How Much Does Dental Insurance Cover

Dental insurance is an essential aspect of healthcare coverage, providing individuals and families with financial protection for various dental treatments and procedures. The coverage offered by dental insurance plans can vary significantly, and understanding the extent of your coverage is crucial to making informed decisions about your oral health. In this comprehensive article, we delve into the world of dental insurance, exploring the factors that influence coverage, the typical procedures and treatments covered, and the benefits and limitations of these plans. We aim to provide you with a detailed understanding of how much dental insurance covers and empower you to navigate the complexities of dental care with confidence.

Understanding Dental Insurance Coverage

Dental insurance plans are designed to help individuals manage the costs associated with dental care, which can range from routine check-ups and cleanings to more complex procedures like root canals and dental implants. The coverage provided by these plans typically falls into three main categories: preventive care, basic procedures, and major treatments.

Preventive Care

Preventive dental care focuses on maintaining optimal oral health and preventing potential issues from developing into more serious problems. Most dental insurance plans cover preventive services at a higher percentage or even 100% after the deductible is met. These services often include:

- Dental Cleanings: Professional teeth cleanings are typically covered twice a year, helping to remove plaque and tartar buildup and maintain healthy gums.

- Dental Exams: Regular dental exams are essential for detecting early signs of tooth decay, gum disease, and other oral health issues. Many plans cover these exams annually or bi-annually.

- X-rays: Dental X-rays, such as bitewing and panoramic X-rays, are crucial for diagnosing hidden issues like cavities or impacted teeth. Coverage for X-rays may vary depending on the plan.

- Fluoride Treatments: Fluoride applications, especially for children, help strengthen teeth and prevent cavities. Some plans include this as a covered preventive service.

- Sealants: Dental sealants, often applied to children’s molars, act as a barrier against bacteria and food particles, reducing the risk of cavities. Certain insurance plans cover this preventive measure.

By covering these preventive services, dental insurance aims to promote good oral hygiene and catch potential problems early on, ultimately reducing the need for more extensive and costly treatments down the line.

Basic Procedures

Basic dental procedures address common issues such as tooth decay and gum disease. The coverage for these procedures can vary, but they often include:

- Fillings: Dental fillings are used to restore teeth affected by cavities. The coverage for fillings depends on the type of material used, with composite fillings (tooth-colored) often costing more than amalgam (silver) fillings.

- Root Planing and Scaling: This deep cleaning procedure is essential for treating gum disease. While some plans may cover it as a basic procedure, others might categorize it as a major treatment, affecting the out-of-pocket costs.

- Extraction: Simple tooth extractions are typically covered, but more complex procedures like surgical extractions may be considered major treatments.

- Periodontal Treatment: Basic periodontal treatments, such as scaling and root planing, are often included in the basic coverage category. However, more advanced gum treatments might be classified as major procedures.

Major Treatments

Major dental treatments address more complex issues and often require specialized care. These procedures are typically covered at a lower percentage or have higher out-of-pocket costs. Major treatments may include:

- Crowns: Dental crowns are used to restore and strengthen damaged teeth. The coverage for crowns can vary based on the material used and the complexity of the case.

- Bridges: Dental bridges are prosthetic devices used to replace one or more missing teeth. The coverage for bridges depends on the number of teeth replaced and the type of bridge used.

- Implants: Dental implants are a long-term solution for missing teeth, providing a stable and natural-looking replacement. Implants are often considered major treatments and may have significant out-of-pocket expenses.

- Root Canal Therapy: Root canals are necessary when the pulp of a tooth becomes infected or damaged. The coverage for root canals can vary based on the tooth’s location and the complexity of the procedure.

- Orthodontic Treatment: Traditional braces and clear aligners for adults are often classified as major treatments and may have limited coverage or high co-pays.

Factors Influencing Dental Insurance Coverage

The level of coverage provided by dental insurance plans can be influenced by several factors, including the type of plan, the insurance provider, and the specific policy chosen. Here are some key considerations:

Plan Types

Dental insurance plans can be broadly categorized into three types: Indemnity Plans, Preferred Provider Organization (PPO) Plans, and Health Maintenance Organization (HMO) Plans. Each plan type has its own coverage parameters:

- Indemnity Plans: These plans offer the most flexibility, allowing you to choose any dentist and covering a percentage of the fees, typically 50% to 80% for basic and major treatments. However, you may be responsible for paying the full cost up to an annual maximum.

- PPO Plans: PPO plans provide a network of preferred dentists, and using an in-network dentist typically results in lower out-of-pocket costs. The coverage percentage and annual maximums may vary based on the plan.

