How Does An Insurance Deductible Work

Understanding insurance deductibles is crucial for anyone looking to protect their assets and manage their financial risks effectively. An insurance deductible is a key component of insurance policies, often overlooked by policyholders until they need to make a claim. This article aims to demystify the concept of insurance deductibles, exploring how they work, their impact on insurance coverage, and the strategies to optimize their use.

The Basics of Insurance Deductibles

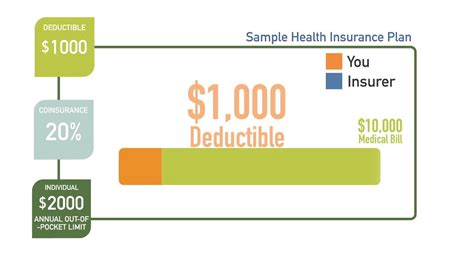

An insurance deductible is a predetermined amount that an insured individual or entity must pay out of pocket before the insurance company starts covering the costs of a claim. In simple terms, it’s the first part of a claim that the policyholder is responsible for paying.

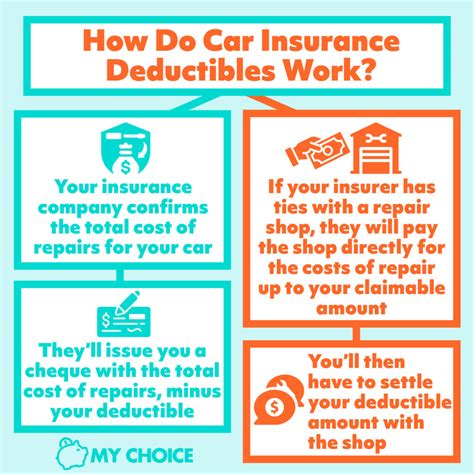

For instance, imagine you have a car insurance policy with a $500 deductible. If you get into an accident and your repairs cost $3,000, you'll need to pay the first $500, and your insurance company will cover the remaining $2,500.

Deductibles can vary significantly across different types of insurance, from auto and home insurance to health and life insurance policies. The amount of the deductible is typically chosen by the policyholder during the policy purchase or renewal process, and it can greatly affect the cost of the insurance premium.

How Deductibles Impact Insurance Coverage

Insurance deductibles play a crucial role in determining the cost and extent of coverage provided by an insurance policy. Here’s how they impact insurance coverage:

Lower Deductibles vs. Higher Deductibles

Choosing a lower deductible often results in a higher insurance premium. This is because the insurance company assumes more financial responsibility with a lower deductible, which increases their potential exposure to claims.

Conversely, opting for a higher deductible can lead to a lower insurance premium. In this case, the policyholder accepts more financial responsibility, which reduces the insurer's potential claim payouts and, consequently, lowers the premium.

| Deductible Level | Premium Cost | Financial Responsibility |

|---|---|---|

| Low Deductible | High Premium | Insurer assumes more risk |

| High Deductible | Low Premium | Policyholder assumes more risk |

Impact on Claims Process

When a claim is made, the deductible amount is subtracted from the total claim cost. This means that the policyholder must first pay the deductible before the insurance company pays the rest.

For example, if your home insurance policy has a $1,000 deductible and you have a claim for $15,000 in damages, you'll need to pay the first $1,000, and the insurance company will cover the remaining $14,000.

Policy Coverage and Deductibles

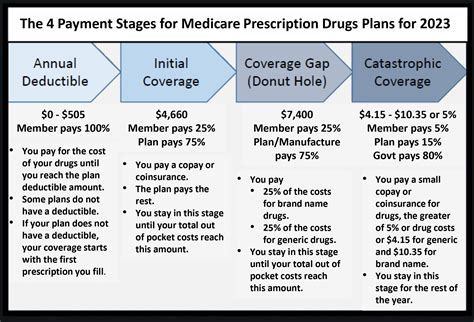

Different insurance policies have varying types of deductibles. Some policies may have a single deductible for all types of claims, while others might have specific deductibles for different coverage areas. For instance, a health insurance policy might have one deductible for hospital stays and another for prescription medications.

