How Can I Get Gap Insurance

Gap insurance, or Guaranteed Asset Protection insurance, is a valuable addition to your automotive insurance coverage, especially when financing or leasing a vehicle. It protects you from potential financial losses in certain situations, such as a total loss or write-off, where the insurance payout may not cover the remaining balance on your loan or lease.

Here's a comprehensive guide on understanding Gap insurance and how you can acquire it to safeguard your financial interests.

Understanding Gap Insurance

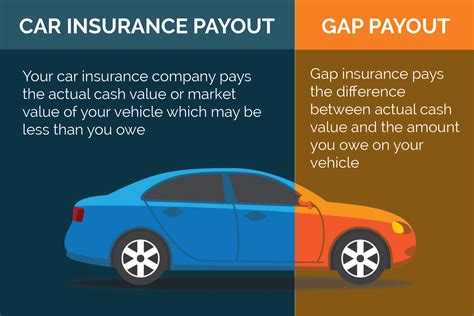

Gap insurance fills the financial gap between the actual cash value (ACV) of your vehicle and the outstanding balance on your loan or lease agreement. This type of insurance is crucial because new vehicles depreciate rapidly in the first few years of ownership, often losing up to 20-30% of their value within the first year.

Consider the following scenarios where Gap insurance can be a lifesaver:

- Total Loss Due to Accident: If your vehicle is involved in a severe accident and deemed a total loss, your standard auto insurance policy will pay out the ACV of the vehicle at the time of the accident. However, if the ACV is less than the outstanding loan balance, you would still be responsible for paying off the remaining amount.

- Vehicle Theft or Natural Disasters: In cases where your vehicle is stolen or damaged beyond repair due to natural disasters like floods or hurricanes, Gap insurance ensures you're not left with a large bill despite having comprehensive coverage.

- Lease Agreements: When leasing a vehicle, Gap insurance is particularly beneficial as it covers the difference between the residual value of the vehicle and the amount owed at the end of the lease term.

When to Consider Gap Insurance

While Gap insurance is an excellent safety net, it’s not always necessary for every vehicle owner. Here are some scenarios where Gap insurance is highly recommended:

- New Vehicle Purchases: If you've just bought a new car, especially with a substantial loan, Gap insurance is an essential safeguard against rapid depreciation.

- Long-Term Loans or Leases: If you have a longer loan or lease term, your vehicle will likely depreciate further, making Gap insurance a prudent choice.

- High Loan-to-Value Ratios: When your loan amount is close to or exceeds the value of your vehicle, Gap insurance ensures you're not left with a significant financial burden.

- Vehicle Depreciation Concerns: Some vehicles, especially luxury or high-performance models, depreciate more rapidly. In such cases, Gap insurance can provide peace of mind.

Acquiring Gap Insurance

There are several avenues to obtain Gap insurance coverage, each with its own benefits and considerations:

Dealer-Offered Gap Insurance

Many dealerships offer Gap insurance as an add-on when you purchase or lease a vehicle. While convenient, it’s essential to review the terms and conditions carefully. Dealer-offered Gap insurance may be more expensive than other options, and the coverage might not be as comprehensive.

Lender-Provided Gap Insurance

Your lender or financial institution might offer Gap insurance as part of your loan or lease agreement. This option is often more affordable than dealer-offered insurance and can be included in your monthly payments. However, ensure you understand the coverage and terms before accepting.

Third-Party Gap Insurance Providers

Independent insurance companies and brokers specialize in providing Gap insurance. Shopping around for third-party providers can offer more competitive rates and customizable coverage options. Ensure the provider is reputable and licensed to operate in your region.

Bundling with Auto Insurance

Some auto insurance companies offer Gap insurance as an add-on to your existing policy. Bundling your auto insurance and Gap insurance with the same provider can often result in discounts and simplified billing.

Key Considerations for Gap Insurance

When exploring Gap insurance options, keep the following considerations in mind:

- Coverage Duration: Ensure the Gap insurance policy covers the entire loan or lease term. Some policies may have a shorter duration, leaving you vulnerable to financial loss if your vehicle is written off early in the loan term.

- Exclusions and Limitations: Read the fine print to understand any exclusions or limitations in the policy. Some policies might not cover certain types of losses or have restrictions based on the vehicle's age or mileage.

- Renewal Options: Inquire about renewal options, especially if you plan to keep the vehicle beyond the initial loan or lease term. Some providers offer extended coverage at a reduced rate.

- Cost vs. Benefit: While Gap insurance provides significant financial protection, it's essential to balance the cost of the policy with the potential benefits. Assess your financial situation and the likelihood of needing Gap insurance coverage.

Performance Analysis and Real-World Examples

Gap insurance has proven to be a valuable asset for many vehicle owners, especially in scenarios where a total loss or write-off occurs early in the loan or lease term. Here’s a real-world example to illustrate the benefits:

Scenario: John purchased a new SUV for $50,000 with a loan term of 60 months. After 18 months, his SUV was involved in an accident and deemed a total loss. At the time of the accident, the SUV's ACV was $35,000. Without Gap insurance, John would have been responsible for paying off the remaining $15,000 on his loan.

Outcome with Gap Insurance: John had wisely invested in Gap insurance when he purchased his SUV. The Gap insurance policy covered the $15,000 difference, ensuring John didn't have to pay out of pocket. This scenario highlights the crucial role Gap insurance plays in protecting vehicle owners from unexpected financial burdens.

Future Implications and Industry Insights

The demand for Gap insurance is expected to remain strong, particularly as vehicle leasing continues to grow in popularity. Additionally, the increasing awareness of financial protection options among vehicle owners is likely to drive the market for Gap insurance. Here are some key trends and insights:

- Technology Integration: Insurers are leveraging technology to streamline the Gap insurance acquisition process. Online platforms and digital tools allow for more efficient policy selection and purchase, enhancing the customer experience.

- Customized Coverage: Insurers are offering more tailored Gap insurance policies to meet the diverse needs of vehicle owners. This includes options for specific vehicle types, loan structures, and coverage durations.

- Education and Awareness: There's a growing emphasis on financial literacy in the automotive industry, with efforts to educate consumers about the benefits of Gap insurance. This awareness is expected to drive more informed decision-making when it comes to purchasing and leasing vehicles.

Frequently Asked Questions

Is Gap Insurance Mandatory?

+Gap insurance is typically not mandatory, but it’s highly recommended, especially if you’re financing or leasing a vehicle. It provides an additional layer of financial protection in case of total loss or write-off.

How Much Does Gap Insurance Cost?

+The cost of Gap insurance can vary depending on several factors, including the value of your vehicle, the loan amount, and the insurance provider. On average, Gap insurance can range from 200 to 1,000 annually.

Can I Get Gap Insurance After Purchasing My Vehicle?

+While it’s ideal to purchase Gap insurance when you first acquire your vehicle, some providers offer coverage even after the purchase. However, the availability and cost may vary, so it’s best to check with multiple providers.

Does Gap Insurance Cover All Types of Vehicles?

+Gap insurance is available for a wide range of vehicles, including cars, SUVs, trucks, and motorcycles. However, the specific coverage and terms may vary depending on the vehicle type and its usage.

What Happens If I Sell My Vehicle Before the Loan Is Paid Off?

+If you sell your vehicle before the loan is paid off, the outstanding balance must be settled. Gap insurance typically covers the difference between the ACV and the loan balance, but it does not cover the remaining balance if you sell the vehicle.