Homeowners Insurance Dwelling

In the realm of property ownership, safeguarding one's abode is paramount, and homeowners insurance emerges as a vital pillar of protection. This comprehensive guide delves into the intricate world of dwelling coverage, offering an expert analysis to empower homeowners in making informed decisions. From understanding the fundamental concepts to exploring real-world applications and future implications, this article aims to provide a thorough exploration of this essential aspect of homeowners insurance.

Understanding Homeowners Insurance: A Foundation for Protection

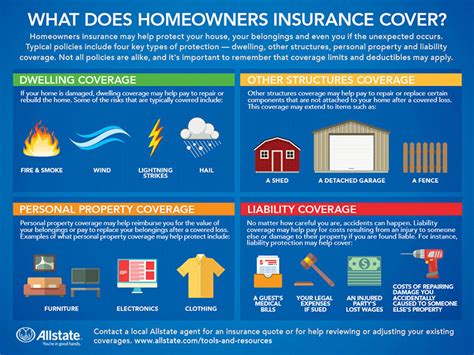

Homeowners insurance stands as a critical financial safeguard, offering protection against various risks that homeowners may encounter. This comprehensive coverage is designed to provide peace of mind and financial assistance in the event of unforeseen circumstances, ranging from natural disasters to accidental damage.

The foundation of homeowners insurance lies in its ability to offer financial reimbursement for losses and damages sustained to a property and its contents. This includes not only the physical structure of the home but also the personal belongings within it. Moreover, it extends beyond the physical realm, offering liability coverage for legal expenses and medical costs incurred as a result of accidents on the insured property.

When selecting homeowners insurance, it is crucial to consider the specific needs and circumstances of the homeowner. Factors such as the location, age, and type of the property, as well as the personal belongings and lifestyle of the occupants, play a significant role in determining the appropriate level of coverage. By tailoring the insurance policy to these unique factors, homeowners can ensure that they are adequately protected against a wide range of potential risks.

The Essence of Dwelling Coverage: Protecting the Heart of the Home

At the core of homeowners insurance lies dwelling coverage, a fundamental component that safeguards the physical structure of the home itself. This coverage extends beyond the mere bricks and mortar, encompassing a wide array of elements that contribute to the overall integrity of the dwelling.

Dwelling coverage typically includes protection for the main residence, as well as any attached structures such as garages, carports, and sheds. Additionally, it covers a range of permanent fixtures and fittings, including built-in appliances, cabinets, and permanent flooring. This comprehensive coverage ensures that the heart of the home is safeguarded against a multitude of potential hazards, providing homeowners with peace of mind and financial security.

Furthermore, dwelling coverage often extends to cover the cost of temporary accommodation in the event that the home becomes uninhabitable due to insured damages. This additional layer of protection ensures that homeowners have a safe and secure place to reside while their home is being repaired or rebuilt, minimizing the disruption caused by such unforeseen circumstances.

Key Components of Dwelling Coverage

- Structure of the Home: From the roof to the foundation, dwelling coverage provides protection for the entire physical structure.

- Attached Structures: Garages, carports, and sheds are often covered, ensuring that these essential components of the property are safeguarded.

- Permanent Fixtures and Fittings: Built-in appliances, cabinets, and permanent flooring are included, offering protection for these integral parts of the home.

- Temporary Accommodation: In the event of severe damage, dwelling coverage may include the cost of alternative housing, providing a vital safety net for homeowners.

Real-World Applications: Dwelling Coverage in Action

To truly grasp the significance of dwelling coverage, it is essential to explore real-world scenarios where this insurance has made a tangible difference in the lives of homeowners.

Natural Disasters and Extreme Weather

One of the primary benefits of dwelling coverage becomes evident when faced with the aftermath of natural disasters or extreme weather events. Whether it’s a hurricane, tornado, earthquake, or wildfire, these catastrophic occurrences can inflict severe damage on homes, often leaving homeowners in dire financial straits.

In such scenarios, dwelling coverage steps in as a crucial lifeline, providing financial assistance to cover the costs of repairing or rebuilding the damaged home. This coverage ensures that homeowners have the necessary resources to restore their dwellings to their former glory, allowing them to move forward with their lives and communities in the wake of such devastating events.

Accidental Damage and Unexpected Events

Dwelling coverage is not limited to natural disasters; it also provides protection against a wide range of accidental damages and unexpected events that can occur within the home. From burst pipes and roof leaks to electrical malfunctions and fire incidents, these unforeseen circumstances can result in significant damage to the dwelling.

With dwelling coverage in place, homeowners can rest assured that they will have the necessary financial support to repair or replace the damaged portions of their home. This coverage not only alleviates the financial burden but also provides a sense of security and stability, allowing homeowners to focus on their recovery and the well-being of their families.

Protection Against Theft and Vandalism

Unfortunately, the threat of theft and vandalism is a reality that many homeowners face. In such instances, dwelling coverage plays a vital role in mitigating the financial impact of these criminal acts. Whether it’s a break-in that results in stolen belongings or vandalism that causes structural damage, this coverage ensures that homeowners are not left to bear the full brunt of the financial loss.

By providing reimbursement for the cost of repairs or replacements, dwelling coverage helps homeowners restore their homes to their original state, offering a sense of security and peace of mind in the face of such distressing incidents.

