How Much Are Life Insurance Policies

Life insurance is a vital financial tool that provides a safety net for individuals and their loved ones, ensuring financial protection and peace of mind. The cost of life insurance policies is a common concern for many, as it directly impacts the affordability and accessibility of this essential coverage. The price of life insurance can vary significantly based on various factors, and understanding these variables is crucial for making informed decisions about purchasing adequate coverage.

Factors Influencing Life Insurance Costs

The cost of a life insurance policy is influenced by a multitude of factors, each playing a unique role in determining the overall price. Here's a breakdown of the key elements that affect the premiums:

1. Age and Health

Age and health status are paramount when it comes to life insurance costs. Younger individuals tend to pay lower premiums as they are generally considered less risky. The younger you are when you purchase a policy, the more affordable it tends to be. Additionally, good health can significantly reduce costs. Those with healthy lifestyles, no pre-existing conditions, and a clean medical history often enjoy more favorable rates.

For instance, a 30-year-old non-smoker with no health issues might pay an annual premium of $300 for a $500,000 term life insurance policy, whereas a 50-year-old with high blood pressure and a history of smoking could pay upwards of $1,200 for the same coverage.

2. Policy Type and Coverage Amount

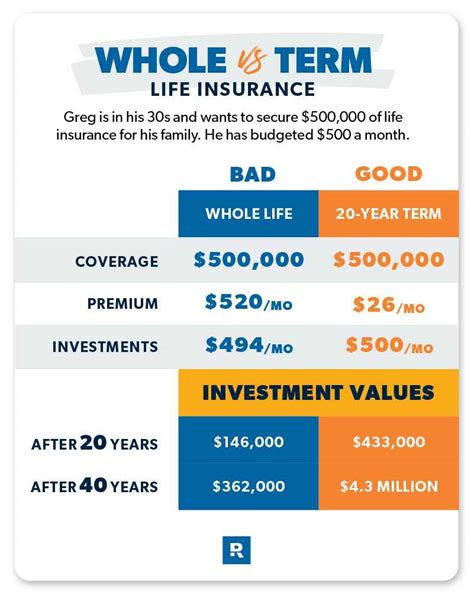

The type of policy and the coverage amount are major contributors to the cost. There are two primary types of life insurance: term life and permanent life.

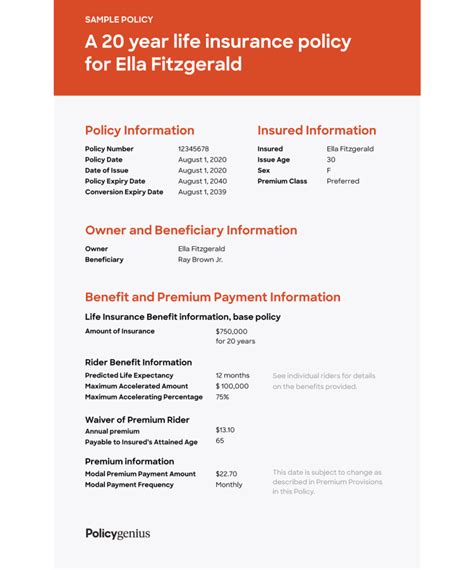

- Term Life Insurance: This provides coverage for a specific period, typically 10, 20, or 30 years. It offers a death benefit only and is generally more affordable. The premium remains fixed during the term, but the cost can increase significantly when the term renews.

- Permanent Life Insurance: This includes whole life, universal life, and variable life policies. These policies offer lifetime coverage and often include a cash value component that grows over time. While the death benefit is guaranteed, the premiums are usually higher compared to term life.

The coverage amount also affects the premium. A higher death benefit will result in a higher premium. For example, a $1 million term life policy may cost around $500 annually for a healthy 35-year-old, whereas a $2 million policy could double that amount.

3. Lifestyle and Hobbies

Your lifestyle and hobbies can impact your life insurance premiums. Activities considered risky, such as extreme sports, hazardous occupations, or frequent international travel, can lead to higher costs. Insurance companies assess these factors to determine the level of risk associated with insuring you.

| Activity | Impact on Premium |

|---|---|

| Skydiving | May result in higher premiums or exclusions for claims related to skydiving accidents. |

| High-Risk Occupation (e.g., logging) | Could lead to increased premiums or limited coverage options. |

| International Travel | Frequent travel might require additional coverage and potentially higher premiums. |

4. Family History and Genetics

Your family's medical history can influence your life insurance costs. If there's a history of genetic disorders or certain medical conditions in your family, it might impact your premium. For instance, a family history of heart disease or cancer could lead to higher premiums or even the need for a medical exam to assess your risk.

