Homeowners Insurance Florida

Homeowners insurance is an essential aspect of protecting your home and finances, especially in a state like Florida, known for its unique climate and potential natural disasters. With a diverse range of weather patterns, from hurricanes to tornadoes, floods, and even the occasional snowstorm, Florida residents must navigate a complex landscape of risks and insurance coverage.

This comprehensive guide aims to demystify homeowners insurance in Florida, offering an in-depth analysis of the factors that influence policy choices, the costs involved, and the key considerations for residents. By understanding the intricacies of Florida's insurance market, you can make informed decisions to safeguard your home and assets effectively.

Understanding the Unique Risks in Florida

Florida’s geography and climate present a distinct set of challenges for homeowners. The state’s location makes it susceptible to a variety of natural disasters, each with its own set of risks and potential damages. From the frequent hurricanes that can cause catastrophic destruction to the more localized tornadoes and floods, Florida homeowners face a constant battle against nature’s fury.

Moreover, the state's unique environment also contributes to less publicized, yet equally significant, risks. For instance, sinkholes, a result of Florida's limestone bedrock, can lead to significant property damage. Additionally, the high humidity and frequent rainfall create an ideal environment for mold growth, a problem that can quickly escalate and affect a home's structural integrity.

The Role of Insurance in Mitigating These Risks

Homeowners insurance is not just a financial safeguard; it is a critical tool for managing the inherent risks associated with owning a home in Florida. A standard policy typically covers damages from events like fire, lightning, windstorms, hail, and even vandalism. However, it’s important to note that not all policies are created equal, and understanding the specifics of your coverage is crucial.

For instance, while most policies cover wind damage, this may not extend to all types of wind-related events. In Florida, where hurricanes are a significant concern, a separate hurricane deductible may be applicable, which could mean higher out-of-pocket expenses in the event of a hurricane-related claim.

| Risk | Standard Policy Coverage |

|---|---|

| Hurricanes | May require a separate deductible or policy endorsement. |

| Tornadoes | Typically covered, but check for any specific exclusions or limitations. |

| Floods | Standard policies often exclude flood damage. A separate flood insurance policy may be necessary. |

| Sinkholes | Some policies may offer optional sinkhole coverage or provide coverage for sudden sinkhole damage. However, long-term gradual sinkhole damage might not be covered. |

Note: It's crucial to review your policy documents thoroughly and clarify any uncertainties with your insurance provider to ensure you have the right coverage for your specific needs.

Cost of Homeowners Insurance in Florida

The cost of homeowners insurance in Florida is influenced by a multitude of factors, some unique to the state’s environment and others applicable across the board. Here’s a breakdown of the key elements that contribute to the overall cost of insurance premiums.

The Impact of Florida’s Climate

Florida’s climate is a significant factor in determining insurance costs. The frequent and severe weather events, particularly hurricanes, can drive up insurance rates. Insurance companies consider the historical data of natural disasters in a given area to assess the risk level and set their premiums accordingly.

For instance, a home located in a high-risk hurricane zone will likely have higher insurance premiums compared to one in a less vulnerable area. This is because insurance companies must balance their risk exposure with the potential for significant losses in the event of a hurricane.

Coverage and Deductibles

The level of coverage you choose will directly impact your insurance premium. Higher coverage limits will result in higher premiums, as the insurance company is taking on more financial risk. Similarly, the type of deductible you select can also affect your premium. A higher deductible (the amount you pay out-of-pocket before the insurance coverage kicks in) usually results in a lower premium, as you’re shouldering more of the potential financial burden.

Home’s Construction and Age

The construction and age of your home play a significant role in determining insurance costs. Older homes may be more susceptible to damage and may not meet modern building codes, which can increase the risk and, therefore, the insurance premium. Similarly, the materials used in construction can impact the cost. For instance, a home with a metal roof may be more resistant to wind damage and therefore might result in lower insurance premiums compared to a home with a traditional shingle roof.

| Factor | Impact on Premium |

|---|---|

| Home's Location | Homes in high-risk areas for hurricanes, tornadoes, or floods will have higher premiums. |

| Coverage Amount | Higher coverage limits result in higher premiums. |

| Deductible | A higher deductible can lower your premium. |

| Home's Construction and Age | Older homes or those with outdated construction may face higher premiums. |

Choosing the Right Policy for Florida Residents

With the diverse range of risks and insurance considerations in Florida, choosing the right homeowners insurance policy can be a complex task. It’s crucial to understand your specific needs and the unique risks associated with your home’s location and construction.

Assessing Your Coverage Needs

The first step in choosing the right policy is to assess your coverage needs. Consider the replacement cost of your home and its contents. This is the amount of money it would take to rebuild your home and replace your belongings if they were damaged or destroyed. Ensure your policy provides sufficient coverage to match these replacement costs.

Additionally, consider any unique risks your home might face. For instance, if your home is in an area prone to flooding, you'll need to ensure you have the appropriate coverage, which may require a separate flood insurance policy.

