How Do I Get Dental Insurance

Securing Dental Insurance: A Comprehensive Guide to Better Oral Health

Maintaining optimal oral health is a crucial aspect of overall well-being, and dental insurance plays a pivotal role in making essential dental care more accessible and affordable. Whether you're an individual seeking personal coverage or an employer aiming to provide benefits to your workforce, understanding the process of obtaining dental insurance is key to ensuring a healthy smile for years to come.

In this comprehensive guide, we'll walk you through the steps to navigate the world of dental insurance, exploring various options, considerations, and strategies to secure the best coverage for your needs. By the end, you'll have the knowledge and tools to make informed decisions, empowering you to take control of your oral health and financial well-being.

Understanding Dental Insurance

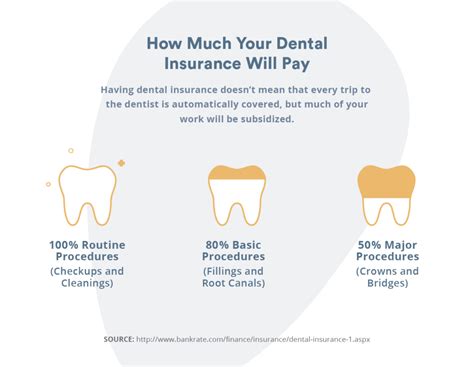

Dental insurance is a specialized form of health insurance designed to cover the costs of dental care, ranging from routine check-ups and cleanings to more complex procedures like root canals and dental implants. It operates similarly to traditional health insurance, with premiums, deductibles, and co-payments, but with a specific focus on dental services.

The primary goal of dental insurance is to encourage regular dental visits and make necessary treatments more financially manageable. By providing coverage for preventive care and offering benefits for restorative procedures, dental insurance plans aim to promote oral health and prevent more serious, costly issues down the line.

Key Components of Dental Insurance Plans

To better understand how dental insurance works, let's break down some key components of typical plans:

- Premiums: The amount you pay regularly (usually monthly) to maintain your dental insurance coverage. Premiums can vary based on factors like age, location, and the level of coverage desired.

- Deductibles: The initial amount you must pay out of pocket before your insurance coverage kicks in. Deductibles are typically reset annually and can be waived for certain preventive services.

- Co-payments or Co-insurance: These are the fees you pay for covered services after the deductible has been met. Co-payments are usually a fixed amount, while co-insurance is a percentage of the total cost of the service.

- Annual Maximums: The maximum amount your dental insurance plan will pay out in a year. Once this limit is reached, you'll be responsible for the full cost of any additional dental services.

- Waiting Periods: Some dental insurance plans have waiting periods before certain procedures are covered. For instance, there might be a 6-month waiting period for major restorative work like crowns or implants.

- Network Providers: Many dental insurance plans have networks of preferred dentists and specialists. Using in-network providers typically results in lower out-of-pocket costs.

Assessing Your Dental Insurance Needs

Before diving into the process of obtaining dental insurance, it's essential to assess your specific needs and priorities. This self-evaluation will guide you toward the most suitable plan for your circumstances.

Consider Your Dental History and Future Needs

Start by reflecting on your recent dental history. Have you been visiting the dentist regularly for check-ups and cleanings? Are there any outstanding dental issues that require treatment? Understanding your current dental health status can help you estimate the level of coverage you might need in the short term.

Additionally, consider any long-term dental goals or anticipated needs. For instance, if you know you'll need braces in the future or are considering cosmetic dentistry, choose a plan that offers comprehensive coverage for these procedures.

Evaluate Your Financial Situation

Dental insurance can be a significant expense, so it's crucial to assess your financial capacity. Consider your monthly budget and how much you're comfortable allocating towards dental insurance premiums. Remember, while dental insurance can provide substantial savings in the long run, it's essential to choose a plan that fits your financial capabilities.

Think About Convenience and Flexibility

The convenience and flexibility of your dental insurance plan can significantly impact your experience. If you frequently travel or live in a location with limited dental providers, ensure your plan has a broad network of dentists, both locally and nationally.

Furthermore, consider the administrative processes involved. Some plans offer simplified claims procedures or direct billing, reducing the hassle of managing your insurance. These small details can make a big difference in your overall satisfaction with the plan.

Exploring Dental Insurance Options

Once you've assessed your needs, it's time to explore the various dental insurance options available to you. The market offers a wide range of plans, each with unique features and benefits. Understanding these options will empower you to make an informed choice.

Individual Dental Insurance Plans

If you're seeking dental insurance for yourself or your family, individual plans are a popular choice. These plans are designed to cater to the specific needs of individuals and small groups, offering a range of coverage levels and benefits.

