How Much For Health Insurance Per Month

Health insurance is a vital aspect of modern life, providing financial protection and access to essential healthcare services. The cost of health insurance varies greatly depending on several factors, including the type of plan, coverage options, and individual or family needs. In this comprehensive guide, we will delve into the factors influencing health insurance costs and provide an in-depth analysis to help you understand the average monthly expenses associated with health insurance.

Understanding Health Insurance Costs

The cost of health insurance is influenced by a multitude of factors, and it is essential to grasp these elements to make informed decisions about your coverage. Here are the key considerations:

Type of Health Insurance Plan

Health insurance plans come in various forms, each with its own cost structure. The three primary types of plans include:

- Fee-for-Service Plans: These traditional plans offer flexibility in choosing healthcare providers but may have higher premiums and out-of-pocket costs.

- Managed Care Plans: Managed care plans, such as Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs), often have lower premiums and out-of-pocket expenses but may restrict provider choices.

- High-Deductible Health Plans (HDHPs): HDHPs have lower premiums but higher deductibles, making them suitable for those who prioritize lower monthly costs and expect fewer healthcare expenses.

Coverage Options and Benefits

The level of coverage and the benefits included in a health insurance plan significantly impact its cost. Plans with comprehensive coverage for a wide range of services, including prescription drugs, mental health services, and specialized care, tend to have higher premiums. On the other hand, plans with limited coverage or specific focus areas may have lower monthly costs.

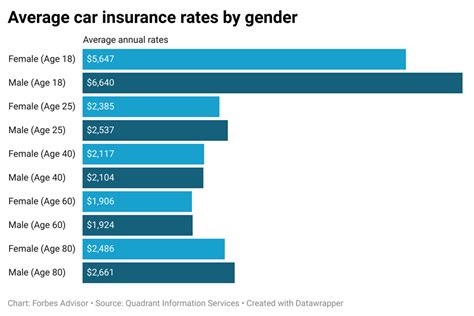

Age and Gender

Health insurance premiums often vary based on age and gender. Generally, younger individuals pay lower premiums compared to older adults, as they are less likely to require extensive medical care. Additionally, gender-specific health conditions can influence premium rates, with some plans charging differently for men and women.

Geographic Location

The cost of health insurance can vary significantly from one region to another. Factors such as the cost of living, availability of healthcare services, and the overall healthcare market in a particular area can impact insurance premiums. Urban areas often have higher costs compared to rural regions.

Tobacco Use

Tobacco use, including smoking and chewing tobacco, is a significant factor in health insurance premiums. Insurers may charge higher rates for individuals who use tobacco products, as they are at a higher risk of developing certain health conditions.

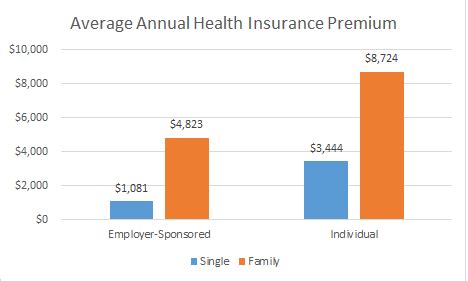

Family Size and Dependents

Health insurance plans for families or those with dependents typically have higher premiums compared to individual plans. The cost increases with the number of family members or dependents covered under the policy.

Pre-Existing Conditions

The presence of pre-existing medical conditions can influence health insurance costs. Some insurers may offer specialized plans or charge higher premiums for individuals with specific health issues. However, thanks to the Affordable Care Act (ACA), insurers cannot deny coverage or charge exorbitant rates based solely on pre-existing conditions.

Average Monthly Costs for Health Insurance

The average monthly cost for health insurance varies based on the factors mentioned above and can range from a few hundred to several thousand dollars per month. According to recent data, here are some average estimates:

| Type of Plan | Average Monthly Premium |

|---|---|

| Individual Fee-for-Service Plan | $400 - $800 |

| Individual Managed Care Plan (HMO/PPO) | $350 - $600 |

| Individual High-Deductible Health Plan (HDHP) | $250 - $450 |

| Family Fee-for-Service Plan | $1,200 - $2,000 |

| Family Managed Care Plan (HMO/PPO) | $1,000 - $1,800 |

| Family High-Deductible Health Plan (HDHP) | $800 - $1,500 |

These averages provide a general idea, but it's important to note that actual costs can vary significantly based on individual circumstances and the specific plan chosen. Additionally, these figures represent the premium, which is just one component of the overall cost of health insurance.

Out-of-Pocket Costs and Deductibles

In addition to monthly premiums, health insurance plans often come with out-of-pocket costs, such as deductibles, copayments, and coinsurance. These costs can significantly impact your overall healthcare expenses.

