Homeowner Insurance Comparison

Homeowner insurance is a vital aspect of protecting one's largest investment - their home. It provides financial security and peace of mind, ensuring that homeowners are covered in the event of various unforeseen circumstances. With a plethora of insurance providers offering different policies and coverage options, it's essential to conduct a thorough comparison to find the best fit. This article aims to provide an in-depth analysis of the homeowner insurance landscape, offering insights to help you make an informed decision.

Understanding Homeowner Insurance Policies

Homeowner insurance policies are designed to offer comprehensive protection against a range of risks, including natural disasters, theft, and accidental damage. These policies typically cover the structure of the home, as well as its contents and personal belongings. Additionally, they provide liability coverage, safeguarding homeowners from potential legal expenses arising from accidents on their property.

When comparing homeowner insurance policies, it's crucial to consider the specific coverage needs of your home. Factors such as the location, age, and construction of your house, as well as any unique features or high-value items inside, will influence the type of coverage you require. Understanding the basic components of a homeowner insurance policy is the first step towards making an informed choice.

Basic Coverage Types

Homeowner insurance policies generally offer the following types of coverage:

- Dwelling Coverage: This covers the physical structure of your home, including walls, roofs, and permanent fixtures. It ensures that in the event of a covered loss, you can repair or rebuild your home.

- Personal Property Coverage: This provides protection for your personal belongings, such as furniture, electronics, and clothing. It’s important to note that valuable items like jewelry or fine art may require additional coverage.

- Liability Coverage: This safeguards you against lawsuits and medical expenses if someone is injured on your property. It covers both legal fees and any compensation awarded to the injured party.

- Additional Living Expenses (ALE): If your home becomes uninhabitable due to a covered loss, this coverage helps cover the costs of temporary housing and other necessary expenses until you can return to your home.

It's essential to review these coverage types and understand their limitations. For instance, standard homeowner policies may not cover certain natural disasters, such as earthquakes or floods, requiring additional endorsements or separate policies.

Key Factors in Homeowner Insurance Comparison

When comparing homeowner insurance policies, several key factors come into play. These factors will help you assess the value and suitability of different policies, ensuring you find the best coverage for your needs.

Coverage Limits and Deductibles

Coverage limits refer to the maximum amount an insurance company will pay for a covered loss. It’s crucial to choose limits that align with the replacement cost of your home and belongings. Insuring your home for less than its replacement value can lead to underinsurance, which may result in financial strain if you need to rebuild.

Deductibles, on the other hand, are the amount you agree to pay out-of-pocket before your insurance coverage kicks in. Higher deductibles can lower your premium, but it's important to consider your financial ability to cover these costs in the event of a claim.

Policy Exclusions and Endorsements

Every homeowner insurance policy comes with its own set of exclusions, which are specific risks or circumstances that are not covered. It’s essential to review these exclusions carefully to ensure that your policy provides the coverage you need. For example, standard policies may exclude coverage for floods, hurricanes, or earthquakes, requiring additional endorsements or separate policies.

Endorsements, also known as policy riders, are additions or amendments to your policy that broaden the scope of coverage. These can be particularly useful for covering high-value items or unique risks associated with your home or location. It's important to discuss these options with your insurance provider to tailor your policy to your specific needs.

Premium Costs and Payment Options

The premium is the amount you pay to maintain your homeowner insurance policy. Premiums can vary significantly between providers, so it’s important to shop around and compare quotes. However, it’s crucial to remember that the lowest premium may not always offer the best value, especially if it comes with high deductibles or limited coverage.

Additionally, consider the payment options offered by different providers. Some may offer discounts for paying annually rather than monthly, while others may provide flexible payment plans. Understanding these options can help you manage your insurance costs effectively.

Customer Service and Claims Handling

In the event of a claim, you’ll want to work with an insurance provider that offers efficient and responsive customer service. Look for providers with a good reputation for handling claims fairly and promptly. Consider reading reviews and seeking recommendations from friends and family to gauge the quality of customer service.

Additionally, assess the claims process of different providers. This includes understanding the steps you need to take to file a claim, the documentation required, and the average time it takes for claims to be processed and paid out. A seamless claims process can make a significant difference during a stressful time.

