How Much Does Motorcycle Insurance Cost

Understanding the cost of motorcycle insurance is crucial for every rider, as it directly impacts their financial planning and overall riding experience. The price of motorcycle insurance can vary significantly depending on a range of factors, and it's essential to delve into these details to make an informed decision. In this comprehensive guide, we'll explore the various elements that influence insurance rates and provide real-world examples to help you navigate this essential aspect of motorcycle ownership.

Factors Influencing Motorcycle Insurance Costs

The cost of motorcycle insurance is influenced by a combination of personal and vehicle-related factors. Here’s a breakdown of the key considerations:

Rider’s Profile

- Age and Riding Experience: Younger riders, especially those under 25, often face higher insurance premiums due to their perceived risk. However, as riding experience accumulates, insurance rates may decrease.

- Riding History: A clean riding record, free of accidents and traffic violations, can lead to lower insurance costs. Conversely, a history of accidents or traffic infractions may result in higher premiums.

- Type of Riding: Insurers may consider the purpose of your riding, such as whether it’s for leisure, commuting, or participating in races. Different riding types can influence insurance rates.

Vehicle Characteristics

- Make and Model: The make and model of your motorcycle play a significant role. High-performance bikes or those with a history of theft may incur higher insurance costs.

- Engine Size: Insurance premiums can increase with larger engine sizes, as they are often associated with higher speeds and a greater risk of accidents.

- Safety Features: Motorcycles equipped with advanced safety features, such as ABS (Anti-lock Braking System) or traction control, may qualify for lower insurance rates.

Geographical Location

The area where you reside and ride can impact insurance costs. Factors such as local crime rates, traffic density, and weather conditions can influence insurance rates.

Coverage Types and Limits

The type and extent of coverage you choose will directly affect your insurance costs. Common coverage types include liability, collision, comprehensive, and personal injury protection (PIP). The higher the coverage limits you select, the more expensive your insurance will likely be.

Real-World Insurance Cost Examples

To provide a clearer picture, let’s look at some actual insurance quotes for different motorcycles and riders:

Example 1: Sport Bike Rider

Consider a 30-year-old rider with a clean driving record who owns a Kawasaki Ninja ZX-6R. In this scenario, the annual insurance premium could range from 500 to 800, depending on the coverage chosen and the rider’s location.

Example 2: Cruiser Motorcycle Owner

A 45-year-old rider with a Harley-Davidson Heritage Softail might pay an annual premium of approximately 400 to 600. The lower cost compared to the sport bike is influenced by the cruiser’s generally lower performance and perceived risk.

Example 3: Adventure Motorcycle Enthusiast

For a rider with an adventure bike like the BMW R1250GS, insurance costs can vary between 600 and 900 annually. The higher cost reflects the bike’s higher performance and the potential for off-road riding, which may carry additional risks.

Tips to Reduce Insurance Costs

While insurance rates are influenced by various factors, there are strategies to potentially reduce costs:

- Shop Around: Compare quotes from multiple insurers to find the best rates for your specific circumstances.

- Consider Bundling: Insuring your motorcycle with the same company that covers your car or home can often lead to discounts.

- Increase Deductibles: Opting for a higher deductible can lower your insurance premiums, but ensure you have the financial capacity to cover the deductible in the event of a claim.

- Take Advantage of Discounts: Many insurers offer discounts for various reasons, such as completing a motorcycle safety course, having anti-theft devices installed, or maintaining a clean driving record.

The Impact of Coverage Limits

The level of coverage you choose has a direct impact on your insurance costs. Let’s explore this further with a table comparing insurance costs at different coverage limits for a hypothetical rider:

| Coverage Level | Liability | Collision | Comprehensive | Annual Premium |

|---|---|---|---|---|

| Basic | $25,000 | $5,000 | $5,000 | $550 |

| Standard | $50,000 | $10,000 | $10,000 | $700 |

| Enhanced | $100,000 | $20,000 | $20,000 | $950 |

Understanding Deductibles

A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Higher deductibles can lead to lower insurance premiums, but it’s crucial to consider your financial preparedness in the event of an accident or incident.

Example of Deductible Impact

For instance, if you have a 500 deductible and get into an accident with repair costs totaling 3,000, you’ll be responsible for paying the first 500, and your insurance will cover the remaining 2,500. Choosing a higher deductible, say $1,000, would reduce your insurance premium but would also mean you’d have to pay a larger amount out of pocket in the event of a claim.

Conclusion

The cost of motorcycle insurance is a multifaceted consideration that involves various factors. By understanding these elements and exploring different coverage options, you can make an informed decision that balances your financial needs with the necessary protection for your motorcycle. Remember, shopping around and taking advantage of discounts can also help reduce insurance costs.

How do insurance rates vary by state or region?

+Insurance rates can differ significantly between states or regions due to variations in factors such as traffic density, weather conditions, and crime rates. For instance, states with higher rates of motorcycle theft or accidents may have higher insurance premiums.

Can I get a discount for completing a motorcycle safety course?

+Many insurance companies offer discounts for riders who complete approved motorcycle safety courses. These courses can enhance your riding skills and safety awareness, which may lead to lower insurance premiums.

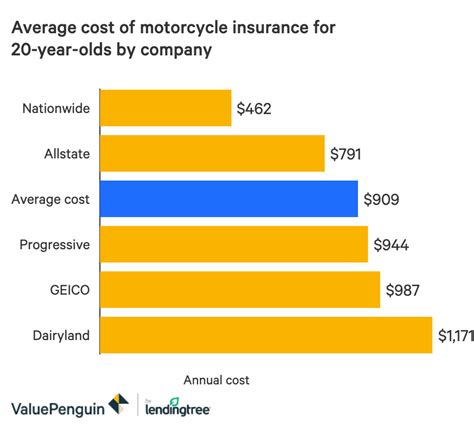

What is the average cost of motorcycle insurance annually?

+The average annual cost of motorcycle insurance can range from 300 to 1,000 or more. The actual cost depends on various factors, including the rider’s profile, the motorcycle’s characteristics, and the chosen coverage limits.