Home Insurance Search

Securing your home and its contents is a vital step in responsible homeownership. As such, homeowners insurance has become an essential aspect of modern living, offering protection and peace of mind. However, navigating the complex world of home insurance can be a daunting task. This comprehensive guide aims to demystify the process, providing an in-depth analysis of home insurance policies, their benefits, and how to choose the right coverage for your unique needs.

Understanding Home Insurance: The Basics

Home insurance, also known as homeowners insurance, is a type of property insurance that covers a private residence, its contents, and associated risks. It is designed to protect homeowners from financial losses resulting from damage to their home or its contents, or from liability claims arising from injuries or property damage caused by the homeowner or their guests.

A standard home insurance policy typically includes coverage for the dwelling (the physical structure of the home), personal property (belongings inside the home), liability protection (for bodily injury or property damage claims made against the insured), and additional living expenses (if the home becomes uninhabitable due to an insured peril). However, the exact coverage and limitations can vary significantly depending on the insurer and the policy type.

Understanding the basics of home insurance is crucial for homeowners. It enables them to make informed decisions about their coverage, ensuring they have adequate protection for their specific needs. This includes being aware of the types of perils (risks) covered by their policy, such as fire, theft, and certain natural disasters, as well as the perils that are typically excluded, like floods and earthquakes, which may require separate policies.

Types of Home Insurance Policies

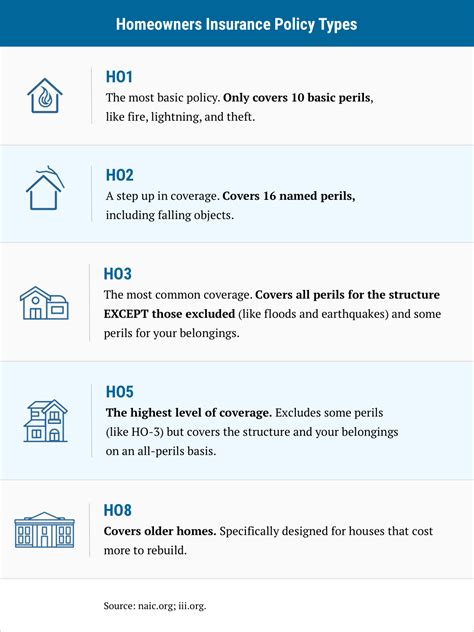

There are several types of home insurance policies, each designed to meet the specific needs of different homeowners. The most common types include:

- HO-1 Basic Form: This is the most basic form of homeowners insurance, providing coverage for a limited number of perils, such as fire, lightning, and windstorm/hail.

- HO-2 Broad Form: Offers broader coverage than the HO-1, including protection against additional perils like theft, vandalism, and smoke damage.

- HO-3 Special Form: The most common type of homeowners insurance, it provides comprehensive coverage for the dwelling and its contents against all perils except those specifically excluded, such as floods and earthquakes.

- HO-4 Renter's Insurance: Designed for tenants, this policy covers personal belongings and provides liability protection, but not the structure of the home itself.

- HO-5 Comprehensive Form: Offers the highest level of coverage, providing protection for personal belongings and the dwelling against a wide range of perils, including those typically excluded in other policies.

The choice of policy type depends on several factors, including the location of the home, its construction, the value of the property and its contents, and the specific needs and concerns of the homeowner. For instance, homeowners in areas prone to natural disasters like hurricanes or earthquakes may opt for more comprehensive coverage to protect against these specific risks.

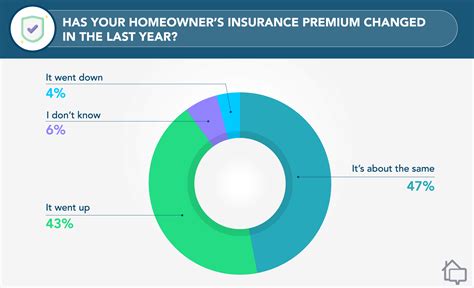

Factors Affecting Home Insurance Premiums

The cost of home insurance, or the premium, can vary significantly depending on several factors. These factors are considered by insurance companies when determining the risk associated with insuring a particular home and, consequently, the premium to charge.

Location

The location of the home is a significant factor in determining insurance premiums. Homes in areas prone to natural disasters like hurricanes, tornadoes, or wildfires, or those in high-crime neighborhoods, typically face higher premiums due to the increased risk of claims.

Home Value and Size

The value and size of the home also influence insurance costs. Generally, larger homes with higher replacement costs will require more extensive coverage and thus, higher premiums. Similarly, homes with expensive fixtures, fittings, or high-value art and jewelry collections may require specialized policies and higher premiums to adequately insure these items.

Construction and Age of the Home

The construction materials and age of the home can impact insurance costs. Homes built with fire-resistant materials, for instance, may qualify for lower premiums, while older homes may require more extensive (and costly) repairs, leading to higher insurance costs.

Claim History

The claim history of the home and its previous owners can also affect insurance premiums. Homes with a history of frequent or costly claims may be seen as higher risk, leading to higher premiums or even non-renewal of the policy by the insurer.