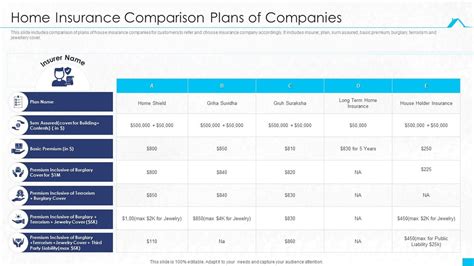

Comparing Top Homeowner Insurance Providers

To help you narrow down your options, let’s take a closer look at some of the top homeowner insurance providers in the market. Each of these providers offers unique features and benefits, so it’s essential to compare them based on your specific needs.

Provider 1: [Provider Name]

Known for their comprehensive coverage and competitive pricing, [Provider Name] offers a range of customizable policies to suit different homeowner needs. Their policies typically include:

- Dwelling coverage with replacement cost valuation

- Personal property coverage with optional add-ons for high-value items

- Liability coverage with limits up to $1 million

- Additional living expenses coverage for up to 24 months

One of the standout features of [Provider Name] is their flexible payment plans, offering discounts for annual payments and providing interest-free monthly installments. They also have an excellent claims handling process, with a dedicated claims team and a reputation for quick response times.

Provider 2: [Provider Name]

[Provider Name] specializes in providing insurance for high-value homes and unique properties. Their policies are tailored to offer extensive coverage for luxury homes, historical buildings, and properties with unique features.

- Customized dwelling coverage with replacement cost valuation, including coverage for unique architectural features

- Enhanced personal property coverage, including fine art, antiques, and high-end electronics

- Liability coverage with limits up to $5 million

- Additional living expenses coverage for up to 36 months

What sets [Provider Name] apart is their expertise in insuring high-value homes. They offer specialized endorsements for unique risks, such as coverage for expensive landscaping or pools. Additionally, they provide concierge-level customer service, with dedicated account managers and a 24/7 claims hotline.

Provider 3: [Provider Name]

[Provider Name] is a leading provider of homeowner insurance, known for their innovative technology and customer-centric approach. Their policies offer a range of benefits, including:

- Dwelling coverage with inflation protection, ensuring your coverage keeps pace with rising construction costs

- Personal property coverage with replacement cost valuation and optional add-ons for high-value items

- Liability coverage with limits up to $2 million

- Additional living expenses coverage for up to 12 months

One of the standout features of [Provider Name] is their digital platform, which allows policyholders to manage their policies, file claims, and access resources easily. They also offer a range of discounts, including bundle discounts for combining homeowner and auto insurance policies.

Real-Life Case Studies: Homeowner Insurance Claims

To illustrate the importance of homeowner insurance and the impact it can have, let’s explore a few real-life case studies of homeowner insurance claims.

Case Study 1: Natural Disaster

John and Emily, residents of a coastal town, experienced a devastating hurricane that caused extensive damage to their home. Their homeowner insurance policy, provided by [Provider Name], covered the cost of repairs, including the replacement of the roof, damaged walls, and personal belongings. The policy’s additional living expenses coverage also helped them cover the costs of temporary housing while their home was being repaired.

Thanks to their comprehensive coverage and the efficient claims handling process of [Provider Name], John and Emily were able to rebuild their home and get back on their feet quickly.

Case Study 2: Theft and Vandalism

Sarah, a homeowner in a suburban area, unfortunately became a victim of theft and vandalism. Her home was broken into, and several high-value items were stolen, including jewelry and electronics. The intruders also caused significant damage to her property.

Fortunately, Sarah had a homeowner insurance policy with [Provider Name] that included coverage for theft and vandalism. The policy covered the replacement of her stolen belongings and the cost of repairing the damage to her home. The process was made easier by the dedicated claims team at [Provider Name], who guided Sarah through every step of the claims process.

Case Study 3: Liability Claim

Michael, a homeowner with a pool in his backyard, faced a liability claim when a neighbor’s child was injured while playing in the pool. The child slipped and fell, resulting in a broken arm. Michael’s homeowner insurance policy, provided by [Provider Name], included liability coverage that helped cover the medical expenses and potential legal fees associated with the incident.

With the assistance of [Provider Name]'s legal support team, Michael was able to navigate the complex liability claim process, ensuring he was protected from potential financial loss.

Tips for Choosing the Right Homeowner Insurance

As you embark on your journey to find the right homeowner insurance policy, here are some additional tips to guide you:

- Conduct a Home Inventory: Create a detailed list of your personal belongings, including their value. This will help you assess the level of personal property coverage you need and ensure you don't underinsure your possessions.

