How Do I Save Money On Car Insurance

Car insurance is an essential financial investment for any vehicle owner, providing protection and peace of mind. However, it can often be a significant expense, leaving many individuals and families searching for ways to reduce their insurance costs. Fortunately, there are numerous strategies and considerations that can help you save money on car insurance while still maintaining adequate coverage. This article aims to explore these methods, offering expert advice and practical tips to optimize your insurance spending.

Understanding Your Insurance Policy

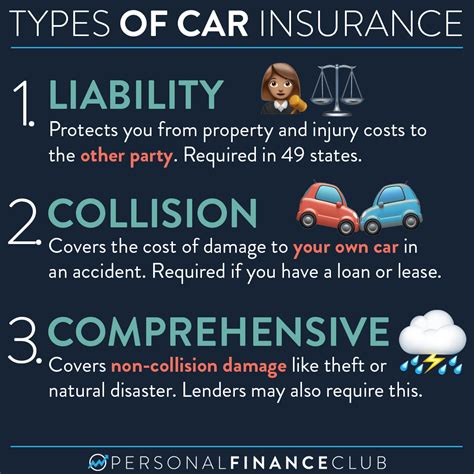

Before delving into strategies to save money, it’s crucial to understand the components of your insurance policy. Car insurance policies typically consist of various coverages, including liability, collision, comprehensive, personal injury protection (PIP), and uninsured/underinsured motorist coverage. Each coverage has its own cost, and by understanding these costs and how they work together, you can make more informed decisions about your insurance needs.

Liability Coverage

Liability insurance is a fundamental part of any car insurance policy. It covers damages and injuries you cause to others in an accident for which you are at fault. This coverage is mandatory in most states and is essential to protect your financial well-being. However, the amount of liability coverage you need can vary based on your personal circumstances and the value of your assets. It’s important to strike a balance between adequate coverage and cost-effectiveness.

Consider your financial situation and the potential risks you face. If you have substantial assets, you may want to opt for higher liability limits to protect your wealth. On the other hand, if you're a low-risk driver with limited assets, you might consider lower liability limits to save on insurance costs.

Collision and Comprehensive Coverage

Collision and comprehensive coverage are optional but highly recommended. Collision insurance covers damages to your vehicle in the event of an accident, while comprehensive coverage protects against non-collision incidents such as theft, vandalism, or natural disasters. These coverages can be costly, especially for newer or luxury vehicles.

When assessing your need for collision and comprehensive coverage, consider the age and value of your vehicle. If your car is older and has low resale value, you might consider dropping these coverages to save money. However, if you have a newer or more expensive vehicle, these coverages can provide essential protection.

| Coverage Type | Description |

|---|---|

| Collision | Covers damages to your vehicle in an accident |

| Comprehensive | Protects against non-collision incidents like theft or natural disasters |

Personal Injury Protection (PIP) and Uninsured/Underinsured Motorist Coverage

PIP and uninsured/underinsured motorist coverage are additional optional coverages that provide protection for you and your passengers in the event of an accident. PIP covers medical expenses and lost wages, while uninsured/underinsured motorist coverage protects you if you’re involved in an accident with a driver who has little or no insurance.

These coverages can be valuable, especially if you or your passengers frequently travel in your vehicle. However, they can also add to your insurance costs. Assess your personal situation and the risks you face to determine if these coverages are necessary for your specific needs.

Shopping Around for the Best Rates

One of the most effective ways to save money on car insurance is to shop around and compare quotes from multiple insurance providers. Insurance rates can vary significantly between companies, and by comparing quotes, you can identify the most cost-effective option for your needs.

Online Comparison Tools

Utilize online comparison tools to quickly and easily gather quotes from various insurance companies. These tools allow you to input your information once and receive multiple quotes, saving you time and effort. Compare not only the prices but also the coverages and policy features offered by each provider to ensure you’re getting the best value.

Direct Insurance Companies vs. Independent Agents

Consider whether you prefer to work with a direct insurance company or an independent agent. Direct insurance companies sell policies directly to consumers, often offering more competitive rates. However, independent agents can provide quotes from multiple companies, giving you a broader range of options.

When working with an independent agent, they can guide you through the process, helping you understand the nuances of each policy and ensuring you get the coverage you need at a competitive price. On the other hand, direct insurance companies may offer more streamlined processes and potentially lower rates, but you may need to invest more time in researching and understanding the policies yourself.

Bundling Policies for Discounts

If you have multiple insurance needs, such as car, home, or renters insurance, consider bundling your policies with the same provider. Many insurance companies offer discounts when you bundle multiple policies, as it’s more convenient for them to manage and can reduce their administrative costs.

By bundling your policies, you not only save money on insurance premiums but also streamline your insurance management. You'll have a single provider to contact for all your insurance needs, making it easier to make changes, file claims, and keep track of your coverage.

Optimizing Your Driving Behavior

Your driving behavior and history play a significant role in determining your car insurance rates. Insurance companies consider factors such as your driving record, claims history, and even your credit score when calculating your premiums. By maintaining a positive driving record and adopting safe driving habits, you can potentially save money on your insurance.

