How Do I Know If I Have Health Insurance

Health insurance is an essential aspect of modern healthcare systems, providing individuals with access to medical services and financial protection. It can often be a complex topic, with various plans, policies, and coverage options available. So, how can you determine if you have health insurance and understand the extent of your coverage? Let's delve into the details and explore the steps to identify and comprehend your health insurance status.

Understanding Your Health Insurance Coverage

Having health insurance is crucial for maintaining your well-being and managing healthcare costs effectively. To navigate the world of health insurance, it's important to first identify if you have coverage and then comprehend the specifics of your plan.

Identifying Your Health Insurance Status

Determining whether you have health insurance is the first step towards understanding your healthcare coverage. Here are some ways to identify your insurance status:

-

Review Your Employment Benefits: If you are employed, your employer may offer health insurance as part of your benefits package. Check your employee handbook or reach out to your HR department to access information about your insurance plan.

-

Check Government Programs: In many countries, government-sponsored programs provide health insurance to eligible individuals. Research the specific programs available in your region and verify if you qualify for any of them.

-

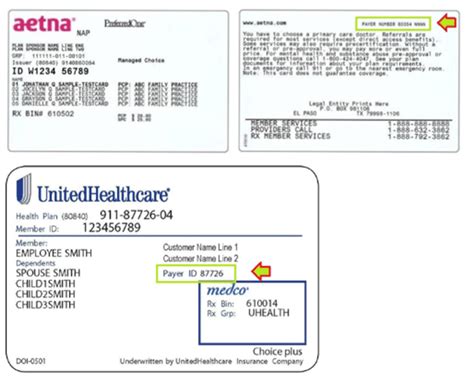

Examine Insurance Documents: If you have previously purchased health insurance, locate and review your insurance policy documents. These documents will provide detailed information about your coverage, including plan type, effective dates, and policy limits.

-

Contact Insurance Providers: Reach out to insurance companies or brokers you have dealt with in the past. They can help you verify your insurance status and provide information about any active policies.

-

Utilize Online Tools: Several online platforms and government websites offer tools to check your insurance eligibility and provide details about available plans. These resources can be a quick and convenient way to assess your insurance status.

Once you have confirmed your health insurance status, the next step is to delve into the specifics of your coverage.

Comprehending Your Health Insurance Plan

Understanding the intricacies of your health insurance plan is essential to ensure you receive the necessary medical care and avoid unexpected costs. Here's what you need to know:

-

Plan Type: Identify whether you have a private insurance plan, government-sponsored insurance, or a combination of both. This information will help you understand the scope and limitations of your coverage.

-

Effective Dates: Determine the start and end dates of your insurance coverage. This ensures you are aware of any upcoming changes or renewals.

-

Network Providers: Check if your insurance plan has a network of preferred providers. Using in-network doctors and hospitals can often result in lower out-of-pocket costs.

-

Coverage Limits: Understand the maximum amount your insurance plan will cover for various medical services. This includes annual limits, lifetime limits, and specific limits for different procedures or treatments.

-

Deductibles and Copays: Familiarize yourself with your deductible, which is the amount you pay out of pocket before your insurance coverage kicks in. Additionally, understand copays, which are fixed amounts you pay for specific services.

-

Pre-Authorization Requirements: Some insurance plans require pre-authorization for certain procedures or treatments. Ensure you are aware of these requirements to avoid delays in receiving necessary care.

-

Exclusions and Limitations: Every insurance plan has exclusions and limitations. Understand what services or treatments are not covered by your plan to manage your expectations and financial responsibilities.

By thoroughly understanding your health insurance plan, you can make informed decisions about your healthcare and effectively utilize your coverage.

Seeking Professional Guidance

Navigating the complexities of health insurance can be challenging, and seeking professional guidance can provide valuable insights. Here are some options to consider:

-

Insurance Brokers: Insurance brokers are professionals who specialize in helping individuals and businesses find the right insurance plans. They can assist you in understanding your options, comparing plans, and selecting the most suitable coverage for your needs.

-

Employer's HR Department: If your insurance is provided through your employer, reach out to the HR department for assistance. They can provide detailed information about your plan, answer any questions, and guide you through the enrollment process.

-

Government Agencies: Government agencies responsible for healthcare and insurance often have resources and support available to help individuals understand their coverage. These agencies can provide guidance on eligibility, plan options, and any necessary enrollment processes.

-

Healthcare Providers: Your healthcare providers, such as doctors or hospital staff, can also offer valuable insights into your insurance coverage. They can explain how your plan works and provide information on out-of-pocket costs and billing processes.

The Impact of Health Insurance on Healthcare Access

Health insurance plays a crucial role in ensuring individuals have access to necessary healthcare services. It provides financial protection, allowing individuals to seek medical attention without the burden of excessive costs. Here's how health insurance impacts healthcare access:

Financial Protection

Health insurance acts as a safety net, protecting individuals from the potentially devastating financial impact of medical expenses. It helps cover the costs of various healthcare services, including doctor visits, hospital stays, prescription medications, and specialized treatments.

