How Much Fdic Insured

In today's financial landscape, understanding the extent of FDIC insurance coverage is crucial for anyone seeking to protect their hard-earned money. This article delves into the specifics of FDIC insurance, providing a comprehensive guide to help individuals make informed decisions about their financial security.

The Extent of FDIC Insurance Coverage

The Federal Deposit Insurance Corporation (FDIC) is a government agency that insures deposits in banks and savings associations. It plays a vital role in maintaining public confidence in the financial system and protecting consumers from the risk of bank failures.

FDIC insurance provides coverage for a wide range of deposit products, including checking accounts, savings accounts, money market accounts, and certificates of deposit (CDs). However, it is essential to understand the limits and conditions of this coverage to ensure that your deposits are fully protected.

FDIC Insurance Limits

The standard insurance amount provided by the FDIC is $250,000 per depositor, per insured bank, for each ownership category.

| Ownership Category | Insurance Limit |

|---|---|

| Single Accounts | $250,000 |

| Joint Accounts | $250,000 |

| Trust Accounts | $250,000 per beneficiary |

| Retirement Accounts (IRAs) | $250,000 |

| Business Accounts | $250,000 per ownership category |

It's important to note that these limits apply to the total deposits held at a single bank. If you have deposits exceeding the insurance limit, you may need to consider spreading your funds across multiple insured banks to ensure full coverage.

Types of Deposits Covered

FDIC insurance covers a wide array of deposit products, offering peace of mind to depositors. Here’s a breakdown of the different types of deposits protected by FDIC insurance:

- Checking Accounts: From everyday transactions to direct deposits, your checking account funds are insured.

- Savings Accounts: Whether you're saving for a short-term goal or building an emergency fund, savings accounts are covered.

- Money Market Accounts: These accounts, often offering higher interest rates, are also protected by FDIC insurance.

- Certificates of Deposit (CDs): FDIC insurance covers CDs, which are time-based deposits with fixed interest rates.

It's crucial to verify that the bank you choose for these deposit products is indeed FDIC-insured. You can check the FDIC's BankFind tool to confirm a bank's insured status.

Special Coverage Scenarios

FDIC insurance provides additional coverage in certain scenarios to protect depositors further.

- Business Accounts: Businesses often have multiple accounts with different ownership structures. FDIC insurance provides coverage for each unique ownership category, ensuring comprehensive protection.

- Trust Accounts: When funds are held in trust for beneficiaries, each beneficiary is entitled to the standard insurance limit. This means that trust accounts can provide higher levels of coverage for beneficiaries.

- Retirement Accounts (IRAs): Individual Retirement Accounts (IRAs) are insured separately from other deposit products, offering an additional layer of protection for your retirement savings.

FDIC’s Role in Bank Failures

In the unfortunate event of a bank failure, the FDIC steps in to protect depositors. It promptly closes the affected bank and works to transfer the deposits to another insured bank. Depositors can access their insured funds within a short timeframe, typically without interruption to their financial activities.

The FDIC's prompt action ensures that depositors' funds remain secure, even in the face of bank failures. This stability and protection are essential in maintaining public trust in the banking system.

Maximizing FDIC Insurance Coverage

Understanding how to maximize FDIC insurance coverage is crucial for individuals seeking to protect their finances effectively. This section provides practical strategies and insights to ensure your deposits are optimally secured.

Understanding Ownership Categories

FDIC insurance coverage is determined by ownership categories. It’s essential to understand these categories to ensure your deposits are fully protected.

- Single Accounts: Accounts owned by one individual, with a maximum insurance limit of $250,000.

- Joint Accounts: Accounts owned by two or more individuals, also with a $250,000 limit per co-owner.

- Trust Accounts: Funds held in trust for beneficiaries, with each beneficiary entitled to a separate $250,000 insurance limit.

- Retirement Accounts (IRAs): These accounts, such as traditional IRAs or Roth IRAs, are insured separately from other deposit products, ensuring additional protection.

- Business Accounts: Business accounts are insured based on the legal structure of the business. For example, a sole proprietorship's account would be insured under the single account category, while a partnership's account would be insured under the joint account category.

