How Much Car Insurance Cost

Understanding car insurance costs is crucial for any vehicle owner. This comprehensive guide aims to demystify the factors that influence insurance premiums and provide insights into the average costs, helping you make informed decisions about your coverage.

The Cost of Car Insurance: A Comprehensive Breakdown

Car insurance is a necessary expense for vehicle owners, but the cost can vary significantly based on numerous factors. In this section, we delve into the key elements that impact insurance premiums, offering a transparent view of the expenses you might encounter.

Understanding Premium Calculations

Insurance companies employ intricate methodologies to determine the cost of premiums. These calculations are influenced by a range of variables, including your:

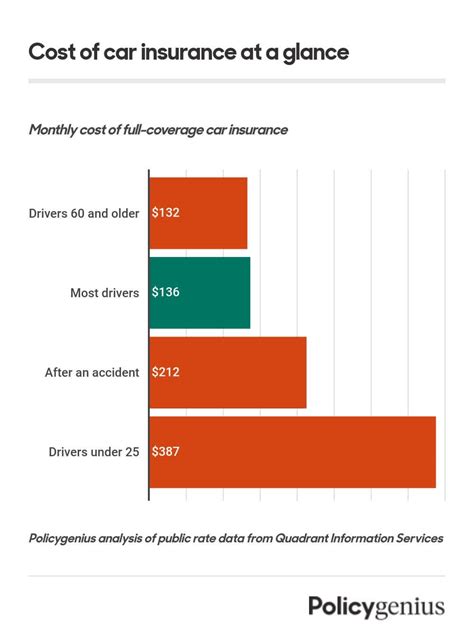

- Age and Gender: Younger drivers, particularly males, often face higher premiums due to statistical risk factors.

- Driving History: A clean record can lead to lower rates, while violations and accidents can increase costs.

- Vehicle Type: The make, model, and year of your car can affect insurance costs, with luxury or sports cars often incurring higher premiums.

- Location: The area where you live and drive plays a role, with urban areas and high-crime regions typically commanding higher rates.

- Coverage Level: The extent of your desired coverage will directly impact your premium. Comprehensive and collision coverage, for instance, can be more expensive than liability-only plans.

Average Costs and Variations

The average cost of car insurance in the United States can vary significantly based on these factors. According to industry data, the average annual premium for a standard policy in 2022 was approximately $1,674. However, this is just an average, and your personal circumstances can lead to higher or lower costs.

| Coverage Type | Average Annual Premium |

|---|---|

| Liability-Only | $500 - $1,500 |

| Comprehensive | $1,200 - $2,000 |

| Collision | $1,000 - $1,800 |

It's important to note that these averages are just a guideline, and your actual costs may differ. Factors like your state, city, and personal driving history can significantly influence your premium.

Factors Affecting Insurance Costs

Beyond the basic factors mentioned earlier, several other elements can influence your car insurance premiums. These include:

- Credit Score: Surprisingly, your credit history can impact your insurance rates. Many insurers consider credit scores when calculating premiums, with higher scores often leading to lower costs.

- Marital Status: Married individuals tend to have lower insurance rates, as they are often viewed as more responsible drivers.

- Education Level: Some insurers offer discounts to individuals with higher education degrees, believing they are more responsible and safer drivers.

- Discounts and Bundles: Taking advantage of discounts and bundling multiple policies (like home and auto) can significantly reduce your overall insurance costs.

Tips for Reducing Car Insurance Costs

If you’re looking to minimize your car insurance expenses, here are some strategies to consider:

- Shop around and compare quotes from multiple insurers. Rates can vary significantly between companies.

- Raise your deductible. A higher deductible can lead to lower premiums, but ensure you can afford the increased out-of-pocket expense.

- Maintain a clean driving record. Avoid violations and accidents to keep your premiums as low as possible.

- Explore discounts. Many insurers offer discounts for safe driving, loyalty, or even membership in certain organizations.

- Consider bundling. Insuring multiple vehicles or combining auto and home insurance policies can often lead to substantial savings.

The Future of Car Insurance Costs

As the automotive industry evolves, so too will the landscape of car insurance. Emerging technologies like autonomous driving and advanced safety features are likely to impact insurance costs in the coming years. While these innovations may reduce the frequency of accidents, they could also lead to increased repair costs, potentially impacting insurance premiums.

Additionally, the rise of usage-based insurance (UBI) programs, which track driving behavior and reward safe driving with lower premiums, is expected to gain traction. This could provide a more personalized insurance experience, offering benefits to safe drivers while potentially increasing costs for riskier ones.

How often should I review my car insurance policy and costs?

+It's recommended to review your policy and costs annually, especially if your circumstances have changed. This includes updates to your driving record, vehicle, or personal situation.

Are there any ways to get car insurance without a credit check?

+Some insurers offer policies that do not consider credit scores. However, these policies may be more expensive or have limited coverage options.

What is the average cost of car insurance for a teenager?

+Teenagers often face the highest insurance premiums due to their age and lack of driving experience. The average cost for a teenage driver can range from $600 to $1,500 per month, depending on various factors.

Understanding the factors that influence car insurance costs is the first step toward making informed decisions about your coverage. By staying informed and taking advantage of available discounts and strategies, you can ensure you’re getting the best value for your insurance dollar.