- HMO Plans: HMO plans often have a more limited network of dentists, and you may need a referral from your primary care dentist to access certain specialists. These plans typically have lower premiums but may have higher out-of-pocket costs for procedures.

Insurance Provider

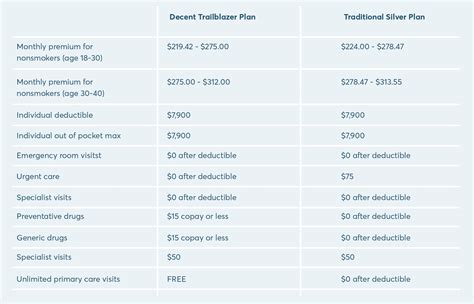

Different insurance companies may offer varying levels of coverage for dental procedures. It’s essential to research and compare plans from multiple providers to find the one that best suits your needs. Factors to consider include the network of dentists, the annual maximum coverage, and the specific procedures covered.

Policy Details

Within each plan type, there can be significant variations in coverage. When selecting a dental insurance policy, carefully review the following aspects:

- Annual Maximum: This is the maximum amount the insurance plan will cover in a year. Once you reach this limit, you’ll be responsible for paying the full cost of any additional treatments.

- Deductible: The deductible is the amount you must pay out of pocket before the insurance coverage kicks in. Some plans have no deductible, while others may require a substantial payment upfront.

- Co-insurance or Co-payment: Co-insurance refers to the percentage of the treatment cost you must pay after meeting the deductible. Co-payment is a fixed amount you pay for each service, with the insurance covering the rest. Both of these factors can impact your out-of-pocket expenses.

- Waiting Periods: Some plans may have waiting periods for specific treatments, especially for major procedures. During this period, you may have limited or no coverage for certain services.

- Pre-authorization: Certain procedures may require pre-authorization from the insurance company. This process ensures that the treatment is medically necessary and covered by your plan.

Maximizing Your Dental Insurance Benefits

To make the most of your dental insurance coverage, consider the following strategies:

Choose an In-Network Dentist

If you have a PPO or HMO plan, selecting an in-network dentist can significantly reduce your out-of-pocket costs. These dentists have agreed to accept the insurance company’s fees as payment in full, which often results in lower fees for you.

Understand Your Policy

Take the time to carefully review your dental insurance policy. Familiarize yourself with the covered procedures, annual maximums, deductibles, and any limitations or exclusions. This knowledge will help you make informed decisions about your dental care and avoid unexpected expenses.

Utilize Preventive Care

Make the most of your preventive care coverage by scheduling regular dental check-ups and cleanings. Preventive care not only helps maintain good oral health but also allows your dentist to detect potential issues early on, potentially saving you from more costly treatments in the future.

Plan Procedures Strategically

If you require multiple treatments, consider planning your dental work strategically. For instance, if you need both a filling and a crown, you may be able to save money by having the filling done first and then waiting until the new year to have the crown placed, allowing you to utilize a fresh annual maximum.

Consider Alternative Treatments

Some dental procedures may have alternative, less costly options. For example, dental bonding can sometimes be used as an alternative to veneers, and certain tooth-colored fillings may be more affordable than traditional amalgam fillings. Discuss these options with your dentist to find the most cost-effective solution.

Explore Additional Coverage

If you anticipate needing extensive dental work, you may want to explore additional coverage options. Some plans offer supplemental insurance or riders that provide more comprehensive coverage for specific treatments. These add-ons can help reduce your out-of-pocket expenses for major procedures.

Conclusion: Making Informed Choices

Understanding the coverage provided by your dental insurance plan is crucial for making informed decisions about your oral health. By recognizing the factors that influence coverage and adopting strategies to maximize your benefits, you can navigate the complexities of dental care with confidence. Remember, preventive care is key to maintaining good oral health and potentially avoiding more costly treatments down the line. With the right knowledge and approach, you can make the most of your dental insurance coverage and achieve a healthy, radiant smile.

What is the typical annual maximum coverage for dental insurance plans?

+Annual maximum coverage for dental insurance plans can vary significantly, typically ranging from 1,000 to 2,000 per year. However, some plans may offer higher maximums, especially for major procedures.

Are there any procedures not covered by dental insurance plans?

+Yes, certain procedures may not be covered by dental insurance plans. These can include cosmetic dentistry (such as teeth whitening), orthodontic treatments for adults, and elective procedures like dental implants for purely aesthetic purposes. It’s important to review your policy to understand the exclusions.

How can I reduce my out-of-pocket expenses for major dental treatments?

+To reduce out-of-pocket expenses for major treatments, consider choosing an in-network dentist, planning procedures strategically within your plan’s coverage year, and exploring supplemental insurance options or flexible spending accounts (FSAs) to help cover costs.