Homeowners Insurance Premium

Homeowners insurance is a crucial aspect of homeownership, providing financial protection against various risks and perils. The premium, or the cost of this insurance, is a significant consideration for homeowners as it directly impacts their monthly or annual expenses. Understanding the factors that influence homeowners insurance premiums is essential for making informed decisions and potentially saving money.

In this comprehensive guide, we will delve into the world of homeowners insurance premiums, exploring the key elements that affect their calculation. By the end of this article, you'll have a deeper understanding of how insurance companies assess risk and determine the cost of your homeowners insurance policy. Let's begin by examining the fundamental factors that play a role in setting these premiums.

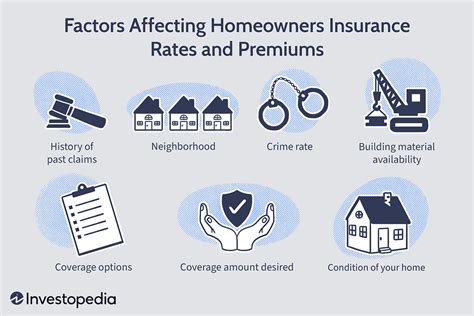

Factors Influencing Homeowners Insurance Premiums

Homeowners insurance premiums are not set in stone; they are tailored to the specific risks and characteristics associated with each property and its occupants. Here’s a closer look at the primary factors that insurance companies consider when determining the cost of your homeowners insurance policy.

1. Location, Location, Location

The location of your home is a critical factor in determining your insurance premium. Insurance companies assess the risks associated with different geographical areas, taking into account factors such as crime rates, natural disasters, and even the local fire department’s response times and ratings.

For instance, if you live in an area prone to hurricanes, your insurance premium will likely be higher due to the increased risk of property damage. Similarly, homes located in neighborhoods with higher crime rates may face higher premiums to account for the potential risk of theft or vandalism.

| Location Factor | Impact on Premium |

|---|---|

| Natural Disaster Risk | Higher premiums for areas prone to hurricanes, floods, earthquakes, etc. |

| Crime Rates | Increased premiums in neighborhoods with higher theft or vandalism rates. |

| Fire Department Response | Better-rated fire departments can lead to lower premiums. |

2. Home’s Age and Construction

The age and construction materials of your home play a significant role in determining your insurance premium. Older homes may have outdated electrical systems, plumbing, or roofing, which can increase the risk of accidents and damage. As a result, insurance companies often charge higher premiums for older homes.

Additionally, the construction materials used in your home can impact its vulnerability to certain types of damage. For example, homes with asphalt shingle roofs may be more susceptible to wind damage compared to those with metal or tile roofs. Insurance companies take these factors into account when calculating premiums.

3. Policy Coverage and Deductibles

The level of coverage you choose for your homeowners insurance policy directly affects your premium. Higher coverage limits typically result in higher premiums, as the insurance company assumes greater financial responsibility. On the other hand, selecting a higher deductible (the amount you pay out of pocket before your insurance kicks in) can lead to lower premiums.

It's important to strike a balance between coverage and cost. Choosing a deductible that you're comfortable paying in the event of a claim can help reduce your premium. However, be cautious not to select a deductible that's too high, as it may make it difficult to afford repairs or replacements if needed.

4. Claims History and Credit Score

Your claims history and credit score are two additional factors that insurance companies consider when setting your premium. A history of frequent claims may indicate a higher risk to the insurance company, leading to increased premiums.

Similarly, your credit score can influence your insurance premium. Studies have shown a correlation between credit scores and the likelihood of filing insurance claims. Insurance companies often use credit-based insurance scores to assess the risk of insuring a particular individual, which can impact the premium you pay.

5. Home Security and Safety Features

The presence of security and safety features in your home can significantly impact your insurance premium. Installing features such as burglar alarms, fire alarms, smoke detectors, and sprinkler systems can lower your risk of theft, fire, and other types of damage. As a result, insurance companies may offer discounts or reduced premiums for homes with these safety enhancements.

Additionally, having a monitored security system can provide an extra layer of protection and may further qualify you for insurance discounts. It's always worth discussing these potential savings with your insurance provider.

6. Personal Factors and Occupancy

Certain personal factors and the occupancy status of your home can also influence your insurance premium. For example, if you’re a senior citizen or have specific hobbies or collections, your insurance needs and premiums may be affected.

