Homeowners Insurance Calculated

Understanding how homeowners insurance is calculated is essential for any homeowner. It's not just about finding the cheapest policy; it's about ensuring your home and belongings are adequately protected. The calculation of homeowners insurance premiums involves various factors, and it's a complex process that aims to assess the level of risk associated with insuring your property. In this comprehensive guide, we'll delve into the key aspects that influence these premiums, offering you an expert-level understanding of this critical aspect of homeownership.

The Fundamentals of Homeowners Insurance Premiums

Homeowners insurance, often referred to as home insurance, is a financial safeguard designed to protect homeowners against various risks and liabilities. These policies typically cover the structure of your home, your personal belongings, and provide liability coverage for accidents that may occur on your property. The cost of this protection, known as the premium, is determined by a meticulous evaluation of numerous factors, each contributing to the overall assessment of risk.

The insurance industry employs sophisticated actuarial science to calculate these premiums. Actuaries, experts in this field, analyze historical data, trends, and statistical models to forecast the likelihood and cost of potential claims. This scientific approach ensures that premiums are set at a level that is fair, covering the expected costs while remaining competitive in the market.

Key Factors Influencing Homeowners Insurance Premiums

The calculation of homeowners insurance premiums is influenced by a multitude of factors, each playing a significant role in assessing the level of risk associated with your property. These factors can be broadly categorized into four main groups: the home itself, the location, the policyholder’s history, and additional considerations.

The Home: A Detailed Assessment

The home you wish to insure is a crucial factor in determining your insurance premium. Insurers will thoroughly examine various aspects of your property to assess the potential risks and costs associated with insuring it.

Home Value and Replacement Cost

The value of your home is a fundamental consideration. Insurers typically calculate premiums based on the replacement cost, which is the amount it would take to rebuild your home and replace its contents if they were destroyed. This cost can vary significantly depending on the size, age, and construction materials of your home.

For instance, consider a modern, brick-built home with a large floor plan and expensive fixtures. Such a home would likely have a higher replacement cost than an older, smaller home built with less durable materials. The premium for the former would therefore be higher to reflect the increased cost of rebuilding.

| Home Characteristics | Replacement Cost (Est.) |

|---|---|

| Modern, Brick Home (3,000 sq. ft) | $450,000 |

| Older, Wood-Frame Home (1,500 sq. ft) | $200,000 |

Construction Materials and Age

The materials used to construct your home and its age can significantly impact your premium. For example, homes built with fire-resistant materials or those located in areas with lower crime rates may enjoy lower premiums due to the reduced risk of theft or fire damage.

Additionally, older homes may present unique challenges. They may require more specialized repairs or have outdated electrical systems, which can increase the risk of fire. Insurers will often assess the age of your home and any recent renovations or improvements to determine the appropriate premium.

Home Size and Layout

The size and layout of your home also play a role in premium calculation. Larger homes generally have higher premiums because they cost more to rebuild and often contain more valuable items. Additionally, homes with complex layouts or unique architectural features may require specialized construction techniques if damaged, increasing the potential cost of repairs.

The Location: Environmental and Social Factors

The location of your home is another critical factor in determining your insurance premium. This involves considering both the physical environment and the social aspects of your neighborhood.

Climate and Natural Disasters

The climate and natural disaster risks in your area can significantly influence your premium. Regions prone to hurricanes, tornadoes, earthquakes, or severe storms often carry higher insurance costs due to the increased likelihood of property damage.

For instance, a homeowner in a hurricane-prone coastal area may face higher premiums compared to one in a more inland, less storm-vulnerable region. This is because the former is at greater risk of storm damage, which can result in costly repairs or even total loss of the property.

| Location | Natural Disaster Risk | Average Premium |

|---|---|---|

| Hurricane-Prone Coastal Region | High (Storms, Floods) | $2,500/year |

| Inland, Low-Risk Area | Low (Fires, Storms) | $1,800/year |

Crime Rates and Neighborhood Safety

The crime rate and overall safety of your neighborhood are also taken into account. Areas with higher crime rates often have higher insurance premiums due to the increased risk of theft, vandalism, or other property-related crimes.

For example, if you live in a neighborhood with a high burglary rate, your insurance provider may charge a higher premium to reflect the increased likelihood of a claim being made. This is because the insurer would need to pay out more frequently for such incidents.

The Policyholder: A History of Claims and Risk

Your personal history as a policyholder is a critical factor in determining your homeowners insurance premium. Insurers carefully examine your claims history and other risk factors associated with you and your family.

Claims History

Your previous claims history is a significant determinant of your future premiums. If you’ve made multiple claims in the past, especially for costly incidents, your insurance provider may view you as a higher risk and increase your premium accordingly.

For instance, if you've made three claims over the past five years, each costing your insurer $10,000, you might be considered a high-risk policyholder. This could lead to a substantial increase in your premium to cover the potential for future claims.

| Claim Type | Number of Claims | Average Payout |

|---|---|---|

| Theft | 2 | $8,000 |

| Water Damage | 1 | $12,000 |

Credit Score and Personal Profile

Your credit score can also affect your insurance premium. Insurance companies often use credit-based insurance scores to assess the risk of insuring you. These scores are calculated based on information in your credit report, and a lower score may indicate a higher risk, leading to a higher premium.