Analyzing Performance: Assessing the Value of Dwelling Coverage

To evaluate the true worth of dwelling coverage, it is essential to examine its performance in real-world scenarios and assess its impact on the lives of homeowners.

Financial Reimbursement and Peace of Mind

One of the primary advantages of dwelling coverage is its ability to provide financial reimbursement in the event of insured losses. This reimbursement not only covers the cost of repairs or replacements but also offers a sense of security and peace of mind to homeowners. By having this coverage in place, homeowners can rest assured that they will have the necessary funds to restore their homes, alleviating the financial burden and stress associated with unexpected damages.

Additionally, dwelling coverage often includes an inflation guard feature, which ensures that the coverage amount keeps pace with rising construction costs. This safeguards homeowners against unexpected increases in repair or rebuilding expenses, providing an added layer of financial protection.

Cost-Effectiveness and Customization

While dwelling coverage is an essential component of homeowners insurance, it is important to note that the cost of this coverage can vary significantly based on a multitude of factors. These factors include the location, size, and construction type of the home, as well as the level of coverage desired by the homeowner.

To ensure cost-effectiveness, it is crucial for homeowners to carefully assess their specific needs and circumstances when selecting dwelling coverage. By tailoring the coverage to their unique requirements, homeowners can strike a balance between adequate protection and budgetary considerations. This customization allows homeowners to maximize the value of their insurance while minimizing unnecessary expenses.

Future Implications: Navigating the Evolving Landscape of Homeowners Insurance

As the world continues to evolve, so too does the landscape of homeowners insurance. With advancements in technology, changing climate patterns, and shifting societal trends, the needs and expectations of homeowners are constantly evolving.

Adapting to Climate Change and Extreme Weather

The increasing prevalence and severity of natural disasters and extreme weather events pose a significant challenge for homeowners and the insurance industry alike. As climate change continues to impact weather patterns, the risk of catastrophic events such as hurricanes, floods, and wildfires is on the rise.

To address these evolving risks, homeowners insurance providers are adapting their policies and coverage options. This includes the introduction of specialized coverage for specific hazards, such as flood or earthquake insurance, which may not be included in standard dwelling coverage. By offering these additional protections, insurance providers aim to provide comprehensive coverage for homeowners facing heightened risks due to climate change.

Incorporating Technology and Smart Home Innovations

The rapid advancement of technology has led to the emergence of smart home devices and systems, which offer enhanced security, convenience, and energy efficiency. As these innovations become more prevalent in homes, insurance providers are recognizing their potential impact on risk mitigation and are incorporating them into their policies.

Insurance companies are now offering discounts or incentives for homeowners who install smart home devices, such as security systems, fire alarms, and water leak detectors. These devices not only enhance the safety and security of the home but also provide real-time monitoring and early warning systems, reducing the likelihood and impact of potential hazards. By embracing these technological advancements, insurance providers are encouraging homeowners to take proactive measures to protect their dwellings, leading to a reduction in insurance claims and a more sustainable insurance ecosystem.

The Rise of Telematics and Usage-Based Insurance

Telematics, the integration of telecommunications and informatics, is revolutionizing the insurance industry, particularly in the context of homeowners insurance. With the advent of usage-based insurance, also known as pay-as-you-go or pay-per-use insurance, homeowners can now tailor their coverage based on their actual usage and risk profile.

By leveraging telematics devices and data analytics, insurance providers can offer more precise and personalized insurance rates. This approach takes into account factors such as the homeowner's lifestyle, the frequency of home occupancy, and the adoption of safety measures. As a result, homeowners who demonstrate responsible behavior and a lower risk profile can benefit from more affordable insurance premiums, fostering a culture of safety and responsible homeownership.

FAQ

What is the difference between dwelling coverage and personal property coverage in homeowners insurance?

+Dwelling coverage refers to the protection provided for the physical structure of the home, including its attached structures and permanent fixtures. On the other hand, personal property coverage focuses on safeguarding the personal belongings within the home, such as furniture, electronics, and clothing. While dwelling coverage protects the home itself, personal property coverage ensures that the contents of the home are also adequately insured.

How is the cost of dwelling coverage determined, and what factors influence it?

+The cost of dwelling coverage is influenced by various factors, including the location, size, and construction type of the home. Additionally, the level of coverage desired by the homeowner, the presence of any specialized coverage options, and the insurance provider’s policies and rates also play a significant role in determining the cost. It is essential for homeowners to carefully assess their needs and circumstances to find the most cost-effective coverage option.

Can dwelling coverage be customized to meet specific needs and circumstances?

+Absolutely! Dwelling coverage can be tailored to meet the unique needs and circumstances of homeowners. Insurance providers offer a range of coverage options and limits, allowing homeowners to select the level of protection that aligns with their specific requirements. Whether it’s increasing coverage for high-value items or adding specialized coverage for specific hazards, customization ensures that homeowners receive the coverage they need without unnecessary expenses.

What should I do if my home sustains damage, and how does dwelling coverage come into play?

+In the event of damage to your home, it is crucial to act promptly and take the necessary steps to mitigate further harm. First, ensure the safety of yourself and your family, and if possible, prevent further damage by taking reasonable measures. Next, contact your insurance provider and provide them with detailed information about the incident and the extent of the damage. Your insurance provider will guide you through the claims process, and dwelling coverage will come into play to provide financial assistance for the repairs or rebuilding of your home.