Spreading Deposits Across Banks

If you have deposits exceeding the standard insurance limit of $250,000, spreading your funds across multiple FDIC-insured banks is a strategic approach to maximize coverage.

For instance, consider a scenario where you have $500,000 in savings. By dividing this amount equally between two insured banks, you can ensure that each bank holds $250,000 of your funds, thereby maximizing insurance coverage.

This strategy is particularly beneficial for those with substantial savings or investments. It provides peace of mind, knowing that your deposits are fully protected, even if one bank experiences financial difficulties.

Utilizing FDIC-Insured Products

FDIC insurance covers a wide range of deposit products, including checking accounts, savings accounts, money market accounts, and CDs. By utilizing these insured products, you can effectively manage your finances while enjoying the protection of FDIC insurance.

For example, you might choose to allocate a portion of your savings to a high-yield savings account, offering competitive interest rates while maintaining FDIC insurance coverage. Similarly, CDs provide a stable investment option with a fixed interest rate, all while being protected by FDIC insurance.

It's essential to review the terms and conditions of these products to ensure they align with your financial goals and risk tolerance.

Monitoring Deposit Holdings

Regularly monitoring your deposit holdings is crucial to ensuring your funds remain within FDIC insurance limits. This practice helps you stay informed and take proactive steps to maximize coverage.

Consider using online banking tools or mobile apps provided by your financial institution to easily track your deposit balances. These digital platforms often offer real-time updates, ensuring you have the most accurate information at your fingertips.

Additionally, it's beneficial to review your deposit holdings annually or whenever significant financial changes occur, such as receiving a large inheritance or making substantial investments.

Staying Informed About FDIC Updates

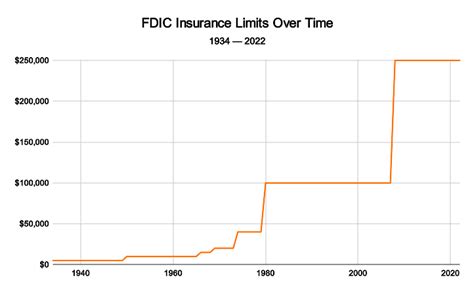

The FDIC periodically reviews and updates its insurance policies to adapt to changing economic conditions and consumer needs. Staying informed about these updates is essential to ensure your deposits remain fully protected.

The FDIC's website is a valuable resource, providing detailed information on insurance coverage, recent policy changes, and tools to help you understand your rights and responsibilities as a depositor.

Additionally, many financial institutions provide educational resources and updates on FDIC insurance. Stay engaged with these resources to ensure you're always up-to-date with the latest information.

FAQs

What happens if my bank fails, and I have deposits exceeding the insurance limit?

+In the event of a bank failure, the FDIC steps in to protect depositors. It promptly closes the affected bank and works to transfer the deposits to another insured bank. If your deposits exceed the insurance limit, the FDIC will prioritize reimbursing you for the insured portion first. Any remaining deposits above the limit may be subject to a delay or partial reimbursement, depending on the bank’s assets and liabilities.

Are all banks FDIC-insured, and how can I verify their insured status?

+Not all banks are FDIC-insured. It’s essential to verify a bank’s insured status before opening an account. The FDIC provides a BankFind tool on its website, allowing you to search for a bank’s insured status. Simply enter the bank’s name, city, and state to confirm if it is FDIC-insured.

Are there any deposit products that are not covered by FDIC insurance?

+FDIC insurance covers a wide range of deposit products, including checking accounts, savings accounts, money market accounts, and CDs. However, certain products, such as mutual funds, stocks, bonds, and life insurance policies, are not covered by FDIC insurance. It’s important to review the terms and conditions of these products to understand their level of protection.

How often does the FDIC update its insurance policies, and where can I find the latest information?

+The FDIC periodically reviews and updates its insurance policies to adapt to changing economic conditions and consumer needs. The FDIC’s website is the primary source for the latest information on insurance coverage and policy updates. You can also stay informed by subscribing to their email updates or following their social media channels for timely notifications.