Household Insurance Online Quote

Household insurance, also known as home insurance or property insurance, is a vital aspect of safeguarding your home and possessions. It provides financial protection against various risks and unexpected events, ensuring that you and your loved ones are covered in case of emergencies. In today's digital age, obtaining an online quote for household insurance has become a convenient and efficient process, allowing homeowners to quickly assess their coverage needs and compare options from the comfort of their homes.

Understanding the Importance of Household Insurance

Household insurance serves as a safety net for homeowners, protecting them from potential financial losses that may arise due to damage or loss of their property. Whether it’s a natural disaster, burglary, or accidental damage, having comprehensive insurance coverage can provide peace of mind and ensure that you can rebuild and recover without incurring significant expenses.

Here are some key reasons why household insurance is essential:

- Protection against unforeseen events: Natural disasters such as floods, hurricanes, or earthquakes can cause extensive damage to your home and belongings. Household insurance provides coverage for these unforeseen events, helping you rebuild and replace damaged items.

- Financial security in case of theft or burglary: Unfortunately, burglaries and thefts are common occurrences. Household insurance policies typically include coverage for stolen items, providing financial compensation to replace your belongings.

- Coverage for accidental damage: Accidents happen, and household insurance covers a wide range of accidental damages, including water damage, fire, or damage caused by fallen trees or power lines.

- Liability protection: If someone gets injured on your property or if your actions result in property damage to others, household insurance offers liability coverage to protect you from potential lawsuits and legal expenses.

- Peace of mind: Knowing that you have adequate insurance coverage gives you the assurance that you and your family are financially protected, allowing you to focus on enjoying your home without worrying about unexpected costs.

The Online Quote Process: A Step-by-Step Guide

Obtaining an online quote for household insurance is a straightforward process that typically involves the following steps:

Step 1: Research and Compare Insurance Providers

Start by researching reputable insurance companies that offer household insurance policies. Look for providers with a strong track record, positive customer reviews, and a wide range of coverage options. Compare their policies, coverage limits, and additional benefits to find the best fit for your needs.

Consider factors such as:

- Coverage options: Ensure that the provider offers comprehensive coverage for your specific needs, including protection against natural disasters, theft, and accidental damage.

- Deductibles and premiums: Evaluate the deductibles (the amount you pay out-of-pocket before the insurance coverage kicks in) and premiums (the cost of the insurance policy) to find a balance that suits your budget.

- Additional benefits: Some insurance providers offer unique benefits such as identity theft protection, replacement cost coverage, or coverage for high-value items. Consider these add-ons based on your requirements.

- Customer service and claims process: Research the insurer's reputation for customer service and claims handling. Look for providers with a positive track record and a seamless claims process to ensure a hassle-free experience if you ever need to file a claim.

Step 2: Gather Relevant Information

Before requesting an online quote, gather the necessary information to ensure a smooth and accurate quotation process. Here’s what you’ll typically need:

- Personal details: Your name, date of birth, contact information, and email address.

- Home details: The address of the property you want to insure, the year it was built, and the type of construction (e.g., brick, wood frame). Provide accurate information about the size of your home, including the number of rooms and any additional structures like garages or sheds.

- Coverage requirements: Determine the level of coverage you desire, including the replacement cost value of your home and the value of your personal belongings. Consider any high-value items or specific coverage needs you may have.

- Previous claims history: If you have had any previous insurance claims, provide details such as the nature of the claim, the date, and the amount paid.

- Security measures: Mention any security systems or devices you have installed, such as alarm systems, surveillance cameras, or reinforced doors. These can often result in lower insurance premiums.

Step 3: Complete the Online Quote Form

Visit the website of your chosen insurance provider and locate the online quote form. Carefully fill out the form, providing accurate and detailed information. Take your time to ensure that all the details are correct, as this will impact the accuracy of your quote.

Common sections in the online quote form include:

- Personal information: Enter your name, contact details, and any additional personal details requested.

- Home details: Provide information about your home, including its location, construction type, and any unique features.

- Coverage requirements: Specify the level of coverage you desire, such as the replacement cost value and any additional coverage options you wish to include.

- Additional information: Answer any questions about your home's condition, any recent renovations, or any potential risks (e.g., proximity to water bodies or fire hazards).

- Security measures: Mention any security systems or devices you have installed to enhance your home's security.

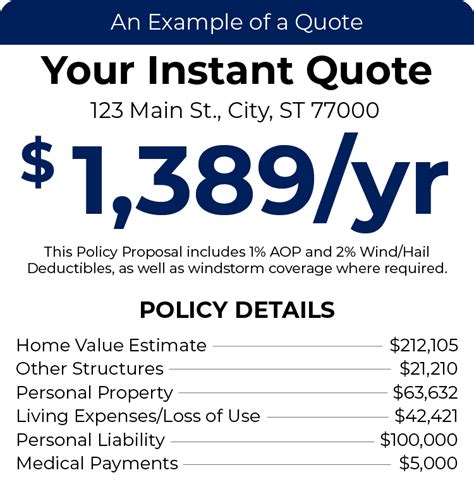

Step 4: Review and Compare Quotes

Once you’ve submitted the online quote form, the insurance provider will generate a quote based on the information you provided. Take the time to carefully review the quote, ensuring that all the details are accurate and aligned with your coverage needs.

