Household Insurance Policy

In the intricate world of financial protection, household insurance policies stand as a cornerstone of security for countless homeowners and renters alike. These policies, meticulously crafted to shield the assets and belongings within a home, offer a vital layer of peace of mind. From the foundations of a property to the cherished possessions within, the scope of household insurance is broad and multifaceted. In this comprehensive exploration, we delve into the intricacies of household insurance policies, dissecting their components, benefits, and the critical role they play in safeguarding the financial well-being of households across the globe.

Understanding the Basics: A Deep Dive into Household Insurance

At its core, a household insurance policy is a legal contract between an insurance provider and a policyholder, designed to protect against potential losses and damages that may occur within a household. This protective umbrella extends to cover a myriad of scenarios, including natural disasters, accidents, theft, and even liability claims. The primary aim of such policies is to provide financial coverage and assistance in the event of unforeseen circumstances, ensuring that policyholders can recover and rebuild with minimal financial strain.

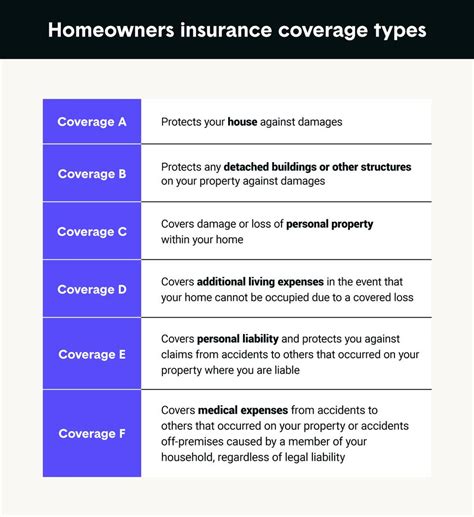

The journey of understanding household insurance begins with a grasp of its fundamental components. These policies typically encompass several key coverages, each tailored to address specific risks. The most common coverages include:

- Dwelling Coverage: This is the cornerstone of most household insurance policies, providing protection for the physical structure of the home, including the walls, roof, and foundation. It covers damages caused by perils such as fire, wind, hail, and vandalism.

- Personal Property Coverage: This coverage safeguards the policyholder's personal belongings, such as furniture, electronics, clothing, and collectibles. It ensures that these items are covered in the event of theft, damage, or destruction.

- Liability Coverage: A critical component, liability coverage protects the policyholder from financial losses arising from accidents or injuries that occur on their property. It covers medical expenses and legal fees in the event of a lawsuit.

- Additional Living Expenses: In the event of a covered loss that renders the home uninhabitable, this coverage steps in to reimburse the policyholder for additional living expenses incurred while the home is being repaired or rebuilt.

- Medical Payments Coverage: This coverage provides financial assistance for medical expenses incurred by visitors who sustain injuries on the policyholder's property, regardless of fault.

Tailoring Coverage: The Art of Customization

One of the unique aspects of household insurance policies is their adaptability. Policyholders have the freedom to tailor their coverage to align with their specific needs and the unique characteristics of their home. This customization process involves a careful assessment of potential risks and the value of assets to be protected.

For instance, a homeowner living in a flood-prone area may opt for additional flood insurance coverage. Alternatively, a homeowner with valuable jewelry or artwork may choose to enhance their personal property coverage to ensure adequate protection for these high-value items. This customization process ensures that policyholders are not overpaying for unnecessary coverage while simultaneously safeguarding their most precious assets.

Specialized Coverages

In addition to the fundamental coverages, household insurance policies often offer a range of specialized options. These include:

- Earthquake Coverage: A vital addition for those residing in earthquake-prone regions, this coverage provides financial protection against damages caused by seismic activity.

- Identity Theft Protection: In today's digital age, identity theft is a growing concern. This coverage assists policyholders in resolving identity theft issues and covers associated costs.

- Home Systems Protection: This coverage safeguards essential home systems and appliances, such as heating, cooling, and plumbing, against unexpected failures.

- Water Backup Coverage: A valuable addition, this coverage provides protection against water damage caused by backup or overflow from drains or sewers.

The Claims Process: A Step-by-Step Guide

Understanding the claims process is essential for any policyholder. When a covered loss occurs, the policyholder initiates the process by filing a claim with their insurance provider. The insurer then assesses the claim, evaluating the extent of the damage and determining the appropriate compensation.

During the claims process, policyholders are often required to provide documentation, such as photographs, receipts, or repair estimates, to support their claim. It's crucial to maintain accurate records of belongings and their values to facilitate a smooth and fair claims settlement.

Once the insurer has approved the claim, the policyholder receives compensation, either as a direct payment or as reimbursement for approved expenses. It's important to note that the claims process can vary depending on the nature of the loss and the insurance provider's policies.

Navigating the Complexities

While the claims process is designed to be straightforward, it can sometimes present challenges. Delays, disagreements over the value of losses, or even denial of claims can occur. In such situations, it’s beneficial for policyholders to understand their rights and have a clear idea of the appeals process.

Many insurance providers offer resources and guidance to assist policyholders throughout the claims process. These resources may include online claim portals, dedicated customer service teams, or even claims specialists who can provide on-site assistance in assessing and documenting damages.

Choosing the Right Policy: Factors to Consider

Selecting the appropriate household insurance policy is a crucial decision that requires careful consideration. Several factors come into play when choosing a policy that aligns with one’s needs and circumstances.

Risk Assessment

The first step in choosing a policy is conducting a thorough risk assessment. This involves evaluating the potential risks and hazards associated with one’s location and lifestyle. Factors such as crime rates, natural disasters, and proximity to bodies of water can influence the choice of coverages and policy limits.

