How Much Auto Insurance

When it comes to auto insurance, the question of how much coverage is needed is a crucial one. Auto insurance is a necessary financial safeguard for vehicle owners, providing protection against various risks and liabilities. The amount of auto insurance required can vary significantly depending on individual circumstances, state regulations, and personal preferences. In this comprehensive guide, we will delve into the factors that influence the cost of auto insurance and explore strategies to ensure you obtain the right amount of coverage without overspending.

Understanding Auto Insurance Coverage

Auto insurance is a contractual agreement between an individual and an insurance provider. It offers financial protection in the event of an accident, theft, or other vehicle-related incidents. The coverage typically includes liability coverage, which safeguards the policyholder against claims for bodily injury or property damage caused to others, and comprehensive coverage, which covers damages to the insured vehicle due to non-collision incidents such as vandalism, theft, or natural disasters.

Factors Influencing Auto Insurance Costs

The cost of auto insurance is influenced by a multitude of factors, including:

- Vehicle Type and Value: The make, model, and year of your vehicle play a significant role in determining insurance premiums. High-performance cars, luxury vehicles, and sports cars often attract higher insurance costs due to their increased risk of theft and higher repair expenses.

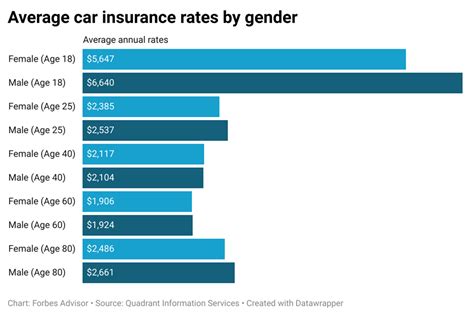

- Driver’s Profile: Insurance companies assess the risk associated with each driver based on their age, gender, driving record, and years of driving experience. Young drivers, especially males, generally pay higher premiums due to their higher risk of accidents. A clean driving record with no accidents or traffic violations can lead to lower insurance rates.

- Location and Usage: The geographic location where the vehicle is primarily driven and parked can impact insurance costs. Urban areas with higher population densities and increased risk of accidents or theft may result in higher premiums. Additionally, the purpose of vehicle usage, such as personal or commercial, can influence insurance rates.

- Coverage Types and Limits: The type and extent of coverage chosen significantly affect the cost of auto insurance. Higher liability limits, comprehensive coverage, and additional features like rental car reimbursement or roadside assistance can increase premiums. It’s essential to strike a balance between coverage and affordability.

- Discounts and Bundling: Many insurance companies offer discounts to policyholders who maintain a good driving record, have multiple vehicles insured with the same company, or bundle their auto insurance with other policies like homeowners or renters insurance.

Assessing Your Coverage Needs

Determining the right amount of auto insurance coverage involves a careful assessment of your specific needs and circumstances. Here are some key considerations:

- Liability Coverage: This is a critical aspect of auto insurance, as it protects you against claims made by others for bodily injury or property damage caused by your vehicle. State laws typically set minimum liability coverage requirements, but it’s advisable to consider purchasing higher limits to ensure adequate protection. Keep in mind that liability coverage does not cover damages to your own vehicle.

- Comprehensive and Collision Coverage: These coverages are optional but highly recommended, especially for newer or financed vehicles. Comprehensive coverage protects against non-collision incidents, while collision coverage covers damages resulting from collisions with other vehicles or objects. The cost of these coverages can vary based on the value and age of your vehicle. Consider your vehicle’s replacement or repair costs when determining the appropriate coverage limits.

- Personal Injury Protection (PIP) and Medical Payments Coverage: These coverages provide financial assistance for medical expenses and lost wages resulting from an accident, regardless of fault. PIP and medical payments coverage can be particularly beneficial if you or your passengers sustain injuries in an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who has little or no insurance. It ensures you have financial protection even if the at-fault driver is unable to compensate you for damages.

- Additional Coverages: Depending on your needs, you may opt for other coverages such as rental car reimbursement, roadside assistance, or gap insurance. These additional coverages can provide extra peace of mind but may increase your overall insurance costs.

Tips for Obtaining the Right Coverage at an Affordable Price

To ensure you have the right amount of auto insurance coverage without breaking the bank, consider the following strategies:

- Compare Quotes: Obtain quotes from multiple insurance providers to compare coverage options and prices. Online comparison tools and insurance brokers can assist in this process. Make sure to compare policies with similar coverage limits and deductibles for an accurate comparison.