5. Location and Occupation

Your geographical location and occupation can also affect your life insurance premiums. Some areas have higher costs of living or higher crime rates, which can impact insurance rates. Similarly, certain occupations are considered more hazardous and may result in higher premiums.

| Occupation | Premium Impact |

|---|---|

| Construction Worker | Increased risk of accidents, potentially leading to higher premiums. |

| Firefighter | Regular exposure to dangerous situations, which may affect premium rates. |

| Pilot | Air travel-related risks could influence premium costs. |

Obtaining the Best Rates

Securing the most affordable life insurance policy involves careful consideration of various factors and a strategic approach. Here are some tips to help you find the best rates:

1. Shop Around and Compare

Don't settle for the first quote you receive. Life insurance rates can vary significantly between companies, so it's essential to compare quotes from multiple providers. Online comparison tools can be a convenient way to start your search and get an idea of the market rates.

2. Maintain a Healthy Lifestyle

Leading a healthy lifestyle is not only beneficial for your overall well-being but can also significantly reduce your life insurance premiums. Regular exercise, a balanced diet, and avoiding harmful habits like smoking can improve your health and make you a more attractive candidate for insurance companies.

3. Consider Term Length and Coverage Amount

The length of your term life insurance policy and the coverage amount can have a substantial impact on your premiums. Shorter terms and lower coverage amounts typically result in lower costs. Assess your needs and choose a policy that provides adequate coverage without unnecessary expenses.

4. Bundle Policies

If you already have other insurance policies, such as auto or home insurance, consider bundling your life insurance with the same provider. Many insurance companies offer discounts when you purchase multiple policies from them.

5. Be Honest and Transparent

When applying for life insurance, it's crucial to provide accurate and honest information about your health, lifestyle, and occupation. Misrepresenting yourself can lead to issues with your policy, including potential claim denials. Transparency ensures you get the right coverage and avoids future complications.

The Impact of Life Insurance Costs

The cost of life insurance can have a significant impact on an individual's financial planning and decision-making. For many, the affordability of life insurance is a critical factor in determining whether they can secure the coverage they need. Here's a closer look at how life insurance costs affect individuals and their financial strategies:

1. Financial Protection for Families

Life insurance is often purchased to provide financial security for families in the event of a breadwinner's untimely demise. The death benefit from a life insurance policy can help cover immediate expenses, such as funeral costs, and provide long-term financial support for surviving family members. The cost of the policy directly influences the ability of individuals to secure adequate coverage, ensuring their loved ones are protected.

2. Estate Planning and Legacy

Life insurance plays a crucial role in estate planning, allowing individuals to leave a legacy for their heirs. Permanent life insurance policies, in particular, can provide a significant death benefit that can be used to cover estate taxes, pay off debts, or fund charitable donations. The cost of these policies impacts an individual's ability to build a substantial estate and leave a lasting financial legacy.

3. Retirement Planning

Life insurance can be an essential component of retirement planning. Many individuals use permanent life insurance policies as a vehicle for long-term savings and investment. The cash value component of these policies grows tax-deferred, providing a valuable asset for retirement. The affordability of these policies directly affects an individual's ability to utilize life insurance as a retirement planning tool.

4. Business Continuity and Succession Planning

Life insurance is often used in business to ensure continuity and facilitate succession planning. Key person insurance, for instance, provides coverage for the death of a vital business owner or employee, helping to mitigate the financial impact of their loss. Similarly, buy-sell agreements funded by life insurance policies ensure a smooth transition of ownership in the event of a partner's death. The cost of these policies is a critical factor in determining the feasibility and effectiveness of such business strategies.

5. Peace of Mind and Financial Security

Beyond the practical financial benefits, life insurance provides peace of mind and a sense of financial security. Knowing that your loved ones are protected and that your financial obligations can be met, even in the event of your death, is invaluable. The cost of life insurance directly influences an individual's ability to obtain this peace of mind and ensure their family's financial well-being.

Frequently Asked Questions

How does age impact life insurance costs?

+Age is a significant factor in life insurance costs. Generally, younger individuals pay lower premiums as they are considered less risky. The cost tends to increase with age, reflecting the higher likelihood of health issues and shorter life expectancy.

Are there any ways to reduce life insurance premiums?

+Yes, there are several strategies to reduce premiums. Leading a healthy lifestyle, maintaining a good credit score, and opting for a term life policy instead of permanent life insurance can lower costs. Additionally, bundling policies with the same insurer often results in discounts.

What is the average cost of a life insurance policy?

+The average cost of a life insurance policy varies significantly based on individual factors. As a rough estimate, a healthy 30-year-old might pay around 200-300 annually for a 500,000 term life policy, while a 50-year-old could pay 500-$1,000 or more for the same coverage.

Can I get life insurance if I have a pre-existing medical condition?

+Yes, individuals with pre-existing medical conditions can still obtain life insurance. However, the cost may be higher, and you might need to undergo a medical exam to assess your risk. Some conditions might result in exclusions or limitations on your coverage.

Is it worth investing in permanent life insurance, or should I stick to term life?

+The decision between permanent and term life insurance depends on your financial goals and needs. Term life is generally more affordable and suitable for those seeking temporary coverage. Permanent life insurance offers lifetime coverage and a cash value component, making it a more comprehensive option but also more expensive.