How Do I Get Health Insurance In California

Obtaining health insurance in California is an important step towards ensuring your access to quality healthcare services. The state offers a range of options, from government-funded programs to private plans, catering to diverse needs and budgets. This guide will walk you through the key aspects of health insurance in California, helping you navigate the process and make informed choices.

Understanding California's Health Insurance Landscape

California's healthcare system is unique, with a mix of public and private insurance providers. The state has taken significant steps to expand healthcare coverage, making it one of the most comprehensive and accessible systems in the nation. Understanding the different types of insurance plans available is crucial for choosing the right coverage.

Medicaid and Medi-Cal

Medicaid, a federal program, is administered by the state as Medi-Cal. It provides health coverage to eligible low-income adults, children, pregnant women, seniors, and people with disabilities. Medi-Cal covers a wide range of services, including doctor visits, hospital care, prescription drugs, and mental health services.

To be eligible for Medi-Cal, your income must be at or below a certain threshold, which varies based on family size and other factors. You can apply through the Covered California website or by contacting your local County Human Services Agency.

| Program | Income Eligibility |

|---|---|

| Medi-Cal for Adults | Up to 138% of the Federal Poverty Level |

| Medi-Cal for Children | Up to 266% of the Federal Poverty Level |

| Medi-Cal for Pregnant Women | Up to 213% of the Federal Poverty Level |

Covered California

Covered California is the state's official health insurance marketplace, offering a range of private insurance plans. It was established as part of the Affordable Care Act (ACA) to provide an easy way for individuals and families to compare and purchase health insurance. These plans typically offer more flexibility and choice, with varying levels of coverage and cost.

During the annual Open Enrollment Period (usually November 1 to January 15), anyone can sign up for a plan through Covered California. Outside of this period, you can enroll if you have a qualifying life event, such as losing your job, getting married, or having a baby.

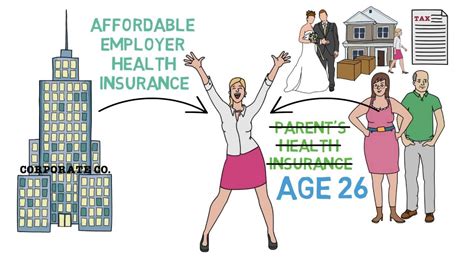

Employer-Sponsored Plans

Many Californians receive health insurance through their employers. These plans are often more comprehensive and can offer significant savings, as the employer typically contributes to the cost. The specific details of employer-sponsored plans vary widely, so it's important to review the benefits and costs carefully.

Individual Market Plans

If you're not eligible for Medi-Cal or don't have access to employer-sponsored insurance, you can purchase an individual health insurance plan. These plans are available directly from insurance companies or through Covered California. The cost and coverage of these plans can vary significantly, so it's important to compare options and understand the fine print.

The Process of Obtaining Health Insurance

Enrolling in health insurance involves several steps, from researching your options to submitting your application and selecting a plan. Let's break down the process to make it more manageable.

Step 1: Research Your Options

The first step is to understand your eligibility for different types of insurance. If you're not sure where to start, the Covered California website provides a Eligibility Quiz that can guide you toward the right programs or plans.

You can also explore the various insurance plans available on the Covered California website. These plans are categorized based on the percentage of healthcare costs they cover, known as Metal Levels: Bronze (60%), Silver (70%), Gold (80%), and Platinum (90%).

When researching, pay attention to the benefits and exclusions of each plan. Some plans may have higher premiums but offer more comprehensive coverage, while others may have lower premiums but require higher out-of-pocket costs.

Step 2: Determine Your Eligibility

Once you've decided on the type of insurance you want, the next step is to determine your eligibility. For Medi-Cal, your income and household size are key factors. You can use the Covered California Eligibility Calculator to get a quick estimate.

If you're applying for private insurance through Covered California, you'll also need to provide information about your household size and income. The marketplace will use this information to determine if you're eligible for Advanced Premium Tax Credits or other cost-saving programs.

Step 3: Compare Plans and Costs

Now that you know your eligibility, it's time to compare plans. Covered California provides a Plan Comparison Tool that allows you to view and compare the details of different plans side by side. This tool displays the estimated cost, benefits, and exclusions of each plan.

When comparing plans, consider your healthcare needs and budget. If you anticipate high medical costs, a plan with higher premiums but lower out-of-pocket costs might be a better fit. Conversely, if you're generally healthy, a plan with lower premiums and higher out-of-pocket costs could be more affordable.

Step 4: Apply and Enroll

Once you've selected a plan, you can apply and enroll through the Covered California website. The application process typically involves providing personal and household information, as well as details about your income and any other insurance coverage you have.

If you're eligible for cost-saving programs like Advanced Premium Tax Credits, these will be automatically applied to your plan. You'll then receive a confirmation of your enrollment, along with details about your coverage and how to use your insurance.

Understanding Your Health Insurance Plan

After enrolling in a health insurance plan, it's important to understand how it works and what it covers. This knowledge can help you make the most of your coverage and avoid unexpected costs.

Key Terms to Understand

- Premium: The amount you pay each month to maintain your health insurance coverage.