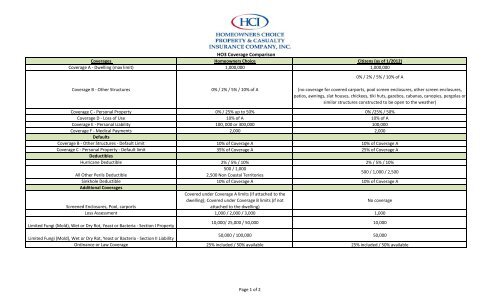

Coverage Limits and Deductibles

Coverage limits dictate the maximum amount an insurance provider will pay for a covered loss. It’s essential to choose limits that adequately reflect the value of one’s home and belongings. Similarly, deductibles, which are the amount policyholders must pay out of pocket before insurance coverage kicks in, should be selected carefully. Higher deductibles can lead to lower premiums, but they also mean policyholders will have to bear a larger portion of the financial burden in the event of a claim.

Comparing Insurance Providers

The market is diverse, with numerous insurance providers offering a range of policies and coverage options. It’s beneficial to compare quotes and coverage details from multiple providers to find the best fit. Factors to consider include the provider’s reputation, financial stability, customer service, and claims handling process.

| Insurance Provider | Coverage Options | Financial Stability Rating | Customer Satisfaction Score |

|---|---|---|---|

| Provider A | Comprehensive, Customizable | AAA | 4.8/5 |

| Provider B | Basic, Value-Oriented | AA | 4.6/5 |

| Provider C | Specialized, High-Value Items | A | 4.7/5 |

💡 Pro Tip: Consider seeking advice from an independent insurance agent or broker who can provide unbiased recommendations based on your specific needs.

Common Misconceptions and Pitfalls

Despite its importance, household insurance is often shrouded in misconceptions and misunderstandings. Here, we dispel some common myths and highlight potential pitfalls to avoid.

Misconception: “My Homeowners Association Covers My Property”

While homeowners associations (HOAs) may provide certain types of insurance coverage, it’s essential to understand that these policies typically only cover common areas and shared amenities. Individual units and personal belongings are not usually covered by HOA insurance. Policyholders should always verify their coverage and consider supplemental policies to protect their assets.

Pitfall: Underinsurance

Underinsurance occurs when a policyholder’s coverage limits are insufficient to cover the actual value of their home and belongings. This can lead to significant financial losses in the event of a claim. It’s crucial to regularly review and update coverage limits to ensure they align with the current market value of one’s property and possessions.

Misconception: “I Don’t Need Insurance for Small Risks”

Many policyholders underestimate the financial impact of minor incidents, such as water leaks or small-scale property damage. These events, though seemingly insignificant, can result in costly repairs and replacements. Comprehensive household insurance policies provide coverage for such incidents, ensuring policyholders are not left bearing the full financial burden.

The Future of Household Insurance: Emerging Trends

The world of household insurance is evolving, driven by technological advancements and changing consumer needs. Here, we explore some of the emerging trends that are shaping the future of this industry.

Digital Transformation

The digital revolution has permeated the insurance industry, with many providers now offering online platforms and mobile apps for policy management and claims processing. This shift towards digital services enhances convenience and efficiency, allowing policyholders to access their policies and file claims from the comfort of their homes.

Data-Driven Personalization

Advanced analytics and data-driven insights are enabling insurance providers to offer more personalized policies. By leveraging data on individual risk factors and behavior, insurers can tailor coverage to specific needs, providing a more accurate and cost-effective solution for policyholders.

Sustainability and Green Initiatives

As environmental concerns rise, insurance providers are incorporating sustainability into their offerings. This includes providing incentives for policyholders who adopt green practices and technologies, such as solar panels or energy-efficient appliances. These initiatives not only promote sustainability but also reduce risks associated with traditional energy sources.

Conclusion: The Imperative of Household Insurance

In a world fraught with uncertainty, household insurance policies stand as a critical safeguard, offering protection against a myriad of potential risks. From natural disasters to everyday accidents, these policies provide the financial stability needed to rebuild and recover. By understanding the intricacies of household insurance, policyholders can make informed decisions, tailor coverage to their needs, and navigate the claims process with confidence.

As we navigate the complexities of modern life, the importance of household insurance cannot be overstated. It is a vital component of financial planning, ensuring that the foundations of our homes and the possessions we cherish are protected. With the right policy in place, policyholders can rest easy, knowing they are prepared for whatever the future may hold.

What is the average cost of household insurance policies?

+The cost of household insurance policies varies significantly based on factors such as location, the value of the property, and the chosen coverage limits. On average, homeowners can expect to pay between 500 and 1,500 annually for standard coverage. However, this range can extend significantly depending on the specific circumstances and the level of coverage desired.

How often should I review and update my household insurance policy?

+It is recommended to review your household insurance policy annually or whenever there are significant changes to your home or lifestyle. This ensures that your coverage remains adequate and aligned with your current needs. Additionally, regular reviews allow you to take advantage of any new coverage options or discounts offered by your insurance provider.

Can I bundle my household insurance with other policies to save money?

+Absolutely! Many insurance providers offer bundled policies, allowing you to combine your household insurance with other types of coverage, such as auto insurance or life insurance. Bundling policies can often result in significant savings, as insurers may offer discounts for multiple policies under one account. It’s a great way to streamline your insurance needs and potentially reduce your overall costs.

What should I do if I’m unsure about the coverage limits on my policy?

+If you have concerns or questions about your coverage limits, it’s essential to reach out to your insurance agent or provider. They can guide you through the process of assessing your current coverage and determining if any adjustments are necessary. Remember, it’s crucial to have adequate coverage to protect your assets and ensure financial stability in the event of a claim.