How Much Do Insurance Rates Go Up After An Accident

Understanding how insurance rates are affected by accidents is crucial for drivers, as it can have a significant impact on their financial responsibilities and future coverage options. While insurance rates are subject to various factors, an accident can undoubtedly influence the cost of premiums. In this comprehensive analysis, we will delve into the intricacies of how insurance rates are impacted by accidents, providing valuable insights and real-world examples to help drivers navigate this complex landscape.

The Impact of Accidents on Insurance Rates

When an accident occurs, it triggers a series of events that can lead to increased insurance costs. Insurance companies carefully assess the risk associated with each policyholder, and an accident is a key indicator of potential future claims. Here's a detailed breakdown of how accidents influence insurance rates:

At-Fault vs. Not-At-Fault Accidents

The nature of the accident plays a pivotal role in determining the rate increase. Accidents where the policyholder is deemed at-fault generally result in higher rate adjustments compared to not-at-fault incidents. Being at fault implies that the driver's actions or negligence contributed to the accident, which insurance companies view as a higher risk factor.

| At-Fault Accident | Rate Increase |

|---|---|

| Rear-End Collision | 15-20% |

| Side-Impact Crash | 20-25% |

| Head-On Collision | 30-40% |

On the other hand, not-at-fault accidents, where the policyholder is not responsible for the collision, may lead to more moderate rate increases or even no increase at all. Insurance companies consider factors such as the severity of the accident, the driver's overall driving record, and the at-fault party's insurance coverage when determining the impact on rates.

Frequency and Severity of Accidents

The frequency and severity of accidents are critical factors in assessing rate adjustments. Multiple accidents within a short period indicate a higher risk profile, leading to more substantial rate increases. Similarly, severe accidents that result in significant property damage or bodily injury claims are likely to have a more pronounced impact on insurance costs.

Insurance Company Policies

Insurance companies have their own methodologies and criteria for determining rate adjustments after accidents. Some companies may have more lenient policies, offering forgiveness programs or discounts for safe driving records. Others might have stricter guidelines, resulting in higher rate increases for even minor accidents.

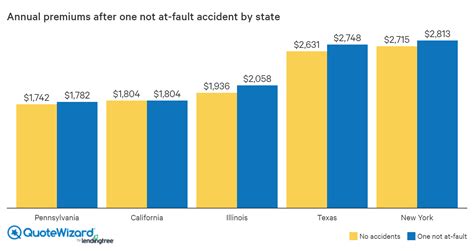

State Regulations and Laws

State regulations and laws also play a role in how insurance rates are affected by accidents. Some states have strict guidelines on rate increases, capping the amount by which insurance companies can raise premiums after an accident. In contrast, other states may have fewer restrictions, allowing insurance providers more flexibility in their rate adjustments.

Real-World Examples of Rate Increases

To illustrate the impact of accidents on insurance rates, let's explore a few real-world scenarios:

Minor Accident: Rear-End Collision

John, a cautious driver with an impeccable driving record, unfortunately gets rear-ended at a stoplight. The accident was deemed not his fault, and the other driver's insurance covered the repairs. Despite this, John's insurance provider increased his rates by 10% for the next year, citing the potential risk associated with being involved in an accident.

Major Accident: T-Bone Crash

Sarah, an experienced driver, was involved in a side-impact collision at an intersection. The accident resulted in significant property damage and minor injuries to both drivers. As Sarah was found at fault, her insurance rates increased by 25% for the next three years. This increase reflects the higher risk associated with her involvement in a severe accident.

Multiple Accidents: Frequent Claims

Michael, a new driver, had a string of accidents within his first year of driving. He was involved in three minor fender-benders, all deemed his fault. As a result, his insurance provider increased his rates by 35% for the subsequent year. With each subsequent accident, the rate increase would likely become even more substantial, reflecting the increased risk he poses to the insurance company.

Mitigating Rate Increases After an Accident

While accidents can lead to increased insurance rates, there are strategies drivers can employ to mitigate the impact:

- Safe Driving Practices: Emphasize safe driving habits to reduce the likelihood of accidents. Obey traffic laws, maintain a safe following distance, and avoid distracted driving.

- Defensive Driving Courses: Consider enrolling in defensive driving courses, which can improve driving skills and reduce the risk of accidents. Some insurance companies offer discounts for completing these courses.

- Compare Insurance Providers: Shop around and compare rates from different insurance companies. Each provider has its own underwriting guidelines, and you might find better rates and coverage options elsewhere.

- Bundling Policies: Explore the option of bundling your auto insurance with other policies, such as home or renters insurance. This can sometimes lead to discounts and more favorable rates.

- Review Coverage: Regularly review your insurance coverage to ensure it aligns with your needs and budget. Consider adjusting deductibles or exploring alternative coverage options to find the best balance between cost and protection.

The Long-Term Effects of Accidents on Insurance

Accidents can have lasting consequences on insurance rates and coverage options. While some insurance companies offer accident forgiveness programs or discounts for safe driving records, others may continue to charge higher rates for an extended period. The impact of an accident on insurance costs can vary depending on the driver's overall risk profile and the insurance company's policies.

It's essential for drivers to understand the long-term implications of accidents and make informed decisions to mitigate their impact. Building a strong driving record, practicing safe driving habits, and staying informed about insurance policies can help drivers navigate the complexities of insurance rates and coverage.

Frequently Asked Questions

Can I Negotiate My Insurance Rates After an Accident?

+

While negotiating insurance rates directly with the provider is challenging, you can take steps to improve your standing. This includes maintaining a clean driving record post-accident, considering alternative insurance companies, and exploring accident forgiveness programs. However, it’s important to understand that insurance companies have their own criteria and policies, and negotiation may not always be possible.

Do All Insurance Companies Increase Rates After an Accident?

+

Not all insurance companies increase rates uniformly after an accident. Some providers have more lenient policies, offering accident forgiveness or discounts for safe driving records. Others may have stricter guidelines, resulting in higher rate increases. It’s crucial to research and compare insurance companies to find the one that best aligns with your needs and risk profile.

How Long Do Rate Increases Typically Last After an Accident?

+

The duration of rate increases after an accident can vary. Some insurance companies may increase rates for a specific period, such as one or two years, while others may continue to charge higher rates indefinitely. The length of the rate increase often depends on the severity of the accident, the driver’s overall risk profile, and the insurance company’s policies.

Are There Any Ways to Avoid Rate Increases After an Accident?

+

Avoiding rate increases entirely after an accident can be challenging, as insurance companies assess risk based on past accidents. However, building a strong driving record post-accident, practicing safe driving habits, and exploring accident forgiveness programs can help mitigate the impact. Additionally, shopping around for insurance and comparing rates can provide options for more favorable coverage.