How Do I Buy Life Insurance

Life insurance is an essential financial tool that provides security and peace of mind for you and your loved ones. It acts as a safety net, ensuring that your family's financial well-being is protected in the event of your untimely demise. With various types of life insurance policies available, it can be daunting to navigate the process of purchasing one. This comprehensive guide will walk you through the steps, considerations, and benefits of buying life insurance, empowering you to make informed decisions about this crucial investment.

Understanding the Basics of Life Insurance

Life insurance is a contract between an individual (the policyholder) and an insurance company. The policyholder pays a premium, typically on a monthly or annual basis, and in return, the insurance company provides a financial benefit to the designated beneficiaries upon the policyholder’s death. This benefit, known as the death benefit, can help cover various expenses, including funeral costs, outstanding debts, and ongoing living expenses for the family.

Types of Life Insurance Policies

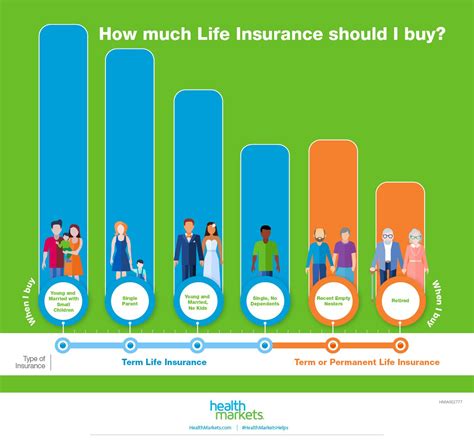

There are two primary types of life insurance policies: term life insurance and permanent life insurance. Understanding the differences between these options is crucial for making an informed choice.

Term Life Insurance

Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years. During this term, the policyholder pays a fixed premium, and if the policyholder passes away within the term, the beneficiaries receive the death benefit. Term life insurance is often more affordable than permanent life insurance, making it an excellent choice for individuals seeking coverage for a specific period, such as during their working years when their income is essential for their family’s livelihood.

Permanent Life Insurance

Permanent life insurance, on the other hand, provides lifelong coverage. The most common types of permanent life insurance are whole life, universal life, and variable life insurance. These policies not only offer a death benefit but also have a cash value component, which grows over time and can be accessed through loans or withdrawals. Permanent life insurance policies tend to have higher premiums compared to term life insurance, but they offer the advantage of lifelong coverage and the potential for building cash value.

| Life Insurance Type | Description |

|---|---|

| Term Life Insurance | Offers coverage for a specified term with fixed premiums. Ideal for temporary financial protection. |

| Whole Life Insurance | Provides lifelong coverage with level premiums and a cash value component that grows over time. |

| Universal Life Insurance | Offers flexible premiums and death benefits, allowing policyholders to adjust coverage as needed. |

| Variable Life Insurance | Combines life insurance with investment options, allowing policyholders to choose investment funds for potential higher returns. |

Assessing Your Life Insurance Needs

Before purchasing life insurance, it’s essential to assess your specific needs and determine the appropriate coverage amount. Consider the following factors to make an informed decision:

Financial Responsibilities

Evaluate your current and future financial responsibilities. Consider factors such as outstanding debts (mortgage, loans, credit cards), ongoing living expenses for your family, children’s education costs, and any other financial commitments. Calculate the amount of coverage needed to ensure your loved ones can maintain their standard of living and meet these financial obligations without your income.

Future Goals and Dreams

Think about your long-term goals and aspirations. Do you have plans to start a business, purchase a new home, or save for retirement? Life insurance can provide the financial means to achieve these dreams even in your absence. Assess how much coverage you would need to ensure your family can continue working towards these goals without financial strain.

Existing Assets and Savings

Take into account any existing assets and savings you have. These can include savings accounts, investments, property, or other forms of wealth. Evaluate how these assets can contribute to your financial plan and whether they can help cover some of the expenses in the event of your demise. This assessment will help you determine the right balance of life insurance coverage.