Compare quotes from multiple providers to find the best value for your money. Consider factors such as coverage limits, deductibles, premiums, and any additional benefits offered. Remember, the cheapest option may not always be the best, as it's essential to have adequate coverage to protect your home and belongings.

Step 5: Customize Your Policy (if needed)

After reviewing the quotes, you may decide to customize your policy to better suit your needs. Contact the insurance provider to discuss any adjustments or additions to your coverage. They can guide you through the process and help you understand the impact of these changes on your premiums.

Step 6: Purchase Your Policy

Once you’ve found the right insurance provider and customized your policy, it’s time to purchase your household insurance. Follow the provider’s instructions to complete the payment process and finalize your policy. Ensure that you receive a confirmation email or document outlining the terms and conditions of your coverage.

Benefits of Obtaining an Online Quote

There are several advantages to obtaining an online quote for household insurance:

- Convenience and accessibility: You can obtain quotes from the comfort of your home at any time, without the need for in-person meetings or phone calls. This saves time and allows you to compare multiple options quickly.

- Comparison shopping: Online quotes provide a platform to easily compare different insurance providers, coverage options, and premiums. This helps you make an informed decision and find the best value for your insurance needs.

- Accurate and personalized quotes: Online quote forms often allow for detailed input, ensuring that the quote is tailored to your specific circumstances. This accuracy helps you understand the true cost of your insurance coverage.

- No-obligation quotes: Obtaining an online quote does not obligate you to purchase a policy. You can request multiple quotes without any commitment, allowing you to explore different options before making a decision.

- Education and understanding: The online quote process often involves providing detailed information about your home and coverage needs. This can help you better understand the various aspects of household insurance and make more informed choices.

Tips for Maximizing Your Household Insurance Coverage

To ensure that you have adequate coverage and make the most of your household insurance policy, consider the following tips:

- Regularly review and update your coverage: Your insurance needs may change over time, especially if you make significant renovations or acquire valuable possessions. Review your policy annually and update it to reflect any changes in your home or lifestyle.

- Understand your coverage limits: Familiarize yourself with the coverage limits and exclusions in your policy. Ensure that you have adequate coverage for your home's replacement cost and the value of your personal belongings. Consider additional coverage for high-value items or specific risks.

- Maintain proper home maintenance: Regularly inspect and maintain your home to prevent potential issues. Keep an eye on plumbing, electrical systems, and roofing to minimize the risk of accidents and reduce the likelihood of insurance claims.

- Document your belongings: Create an inventory of your personal belongings, including photos, purchase receipts, and descriptions. This documentation will help you make accurate claims and receive fair compensation if you ever need to file for losses.

- Understand the claims process: Familiarize yourself with the steps involved in filing a claim and the documentation required. This knowledge will streamline the claims process and ensure a smoother experience if you ever need to make a claim.

Conclusion

Household insurance is an essential safeguard for homeowners, providing financial protection against a wide range of risks. Obtaining an online quote is a convenient and efficient way to explore your insurance options and find the best coverage for your needs. By following the steps outlined above and staying informed about your coverage, you can ensure that your home and possessions are adequately protected.

Remember, household insurance is a vital investment that provides peace of mind and financial security. Take the time to research, compare, and customize your policy to ensure you have the right coverage for your unique circumstances.

Frequently Asked Questions

What factors affect the cost of household insurance?

+The cost of household insurance can be influenced by various factors, including the location of your home, its construction type, the age of the property, and any security features installed. Additionally, your personal claims history, credit score, and the level of coverage you choose can impact the premiums.

How often should I review my household insurance policy?

+It is recommended to review your household insurance policy annually or whenever there are significant changes in your home or lifestyle. Regular reviews ensure that your coverage remains up-to-date and aligns with your current needs.

What happens if I need to make a claim on my household insurance policy?

+If you need to make a claim, contact your insurance provider as soon as possible. They will guide you through the claims process, which typically involves submitting documentation, such as photos, receipts, and a detailed description of the incident. The insurance provider will assess the claim and provide compensation based on the terms of your policy.

Can I bundle my household insurance with other policies to save money?

+Yes, many insurance providers offer discounts when you bundle multiple policies, such as household insurance with auto insurance or life insurance. Bundling can result in significant savings, so it’s worth exploring this option with your insurer.

How can I lower my household insurance premiums?

+There are several ways to potentially lower your household insurance premiums. These include improving your home’s security, maintaining a good credit score, increasing your deductible (but ensure it’s affordable), and reviewing your coverage annually to remove any unnecessary add-ons.