Homeowners Insurance Best Companies

Homeowners insurance is a crucial aspect of homeownership, providing financial protection and peace of mind to millions of homeowners across the country. With a wide range of insurance companies offering various policies and coverage options, choosing the best one can be a daunting task. This comprehensive guide aims to shed light on the top homeowners insurance companies, their offerings, and key factors to consider when making an informed decision.

Understanding the Landscape: Top Homeowners Insurance Companies

The homeowners insurance market is diverse, with numerous companies vying for customers. While some focus on providing comprehensive coverage, others specialize in specific types of policies or cater to unique needs. Here’s an overview of some of the leading players in the industry:

State Farm

State Farm is one of the most well-known and trusted names in the insurance industry. With a strong focus on customer satisfaction and a wide range of coverage options, they have built a solid reputation. State Farm offers customizable homeowners insurance policies, allowing individuals to tailor their coverage to their specific needs. From standard home insurance to specialized coverage for high-value homes, State Farm provides comprehensive protection.

| Key Features | State Farm |

|---|---|

| Coverage Options | Wide range of coverages, including liability, dwelling, personal property, and additional living expenses. |

| Discounts | Multi-policy discounts, loyalty rewards, and safety features discounts. |

| Claims Process | Efficient and streamlined claims process with 24/7 support. |

Allstate

Allstate is another prominent player in the homeowners insurance market, known for its innovative products and customer-centric approach. They offer a range of insurance options, including standard home insurance, rental property insurance, and specialized coverage for unique situations. Allstate’s unique features include their “Value” policy, which provides additional protection for high-value homes, and their “Newly Renovated Home” endorsement, catering to homeowners who have recently renovated their properties.

| Allstate's Key Offerings | |

|---|---|

| Discounts | Multi-policy, safe driver, and protective device discounts. |

| Claims Service | 24/7 claims support and the option to file claims online or via their mobile app. |

| Specialized Coverages | Identity protection, ordinance or law coverage, and equipment breakdown coverage. |

USAA

USAA stands out as a leading provider of insurance services for military members, veterans, and their families. While membership is exclusive to this demographic, USAA offers exceptional benefits and coverage tailored to the unique needs of military personnel. Their homeowners insurance policies provide comprehensive protection, including coverage for military-specific situations such as deployments and relocations.

| USAA's Military-Focused Features | |

|---|---|

| Deployment Protection | Coverage for increased risks during deployments. |

| Relocation Assistance | Assistance with temporary living expenses and coverage during moves. |

| Discounts | Multi-policy discounts, loyalty rewards, and safe driver discounts. |

Chubb

Chubb is renowned for its expertise in providing high-end insurance solutions, including homeowners insurance for luxury properties. Their policies are designed to offer extensive coverage for high-value homes, fine arts, jewelry, and other valuable possessions. Chubb’s personalized approach ensures that each policy is tailored to the unique needs and requirements of its clients.

| Chubb's Luxury Home Insurance Features | |

|---|---|

| Valuable Possessions Coverage | Specialized coverage for fine arts, jewelry, and collectibles. |

| Enhanced Liability Protection | Higher liability limits and comprehensive coverage for legal expenses. |

| Claims Management | Dedicated claims professionals and a fast, efficient claims process. |

Liberty Mutual

Liberty Mutual is a prominent insurance provider offering a comprehensive range of homeowners insurance policies. Their policies provide standard coverage options, including dwelling, personal property, and liability protection. Additionally, Liberty Mutual offers unique features such as their “Identity Manager” service, which helps protect homeowners from identity theft and fraud.

| Liberty Mutual's Distinctive Offerings | |

|---|---|

| Identity Theft Protection | "Identity Manager" service to monitor and protect against identity theft. |

| Home Buying Assistance | Resources and guidance for first-time homebuyers. |

| Discounts | Multi-policy, loyalty, and safety feature discounts. |

Key Considerations: Choosing the Right Homeowners Insurance

Selecting the best homeowners insurance company involves evaluating several critical factors. Here’s a breakdown of what to consider:

Coverage Options

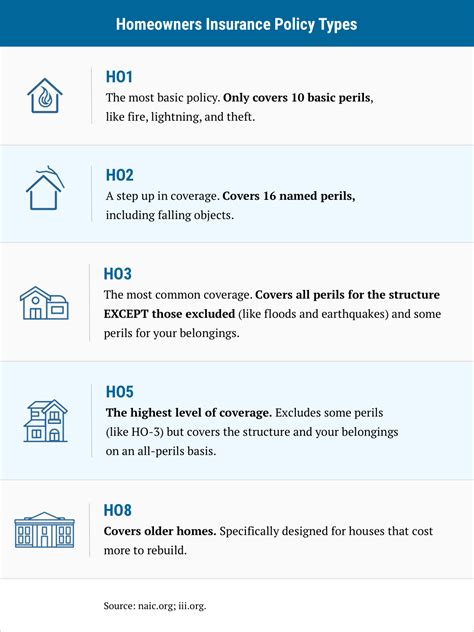

Review the range of coverage options provided by each company. Look for policies that offer comprehensive protection, including dwelling coverage, personal property coverage, liability protection, and additional living expenses. Ensure the policy covers specific risks relevant to your area, such as natural disasters or theft.