Safe Driving Habits

Practice safe driving habits to reduce the risk of accidents and claims. This includes obeying traffic laws, avoiding aggressive driving behaviors like speeding or tailgating, and maintaining a safe following distance. By reducing your risk of accidents, you can potentially lower your insurance costs.

Additionally, consider investing in driver safety courses or defensive driving programs. Many insurance companies offer discounts to policyholders who complete these courses, as they demonstrate a commitment to safe driving and can reduce the risk of accidents.

Reducing Mileage

The number of miles you drive each year can impact your insurance rates. Insurance companies often offer lower rates to drivers who drive fewer miles, as they are statistically less likely to be involved in accidents. If you have the option to reduce your mileage, such as by carpooling, using public transportation, or working from home, you may be able to save money on your insurance.

Maintaining a Clean Driving Record

A clean driving record is crucial for keeping your insurance costs low. Insurance companies consider violations and accidents when determining your premiums. If you have a history of traffic violations or accidents, your insurance rates may be higher. To maintain a clean record, avoid driving under the influence, obey speed limits, and practice defensive driving techniques.

Utilizing Discounts and Special Programs

Insurance companies offer a variety of discounts and special programs that can help you save money on your car insurance. By understanding these opportunities and taking advantage of them, you can potentially reduce your insurance costs.

Discounts for Safe Drivers

Many insurance companies offer discounts to policyholders with a history of safe driving. These discounts can be significant and are often based on factors such as your driving record, claims history, and the number of years you’ve been accident-free. By maintaining a clean driving record, you can qualify for these discounts and save money on your insurance.

Student and Good Grade Discounts

If you’re a student or have children who are students, you may be eligible for student discounts on your car insurance. Many insurance companies offer reduced rates to students who maintain good grades, as this demonstrates a commitment to responsibility and academic success. Check with your insurance provider to see if you qualify for this discount.

Membership and Affiliation Discounts

Certain memberships and affiliations can also lead to insurance discounts. For example, if you’re a member of a professional organization, alumni association, or certain clubs, you may be eligible for group discounts on your car insurance. Additionally, some insurance companies offer discounts to members of specific professions, such as teachers or military personnel.

Safe Vehicle Discounts

Insurance companies may offer discounts for vehicles equipped with safety features. These features can include anti-lock brakes, air bags, anti-theft devices, and collision avoidance systems. By investing in these safety features, you not only enhance the safety of your vehicle but may also qualify for insurance discounts.

Understanding Your State’s Insurance Laws

Each state has its own set of insurance laws and regulations that impact car insurance rates and requirements. Understanding these laws can help you make informed decisions about your insurance coverage and potentially save money.

Minimum Liability Requirements

Every state has minimum liability requirements that drivers must meet. These requirements specify the minimum amount of liability insurance you must carry to drive legally in that state. While you can choose to purchase higher liability limits, understanding the minimum requirements can help you ensure you’re meeting the legal obligations while potentially saving money.

No-Fault vs. Tort Insurance Systems

States have different insurance systems, with some operating under a no-fault system and others under a tort system. In a no-fault system, drivers’ insurance companies pay for damages and injuries regardless of fault, while in a tort system, liability is determined, and the at-fault driver’s insurance covers the damages.

Understanding your state's insurance system can impact your insurance decisions. In a no-fault state, you may prioritize personal injury protection (PIP) coverage, while in a tort state, you may focus more on liability coverage. Consult with an insurance professional to understand how your state's system impacts your insurance needs.

State-Specific Insurance Laws

Each state may have unique insurance laws and regulations that can impact your insurance costs. For example, some states have laws that require insurance companies to offer certain discounts or coverages. Others may have laws that impact the calculation of insurance rates, such as using credit scores or territorial rating systems.

Stay informed about your state's insurance laws and how they may impact your insurance costs. This knowledge can help you make more strategic decisions about your insurance coverage and potentially save money.

Conclusion

Saving money on car insurance requires a combination of understanding your policy, shopping around for the best rates, optimizing your driving behavior, and taking advantage of discounts and special programs. By adopting these strategies and staying informed about your insurance options, you can potentially reduce your insurance costs while still maintaining adequate coverage.

Remember, car insurance is an essential investment to protect your financial well-being and the safety of yourself and others on the road. By making informed decisions and staying proactive, you can find the right balance between cost-effectiveness and adequate coverage.

How often should I review my car insurance policy and rates?

+It’s recommended to review your car insurance policy and rates at least once a year. Insurance rates can change over time, and your personal circumstances may also evolve. By reviewing your policy annually, you can ensure you’re still getting the best value and coverage for your needs.

Can I negotiate my car insurance rates with my provider?

+While car insurance rates are largely determined by factors beyond your control, you can still negotiate with your provider. Explain your situation, highlight your safe driving record or any other relevant factors, and inquire about potential discounts or adjustments to your policy. Some providers may be willing to work with you to find a more affordable solution.

Are there any drawbacks to reducing my car insurance coverage to save money?

+Reducing your car insurance coverage to save money can leave you vulnerable in certain situations. For example, if you drop collision and comprehensive coverage, you’ll be responsible for paying for damages to your vehicle out of pocket if you’re in an accident or if your car is damaged by a non-collision incident. It’s important to carefully consider your needs and the potential risks before making any changes to your coverage.