House Insurance Florida

When it comes to house insurance in Florida, residents and property owners face unique challenges due to the state's susceptibility to natural disasters, particularly hurricanes. Understanding the specific risks and requirements is crucial for ensuring adequate protection for your home and belongings. This comprehensive guide aims to delve into the intricacies of house insurance in Florida, offering expert insights and practical advice to help you navigate this essential aspect of homeownership.

Understanding Florida’s Insurance Landscape

Florida’s insurance market is distinct from other states due to its high vulnerability to catastrophic events. This has led to a complex system of regulations and coverage options, aimed at balancing the needs of homeowners and the insurance industry. Key factors that influence insurance rates and availability in Florida include:

- Hurricane Risk: Florida's frequent and intense hurricane seasons significantly impact insurance rates. Insurers must consider the potential for widespread damage and the costs associated with rebuilding.

- Windstorm Coverage: Many standard insurance policies in Florida exclude coverage for wind-related damage, requiring homeowners to purchase separate windstorm insurance policies.

- Citizens Property Insurance Corporation (CPIC): CPIC is a state-run insurer of last resort, providing coverage to those who cannot obtain insurance through private carriers. However, CPIC policies often have higher deductibles and more limited coverage.

- Insurance Reforms: Florida has implemented various reforms over the years to stabilize the insurance market, including the creation of the Florida Hurricane Catastrophe Fund (FHCF) to provide reinsurance coverage to insurers.

Essential Coverage for Florida Homeowners

Given the unique risks in Florida, it’s crucial for homeowners to ensure they have adequate coverage. Here are some key types of insurance coverage to consider:

Homeowners Insurance

Homeowners insurance is the foundation of your insurance protection. It typically covers:

- Dwelling Coverage: Provides financial protection for the structure of your home.

- Personal Property Coverage: Covers the contents of your home, including furniture, electronics, and clothing.

- Liability Coverage: Protects you against lawsuits for injuries that occur on your property.

- Additional Living Expenses: Covers the cost of temporary housing if your home becomes uninhabitable due to a covered event.

Windstorm Insurance

As mentioned earlier, windstorm coverage is often a separate policy or endorsement to your standard homeowners insurance. It’s crucial to have this coverage in Florida to protect against the high winds associated with hurricanes and tropical storms.

Flood Insurance

Florida is prone to flooding, especially in coastal areas and low-lying regions. Standard homeowners insurance policies typically do not cover flood damage. The National Flood Insurance Program (NFIP) offers flood insurance to homeowners, renters, and business owners. It’s important to consider flood insurance even if you’re not in a high-risk flood zone, as flooding can occur anywhere.

Hurricane Deductibles

Many homeowners insurance policies in Florida have hurricane deductibles, which are a percentage of the insured value of your home. These deductibles apply specifically to damage caused by hurricanes. It’s essential to understand the terms of your hurricane deductible and consider whether you need additional coverage to cover this potential out-of-pocket expense.

Tips for Choosing the Right Insurance Provider

With numerous insurance providers operating in Florida, choosing the right one can be daunting. Here are some tips to guide your decision:

- Compare Policies: Obtain quotes from multiple insurers to compare coverage options, deductibles, and premiums. Look for providers that offer comprehensive coverage tailored to Florida's unique risks.

- Financial Stability: Ensure the insurer you choose is financially stable and has a strong reputation. Check their financial ratings and reviews from independent sources.

- Claims Process: Understand the insurer's claims process and reputation for timely and fair settlements. Look for providers with a track record of excellent customer service during and after a disaster.

- Bundling Options: Consider bundling your homeowners insurance with other policies, such as auto or umbrella insurance, to potentially save on premiums.

- Local Agents: Working with a local insurance agent can provide personalized advice and support. They can help you navigate the complex Florida insurance landscape and find the best coverage for your needs.

Mitigating Risks and Lowering Insurance Costs

While insurance is essential, there are steps you can take to reduce your risk of damage and potentially lower your insurance premiums:

Hurricane-Proofing Your Home

- Impact-Resistant Windows and Doors: Installing impact-resistant windows and doors can significantly reduce the risk of wind and water damage during a hurricane.

- Roof Strengthening: Regularly inspect and maintain your roof to ensure it can withstand high winds. Consider upgrading to a hurricane-resistant roof if necessary.

- Secure Outdoor Items: During hurricane season, ensure that all outdoor furniture, decorations, and equipment are secured or brought indoors to prevent them from becoming dangerous projectiles.

Flood Prevention and Mitigation

- Elevate Electrical Systems: Raise electrical panels, outlets, and appliances above expected flood levels to prevent water damage.

- Install Sump Pumps: Sump pumps help remove water from your property, preventing flooding and water damage.

- Clear Drainage Areas: Regularly clean and maintain gutters, downspouts, and drainage areas to ensure water can flow freely away from your home.

The Future of Insurance in Florida

The insurance landscape in Florida is continually evolving to adapt to the state’s unique challenges. Here are some trends and considerations for the future:

- Climate Change Impact: As climate change contributes to more frequent and severe weather events, insurers will need to adapt their models and rates to reflect these changing risks.

- Technological Advancements: The use of advanced technologies, such as drones for claims assessment and AI for risk modeling, is expected to become more prevalent in the Florida insurance market.

- Reinsurance Capacity: The availability and cost of reinsurance, which provides financial protection to insurers, will continue to be a critical factor in the stability of the Florida insurance market.

- Public-Private Partnerships: There may be increasing collaboration between the state government and private insurers to develop innovative solutions for covering catastrophic risks.

Conclusion

House insurance in Florida is a complex but crucial aspect of homeownership. By understanding the unique risks, coverage options, and market dynamics, you can make informed decisions to protect your home and finances. Remember to regularly review and update your insurance policies to stay ahead of changing risks and market conditions.

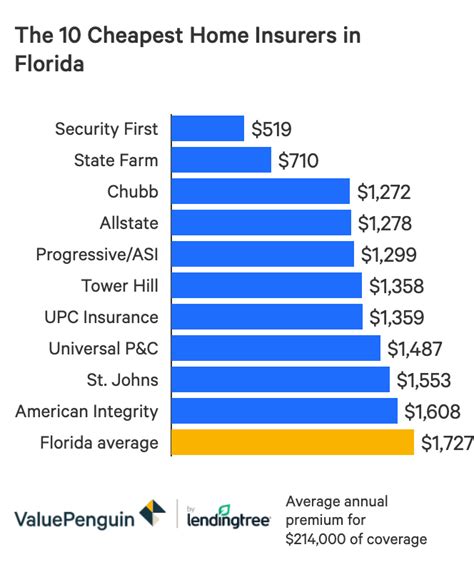

What is the average cost of homeowners insurance in Florida?

+The average cost of homeowners insurance in Florida varies based on factors such as location, home value, and coverage limits. As of [insert date], the average annual premium for a 250,000 home in Florida is approximately 2,000, but this can range significantly depending on individual circumstances.

How often should I review my insurance policy?

+It’s recommended to review your insurance policy annually, especially after significant life changes like home renovations, marriage, or the purchase of valuable items. Regular reviews ensure your coverage remains adequate and up-to-date.

Can I save money on my insurance premiums in Florida?

+Yes, there are several ways to potentially lower your insurance premiums. This includes implementing hurricane-proofing measures, maintaining a good claims history, bundling policies, and shopping around for the best rates from different insurers.

What should I do if my insurance claim is denied?

+If your insurance claim is denied, first review the reasons provided by your insurer. If you believe the denial is unjustified, contact your insurer to discuss the claim further. You may also consider seeking legal advice or filing a complaint with the Florida Department of Financial Services.