With health insurance, individuals can access healthcare without worrying about the immediate financial burden. This encourages people to seek timely medical attention, leading to better health outcomes and improved overall well-being.

Preventive Care

Many health insurance plans emphasize the importance of preventive care. They often cover routine check-ups, screenings, and vaccinations, encouraging individuals to take a proactive approach to their health. Preventive care helps identify potential health issues early on, allowing for timely interventions and potentially preventing more serious conditions from developing.

Specialized Treatments

Health insurance provides access to a wide range of specialized treatments and services. Whether it's managing chronic conditions, undergoing complex surgeries, or accessing mental health services, insurance coverage ensures individuals can receive the necessary care without facing financial barriers.

By covering a broad spectrum of healthcare needs, health insurance promotes holistic well-being and supports individuals in maintaining their health and managing their conditions effectively.

Reduced Healthcare Disparities

Health insurance plays a significant role in reducing healthcare disparities by providing equal access to healthcare services. It ensures that individuals from various socioeconomic backgrounds can access the same level of care, regardless of their financial status.

By offering financial protection and covering essential healthcare services, health insurance helps bridge the gap between those who can afford healthcare and those who cannot. This promotes a more equitable healthcare system and improves overall population health.

Future Trends in Health Insurance

The landscape of health insurance is constantly evolving, driven by advancements in technology, changing healthcare needs, and policy reforms. Here are some key trends shaping the future of health insurance:

Digital Health Solutions

The integration of digital health solutions is transforming the way health insurance operates. Telemedicine, remote monitoring, and digital health platforms are becoming increasingly prevalent, offering convenient and accessible healthcare options.

Insurance companies are leveraging technology to enhance member engagement, streamline claims processes, and provide personalized health recommendations. This digital transformation is expected to continue, improving the overall efficiency and effectiveness of health insurance systems.

Value-Based Care

Value-based care models are gaining prominence in the healthcare industry, and health insurance is following suit. These models focus on delivering high-quality care while reducing costs. Insurance providers are incentivizing healthcare providers to deliver efficient and effective care, leading to better health outcomes for patients.

Value-based care aims to shift the focus from volume-based services to outcome-based care, encouraging providers to prioritize preventive measures and patient-centered approaches.

Consumer-Centric Insurance

Health insurance companies are increasingly adopting a consumer-centric approach, aiming to meet the evolving needs and preferences of their members. This involves providing personalized insurance plans, offering flexible coverage options, and enhancing member engagement through digital platforms.

By prioritizing consumer satisfaction and tailoring insurance plans to individual needs, insurance companies can improve member retention and overall satisfaction with their healthcare coverage.

Collaborative Partnerships

Collaborative partnerships between insurance providers, healthcare organizations, and technology companies are becoming more common. These partnerships aim to improve healthcare delivery, enhance patient experiences, and reduce costs.

Through collaborative efforts, insurance providers can access innovative healthcare solutions, leverage advanced technologies, and develop integrated care models that benefit both patients and healthcare professionals.

FAQ

What happens if I don't have health insurance?

+Not having health insurance can result in significant financial challenges if you require medical care. Without insurance, you may need to pay for all medical expenses out of pocket, which can be costly. Additionally, lack of insurance can limit your access to certain healthcare services and treatments. It's important to explore your options for obtaining insurance coverage to ensure you have the necessary protection.

How do I choose the right health insurance plan?

+Choosing the right health insurance plan depends on your individual needs and circumstances. Consider factors such as your healthcare requirements, the cost of premiums and deductibles, the network of providers, and any specific benefits or coverage limits. It's beneficial to compare multiple plans and seek guidance from insurance brokers or trusted advisors to make an informed decision.

Can I switch health insurance plans?

+Yes, you can typically switch health insurance plans during specific enrollment periods or under certain qualifying life events. These periods allow you to assess your insurance needs and make changes to your coverage. It's important to review your options and understand the enrollment process to ensure a smooth transition to a new plan.

What are some common exclusions in health insurance plans?

+Common exclusions in health insurance plans vary depending on the specific policy. However, some common exclusions include cosmetic procedures, experimental treatments, pre-existing conditions, and certain mental health services. It's crucial to carefully review your policy documents to understand the exclusions and limitations of your coverage.

How can I maximize the benefits of my health insurance plan?

+To maximize the benefits of your health insurance plan, stay informed about your coverage and understand the network of providers. Utilize preventive care services, manage your deductibles and copays, and take advantage of any wellness programs or incentives offered by your insurance provider. Additionally, seek guidance from your healthcare providers and insurance company to ensure you're making the most of your coverage.

Health insurance is a vital component of modern healthcare, providing individuals with access to necessary medical services and financial protection. By understanding your insurance status and comprehending the specifics of your coverage, you can make informed decisions about your healthcare and effectively utilize your insurance benefits. As the landscape of health insurance continues to evolve, staying informed about the latest trends and seeking professional guidance will help you navigate the complexities and ensure you have the coverage you need.