Furthermore, your personal profile, including your age, occupation, and marital status, can influence your premium. For example, younger individuals may be considered higher risk due to their perceived lack of stability, resulting in higher premiums.

Additional Considerations: Deductibles and Policy Coverages

Beyond the fundamental factors, there are additional considerations that can significantly impact your homeowners insurance premium. These include the deductibles you choose and the level of coverage you opt for.

Deductibles

A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premium because it reduces the insurer’s potential liability. However, it’s important to ensure that you can afford the deductible in the event of a claim.

For example, if you select a deductible of $2,000, you'll pay this amount before your insurance coverage begins. This means you'll bear more of the financial burden in the event of a claim, but your premium will be lower as a result.

Policy Coverages and Add-Ons

The level of coverage you choose for your policy also affects your premium. Basic policies typically cover the structure of your home and your personal belongings, but you can often add optional coverages for specific risks or increase the limits of your policy. These additional coverages can increase your premium.

For instance, if you live in a flood-prone area, you might opt for flood insurance as an add-on to your basic policy. This extra coverage will increase your premium but provide essential protection against flood damage, which is typically excluded from standard homeowners policies.

Understanding Your Premium: A Comprehensive Breakdown

To better understand how your homeowners insurance premium is calculated, let’s consider a real-world example. Imagine a homeowner, Mr. Johnson, who lives in a suburban area with a mix of environmental and social risks.

Mr. Johnson’s Case Study

Mr. Johnson lives in a two-story, 2,500 sq. ft. home built with fire-resistant materials and located in a suburban neighborhood with moderate crime rates. He’s been a homeowner for 15 years and has made one claim in that time for $5,000 due to water damage from a burst pipe.

Given these factors, Mr. Johnson's insurance premium would likely be calculated as follows:

| Factor | Description | Impact on Premium |

|---|---|---|

| Home Value | 2,500 sq. ft. home with fire-resistant materials | Moderate |

| Location | Suburban area with moderate crime and natural disaster risks | Moderate |

| Claims History | One claim for $5,000 in the past 15 years | Slightly Higher |

| Deductible | Standard deductible of $1,000 | Moderate |

| Policy Coverages | Basic policy with no add-ons | Standard |

Based on these factors, Mr. Johnson's insurance provider might calculate a premium of $1,800 per year, reflecting the moderate risks associated with his home and location, as well as his claims history.

Conclusion: A Complex But Crucial Understanding

Understanding how homeowners insurance premiums are calculated is a complex but crucial task for any homeowner. By breaking down the process into its key components, we’ve gained insight into the many factors that influence the cost of this essential protection.

From the value and characteristics of your home to the environmental and social risks of your location, and even your personal history as a policyholder, each element plays a significant role in determining your premium. Additionally, the choices you make about your deductible and policy coverages can further impact the cost of your insurance.

By staying informed about these factors and regularly reviewing your policy, you can ensure that your homeowners insurance provides the coverage you need at a fair and competitive price. Remember, while it's essential to keep costs down, it's even more critical to ensure that your home and belongings are adequately protected against the various risks you may face.

FAQ

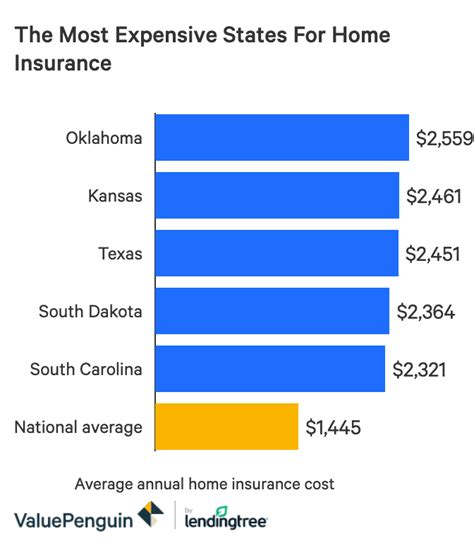

What is the average cost of homeowners insurance in the United States?

+The average cost of homeowners insurance in the U.S. varies significantly based on location, with states like Florida and Louisiana having some of the highest average premiums due to their high risk of natural disasters. On average, homeowners can expect to pay around 1,200 per year for basic coverage, but this can range from 500 to $3,000 or more depending on individual circumstances.

How often should I review my homeowners insurance policy and premium?

+It’s recommended to review your homeowners insurance policy and premium annually, or whenever you make significant changes to your home or personal circumstances. This ensures that your coverage remains adequate and that you’re not overpaying for insurance that doesn’t meet your needs.

Can I negotiate my homeowners insurance premium?

+While homeowners insurance premiums are largely based on standardized formulas, there may be some room for negotiation. You can try discussing your specific circumstances with your insurer to see if they can offer a better rate, especially if you’ve been a long-term, loyal customer.