Insurance Company and Policy Type

The insurance company and the type of policy chosen can significantly impact the premium. Different insurers have different risk assessment models and pricing structures, so it's essential to shop around and compare quotes from multiple providers. The type of policy, as discussed earlier, also plays a role in determining the premium, with more comprehensive policies typically costing more.

| Factor | Effect on Premium |

|---|---|

| Location | Homes in high-risk areas (natural disasters, crime) may have higher premiums. |

| Home Value and Size | Larger, more valuable homes generally require higher coverage and premiums. |

| Construction and Age | Homes with fire-resistant materials or those in good condition may qualify for lower premiums. |

| Claim History | Homes with frequent or costly claims may face higher premiums or non-renewal. |

| Insurance Company and Policy Type | Different insurers have varying pricing structures, and more comprehensive policies typically cost more. |

Choosing the Right Home Insurance Coverage

Selecting the right home insurance coverage involves a careful assessment of your needs and the potential risks you face. Here are some key considerations to help you choose the right policy:

Assess Your Needs

Start by evaluating your specific needs. Consider the value of your home and its contents, the risks you face (e.g., natural disasters, theft), and the level of protection you require. For instance, if you have high-value possessions like jewelry or artwork, you may need to consider additional coverage or a separate policy to adequately insure these items.

Understand the Policy Coverage

Read and understand the policy details thoroughly. Make sure you're aware of what perils are covered, the limits of coverage, and any exclusions. For instance, most standard home insurance policies do not cover floods or earthquakes, so you may need to purchase separate coverage for these risks if you live in an area prone to such events.

Compare Quotes from Multiple Insurers

Get quotes from several insurance companies to compare prices and coverage. This will help you find the best value for your money and ensure you're not overpaying for your policy. Be sure to compare policies with similar coverage to make an accurate comparison.

Consider Additional Coverage

Depending on your needs and circumstances, you may want to consider additional coverage options. These could include:

- Flood Insurance: If your home is in a flood-prone area, consider purchasing a separate flood insurance policy. This is typically provided by the National Flood Insurance Program (NFIP) in the United States.

- Earthquake Insurance: For homes in earthquake-prone regions, this type of insurance can provide vital coverage for damage caused by seismic activity.

- Umbrella Insurance: This policy provides additional liability coverage above and beyond your home and auto insurance policies, offering protection for major lawsuits and claims.

- Jewelry, Art, or Other High-Value Item Coverage: If you have expensive items that are not adequately covered by your standard home insurance policy, consider purchasing a separate policy or rider to insure these items.

Filing a Home Insurance Claim

In the event of a loss or damage to your home or its contents, you'll need to file an insurance claim. Here's a step-by-step guide to help you through the process:

Step 1: Contact Your Insurance Company

The first step is to contact your insurance company as soon as possible after the incident. Most policies have a time limit for reporting claims, so it's crucial to act promptly.

Step 2: Provide Details of the Loss

You'll need to provide detailed information about the loss, including the date, time, and circumstances of the incident. Be as accurate and thorough as possible to ensure a smooth claims process.

Step 3: Document the Damage

Take photographs or videos of the damage, both of the home itself and any personal belongings affected. This documentation will be crucial in supporting your claim.

Step 4: Prepare an Inventory

Create a detailed inventory of all damaged or destroyed items, including their purchase price, age, and any available receipts or appraisals. This will help establish the value of your claim.

Step 5: Submit Your Claim

Once you've gathered all the necessary information and documentation, submit your claim to your insurance company. They will review the claim and, if approved, provide you with an estimate of the payout.

Step 6: Work with Your Insurance Adjuster

An insurance adjuster will be assigned to your claim. They will assess the damage and determine the amount your insurance company will pay. It's important to cooperate fully with the adjuster and provide any additional information they request.

Step 7: Receive Your Payout

Once your claim is approved and the amount has been determined, you will receive a payout from your insurance company. This can be in the form of a check or direct deposit, depending on your policy and the insurance company's procedures.

Home Insurance: Frequently Asked Questions

What is the difference between actual cash value and replacement cost coverage in home insurance policies?

+Actual cash value (ACV) coverage pays for the cost of replacing damaged property minus depreciation, while replacement cost coverage pays the full cost of replacing the property without deducting for depreciation. In simpler terms, ACV coverage considers the age and condition of the property, while replacement cost coverage focuses on the cost to replace the property with a new one.

How often should I review my home insurance policy?

+It's recommended to review your home insurance policy annually, especially after significant life changes like renovations, additions to your home, or major purchases. Regular reviews ensure your policy continues to meet your needs and provides adequate coverage.

What should I do if my home insurance claim is denied?

+If your home insurance claim is denied, first understand the reason for the denial. Your insurance company should provide a detailed explanation. If you believe the denial is unjustified, you can appeal the decision. Contact your insurer to discuss your options and provide additional information if necessary. If the issue remains unresolved, you may need to seek legal advice.

In conclusion, home insurance is a critical aspect of homeownership, offering protection and peace of mind. By understanding the basics, the factors affecting premiums, and how to choose the right coverage, homeowners can make informed decisions to safeguard their homes and belongings. Remember, regular reviews and careful consideration of your specific needs are key to ensuring your home insurance policy provides the protection you require.