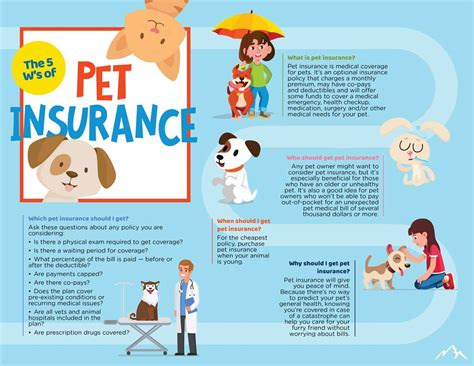

How Much Does Pet Insurance Cover

Pet insurance has become an increasingly popular way for pet owners to manage the potential costs of veterinary care. With the rising expenses of medical treatments and procedures, many pet parents are turning to insurance policies to provide financial security and peace of mind. This article delves into the world of pet insurance, exploring what it covers, the different types of policies available, and the factors that influence the coverage and costs.

Understanding Pet Insurance Coverage

Pet insurance policies vary widely in their coverage and benefits. It is essential to carefully review the terms and conditions of any policy you are considering to ensure it aligns with your pet's specific needs and your financial expectations. Here's an overview of what pet insurance typically covers:

Medical Expenses

The primary purpose of pet insurance is to cover the costs of veterinary care. This includes routine check-ups, vaccinations, and emergency treatments. Most policies provide coverage for accidents, illnesses, and injuries, helping pet owners manage unexpected medical expenses.

For example, if your dog requires emergency surgery due to a sudden illness, a comprehensive pet insurance policy can help cover the costs, potentially saving you thousands of dollars. Common medical conditions covered include gastrointestinal issues, skin allergies, and even more severe ailments like cancer.

| Coverage Type | Example Conditions |

|---|---|

| Accident Coverage | Fractures, Sprains, Bites |

| Illness Coverage | Diabetes, Kidney Disease, Respiratory Issues |

| Injury Coverage | Trauma, Lacerations, Burns |

Wellness and Preventative Care

Many pet insurance policies also offer coverage for wellness and preventative care. This can include routine procedures like spaying or neutering, dental cleanings, and flea and tick prevention. Some policies even cover annual exams and blood work, helping you stay on top of your pet's health.

For instance, a wellness plan might include coverage for regular heartworm tests, helping you detect and treat this potentially fatal condition early on.

Prescription Medications

Prescription medications are often an essential part of treating illnesses and managing chronic conditions. Pet insurance policies typically cover the cost of these medications, providing relief from the financial burden of long-term treatments.

If your cat requires daily medication for a thyroid condition, pet insurance can help ensure you can afford the necessary drugs without straining your budget.

Alternative Therapies

Some pet insurance policies are progressive and now include coverage for alternative therapies like acupuncture, chiropractic care, and hydrotherapy. These treatments can provide additional options for managing pain and promoting healing, especially for older pets.

Emergency Services

Pet insurance policies often cover emergency services, ensuring you have access to immediate veterinary care when your pet requires it most. This can include 24/7 access to veterinary professionals and coverage for out-of-hours emergency visits.

Types of Pet Insurance Policies

There are several types of pet insurance policies, each with its own unique features and benefits. Understanding the different options available can help you choose the best policy for your pet's needs and your budget.

Accident-Only Policies

Accident-only policies, as the name suggests, provide coverage solely for accidents. These policies are typically more affordable than comprehensive plans but offer limited protection. They are ideal for pet owners who want basic coverage for unexpected incidents but may not need coverage for illnesses.

Comprehensive Plans

Comprehensive pet insurance plans are the most extensive type of policy. They cover a wide range of medical conditions, including accidents, illnesses, and injuries. These plans often include wellness and preventative care coverage, providing a comprehensive solution for your pet's healthcare needs.

Lifetime Policies

Lifetime pet insurance policies are designed to provide coverage for the duration of your pet's life. These policies typically offer the highest level of protection and are ideal for pet owners who want long-term peace of mind. Lifetime policies often have higher premiums but can be worth the investment for pets with ongoing health issues.

Maximum Benefit Policies

Maximum benefit policies have a set limit on the amount of coverage they provide per condition or per year. Once this limit is reached, the policy will no longer provide coverage for that specific condition. These policies can be a more affordable option but may not provide the same level of protection as lifetime or comprehensive plans.

Factors Influencing Pet Insurance Coverage and Costs

The coverage and costs of pet insurance policies can vary significantly based on several factors. Understanding these factors can help you make an informed decision when choosing a policy.

Age and Breed

The age and breed of your pet play a significant role in determining the cost and coverage of your insurance policy. Younger pets are often considered lower risk and may have more affordable premiums. Certain breeds, particularly those with known genetic predispositions to specific health issues, may face higher premiums or even exclusions.