Deductibles

A deductible is the amount you must pay out of pocket before your insurance coverage kicks in. Higher deductibles typically result in lower monthly premiums, while lower deductibles lead to higher premiums. The average deductible for individual plans ranges from 1,500 to 3,000, while family plans may have deductibles up to $6,000 or more.

Copayments and Coinsurance

Copayments (copays) are fixed amounts you pay for covered services, such as doctor visits or prescription medications. Coinsurance, on the other hand, is a percentage of the cost of a covered service that you pay after meeting your deductible. For example, a 20% coinsurance rate means you pay 20% of the cost, and the insurance company pays the remaining 80%.

Factors Affecting Out-of-Pocket Costs

The amount you pay out of pocket for healthcare services can vary depending on several factors, including:

- Network of Providers: Staying within your insurance plan’s network of providers can help minimize out-of-pocket costs. Out-of-network services may incur higher expenses.

- Utilization of Services: The more healthcare services you utilize, the more you’ll pay out of pocket, especially if you haven’t met your deductible.

- Negotiated Rates: Insurance companies negotiate rates with healthcare providers. You may pay less for services if your provider has a negotiated rate with your insurance company.

Tips for Managing Health Insurance Costs

Here are some strategies to help you manage and potentially reduce your health insurance costs:

Shop Around and Compare Plans

Don’t settle for the first plan you come across. Compare different insurance providers and their plans to find the one that best fits your needs and budget. Online marketplaces and insurance brokers can be valuable resources for comparison shopping.

Consider High-Deductible Health Plans (HDHPs)

If you’re generally healthy and don’t anticipate frequent healthcare expenses, an HDHP can be a cost-effective option. These plans have lower premiums, allowing you to save money each month.

Enroll in Employer-Sponsored Plans

If you’re employed, consider enrolling in your company’s health insurance plan. Many employers offer competitive rates and may even contribute to your premiums.

Take Advantage of Tax Benefits

Health savings accounts (HSAs) and flexible spending accounts (FSAs) offer tax advantages, allowing you to set aside pre-tax dollars for qualified medical expenses. These accounts can help reduce your taxable income and provide additional funds for healthcare costs.

Stay Healthy and Utilize Preventive Care

Maintaining a healthy lifestyle and taking advantage of preventive care services can help reduce your long-term healthcare costs. Many insurance plans cover preventive care services at no cost to you.

Future Implications and Trends

The landscape of health insurance is constantly evolving, and several factors are likely to impact costs in the future:

Healthcare Reform and Policy Changes

Changes in healthcare policies and reforms, such as the Affordable Care Act (ACA) and potential future legislation, can influence insurance premiums and coverage options. Staying informed about these changes is essential for understanding how they may affect your costs.

Advancements in Healthcare Technology

Technological advancements in healthcare, such as telemedicine and digital health solutions, have the potential to reduce costs by improving efficiency and access to care. These innovations may lead to more affordable healthcare options over time.

Changing Demographics and Health Trends

As the population ages and health trends evolve, the demand for healthcare services may shift. This could impact insurance premiums and the overall cost of healthcare.

Growing Focus on Value-Based Care

Value-based care models, which focus on the quality and outcomes of healthcare rather than the quantity of services provided, are gaining traction. These models have the potential to reduce costs by improving efficiency and patient outcomes.

Conclusion

Understanding the factors that influence health insurance costs is crucial for making informed decisions about your coverage. By considering your individual needs, shopping around for the best plan, and staying informed about industry trends, you can navigate the complex world of health insurance and find a plan that provides the coverage you need at a price you can afford.

How does my age affect health insurance costs?

+Age is a significant factor in health insurance premiums. Younger individuals generally pay lower premiums as they are less likely to require extensive medical care. Premiums tend to increase with age, as older adults are more susceptible to health issues.

Can I get health insurance if I have a pre-existing condition?

+Yes, thanks to the Affordable Care Act (ACA), insurers cannot deny coverage based solely on pre-existing conditions. However, some plans may charge higher premiums for individuals with specific health issues.

Are there any tax benefits associated with health insurance?

+Yes, health savings accounts (HSAs) and flexible spending accounts (FSAs) offer tax advantages. These accounts allow you to set aside pre-tax dollars for qualified medical expenses, reducing your taxable income and providing additional funds for healthcare costs.

What is the difference between a deductible and coinsurance?

+A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Coinsurance, on the other hand, is a percentage of the cost of a covered service that you pay after meeting your deductible. For example, a 20% coinsurance rate means you pay 20% of the cost, and the insurance company pays the remaining 80%.