Coverage for Specific Events

Consider specific events or milestones in your life that may require additional coverage. For example, if you have a child with special needs, you might need to provide for their care beyond your expected lifespan. Similarly, if you have a business, you may want to include key person insurance to ensure its continuity in your absence. Tailor your life insurance coverage to address these unique circumstances.

Researching and Choosing a Life Insurance Provider

Once you have assessed your life insurance needs, it’s time to research and select a reputable insurance provider. Here’s a step-by-step guide to help you through this process:

Step 1: Understand Provider Options

Start by researching the different life insurance providers available in your region. Consider established companies with a solid reputation and financial stability. Look for providers that offer a range of policy options to cater to various needs. Online reviews and ratings can provide valuable insights into the customer experience and satisfaction levels.

Step 2: Compare Policy Features and Costs

Shortlist a few providers based on your initial research. Compare their policy features, including coverage amounts, term lengths, and any additional benefits or riders. Evaluate the costs associated with each policy, considering both the initial premium and any potential increases over time. Remember, the cheapest policy might not always be the best fit for your needs.

Step 3: Evaluate Financial Strength and Stability

Assess the financial strength and stability of the shortlisted providers. Look for companies with strong financial ratings from reputable agencies such as Standard & Poor’s, Moody’s, or A.M. Best. A solid financial rating indicates the provider’s ability to meet its obligations and pay out claims. This is crucial for ensuring your policy’s long-term viability.

Step 4: Consider Customer Service and Claims Process

Research the provider’s customer service reputation. Look for companies with a history of prompt and efficient service, as this can be crucial during times of need. Additionally, understand their claims process, including the documentation required and the average time taken to process claims. A streamlined and transparent claims process is essential for a smooth experience.

Step 5: Review Policy Terms and Conditions

Carefully review the policy terms and conditions of the shortlisted providers. Pay attention to details such as exclusions, waiting periods, and any potential penalties for late payments or policy changes. Ensure that the policy aligns with your expectations and provides the coverage you require.

Step 6: Seek Professional Advice (if needed)

If you’re still unsure or have complex financial circumstances, consider seeking advice from a qualified financial advisor or insurance broker. They can provide personalized guidance based on your specific needs and help you make an informed decision.

Applying for Life Insurance

Once you have chosen a life insurance provider, it’s time to apply for coverage. The application process typically involves the following steps:

Step 1: Complete an Application Form

Provide accurate and detailed information on the application form. This includes personal details, health information, and lifestyle factors that may impact your premium and coverage. Be honest and thorough to ensure a smooth application process and accurate coverage.

Step 2: Underwriting Process

After submitting your application, the insurance provider will assess your risk profile through an underwriting process. This involves reviewing your medical history, lifestyle choices, and other factors. The underwriter may request additional information or medical examinations to determine your eligibility and the appropriate premium.

Step 3: Medical Examination (if required)

Depending on your age, health status, and the coverage amount, the insurance provider may require a medical examination. This examination is typically conducted by a licensed paramedical professional and involves a physical assessment, blood and urine tests, and sometimes an electrocardiogram (ECG). The results help the insurer understand your health status and determine the risk associated with insuring you.

Step 4: Policy Offer and Acceptance

Once the underwriting process is complete, the insurance provider will offer you a policy based on the information provided and the results of the medical examination (if applicable). Review the policy terms, including the coverage amount, premium, and any exclusions or limitations. If you are satisfied with the offer, accept the policy and pay the initial premium to activate your coverage.

Maintaining and Reviewing Your Life Insurance Policy

Life insurance is a long-term commitment, and it’s essential to regularly review and maintain your policy to ensure it remains adequate and up-to-date. Here’s how you can effectively manage your life insurance:

Regular Policy Reviews

Schedule periodic reviews of your life insurance policy, ideally every few years or whenever there are significant life changes. Assess whether your coverage amount is still sufficient to meet your financial goals and responsibilities. Consider factors such as income growth, changes in family size, or major life events (e.g., marriage, divorce, birth of a child) that may impact your needs.

