Homeowners And Flood Insurance

Flooding is one of the most common and devastating natural disasters that can affect homeowners. It can lead to significant property damage, financial strain, and emotional distress. While many people associate floods with coastal areas, the reality is that floods can occur anywhere, from heavy rainfall and overflowing rivers to melting snow and flash floods. This article aims to provide an in-depth guide for homeowners, offering valuable insights into flood insurance, its importance, and how it can protect against the devastating consequences of flooding.

Understanding the Impact of Flooding on Homeowners

Floods are unpredictable and can strike quickly, leaving homeowners with little time to prepare. The damage caused by flooding goes beyond the visible water marks and soaked carpets. It can lead to structural issues, electrical and plumbing problems, mold growth, and even the loss of cherished belongings. The financial burden of repairing or rebuilding a home after a flood can be overwhelming, often resulting in long-term debt and emotional turmoil.

The emotional toll of experiencing a flood cannot be understated. Homeowners may face the heart-wrenching decision of letting go of sentimental items, and the process of rebuilding can be a stressful and lengthy journey. Additionally, the disruption to daily life, the potential health risks associated with mold and contaminated water, and the uncertainty of the future can take a significant toll on homeowners' well-being.

The Role of Flood Insurance in Protecting Homeowners

Flood insurance is designed to provide financial protection to homeowners and renters against flood-related losses. It offers coverage for both the structure of the home and its contents, ensuring that policyholders can recover and rebuild with greater ease.

One of the key advantages of flood insurance is that it provides peace of mind. Knowing that you are financially protected against the potentially devastating consequences of flooding can reduce stress and anxiety, allowing homeowners to focus on their daily lives with greater confidence.

Coverage Options and Benefits

Flood insurance policies typically offer two types of coverage: building property coverage and personal property coverage.

- Building Property Coverage: This covers the physical structure of the home, including the foundation, walls, roof, and attached fixtures. It also extends to the costs of debris removal and the necessary upgrades to comply with building codes during the rebuilding process.

- Personal Property Coverage: This provides protection for the contents of the home, such as furniture, appliances, clothing, and electronics. Policyholders can choose the level of coverage they require based on the value of their belongings.

Additionally, flood insurance offers coverage for additional living expenses. If a home becomes uninhabitable due to flood damage, the policy will reimburse the policyholder for the additional costs incurred while temporarily living elsewhere during the repair or rebuilding process.

Who Needs Flood Insurance?

While flood insurance is not typically required by law for all homeowners, it is strongly recommended for those living in high-risk flood zones. These areas are designated by the Federal Emergency Management Agency (FEMA) as having a 1% annual chance of flooding, also known as the 100-year floodplain.

Even if a home is not located in a high-risk zone, flood insurance can still be beneficial. Floods can occur in low-risk areas, and the financial protection offered by insurance can provide a safety net for unexpected events. Moreover, some mortgage lenders may require flood insurance for properties located in moderate- to low-risk zones, especially if the loan is backed by the federal government.

The Process of Obtaining Flood Insurance

Obtaining flood insurance involves a few key steps to ensure that homeowners receive the appropriate coverage for their needs.

Assessing Risk and Understanding Coverage

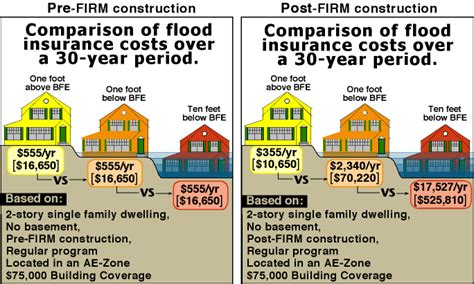

Homeowners should begin by understanding their flood risk. This can be done by checking the FEMA Flood Insurance Rate Map (FIRM) or consulting with a local floodplain manager. Understanding the risk level will help determine the necessary coverage and the potential costs.

It is essential to carefully review the policy's coverage limits, deductibles, and exclusions. Flood insurance policies have specific limitations and may not cover certain types of damage, such as damage caused by groundwater or sewage backups. Policyholders should also be aware of any waiting periods before coverage takes effect.

Shopping for Flood Insurance

Flood insurance is available through private insurance companies and the National Flood Insurance Program (NFIP). Homeowners should compare rates, coverage options, and policy terms to find the best fit for their needs.

Private insurance companies may offer additional benefits and personalized coverage options. However, it is important to note that not all private insurers provide flood insurance, and those that do may have different underwriting guidelines and coverage limits.

The NFIP, on the other hand, is a federal program that provides flood insurance to homeowners, renters, and businesses. It offers standardized coverage and is backed by the federal government, ensuring that policyholders will receive the necessary financial support in the event of a flood.

Applying for Flood Insurance

The application process for flood insurance involves providing detailed information about the property, including its location, construction type, and any previous flood damage claims. Insurers will use this information to assess the risk and determine the premium.

Homeowners should also be aware of any documentation requirements, such as providing a survey or elevation certificate. These documents can help insurers accurately assess the flood risk and may result in a lower premium.

Making a Flood Insurance Claim

In the unfortunate event of a flood, homeowners with flood insurance can take solace in knowing that the process of making a claim is designed to be straightforward and efficient.

