House Insurance Liability Coverage

House insurance, also known as homeowners insurance, is a crucial aspect of protecting one's property and financial well-being. While most people are familiar with the basic concept of insuring their homes, many might not fully comprehend the importance and intricacies of liability coverage within their policies. Liability coverage is an essential component that safeguards homeowners from a wide range of potential risks and liabilities that can arise from daily life.

In this comprehensive guide, we will delve into the world of house insurance liability coverage, exploring its significance, what it entails, and how it can provide peace of mind for homeowners. We will discuss various scenarios where liability coverage becomes invaluable and provide insights into maximizing the benefits of this often-overlooked aspect of insurance policies. By the end of this article, readers will have a deeper understanding of liability coverage and its role in ensuring their homes and finances are adequately protected.

Understanding House Insurance Liability Coverage

Liability coverage within house insurance policies is designed to protect homeowners from legal and financial liabilities that may arise from accidents or incidents that occur on their property or involve their actions or possessions. It provides a safety net, ensuring that homeowners are not personally responsible for paying significant damages if they are found legally liable for causing harm or injury to others.

Here are some key aspects to understand about liability coverage in house insurance:

- Legal Defense Costs: Liability coverage often includes legal defense costs, covering the expenses associated with hiring an attorney to defend against claims or lawsuits brought against the homeowner.

- Bodily Injury and Property Damage: This coverage applies to situations where guests or visitors suffer bodily injury or property damage on the insured's property. It covers medical expenses, rehabilitation costs, and even loss of income if the injured party is unable to work.

- Personal Injury Liability: Personal injury liability extends beyond physical harm to include defamation, libel, slander, false arrest, and invasion of privacy. It protects homeowners from legal action arising from these non-physical forms of harm.

- Damage to Others' Property: Liability coverage also applies if the homeowner accidentally damages someone else's property, whether it's a neighbor's fence, a car in a parking lot, or a guest's personal belongings.

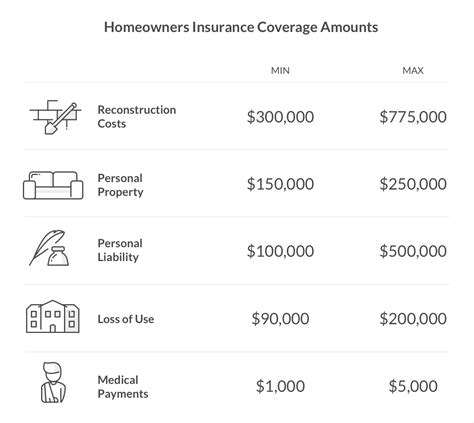

- Coverage Limits: Liability coverage has specific limits, which are the maximum amounts the insurance company will pay for covered claims. It's important to choose appropriate limits based on individual circumstances and the potential risks associated with the property.

Real-Life Scenarios and the Role of Liability Coverage

To illustrate the significance of liability coverage, let’s explore a few real-life scenarios where this aspect of house insurance becomes crucial:

Slip and Fall Accidents

Imagine a homeowner hosts a backyard barbecue for friends and family. During the gathering, a guest trips over a garden hose and suffers a serious injury, requiring medical attention and potentially long-term rehabilitation. In such a scenario, liability coverage would step in to cover the guest’s medical expenses and any other associated costs, protecting the homeowner from personal financial liability.

| Scenario | Coverage |

|---|---|

| Guest Injury | Medical Expenses, Rehabilitation Costs |

| Legal Defense | Attorney Fees, Court Costs |

| Property Damage | Repair or Replacement Costs |

Without adequate liability coverage, the homeowner could face significant financial burdens, not to mention the emotional stress of dealing with a legal battle. Liability coverage ensures that the homeowner's personal assets and finances are protected, allowing them to focus on supporting their guest's recovery.

