, ensuring homeowners can find a policy that fits their budget.

Additional Benefits and Perks

Insurers often provide extra benefits and perks to enhance the overall insurance experience. The insurers leading in this area are:

- Allstate: Allstate offers a range of additional benefits, including identity theft protection, accident forgiveness, and discounts for loyalty and safe driving. These perks add value to their insurance policies.

- Liberty Mutual: Liberty Mutual provides unique benefits, such as a home buying assistance program and green home discounts. These incentives encourage homeowners to make eco-friendly choices and simplify the home-buying process.

- Amica: Amica's commitment to customer satisfaction extends beyond claims handling. They offer additional benefits like rental car coverage, trip cancellation insurance, and pet injury coverage, adding value to their policies.

The Future of Home Insurance: Emerging Trends and Innovations

The home insurance industry is constantly evolving, and several emerging trends are shaping its future. Here’s a glimpse into what homeowners can expect in the coming years:

- Digital Transformation: Insurers are increasingly adopting digital technologies to enhance the customer experience. From online policy management to digital claim submissions, the industry is becoming more accessible and efficient.

- Personalized Coverage: With advancements in data analytics, insurers are better equipped to offer personalized coverage options. By analyzing individual risk profiles, insurers can provide tailored policies that address unique needs.

- Sustainable Practices: Environmental sustainability is becoming a key focus for insurers. Many are introducing eco-friendly coverage options and incentives to encourage homeowners to adopt green practices, reducing their environmental impact.

- Enhanced Customer Support: Insurers are investing in innovative customer support channels, such as chatbots and AI-powered assistance. These technologies provide instant support and guidance, ensuring homeowners receive timely assistance.

- Expanded Coverage Options: As risks evolve, insurers are expanding their coverage offerings. From cyber insurance to specialty policies for unique assets, homeowners can expect more comprehensive protection against emerging threats.

Frequently Asked Questions

What factors should I consider when choosing a home insurance company?

+When selecting a home insurance company, consider financial stability, coverage options, customer satisfaction ratings, claims handling efficiency, and pricing. Additionally, assess any additional benefits and perks offered by insurers to find the best fit for your needs.

How do I determine the right amount of coverage for my home?

+Assessing the replacement cost of your home, personal belongings, and any unique risks is crucial. Work with an insurance agent to evaluate your needs and choose coverage limits that provide adequate protection without unnecessary expenses.

What are some common discounts offered by home insurance providers?

+Common discounts include multi-policy discounts (bundling home and auto insurance), loyalty discounts for long-term customers, and safety features discounts for homes with security systems or fire protection. Some insurers also offer discounts for green homes or energy-efficient upgrades.

How can I streamline the claims process in the event of a loss or damage?

+Familiarize yourself with your insurance policy’s claims process and requirements. Document any damage with photos and videos, and report the claim promptly to your insurer. Provide all necessary information and documentation to expedite the claims settlement.

Are there any emerging risks that home insurance policies should cover?

+Yes, emerging risks such as cyber attacks, identity theft, and water backup damage are becoming more prevalent. Ensure your home insurance policy offers adequate coverage for these risks, or consider adding endorsements to address specific concerns.