Additionally, the primary occupancy status of your home matters. If your home is your primary residence, you may qualify for lower premiums compared to a vacation home or rental property. Insurance companies typically view primary residences as lower-risk properties.

Understanding Premium Calculations: A Real-World Example

To illustrate how these factors come together to determine your homeowners insurance premium, let’s consider a real-world example. Meet John, a homeowner in a suburban area who recently purchased a home built in the 1980s.

John's home is located in a low-crime area with minimal natural disaster risks. However, it has an older roof and outdated electrical wiring. John opts for a comprehensive coverage policy with a $1,000 deductible and installs a monitored security system.

Based on these factors, John's insurance company calculates his premium as follows:

- Base Premium: $1,200 (based on location and construction factors)

- Coverage: +$200 (for comprehensive coverage)

- Deductible: -$100 (for selecting a $1,000 deductible)

- Security System: -$150 (discount for monitored security system)

- Total Premium: $1,150 annually

This example showcases how different factors can influence the final premium. By understanding these calculations, homeowners like John can make informed decisions to potentially lower their insurance costs.

Tips for Managing Your Homeowners Insurance Premium

While many factors influencing your homeowners insurance premium are beyond your control, there are strategies you can employ to potentially reduce your costs.

1. Shop Around and Compare Quotes

Insurance companies use different rating systems and may offer varying premiums for similar coverage. Shopping around and comparing quotes from multiple insurers can help you identify the best value for your specific situation.

Online insurance marketplaces and comparison websites can be valuable tools for this process. They allow you to quickly gather quotes from multiple insurers, making it easier to find the most competitive rates.

2. Bundle Your Policies

Many insurance companies offer discounts when you bundle multiple policies with them. For example, if you have auto insurance with a particular company, you may be eligible for a discount on your homeowners insurance if you bundle the two policies together.

Bundling can lead to significant savings, so it's worth exploring this option with your insurance provider.

3. Maintain a Good Claims History

A history of frequent insurance claims can signal a higher risk to insurance companies, potentially leading to increased premiums. While it’s important to file claims when necessary, try to avoid making claims for minor incidents that you can afford to pay for out of pocket.

By maintaining a good claims history, you may be rewarded with lower premiums over time.

4. Improve Your Home’s Safety Features

Investing in home security and safety features can pay off in the form of insurance discounts. Consider installing a monitored security system, smoke detectors, and fire alarms. These enhancements not only protect your home but can also reduce your insurance costs.

Additionally, regular maintenance and upgrades to your home's systems, such as updating outdated electrical wiring or replacing an aging roof, can help mitigate potential risks and lower your insurance premium.

5. Maintain a Good Credit Score

As mentioned earlier, your credit score can impact your insurance premium. Maintaining a good credit score not only benefits your financial health but can also lead to lower insurance costs. Insurance companies often use credit-based insurance scores to assess risk, so keeping your credit score in good standing can be advantageous.

Conclusion: Empowering Homeowners with Knowledge

Understanding the factors that influence homeowners insurance premiums is an essential step towards managing your insurance costs effectively. By considering factors such as location, home construction, coverage choices, and personal factors, you can make informed decisions to potentially lower your insurance premiums.

Remember, shopping around, bundling policies, maintaining a good claims history, improving your home's safety features, and keeping your credit score in check are all strategies that can help you save on your homeowners insurance. By staying informed and proactive, you can navigate the world of insurance with confidence and find the best coverage for your needs.

Can I negotiate my homeowners insurance premium with my insurance company?

+While insurance premiums are based on standardized calculations, you can still negotiate with your insurance provider. Review your policy annually and discuss any changes or improvements you’ve made to your home that may reduce risk. Your insurer may offer discounts or lower your premium accordingly.

How often should I review my homeowners insurance policy and premium?

+It’s recommended to review your homeowners insurance policy and premium annually. This allows you to assess any changes in your circumstances, ensure your coverage is up to date, and potentially negotiate better rates or explore alternative options.

What should I do if my homeowners insurance premium increases significantly?

+If your homeowners insurance premium increases significantly, it’s important to understand the reason for the increase. Contact your insurance provider to discuss the change and review your policy. They may be able to provide explanations and offer alternative coverage options to help manage the increase.