- Deductible: The amount you must pay out of pocket before your insurance starts to cover costs. Higher-premium plans often have lower deductibles.

- Copay: A fixed amount you pay for covered healthcare services, like a doctor's visit or prescription drugs.

- Coinsurance: Your share of the costs of a covered healthcare service, calculated as a percentage (e.g., 20% coinsurance means you pay 20% of the cost of the service).

- Out-of-Pocket Maximum: The most you'll pay during a policy period before your insurance plan starts to pay 100% of the costs for covered services.

Understanding Your Coverage

Your health insurance plan covers a range of services, including doctor visits, hospital stays, prescription drugs, and preventive care. The specific services covered and the amount you'll pay for them can vary based on your plan.

It's important to review your Summary of Benefits and Coverage, which outlines what's covered and what you'll pay. This document is available from your insurance provider or through Covered California. It's a valuable resource for understanding your coverage and can help you make informed decisions about your healthcare.

Making the Most of Your Health Insurance

Having health insurance is just the first step. To get the most out of your coverage, it's important to understand how to use it effectively and make informed choices about your healthcare.

Choosing a Primary Care Provider (PCP)

Most health insurance plans require you to choose a Primary Care Provider (PCP). This is usually a doctor or healthcare professional who provides your routine care and coordinates your overall healthcare. When choosing a PCP, consider their location, office hours, and whether they accept your insurance.

Once you've selected a PCP, you'll need to establish care with them. This typically involves an initial visit to discuss your health history and any current concerns. Your PCP can then help manage your ongoing healthcare needs, refer you to specialists when needed, and ensure you're getting the care you require.

Using Your Insurance Effectively

To make the most of your health insurance, it's important to understand how to use it. This includes knowing when and how to access care, and what to expect in terms of costs.

- Routine Care: For routine healthcare needs, such as annual check-ups or minor illnesses, you'll typically visit your PCP. Most plans cover these visits at little or no cost to you.

- Specialist Care: If you need to see a specialist, such as a cardiologist or dermatologist, your PCP will refer you. Depending on your plan, you may need to choose a specialist within your insurance network to avoid higher costs.

- Emergency Care: In an emergency, you can go to any hospital or emergency room. Your insurance plan will typically cover emergency care, but you may have to pay a copay or deductible.

- Prescription Drugs: Many health insurance plans cover prescription drugs, but the specific drugs covered and the amount you'll pay can vary. Your plan may have a formulary, which is a list of covered drugs. It's important to check if your required medications are covered before filling a prescription.

Future of Health Insurance in California

California's healthcare landscape is continually evolving, with ongoing efforts to improve access and affordability. The state's commitment to expanding healthcare coverage has led to significant progress, but challenges remain, particularly in ensuring that all Californians have access to quality, affordable healthcare.

Expanding Coverage

California has made significant strides in expanding health insurance coverage, with the goal of achieving universal coverage. The state's efforts, including the establishment of Covered California and the expansion of Medi-Cal, have led to a substantial increase in the number of insured residents.

Despite these achievements, there are still gaps in coverage. Uninsured rates remain higher among certain populations, such as low-income individuals and undocumented immigrants. Addressing these gaps and ensuring that all Californians have access to healthcare is a key focus of ongoing policy discussions.

Improving Affordability

While California has made progress in expanding coverage, affordability remains a significant challenge. Premiums and out-of-pocket costs can be a barrier for many residents, particularly those with lower incomes. The state is exploring various strategies to address this issue, including expanding eligibility for cost-saving programs and exploring new funding models.

Enhancing Healthcare Quality

In addition to expanding coverage and improving affordability, California is focused on enhancing the quality of healthcare. This includes initiatives to improve healthcare outcomes, reduce disparities, and promote preventive care. The state is also working to address the shortage of healthcare providers, particularly in rural and underserved areas.

Conclusion

Obtaining health insurance in California is a critical step towards ensuring your access to healthcare services. With a range of options available, from government-funded programs like Medi-Cal to private plans through Covered California, Californians have the opportunity to find coverage that meets their needs and budget.

By understanding the different types of insurance plans, the enrollment process, and how to make the most of your coverage, you can navigate the healthcare system with confidence. Remember, having health insurance is not just about covering unexpected medical costs; it's about having peace of mind and access to the care you need to stay healthy.

Frequently Asked Questions

Can I apply for Medi-Cal at any time, or is there an enrollment period like Covered California?

+

Unlike Covered California, which has a specific Open Enrollment Period, you can apply for Medi-Cal at any time. If you meet the income and other eligibility requirements, you can enroll in Medi-Cal throughout the year.

What happens if I miss the Open Enrollment Period for Covered California? Can I still get health insurance?

+

If you miss the Open Enrollment Period, you can still get health insurance through Covered California if you experience a Qualifying Life Event, such as losing your job, getting married, or having a baby. These events allow you to enroll outside of the regular enrollment period.

Are there any programs to help with the cost of health insurance in California for low-income individuals?

+

Yes, California offers several programs to assist low-income individuals with the cost of health insurance. Medi-Cal is one such program, providing free or low-cost health coverage to eligible individuals. Additionally, through Covered California, low-income individuals may qualify for Advanced Premium Tax Credits, which can significantly reduce the cost of their monthly premiums.