Discounts and Savings

Explore the discounts and savings opportunities offered by each insurance provider. Common discounts include multi-policy discounts (bundling home and auto insurance), loyalty rewards, and safety feature discounts for homes equipped with security systems or fire protection devices. These discounts can significantly reduce your insurance premiums.

Claims Process and Customer Service

The efficiency and responsiveness of an insurance company’s claims process are crucial. Look for companies that offer 24⁄7 claims support, easy online or mobile app filing options, and a track record of prompt claim settlements. Additionally, consider the overall customer service experience, including the availability of knowledgeable representatives and the ease of communication.

Specialized Coverages

If you have unique needs or specific valuables to insure, consider companies that offer specialized coverages. For instance, if you own high-value jewelry or fine art, look for companies that provide specialized endorsements or policies to cover these items. Similarly, if you have a home office or unique structural features, ensure the company can provide adequate coverage for these aspects.

Reputation and Financial Stability

Research the reputation and financial stability of the insurance companies you are considering. Look for companies with a solid track record of customer satisfaction, positive reviews, and a strong financial standing. This ensures that the company will be able to fulfill its obligations and provide reliable coverage in the long term.

Cost and Premiums

While cost is an important factor, it should not be the sole determining factor. Compare the premiums offered by different companies, but also consider the coverage provided and the overall value. Sometimes, a slightly higher premium may be worth it if it provides more comprehensive coverage and better customer service.

Industry Insights: Trends and Innovations in Homeowners Insurance

The homeowners insurance industry is constantly evolving, driven by technological advancements and changing consumer needs. Here are some key trends and innovations shaping the future of homeowners insurance:

Digital Transformation

Insurance companies are embracing digital technologies to enhance the customer experience. This includes online policy management, mobile apps for easy claim filing, and the use of artificial intelligence for faster claim processing. Digital transformation allows for more efficient and convenient interactions between insurers and homeowners.

Personalized Coverage

Insurance providers are moving towards more personalized coverage options. By leveraging data analytics and customer insights, companies can offer tailored policies that meet the unique needs of individual homeowners. This approach ensures that customers receive the coverage they require without paying for unnecessary add-ons.

Smart Home Integration

The rise of smart home technology has led to innovative insurance solutions. Some insurance companies now offer discounts or coverage enhancements for homes equipped with smart devices, such as security cameras, smart locks, and fire detection systems. These technologies not only enhance home safety but also provide additional peace of mind to homeowners.

Sustainability and Green Initiatives

With a growing focus on environmental sustainability, insurance companies are incorporating green initiatives into their policies. This includes offering discounts for energy-efficient homes, providing coverage for sustainable renovations, and supporting customers in their efforts to reduce their carbon footprint.

Data-Driven Risk Assessment

Advanced data analytics and predictive modeling are being used to assess risks more accurately. By analyzing historical data and trends, insurance companies can better understand potential risks and offer more precise coverage options. This data-driven approach leads to more efficient risk management and fairer premium pricing.

Conclusion: Empowering Homeowners with Informed Choices

Selecting the best homeowners insurance company is a critical decision that requires careful consideration. By understanding the landscape, evaluating key factors, and staying informed about industry trends, homeowners can make informed choices that provide the right level of protection for their homes and possessions. Remember, the best insurance policy is one that meets your unique needs, offers comprehensive coverage, and provides excellent customer service.

What factors should I consider when comparing homeowners insurance companies?

+When comparing homeowners insurance companies, consider factors such as coverage options, discounts and savings, claims process and customer service, specialized coverages, reputation and financial stability, and cost. Each of these factors plays a crucial role in ensuring you find the right policy for your needs.

Are there any specialized homeowners insurance policies available for unique needs?

+Yes, several insurance companies offer specialized policies to cater to unique needs. For instance, USAA provides insurance tailored to the needs of military personnel, while Chubb offers luxury home insurance for high-value properties. Other companies may offer specialized coverages for homeowners with specific valuables or unique circumstances.

How can I save money on my homeowners insurance premiums?

+You can save money on your homeowners insurance premiums by exploring various discounts. Common discounts include multi-policy discounts (bundling home and auto insurance), loyalty rewards, and safety feature discounts for homes equipped with security systems or fire protection devices. Additionally, consider increasing your deductible to lower your premiums.

What should I look for in terms of customer service and claims support?

+When it comes to customer service and claims support, look for insurance companies that offer 24⁄7 claims assistance, easy online or mobile app claim filing, and a track record of prompt claim settlements. Ensure the company has knowledgeable representatives and provides efficient communication channels.