Pre-Existing Conditions

Pet insurance policies typically do not cover pre-existing conditions. A pre-existing condition is any illness, injury, or symptom that your pet has exhibited prior to enrolling in a policy. It's important to carefully review the policy's terms to understand how pre-existing conditions are defined and handled.

Deductibles and Co-Pays

Similar to human health insurance, pet insurance policies often have deductibles and co-pays. A deductible is the amount you must pay out of pocket before the insurance coverage kicks in. Co-pays are the portion of the bill you are responsible for paying after the deductible has been met. Understanding these costs can help you budget effectively.

Coverage Limits

Pet insurance policies may have annual or lifetime coverage limits. Once these limits are reached, the policy will no longer provide coverage for additional expenses. It's essential to review these limits and ensure they align with your expectations and potential healthcare needs.

Optional Add-Ons

Many pet insurance providers offer optional add-ons or riders that can enhance your policy's coverage. These add-ons may include coverage for specific conditions, such as cancer or hip dysplasia, or additional benefits like coverage for boarding fees during hospitalization.

The Benefits of Pet Insurance

Pet insurance offers numerous benefits beyond financial protection. It provides peace of mind, knowing that you can provide your pet with the best possible care without worrying about the cost. Here are some key advantages of pet insurance:

Early Detection and Prevention

With pet insurance, you are more likely to bring your pet in for regular check-ups and preventative care. This early detection can lead to better health outcomes and potentially prevent more severe and costly issues down the line.

Access to Advanced Treatments

Pet insurance can give you the financial flexibility to pursue advanced treatments and procedures that might not be affordable otherwise. This includes specialized surgeries, chemotherapy for cancer, or even experimental therapies.

Improved Quality of Life

Pet insurance allows you to focus on your pet's well-being without the stress of financial burden. This can lead to improved quality of life for both you and your pet, ensuring your furry friend receives the care they need to live a happy and healthy life.

The Future of Pet Insurance

The pet insurance industry is evolving rapidly, with new technologies and trends shaping the way policies are designed and delivered. Here's a glimpse into the future of pet insurance:

Telemedicine and Remote Care

The rise of telemedicine is transforming the way veterinary care is delivered. Pet insurance policies are beginning to incorporate telemedicine benefits, allowing pet owners to access remote consultations and diagnoses. This can be particularly beneficial for rural areas or situations where in-person visits are challenging.

Genetic Testing and Precision Medicine

As genetic testing becomes more accessible and affordable, pet insurance providers are exploring ways to integrate this technology into their policies. Genetic testing can help identify potential health risks and guide preventative care, potentially reducing the need for expensive treatments down the line.

Digital Health Tools

Digital health tools, such as fitness trackers and smart collars, are becoming increasingly popular for pets. These devices can provide valuable data on your pet's health and behavior, helping to identify potential issues early on. Pet insurance companies are beginning to offer incentives and discounts for pet owners who utilize these technologies.

Alternative Payment Options

Pet insurance providers are exploring alternative payment models, such as subscription-based plans and pet healthcare savings accounts. These options can provide greater flexibility and affordability for pet owners, making insurance more accessible.

Data-Driven Personalization

With the increasing availability of pet health data, insurance providers are developing more personalized policies. By analyzing factors like breed, age, and lifestyle, providers can offer tailored coverage and pricing, ensuring pet owners receive the most appropriate and cost-effective plans.

Frequently Asked Questions

What is the average cost of pet insurance per month?

+The average cost of pet insurance varies depending on factors like the age, breed, and coverage level of your pet. Basic accident-only policies can start at around 10 per month, while comprehensive plans for older pets may cost 50 or more per month. It’s essential to compare quotes from multiple providers to find the best fit for your budget.

Can I get pet insurance for an older pet?

+Yes, many pet insurance providers offer policies for older pets. However, premiums may be higher, and there may be exclusions or limitations based on pre-existing conditions. It’s important to carefully review the policy’s terms to understand the coverage and any potential restrictions.

What is not covered by pet insurance?

+Pet insurance typically does not cover pre-existing conditions, elective procedures, and breeding-related expenses. Additionally, some policies may exclude certain conditions or treatments based on your pet’s breed or medical history. Always review the policy’s exclusions to understand what is not covered.

How do I choose the right pet insurance provider?

+When choosing a pet insurance provider, consider factors like coverage options, deductibles, co-pays, and annual limits. Read reviews and compare policies from multiple providers to find the best fit for your pet’s needs and your budget. Don’t hesitate to contact providers directly with any questions or concerns.

What should I do if my pet has a medical emergency?

+In the event of a medical emergency, contact your veterinarian immediately. If your pet insurance policy includes emergency coverage, ensure you understand the process for submitting claims and receiving reimbursement. Keep records of all expenses and communicate with your insurance provider to ensure a smooth claims process.