Reporting the Flood Damage

Policyholders should immediately contact their insurance company to report the flood damage. It is crucial to take photographs and videos of the damage and keep detailed records of any expenses incurred during the cleanup and repair process. These records will be essential when filing a claim.

It is advisable to begin the cleanup process as soon as it is safe to do so. However, it is important to document the damage thoroughly before making any permanent repairs. Insurance adjusters will need to assess the extent of the damage to determine the amount of the claim.

The Claims Process

Once the insurance company receives the claim, an adjuster will be assigned to evaluate the damage. The adjuster will inspect the property, review the policy, and determine the extent of the coverage based on the specific circumstances of the flood event.

Policyholders should be prepared to provide any additional documentation or information requested by the adjuster. This may include receipts for repairs, estimates from contractors, or other supporting evidence of the damage and the costs incurred.

Understanding the Claims Settlement

The claims settlement process can vary depending on the severity of the flood and the complexity of the damage. In some cases, the insurance company may provide an advance payment to cover immediate needs while the full extent of the damage is being assessed.

Once the adjuster has completed their assessment, they will provide a detailed report outlining the covered damages and the amount of the settlement. Policyholders should carefully review this report and contact their insurance company if they have any questions or concerns.

Maximizing Flood Insurance Benefits

To make the most of flood insurance, homeowners can take proactive steps to mitigate flood risks and understand their policy’s coverage.

Mitigation Strategies

Implementing mitigation strategies can reduce the impact of flooding and potentially lower insurance premiums. Some common mitigation measures include elevating the home, installing flood vents, and using flood-resistant materials during construction or renovation.

Homeowners can also consider installing a sump pump or a backup power system to help prevent water from entering the home during a flood. These measures can significantly reduce the risk of damage and provide added protection during severe weather events.

Understanding Policy Exclusions

It is crucial for homeowners to carefully review their policy’s exclusions to avoid any surprises when making a claim. Common exclusions may include damage caused by groundwater, surface water, waves, or tides. Policyholders should also be aware of any limitations on coverage for certain types of personal property, such as valuable collectibles or jewelry.

Regularly Reviewing and Updating Coverage

Flood insurance policies should be reviewed annually to ensure that the coverage limits and deductibles are still adequate. Homeowners should also consider any changes to the property, such as renovations or additions, which may impact the value and require an adjustment to the policy.

Additionally, it is essential to keep the insurance company informed of any changes to the property's occupancy or usage. This includes renting out a portion of the home or using it for business purposes, as these changes may affect the coverage and premium.

The Future of Flood Insurance and Homeowner Protection

As climate change continues to impact weather patterns and increase the frequency and severity of flooding, the need for comprehensive flood insurance is becoming increasingly critical.

The insurance industry is actively working to improve flood risk assessment and coverage options. Advanced technology, such as satellite imagery and predictive modeling, is being utilized to more accurately assess flood risks and develop innovative insurance products.

Furthermore, there is a growing focus on educating homeowners about the importance of flood insurance and the steps they can take to mitigate flood risks. Community outreach programs, online resources, and partnerships with local governments are helping to raise awareness and encourage proactive flood preparedness.

| Key Takeaways |

|---|

| Flood insurance provides financial protection against flood-related losses, covering both the structure of the home and its contents. |

| It is recommended for homeowners in high-risk flood zones but can also benefit those in moderate- to low-risk areas. |

| The process of obtaining flood insurance involves assessing risk, shopping for coverage, and understanding policy terms and exclusions. |

| Making a flood insurance claim requires prompt reporting, thorough documentation, and cooperation with insurance adjusters. |

| Homeowners can maximize their flood insurance benefits by implementing mitigation strategies, understanding policy exclusions, and regularly reviewing their coverage. |

| The future of flood insurance lies in improved risk assessment, innovative coverage options, and increased awareness and education for homeowners. |

How much does flood insurance cost?

+The cost of flood insurance varies depending on several factors, including the location of the property, the level of risk, and the coverage limits chosen. On average, flood insurance policies can range from a few hundred dollars to over a thousand dollars per year. However, it is important to note that the cost of flood insurance is often significantly lower than the potential financial losses from a flood event.

Can I get flood insurance if I live in a high-risk flood zone?

+Yes, flood insurance is specifically designed to provide coverage for properties located in high-risk flood zones. In fact, it is highly recommended for homeowners in these areas to ensure they have adequate protection against the increased risk of flooding. The National Flood Insurance Program (NFIP) offers flood insurance policies to homeowners, renters, and businesses in high-risk zones.

What happens if I don’t have flood insurance and my home is flooded?

+If a homeowner does not have flood insurance and their home is flooded, they may face significant financial challenges. Without insurance coverage, the costs of repairing or rebuilding the home, replacing personal belongings, and covering additional living expenses during the recovery process fall solely on the homeowner. This can result in substantial debt and financial strain.

Are there any alternatives to flood insurance for homeowners?

+While flood insurance is the primary means of financial protection against flooding, there are some alternative options available. Homeowners can consider implementing flood mitigation measures, such as elevating the home or installing flood barriers, which may reduce the risk of flood damage and potentially lower insurance premiums. However, it is important to note that these measures may not provide the same level of comprehensive coverage as flood insurance.