How Do I Get Homeowners Insurance

Homeowners insurance is an essential aspect of protecting your biggest asset and ensuring financial security. It provides coverage for your home, its contents, and your personal liability. Obtaining the right homeowners insurance policy can be a straightforward process if you follow these comprehensive steps. In this guide, we will explore the ins and outs of securing homeowners insurance, from understanding your coverage needs to navigating the application process.

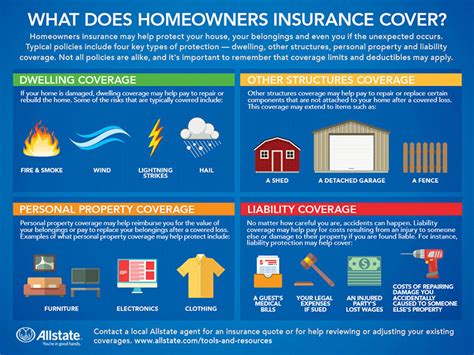

Understanding Homeowners Insurance Coverage

Before diving into the application process, it’s crucial to grasp the various components of homeowners insurance and tailor your coverage to your specific needs. Here’s a breakdown of the key aspects:

Dwelling Coverage

This is the core of your homeowners insurance policy. Dwelling coverage protects the structure of your home, including the main building, attached structures like garages, and even detached buildings like sheds or guest houses. It covers damages caused by perils such as fire, windstorms, hail, and vandalism. The coverage amount should reflect the cost of rebuilding your home, not its market value.

| Perils Covered | Examples |

|---|---|

| Fire | Structure damage due to fire. |

| Windstorms | Damage from hurricanes, tornadoes, and high winds. |

| Hail | Roof damage from hailstorms. |

| Vandalism | Graffiti, broken windows, or other intentional damage. |

Personal Property Coverage

Personal property coverage protects your belongings inside the home, including furniture, appliances, electronics, clothing, and jewelry. It typically covers losses due to theft, vandalism, or natural disasters. The coverage amount should reflect the replacement value of your possessions. Consider additional riders for high-value items like fine art or jewelry.

Liability Coverage

Liability coverage is a crucial aspect of homeowners insurance, as it protects you from financial loss in case someone is injured on your property or if you are held legally responsible for an injury or damage to someone else’s property. It covers legal defense costs and any damages you are required to pay. The coverage amount should be sufficient to protect your assets in the event of a lawsuit.

Additional Living Expenses

If your home becomes uninhabitable due to a covered loss, this coverage reimburses you for additional living expenses, such as hotel stays or temporary housing costs, until you can return to your home. It ensures you’re not left financially stranded during the restoration process.

Assessing Your Homeowners Insurance Needs

Every homeowner’s insurance needs are unique, and it’s essential to assess your specific requirements. Consider the following factors when evaluating your coverage needs:

Location and Risk Factors

Your home’s location plays a significant role in determining your insurance needs. Areas prone to natural disasters like hurricanes, earthquakes, or wildfires may require specialized coverage. Assess the risks specific to your location and choose a policy that offers adequate protection.

Home Value and Replacement Cost

Accurately determining the replacement cost of your home is crucial. It’s not the same as the market value, as it considers the cost of rebuilding your home from the ground up using current construction costs. Overestimating can lead to higher premiums, while underestimating may leave you underinsured in the event of a total loss.

Personal Belongings and High-Value Items

Take an inventory of your personal belongings and assess their value. Consider the cost of replacing or repairing items like furniture, electronics, and jewelry. If you have high-value items, such as fine art or collectibles, ensure you have adequate coverage or consider additional riders.

Personal Liability Concerns

Evaluate your personal liability risks. If you have a swimming pool, trampoline, or other potential hazards on your property, you may need increased liability coverage. Additionally, consider your financial assets and choose a liability limit that provides sufficient protection.

Researching Insurance Providers and Policies

With a clear understanding of your coverage needs, it’s time to research insurance providers and their policies. Here are some key steps to navigate this process effectively:

Compare Insurance Companies

Explore multiple insurance companies to find the best fit for your needs. Consider factors such as financial stability, customer satisfaction ratings, and the range of coverage options they offer. Online resources and reviews can provide valuable insights into different providers.