Keeping Your Policy Up-to-Date

Notify your insurance provider of any significant changes in your life, such as a new address, change in marital status, or a diagnosis of a serious health condition. These updates ensure that your policy remains accurate and valid. Additionally, review your policy’s beneficiary designations regularly to ensure they are current and reflect your wishes.

Managing Premium Payments

Stay on top of your premium payments to avoid policy lapses or cancellations. Set up automatic payments or reminders to ensure timely payments. If you encounter financial difficulties, contact your insurance provider to discuss potential options, such as premium reduction or policy adjustments.

Exploring Policy Riders and Add-ons

Policy riders and add-ons are additional features that can enhance your life insurance coverage. Consider adding riders such as waiver of premium (which waives premiums if you become disabled), accelerated death benefit (which allows access to a portion of the death benefit if diagnosed with a terminal illness), or spousal coverage (which provides coverage for your spouse). These riders can further tailor your policy to your specific needs.

The Benefits of Life Insurance

Investing in life insurance offers numerous benefits that extend beyond financial protection. Here are some key advantages:

Financial Security for Your Loved Ones

The primary benefit of life insurance is providing financial security for your family in the event of your death. The death benefit can help cover immediate expenses, such as funeral costs, and long-term financial obligations, ensuring your loved ones’ standard of living is maintained.

Debt Repayment and Mortgage Protection

Life insurance can help repay outstanding debts, including credit card balances, personal loans, and mortgages. This ensures that your loved ones are not burdened with these financial obligations, allowing them to focus on healing and moving forward.

Education Funding for Children

With life insurance, you can set aside funds specifically for your children’s education. This ensures they have the financial means to pursue their academic goals, even in your absence. Life insurance can provide a reliable source of funding for college tuition, books, and other education-related expenses.

Business Continuity and Succession Planning

If you own a business, life insurance can play a crucial role in ensuring its continuity and smooth succession. Key person insurance can provide financial support to cover the loss of a key individual’s expertise and contributions, while buy-sell agreements can help business partners purchase the deceased owner’s share, maintaining business stability.

Tax Advantages and Estate Planning

Life insurance can offer tax advantages, as the death benefit is typically tax-free. This can be particularly beneficial for estate planning, as it can help cover estate taxes and ensure the smooth transfer of assets to your beneficiaries.

Peace of Mind

Perhaps the most valuable benefit of life insurance is the peace of mind it provides. Knowing that your loved ones are financially protected and their future is secure can alleviate stress and anxiety, allowing you to focus on living a fulfilling life.

Frequently Asked Questions (FAQ)

What happens if I miss a premium payment for my life insurance policy?

+Missing a premium payment can have varying consequences depending on your policy terms. Some policies offer a grace period, typically 30 days, during which you can make the overdue payment without any penalties. If you consistently miss payments, your policy may lapse, and you’ll need to reapply, potentially at a higher premium or with different coverage terms.

Can I change my life insurance policy or increase the coverage amount after purchasing it?

+Yes, you can often make changes to your life insurance policy, such as increasing the coverage amount or adding riders. However, these changes may require additional underwriting and may impact your premium. It’s best to discuss your options with your insurance provider to understand the process and potential costs.

How long does the underwriting process for life insurance typically take?

+The underwriting process can vary depending on the insurance provider and the complexity of your application. On average, it can take anywhere from a few days to several weeks. Factors such as the completeness of your application, the need for additional medical examinations, and the volume of applications being processed by the insurer can impact the timeline.

Can I have multiple life insurance policies from different providers?

+Yes, you can have multiple life insurance policies from different providers. This can be beneficial if you have specific needs or goals that one policy alone cannot address. However, it’s essential to manage and keep track of multiple policies to ensure timely premium payments and maintain coverage.

Buying life insurance is a responsible decision that demonstrates your commitment to your loved ones’ financial well-being. By understanding the basics, assessing your needs, researching providers, and applying for the right policy, you can ensure a secure future for your family. Regularly review and maintain your life insurance to adapt to life’s changes and continue providing the protection your loved ones deserve.