- Understand Your Risk Profile: Assess the risks associated with your home and location. For example, if you live in an area prone to natural disasters, ensure your policy provides adequate coverage for those risks.

- Shop Around: Don't settle for the first quote you receive. Compare quotes from multiple providers to find the best value for your needs. Online comparison tools can be particularly useful for this.

- Read the Fine Print: Carefully review the policy documents, including the coverage limits, deductibles, and exclusions. Understand what is and isn't covered to avoid any surprises in the event of a claim.

- Consider Bundle Discounts: If you're also looking for auto or other types of insurance, consider bundling your policies with the same provider. Many insurers offer discounts for multiple policies.

The Future of Homeowner Insurance

The homeowner insurance landscape is constantly evolving, driven by technological advancements and changing consumer needs. Here’s a glimpse into the future of homeowner insurance and how it may impact policyholders.

Digital Transformation

Insurance providers are increasingly embracing digital technologies to enhance the policyholder experience. From online policy management and claims filing to real-time risk assessment and predictive analytics, technology is revolutionizing the way homeowner insurance is delivered and consumed.

The use of digital tools can streamline the insurance process, making it more efficient and convenient for policyholders. For instance, insurers may utilize drones for roof inspections, reducing the need for physical assessments and speeding up the claims process.

Climate Change and Risk Assessment

As the impacts of climate change become more apparent, insurers are adjusting their risk assessment models to account for increased frequency and severity of natural disasters. This may lead to changes in coverage options and pricing, particularly for homeowners in high-risk areas.

Insurance providers are also investing in research and development to better understand and mitigate climate-related risks. This includes the use of advanced data analytics and modeling to identify vulnerable areas and develop strategies to reduce the impact of natural disasters.

Personalized Coverage

The future of homeowner insurance is likely to see a shift towards more personalized coverage options. Insurers are exploring ways to tailor policies to the specific needs and circumstances of individual homeowners, offering greater flexibility and customization.

This could involve the use of smart home technologies to monitor and assess risk in real-time. For example, sensors that detect water leaks or smoke could trigger automatic notifications to the insurer, enabling faster response times and more efficient claims handling.

Collaboration and Partnerships

Insurance providers are also exploring collaborations and partnerships to enhance their services. For instance, partnerships with home security companies or smart home technology providers could lead to innovative solutions that improve risk mitigation and claims management.

Additionally, insurers may collaborate with local governments and communities to develop resilience-building initiatives, such as flood prevention measures or wildfire mitigation programs. These partnerships can help reduce the overall risk profile of an area, benefiting both homeowners and insurers.

Conclusion

Choosing the right homeowner insurance policy is a critical decision that can provide financial security and peace of mind. By understanding your coverage needs, comparing policies, and staying informed about industry trends, you can make an informed choice that best protects your largest investment - your home.

As the homeowner insurance landscape continues to evolve, it's essential to stay engaged and proactive. Keep up with the latest developments, leverage technology to your advantage, and don't hesitate to reach out to insurance providers with any questions or concerns. Your home is worth protecting, and the right homeowner insurance policy can help you do just that.

How much does homeowner insurance typically cost?

+The cost of homeowner insurance can vary significantly depending on several factors, including the location, size, and construction of your home, as well as your chosen coverage limits and deductibles. On average, homeowners can expect to pay anywhere from 500 to 2,000 per year for a standard policy. However, it’s important to note that rates can be much higher or lower based on individual circumstances.

What factors can influence my homeowner insurance premium?

+Several factors can influence your homeowner insurance premium, including the location of your home (with higher premiums in areas prone to natural disasters or crime), the age and construction of your home, the value of your personal belongings, and your claims history. Additionally, certain home improvements, such as adding security features or disaster-resistant materials, can lead to premium discounts.

What should I do if I’m not satisfied with my current homeowner insurance provider?

+If you’re not satisfied with your current homeowner insurance provider, it’s perfectly acceptable to explore other options. Shop around and compare quotes from multiple providers to find the best fit for your needs. When making a switch, ensure you understand the cancellation and transfer process, and consider the potential impact on your coverage and premiums.

How often should I review my homeowner insurance policy?

+It’s a good practice to review your homeowner insurance policy annually, or whenever significant changes occur in your home or personal circumstances. This could include renovations, additions to your home, the acquisition of high-value items, or changes in your family structure. Regular reviews ensure that your coverage remains adequate and aligned with your current needs.