Dog Bites and Animal-Related Incidents

Many homeowners have pets, and while they are beloved family members, accidents can happen. If a guest is bitten by a homeowner’s dog, resulting in injuries, liability coverage becomes essential. It covers medical expenses for the injured party and provides legal defense if a lawsuit is filed. Additionally, liability coverage may also apply if the homeowner’s pet damages someone else’s property, such as a neighbor’s garden or a guest’s vehicle.

Home-Based Business Risks

For homeowners who operate a business from their residence, liability coverage takes on added importance. If a client or customer suffers an injury while visiting the home office or if the homeowner’s business activities result in property damage or personal injury to others, liability coverage provides protection. It ensures that the homeowner’s business ventures do not expose their personal finances to unnecessary risks.

Accidental Property Damage

Liability coverage also applies to situations where the homeowner accidentally causes damage to someone else’s property. For instance, if a homeowner is painting their fence and accidentally splatters paint on a neighbor’s car, liability coverage would cover the cost of repairing or replacing the damaged vehicle. This type of coverage provides peace of mind, knowing that accidental incidents won’t result in significant financial setbacks.

Maximizing the Benefits of Liability Coverage

To ensure that liability coverage provides the best possible protection, homeowners should consider the following tips:

- Review Policy Limits: Regularly review the liability coverage limits in your house insurance policy. As your financial situation and assets grow, it's essential to ensure that your coverage limits are adequate to protect your current circumstances.

- Consider Umbrella Policies: For homeowners with substantial assets, an umbrella policy can provide additional liability coverage beyond the limits of their house insurance policy. Umbrella policies offer an extra layer of protection for high-value assets and provide coverage for a broader range of potential liabilities.

- Practice Home Safety: While liability coverage provides peace of mind, it's still important to prioritize home safety. Regular maintenance, proper storage of hazardous materials, and ensuring that your property is safe for guests and visitors can help reduce the likelihood of accidents and subsequent liability claims.

- Understand Exclusions: Familiarize yourself with the exclusions in your liability coverage. Certain incidents, such as intentional acts or certain types of water damage, may not be covered. Understanding these exclusions can help you take the necessary precautions to avoid potential liabilities.

The Future of Liability Coverage

As society evolves and new risks emerge, the role of liability coverage in house insurance policies is likely to adapt and expand. With advancements in technology and changes in lifestyle, insurers are continuously updating their policies to address emerging risks. For instance, with the rise of home-based businesses and shared economies, liability coverage is becoming increasingly important for homeowners who engage in these activities.

Furthermore, as climate change continues to impact weather patterns and natural disasters become more frequent, liability coverage may play a vital role in protecting homeowners from liabilities arising from extreme weather events. Insurers are already adapting their policies to address these new risks, offering specialized coverage options to safeguard homeowners in regions vulnerable to natural disasters.

Conclusion

House insurance liability coverage is a vital component of any comprehensive homeowners insurance policy. It provides a safety net, protecting homeowners from a wide range of potential liabilities that can arise from daily life. By understanding the scope of liability coverage and its applicability to various scenarios, homeowners can rest assured that they are adequately protected. With the right coverage and a proactive approach to home safety, homeowners can enjoy peace of mind, knowing that their financial well-being is secure.

What is the average cost of liability coverage in house insurance policies?

+The cost of liability coverage can vary depending on several factors, including the location of the property, the value of the home, and the chosen coverage limits. On average, liability coverage in house insurance policies can range from 300 to 500 annually. However, it’s important to note that the cost can be significantly higher or lower based on individual circumstances.

Can liability coverage protect me from lawsuits related to my home business?

+Yes, liability coverage in house insurance policies can provide protection for home-based businesses. However, it’s important to carefully review your policy and ensure that it specifically covers liabilities related to your business activities. In some cases, additional coverage or an umbrella policy may be necessary to fully protect your business interests.

Are there any common exclusions in liability coverage that I should be aware of?

+Yes, there are certain common exclusions in liability coverage. These may include intentional acts, certain types of water damage, nuclear incidents, and war-related damage. It’s crucial to thoroughly understand the exclusions in your policy to ensure you are aware of any potential gaps in coverage.