Homeowners Insurance Quote Online

Homeowners insurance is a vital aspect of protecting one's biggest investment: their home. In today's digital age, obtaining an online homeowners insurance quote has become an efficient and convenient process, empowering homeowners to take control of their financial security. This comprehensive guide will delve into the intricacies of acquiring homeowners insurance quotes online, offering valuable insights and expert advice to ensure an informed decision.

Understanding the Online Homeowners Insurance Quote Process

The online homeowners insurance quote journey begins with a simple search for a reputable insurance provider’s website. From there, individuals can embark on a tailored journey that considers their unique circumstances and coverage needs.

Gathering Essential Information

Before initiating the quote process, it’s crucial to have specific details at hand. These include the home’s location, construction type, and square footage. Additionally, personal information such as names, dates of birth, and marital status will be required. Having this information readily available streamlines the quote process, making it a swift and efficient experience.

Navigating the Online Quote Form

The online quote form is designed to be user-friendly and intuitive. It typically guides individuals through a series of questions, allowing them to input the necessary details. This process often involves specifying the type of coverage desired, such as comprehensive or liability-only, and providing information about any existing insurance policies.

| Coverage Type | Description |

|---|---|

| Comprehensive | Covers a wide range of perils, including fire, theft, and natural disasters. |

| Liability-Only | Provides protection against legal claims and damages arising from accidents or injuries on the insured property. |

During this stage, it's beneficial to explore additional coverage options, such as personal property insurance or flood insurance, which can be added to the base policy to enhance protection.

Comparing Quotes and Making an Informed Decision

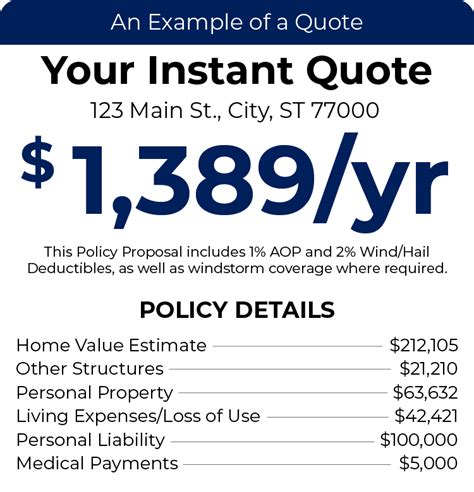

Once the necessary information is provided, the insurance provider’s system generates a quote, detailing the estimated annual premium. It’s advisable to obtain quotes from multiple providers to compare coverage options and prices. This step ensures that homeowners can make an informed decision based on their specific needs and budget.

When comparing quotes, it's essential to consider the reputation and financial stability of the insurance company, as well as the scope of coverage offered. Additionally, reviewing customer reviews and ratings can provide valuable insights into the provider's service quality and claim handling processes.

Tailoring Coverage to Individual Needs

Homeowners insurance is not a one-size-fits-all solution. Every homeowner has unique circumstances and requirements, and it’s crucial to tailor coverage to ensure adequate protection.

Customizing Coverage Limits

The coverage limits of a homeowners insurance policy refer to the maximum amount the insurance company will pay for covered losses. These limits can be customized to align with the homeowner’s specific needs. For instance, individuals with high-value possessions may opt for increased personal property coverage limits to ensure adequate protection in the event of theft or damage.

Selecting the Right Deductible

The deductible is the amount the homeowner must pay out of pocket before the insurance coverage kicks in. Selecting the appropriate deductible can significantly impact the annual premium. A higher deductible typically results in a lower premium, while a lower deductible means a higher premium. It’s essential to strike a balance between affordability and financial protection when choosing a deductible.

Exploring Additional Coverage Options

Beyond the standard coverage provided by homeowners insurance, there are various additional options available. These include coverage for specific perils, such as flood or earthquake, which are not typically included in standard policies. Additionally, homeowners can opt for identity theft protection or coverage for high-value items like jewelry or fine art.

Exploring these additional coverage options allows homeowners to create a comprehensive insurance plan that addresses their unique risks and vulnerabilities.

The Benefits of Online Homeowners Insurance Quotes

Obtaining homeowners insurance quotes online offers numerous advantages that contribute to a seamless and efficient experience.

Convenience and Accessibility

The online quote process eliminates the need for in-person meetings or lengthy phone calls. Homeowners can access quotes from the comfort of their homes, at a time that suits their schedule. This level of convenience is particularly beneficial for busy individuals or those residing in remote areas.

Real-Time Comparison and Decision-Making

Online quote platforms often provide instant comparisons, allowing homeowners to view multiple quotes side by side. This feature facilitates a swift and informed decision-making process, as individuals can easily identify the most suitable policy based on their preferences and budget.

Personalized Coverage Recommendations

Advanced online quote systems utilize algorithms and data analysis to provide personalized coverage recommendations. By considering factors such as the home’s location, construction, and personal possessions, these systems offer tailored suggestions, ensuring homeowners receive the most appropriate coverage for their needs.

Streamlined Application Process

Once a homeowner has selected a suitable policy, the online application process is often seamless. Many insurance providers offer secure online platforms where individuals can complete the necessary paperwork and finalize their policy. This digital approach reduces paperwork and eliminates the need for physical visits, making the entire process more efficient and convenient.

Expert Tips for Navigating the Online Quote Process

To ensure a successful and stress-free experience when obtaining homeowners insurance quotes online, consider the following expert tips.

Research and Compare Multiple Providers

Don’t settle for the first quote you receive. Take the time to research and compare quotes from several reputable insurance providers. This step ensures you are getting the best value for your money and the most comprehensive coverage.

Understand Your Coverage Needs

Before initiating the quote process, take a moment to assess your specific coverage needs. Consider factors such as the value of your home, the replacement cost of your possessions, and any unique risks associated with your location. Understanding these needs will help you make informed decisions when selecting coverage limits and additional endorsements.

Review Policy Details and Exclusions

When reviewing quotes, pay close attention to the policy details and exclusions. Ensure that the coverage provided aligns with your expectations and addresses your specific concerns. Be aware of any exclusions or limitations that may impact your coverage in the event of a claim.

Consider Bundle Discounts

Many insurance providers offer bundle discounts when homeowners combine their homeowners insurance with other policies, such as auto insurance. By bundling multiple policies, individuals can often save money and streamline their insurance management.

Seek Professional Advice

If you have complex insurance needs or are unsure about certain aspects of the quote process, don’t hesitate to seek professional advice. Insurance brokers or agents can provide valuable insights and guidance, ensuring you make the right choices for your specific circumstances.

What factors influence homeowners insurance quotes?

+Homeowners insurance quotes are influenced by various factors, including the home’s location, construction type, square footage, and the homeowner’s personal information. Additionally, the desired coverage type, existing insurance policies, and any additional coverage options selected can impact the quote.

How can I lower my homeowners insurance premium?

+There are several strategies to reduce homeowners insurance premiums. These include increasing the deductible, exploring discounts such as multi-policy bundles or safety device installations, and maintaining a good credit score. Additionally, regularly reviewing and updating coverage limits to align with the home’s current value can help keep premiums affordable.

What should I do if I’m unsure about the coverage limits?

+If you’re uncertain about the coverage limits, it’s advisable to consult with an insurance professional. They can assess your specific circumstances and recommend appropriate coverage limits based on factors like the replacement cost of your home and the value of your personal possessions. This ensures you have adequate protection without overpaying for unnecessary coverage.