When shopping for individual plans, pay close attention to the details. Compare premiums, deductibles, and co-payments across different providers. Look for plans that offer coverage for the specific procedures you might need, whether it's orthodontic care, root canals, or implants.

Employer-Sponsored Dental Insurance

Many employers offer dental insurance as part of their benefits package, providing coverage for their employees and often their families as well. Employer-sponsored plans can be an attractive option, as they're typically more affordable due to the group purchasing power.

If you're an employee considering an employer-sponsored plan, thoroughly review the details of the offered coverage. Understand the limitations and benefits, and ensure it aligns with your dental needs. Don't hesitate to ask your HR department for clarification on any aspects of the plan.

Discount Dental Plans

Discount dental plans, sometimes referred to as dental savings plans, are an alternative to traditional dental insurance. These plans offer discounted rates on dental services without the typical insurance structure of premiums, deductibles, and co-payments.

Discount plans work by partnering with a network of dentists who agree to offer reduced rates to plan members. When you need dental care, you simply pay the discounted fee directly to the dentist at the time of service. These plans can be an affordable option for those who prioritize flexibility and simplicity over comprehensive coverage.

Government-Sponsored Dental Insurance

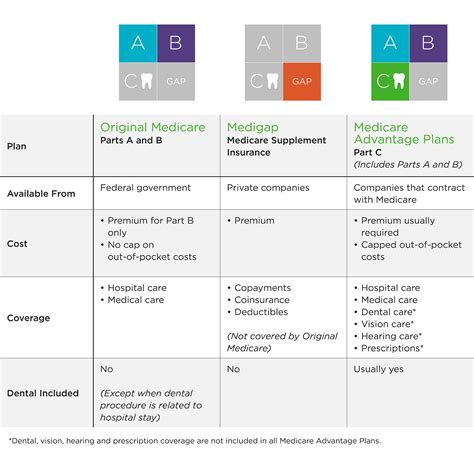

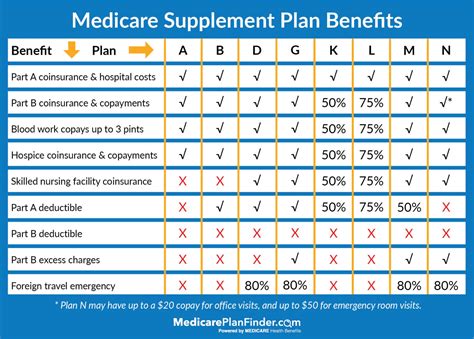

In some cases, government-sponsored programs can provide dental insurance coverage. For instance, Medicaid offers dental benefits to eligible low-income individuals and families, while Medicare typically covers only very limited dental services. Understanding the scope of these programs can help determine if you're eligible for coverage.

Choosing the Right Dental Insurance Plan

With a clear understanding of your needs and the available options, it's time to make an informed decision about your dental insurance plan. Here are some key considerations to guide your choice:

Assess the Coverage Details

Review the plan's coverage details thoroughly. Ensure it covers the essential preventive services like cleanings and check-ups, as well as any anticipated procedures you might need in the near future. Look for plans with a broad range of covered services to provide the most flexibility.

Consider the Cost

While coverage is crucial, it's equally important to consider the cost of the plan. Assess the premiums, deductibles, and co-payments to understand the overall financial commitment. Remember, the cheapest plan might not always be the best value if it offers limited coverage.

Evaluate the Provider Network

The network of providers associated with your dental insurance plan is a critical factor. Ensure the plan includes a sufficient number of dentists and specialists in your area, especially if you have a preferred dentist you'd like to continue seeing.

Read the Fine Print

Don't overlook the fine print! Pay close attention to any limitations, exclusions, or waiting periods outlined in the plan. Understand the conditions under which certain procedures might not be covered and the potential out-of-pocket costs you could incur.

Consider Customer Reviews and Ratings

Research customer reviews and ratings of the insurance provider to gauge their reputation and customer satisfaction. While it's important to take these with a grain of salt, they can provide valuable insights into the overall experience of policyholders.

Enrolling in Your Chosen Dental Insurance Plan

Once you've made your decision, the next step is to enroll in your chosen dental insurance plan. The enrollment process can vary slightly depending on the type of plan and provider, but here's a general guide to help you through the process:

Gather Required Information

Before starting the enrollment process, gather all the necessary information. This typically includes personal details like your name, date of birth, and contact information, as well as any relevant employment or income details if you're enrolling through an employer-sponsored plan.

Complete the Application

Visit the insurance provider's website or contact their customer service to initiate the application process. You'll likely need to provide the gathered information and select your desired coverage level and any optional add-ons.