Review Policy Details

Carefully review the policy documents provided by each insurer. Pay attention to the coverage limits, deductibles, and any exclusions or limitations. Ensure the policy aligns with your assessed needs and provides comprehensive protection.

Consider Discounts and Bundles

Many insurance companies offer discounts for various reasons, such as loyalty, multiple policies (e.g., bundling homeowners and auto insurance), safety features in your home, or even your profession. Take advantage of these discounts to reduce your premiums.

Seek Expert Advice

Consider consulting an insurance agent or broker who can provide personalized advice based on your specific circumstances. They can help you navigate the complexities of homeowners insurance and ensure you have the right coverage.

The Application Process for Homeowners Insurance

Once you’ve selected an insurance provider and policy that meets your needs, it’s time to complete the application process. Here’s a step-by-step guide to ensure a smooth experience:

Gather Necessary Information

Before starting the application, gather all the necessary information, including your home’s address, construction type, square footage, and the year it was built. You’ll also need details about any previous insurance claims and your personal information.

Complete the Application

Whether online or through an agent, complete the application form accurately and thoroughly. Provide detailed information about your home, its contents, and any additional coverage requirements. Be transparent about any known risks or previous claims.

Review and Understand the Policy

Once you receive the policy documents, take the time to review them carefully. Ensure that the coverage limits, deductibles, and exclusions align with your expectations. If you have any questions or concerns, reach out to your insurance provider for clarification.

Make an Informed Decision

After reviewing the policy, make an informed decision about whether to proceed with the coverage. Consider the coverage limits, deductibles, and any additional riders you may need. If you have any doubts, seek advice from an insurance professional.

Tips for Maintaining Your Homeowners Insurance

Obtaining homeowners insurance is just the beginning. Here are some tips to ensure your coverage remains adequate and up-to-date:

Regularly Review and Update Your Policy

Life changes, and so do your insurance needs. Review your policy annually to ensure it still meets your requirements. Update it if you’ve made significant home improvements, acquired new possessions, or experienced changes in your personal liability risks.

Understand Your Deductibles

Deductibles are the amount you pay out of pocket before your insurance coverage kicks in. Choose a deductible that aligns with your financial comfort level. A higher deductible can lead to lower premiums, but ensure you have the financial means to cover it in case of a claim.

Practice Home Maintenance

Regular home maintenance can help prevent insurance claims. Keep your home in good condition, address any potential hazards, and maintain your property to reduce the risk of accidents or damage. This can lead to lower premiums and a smoother claims process.

Stay Informed about Policy Changes

Insurance providers may make changes to their policies, coverage options, or rates. Stay informed about any updates that may impact your coverage. Regularly check for notices from your insurer and ask your agent or broker about any significant changes.

Conclusion: Securing Your Peace of Mind

Obtaining homeowners insurance is a crucial step in protecting your home and your financial well-being. By understanding your coverage needs, researching providers, and following a structured application process, you can secure a policy that provides comprehensive protection. Remember, your homeowners insurance is an ongoing commitment, and regular reviews ensure it continues to meet your evolving needs.

How much does homeowners insurance cost?

+The cost of homeowners insurance varies based on factors such as location, home value, coverage limits, and deductibles. On average, homeowners insurance costs range from 500 to 2,000 annually. However, it’s important to obtain quotes from multiple providers to find the best coverage at a competitive price.

What happens if I don’t have homeowners insurance and my home is damaged?

+Without homeowners insurance, you would be responsible for covering the cost of repairs or rebuilding your home out of pocket. This can be financially devastating, especially for major damages. Homeowners insurance provides the necessary financial protection to help you recover from such losses.

Can I customize my homeowners insurance policy?

+Yes, homeowners insurance policies can be customized to fit your specific needs. You can choose coverage limits, deductibles, and add optional riders or endorsements to cover unique risks or high-value items. Working with an insurance agent can help you tailor your policy to your requirements.

What should I do if I need to file a claim with my homeowners insurance?

+If you need to file a claim, contact your insurance provider as soon as possible. They will guide you through the claims process, which typically involves providing details about the incident, documenting the damage, and cooperating with the insurer’s investigation. Be prepared to provide supporting evidence and cooperate fully to ensure a smooth claims process.