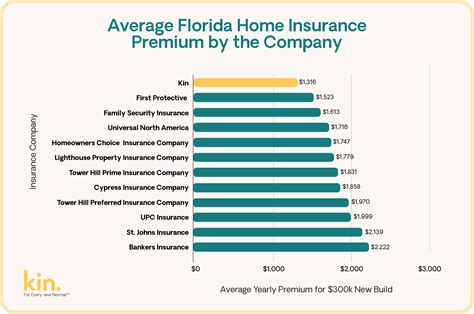

Comparing Policies and Providers

Florida is home to numerous insurance providers, each offering a range of policies with varying coverage and costs. It’s essential to compare these policies to find the best fit for your needs. Look beyond just the premium cost and consider the coverage limits, deductibles, and any additional benefits or perks offered by the provider.

Some providers may offer discounts for bundling policies (e.g., homeowners and auto insurance), or for taking proactive steps to protect your home, such as installing hurricane shutters or a reinforced roof. These discounts can significantly reduce your overall insurance costs.

The Importance of Understanding Policy Exclusions

Policy exclusions are an essential aspect of homeowners insurance that often go overlooked. These are the specific situations or types of damage that are not covered by your policy. Understanding these exclusions is crucial to ensure you’re not left financially vulnerable in the event of a claim.

For instance, while many policies cover wind damage, they may exclude damage caused by a hurricane. This means that if your home is damaged by a hurricane, you may not be fully covered, even if you have a standard windstorm policy. It's important to review these exclusions carefully and consider additional coverage options to fill any gaps.

Tips for Managing Your Homeowners Insurance Costs

Managing your homeowners insurance costs is an ongoing process that involves regular review and proactive measures. Here are some tips to help you keep your insurance costs under control.

Review Your Policy Regularly

Insurance policies and costs can change over time. Regularly reviewing your policy ensures that you’re aware of any changes and can make adjustments as necessary. This could involve updating your coverage limits to match any increases in your home’s value or making changes to your deductibles to reflect your current financial situation.

Take Advantage of Discounts

Insurance providers often offer a range of discounts that can significantly reduce your premiums. These discounts could be for things like having a security system in your home, being claims-free for a certain period, or even for being a loyal customer. Ask your insurance provider about the discounts they offer and ensure you’re taking advantage of all the ones that apply to you.

Make Your Home More Resilient

Taking steps to make your home more resilient to potential risks can not only protect your property but can also reduce your insurance costs. For instance, installing hurricane shutters or a reinforced roof can reduce the risk of wind damage, which may lead to lower insurance premiums. Similarly, making your home more energy-efficient can reduce the risk of fire, which could also impact your insurance costs.

Conclusion: Protecting Your Florida Home

Homeowners insurance in Florida is a complex but essential aspect of homeownership. By understanding the unique risks in the state, the factors that influence insurance costs, and the key considerations when choosing a policy, you can make informed decisions to protect your home and finances effectively.

Regularly reviewing your policy, staying aware of potential discounts, and taking proactive steps to protect your home can all contribute to managing your insurance costs. Remember, your home is likely your most significant asset, and the right insurance coverage is a critical part of safeguarding that investment.

Frequently Asked Questions

What is the average cost of homeowners insurance in Florida?

+

The average cost of homeowners insurance in Florida can vary widely depending on various factors, including the location and construction of the home, the level of coverage chosen, and the deductibles selected. As of recent data, the average annual premium for homeowners insurance in Florida is approximately 2,780, although this can range significantly from as low as 1,000 to well over $4,000.

Are there any government-backed insurance programs available in Florida for homeowners?

+

Yes, Florida offers the Florida Hurricane Catastrophe Fund (FHCF), a state-backed fund that provides reinsurance to insurance companies in the event of a hurricane catastrophe. This fund helps to stabilize insurance rates and ensure coverage availability for homeowners. Additionally, the Florida Windstorm Underwriting Association (FWUA) offers windstorm coverage to homeowners who cannot obtain it from private insurers.

How can I reduce my homeowners insurance premium in Florida?

+

There are several strategies to reduce your homeowners insurance premium in Florida. This includes increasing your deductible, maintaining a claims-free record, taking advantage of any available discounts (e.g., multi-policy discounts or loyalty discounts), and making improvements to your home that enhance its resilience to natural disasters (e.g., installing hurricane shutters or a reinforced roof). Regularly reviewing and comparing insurance policies can also help you find the best value for your insurance needs.

What should I look for when choosing a homeowners insurance policy in Florida?

+

When choosing a homeowners insurance policy in Florida, it’s crucial to consider the specific risks and needs of your home. Look for a policy that provides adequate coverage for your home’s replacement cost and its contents. Ensure the policy covers the unique risks associated with Florida, such as hurricanes, tornadoes, and sinkholes. Understand any exclusions or limitations, especially for natural disasters. Compare policies from different insurers to find the best combination of coverage and cost. Finally, consider the insurer’s reputation and financial stability to ensure they will be able to pay out claims if needed.