Review and Confirm Coverage Details

Once you've completed the application, carefully review the coverage details and terms. Ensure that the plan you're enrolling in aligns with your expectations and needs. If there are any discrepancies or concerns, reach out to the provider's customer service for clarification.

Make the Initial Payment

After confirming the coverage details, you'll typically need to make the initial premium payment to activate your coverage. This payment can often be made online via the provider's website or over the phone.

Receive Your Insurance Card

Once your payment is processed and your coverage is activated, you'll receive your insurance card. This card serves as proof of insurance and is typically required when visiting your dentist. Keep it handy and make sure to bring it with you to all dental appointments.

Maximizing Your Dental Insurance Benefits

Now that you've successfully enrolled in your dental insurance plan, it's time to make the most of your benefits. Here are some strategies to ensure you're getting the full value from your coverage:

Schedule Regular Dental Check-ups

Preventive care is a cornerstone of maintaining good oral health. Schedule regular check-ups and cleanings as recommended by your dentist. Many dental insurance plans offer full coverage or significant discounts for these preventive services, so take advantage of them to keep your teeth and gums healthy.

Understand Your Plan's Coverage

Familiarize yourself with the specifics of your plan's coverage. Know which procedures are fully covered, which require co-payments, and which might not be covered at all. This knowledge will help you plan and budget for any necessary treatments.

Explore Optional Add-ons

Depending on your plan, you might have the option to add additional coverage for specialized procedures like orthodontics or cosmetic dentistry. Evaluate your needs and consider adding these optional coverages if they align with your anticipated dental care requirements.

Utilize In-Network Providers

To maximize your savings, try to use in-network providers whenever possible. These dentists and specialists have agreed to accept the plan's allowed amounts as full payment, often resulting in lower out-of-pocket costs for you.

Understand Your Responsibilities

While dental insurance can significantly reduce your out-of-pocket costs, it's important to understand your financial responsibilities. Be aware of any deductibles, co-payments, or other fees that might apply to your treatments. Plan accordingly and ensure you have the necessary funds available.

Future Considerations and Planning

As you navigate your dental insurance journey, it's essential to keep an eye on the future and plan accordingly. Here are some considerations to keep in mind as you move forward:

Annual Plan Renewals

Most dental insurance plans are renewable on an annual basis. As your plan's renewal date approaches, review the coverage and consider if it still meets your needs. If your circumstances have changed, you might need to adjust your coverage level or consider a different plan.

Tracking Your Plan's Performance

Throughout the year, keep track of your plan's performance. Monitor your out-of-pocket expenses and ensure they align with your expectations. If you're consistently paying more than anticipated, it might be worth reevaluating your plan or seeking alternative options.

Stay Informed About Dental Health

Dental health is an evolving field, with new technologies and treatments emerging regularly. Stay informed about the latest advancements and discuss them with your dentist. Understanding these developments can help you make more informed decisions about your oral health and any necessary treatments.

Frequently Asked Questions

Can I get dental insurance if I have pre-existing dental conditions?

+Yes, many dental insurance plans cover pre-existing conditions. However, there might be waiting periods or limitations on coverage for specific procedures related to those conditions. It’s important to review the plan’s details carefully to understand how your pre-existing condition might impact your coverage.

How do I choose the right dental insurance plan for my family?

+When selecting a plan for your family, consider their collective dental needs. Look for a plan that offers comprehensive coverage for a range of procedures, including preventive care, orthodontics, and restorative work. Also, ensure the plan has a broad network of providers to accommodate the diverse needs of your family members.

What happens if I need a procedure that’s not covered by my plan?

+If a procedure is not covered by your plan, you’ll typically be responsible for paying the full cost out of pocket. However, it’s worth discussing with your dentist to explore potential alternatives or options for managing the cost. Some dentists offer payment plans or can work with you to find a solution that fits your budget.

Can I switch dental insurance plans if I’m not satisfied with my current one?

+Yes, you have the option to switch dental insurance plans. However, it’s important to understand the timing and potential consequences. Switching plans might require waiting periods for certain procedures, and you might lose any benefits you’ve already accrued with your current plan. Carefully review the terms of your current plan and the new plan you’re considering to make an informed decision.

Are there any discounts or subsidies available for dental insurance?

+Yes, there are often discounts or subsidies available for dental insurance, particularly for individuals or families with low incomes. Government-sponsored programs like Medicaid and CHIP (Children’s Health Insurance Program) offer dental benefits to eligible individuals. Additionally, some employers might offer subsidies or contribute towards the cost of dental insurance as part of their benefits package.