- Understand Your Risk Profile: Assess your driving record, years of driving experience, and the overall risk associated with your vehicle. If you have a clean driving record and a safe vehicle, you may be eligible for lower insurance rates. On the other hand, if you have a history of accidents or traffic violations, you may need to consider higher liability limits to protect your assets.

- Review Coverage Regularly: Your insurance needs may change over time. Regularly review your coverage limits and deductibles to ensure they align with your current circumstances. Consider adjusting your coverage if your vehicle’s value has decreased or if your driving habits have changed significantly.

- Consider Higher Deductibles: Opting for higher deductibles can lower your insurance premiums. However, ensure that you can afford the deductible in the event of a claim. Higher deductibles may be a cost-effective strategy for responsible drivers with a low risk of accidents.

- Take Advantage of Discounts: Explore insurance company discounts based on your driving record, vehicle safety features, good student status, or other factors. Some insurance providers offer discounts for bundling multiple policies or for completing defensive driving courses.

- Shop Around: Don’t settle for the first insurance quote you receive. Compare rates and coverage options from different providers to find the best value for your specific needs. Insurance companies often have different risk assessment models and pricing structures, so shopping around can yield significant savings.

Real-World Example: Analyzing Auto Insurance Costs

Let’s consider a real-world scenario to illustrate the process of determining auto insurance coverage and costs. Imagine a 30-year-old professional, Jane, who owns a 2018 Toyota Camry and drives approximately 15,000 miles per year in an urban area. She has a clean driving record with no accidents or traffic violations.

| Coverage Type | Limit | Premium (Annual) |

|---|---|---|

| Liability Coverage | $100,000 per person / $300,000 per accident | $500 |

| Comprehensive Coverage | $1,000 deductible | $350 |

| Collision Coverage | $1,000 deductible | $450 |

| Uninsured Motorist Coverage | $100,000 per person / $300,000 per accident | $150 |

| Medical Payments Coverage | $5,000 | $100 |

| Rental Car Reimbursement | Up to $30/day for 30 days | $50 |

| Total Annual Premium | N/A | $1,600 |

Future Implications and Industry Trends

The auto insurance industry is continually evolving, and several factors are expected to influence coverage and costs in the coming years:

- Advancements in Vehicle Technology: The integration of advanced driver-assistance systems (ADAS) and autonomous driving features in modern vehicles is expected to reduce accident rates and impact insurance costs. However, the initial cost of insuring such vehicles may be higher due to the expense of repairing or replacing these advanced technologies.

- Usage-Based Insurance (UBI): Insurance companies are increasingly offering UBI programs that use telematics devices to monitor driving behavior and offer personalized insurance rates. UBI can reward safe drivers with lower premiums, encouraging safer driving practices and potentially reducing overall insurance costs.

- Increasing Frequency of Natural Disasters: With the growing impact of climate change, the frequency and severity of natural disasters like hurricanes, floods, and wildfires are expected to rise. This could lead to increased insurance claims for comprehensive coverage, potentially impacting insurance rates in vulnerable areas.

- Ride-Sharing and Autonomous Vehicles: The rise of ride-sharing services and the eventual widespread adoption of autonomous vehicles could transform the auto insurance landscape. Insurance companies will need to adapt their coverage models to accommodate these new modes of transportation and assess the associated risks.

- Data Analytics and Machine Learning: Insurance companies are leveraging advanced data analytics and machine learning algorithms to more accurately assess risk and personalize insurance offerings. This can lead to more precise pricing and coverage recommendations, benefiting both insurance providers and policyholders.

FAQ

What is the minimum auto insurance coverage required by law in my state?

+The minimum auto insurance coverage required by law varies from state to state. You can typically find this information on your state’s Department of Motor Vehicles (DMV) website or by contacting your local DMV office. It’s essential to comply with these minimum requirements to ensure legal compliance.

How can I lower my auto insurance premiums without compromising coverage?

+There are several strategies to lower your auto insurance premiums while maintaining adequate coverage. These include comparing quotes from multiple providers, considering higher deductibles, taking advantage of discounts, and reviewing your coverage regularly to ensure it aligns with your needs.

Are there any additional coverages I should consider for my specific circumstances?

+Additional coverages may be beneficial depending on your individual circumstances. For example, if you frequently travel with valuable items in your vehicle, you may want to consider adding personal property coverage. If you live in an area prone to natural disasters, flood insurance could be a wise investment. It’s always advisable to discuss your specific needs with an insurance professional.

In conclusion, determining the right amount of auto insurance coverage involves a careful assessment of your needs, circumstances, and budget. By understanding the factors that influence insurance costs and exploring various coverage options, you can ensure you have adequate protection without overspending. Regularly reviewing your coverage and staying informed about industry trends will help you make informed decisions about your auto insurance.