Strategies for Managing Insurance Deductibles

Understanding how to effectively manage insurance deductibles can help policyholders optimize their insurance coverage and financial planning.

Assessing Your Financial Capacity

Before selecting a deductible, it’s crucial to assess your financial capacity. Can you afford to pay a higher deductible in the event of a claim? Consider your savings, emergency funds, and overall financial stability. Choosing a deductible that aligns with your financial situation can ensure you’re adequately prepared for potential out-of-pocket expenses.

Evaluating Risk Tolerance

Your risk tolerance is another critical factor when choosing a deductible. If you’re comfortable assuming more financial risk, opting for a higher deductible can be a strategic choice. This approach can lead to significant savings on your insurance premium. However, if you prefer to minimize financial risk, a lower deductible might be more suitable, even if it means a higher premium.

Reviewing Deductibles Regularly

Insurance needs and financial situations can change over time. It’s essential to review your insurance policies and deductibles regularly, especially during policy renewals. Changes in your lifestyle, assets, or financial status might warrant adjustments to your deductible levels to ensure you’re adequately covered while managing costs effectively.

Understanding Policy Terms

Before selecting a deductible, thoroughly understand the terms and conditions of your insurance policy. Different policies may have unique deductible structures, exclusions, or limitations. Being well-informed about these details can help you make informed decisions about your deductible choice and ensure you’re not caught off guard by unexpected exclusions or limitations.

The Role of Deductibles in Insurance Claims

Insurance deductibles are not just a financial consideration; they also play a role in the claims process itself.

Preventing Small Claims

One of the primary purposes of insurance deductibles is to discourage policyholders from making small claims. By requiring the policyholder to pay a certain amount out of pocket, deductibles can deter individuals from filing claims for minor incidents that may not significantly impact their overall financial situation.

Encouraging Responsible Behavior

Deductibles can also encourage policyholders to take a more proactive approach to risk management. With a financial stake in the game, individuals are more likely to take steps to prevent accidents or losses, such as maintaining their vehicles, securing their homes, or practicing safe driving habits.

Managing Claim Frequency

Insurance companies use deductibles as a tool to manage the frequency of claims. By implementing deductibles, insurers can reduce the number of small, low-value claims, which can be costly to administer. This approach allows insurers to focus their resources on larger, more significant claims that have a more substantial impact on policyholders.

The Future of Insurance Deductibles

As the insurance industry continues to evolve, the role and structure of deductibles may also change. Here are some potential future developments:

Dynamic Deductibles

Insurance companies may explore dynamic deductibles that adjust based on various factors, such as the policyholder’s claims history, driving behavior (in the case of auto insurance), or even real-time data like weather conditions or traffic congestion.

Personalized Deductibles

With the advancement of technology and data analytics, insurers may offer more personalized deductibles based on an individual’s unique risk profile. This could involve tailoring deductibles to specific policyholders, taking into account their age, health status, or other relevant factors.

Bundled Deductibles

Insurers might consider offering bundled deductibles for policyholders with multiple insurance policies. This approach could simplify the claims process and provide a more streamlined experience for policyholders who have various insurance needs.

Conclusion

Insurance deductibles are a fundamental aspect of insurance policies, offering policyholders and insurers a balance between financial responsibility and risk management. By understanding how deductibles work and their impact on insurance coverage, you can make informed decisions to protect your assets and manage your financial risks effectively.

Frequently Asked Questions

What happens if I can’t afford to pay my insurance deductible?

+

If you’re unable to pay your insurance deductible, you won’t be able to proceed with your claim. It’s important to choose a deductible that aligns with your financial capacity to ensure you’re prepared for any potential out-of-pocket expenses.

Can I negotiate my insurance deductible?

+

Insurance deductibles are typically set by the insurance company and are based on various factors such as your risk profile and the type of coverage you’re seeking. While it’s possible to request a different deductible, the insurance company has the final say, and they may adjust your premium accordingly.

Are there any types of insurance that don’t have deductibles?

+

Some types of insurance, like certain life insurance policies or some government-sponsored health insurance plans, may not have deductibles. However, most standard insurance policies, such as auto, home, and health insurance, typically include deductibles as a standard component of the policy.