How Much Is A Full Covrage Insurance Policy

Full Coverage Insurance: Understanding the Costs and Benefits

Full coverage insurance is a comprehensive policy that offers a higher level of protection for vehicle owners. It goes beyond the basic liability coverage and provides additional financial security in the event of accidents, theft, or other unforeseen circumstances. While the cost of a full coverage insurance policy can vary significantly, it is essential to consider the potential benefits and tailor the coverage to your specific needs.

Factors Influencing the Cost of Full Coverage Insurance

The price of a full coverage insurance policy is influenced by a multitude of factors, each playing a unique role in determining the overall premium. Understanding these factors can help you make informed decisions when choosing the right coverage for your vehicle.

Vehicle Type and Value

One of the primary factors is the type and value of your vehicle. Insurers consider the make, model, and age of your car when calculating premiums. For instance, sports cars or luxury vehicles with higher repair costs may result in pricier policies. On the other hand, older vehicles with lower market values might attract more affordable coverage options.

| Vehicle Type | Average Annual Premium |

|---|---|

| Economy Car | $1,200 - $1,500 |

| SUV | $1,500 - $2,000 |

| Luxury Sedan | $2,000 - $3,000 |

These values are approximate and can vary based on specific vehicle models and regional insurance rates.

Driver’s Profile and History

Your driving history and personal profile also significantly impact the cost of full coverage insurance. Insurers take into account factors such as age, gender, driving experience, and claims history. Younger drivers, for example, often face higher premiums due to their lack of experience on the road.

- Age: Premiums tend to decrease as drivers reach their 25th birthday, as this is associated with increased maturity and better driving habits.

- Gender: Historically, male drivers have been considered higher risk and may pay slightly more for insurance.

- Claims History: A clean driving record with no accidents or traffic violations can lead to lower premiums. Conversely, multiple claims or at-fault accidents can significantly increase costs.

Location and Usage

The geographic location where you reside and the primary usage of your vehicle are other crucial factors. Areas with higher crime rates or a history of frequent accidents may result in higher insurance costs. Additionally, the purpose for which you use your vehicle, whether for personal, business, or pleasure, can also affect your premiums.

Coverage Options and Deductibles

The specific coverage options and deductibles you choose play a vital role in determining the overall cost of your full coverage insurance policy. Opting for higher coverage limits or adding optional coverage like rental car reimbursement or roadside assistance can increase your premiums. Conversely, selecting a higher deductible can lower your monthly payments but may require a larger out-of-pocket expense in the event of a claim.

Benefits of Full Coverage Insurance

While the cost of full coverage insurance can be a significant consideration, it is essential to weigh the benefits it provides. Full coverage policies offer a comprehensive safety net, ensuring you are financially protected in various scenarios.

Comprehensive and Collision Coverage

Full coverage insurance typically includes comprehensive and collision coverage. These coverages protect your vehicle against damage caused by non-collision incidents, such as theft, vandalism, natural disasters, or collisions with animals. With these protections, you can rest assured that your vehicle is safeguarded against a wide range of unforeseen events.

Uninsured/Underinsured Motorist Coverage

Full coverage policies often include uninsured/underinsured motorist coverage, which provides financial protection if you are involved in an accident with a driver who lacks sufficient insurance coverage. This coverage ensures you are not left with excessive out-of-pocket expenses in the event of an accident caused by an uninsured or underinsured driver.

Rental Car Reimbursement

Some full coverage policies offer rental car reimbursement, which covers the cost of renting a vehicle while yours is being repaired or replaced after an insured incident. This additional coverage can provide peace of mind, ensuring you have reliable transportation during unexpected downtimes.

Roadside Assistance

Full coverage insurance policies may also include roadside assistance, providing 24⁄7 emergency services for situations like flat tires, dead batteries, or running out of fuel. This added convenience can be invaluable when unexpected vehicle issues arise.

Comparing Quotes and Customizing Coverage

When considering full coverage insurance, it’s beneficial to obtain multiple quotes from different insurers. This allows you to compare prices and coverage options, ensuring you find the best value for your specific circumstances. Additionally, don’t hesitate to customize your coverage based on your unique needs. By tailoring your policy, you can ensure you’re adequately protected without paying for unnecessary coverage.

The Future of Full Coverage Insurance

The insurance industry is constantly evolving, and full coverage insurance is no exception. As technology advances, insurers are adopting new tools and strategies to enhance their services. From telematics devices that track driving behavior to digital platforms that streamline the claims process, the future of full coverage insurance looks promising. These innovations aim to provide more accurate risk assessments, improve customer experiences, and offer tailored coverage options.

Telematics and Usage-Based Insurance

Telematics devices, often referred to as “black boxes,” are becoming increasingly popular in the insurance industry. These devices collect real-time data on driving behavior, including speed, acceleration, and braking patterns. By analyzing this data, insurers can offer usage-based insurance policies that reward safe driving with lower premiums. This technology provides a more accurate assessment of individual risk, leading to fairer and more personalized coverage.

Digital Transformation and Claims Processing

The digital transformation of the insurance industry has brought about significant improvements in claims processing. Insurers are now leveraging technology to streamline the entire claims journey, from initial reporting to final settlement. Digital platforms and mobile apps enable policyholders to submit claims, upload necessary documentation, and track the progress of their claims in real-time. This efficiency not only speeds up the claims process but also enhances customer satisfaction.

Personalized Coverage Options

As insurers gather more data and utilize advanced analytics, they are better equipped to offer personalized coverage options. By understanding individual driving patterns, vehicle usage, and specific risk factors, insurers can tailor policies to meet the unique needs of each policyholder. This level of customization ensures that customers receive the right coverage at a competitive price, fostering a more satisfying insurance experience.

Conclusion

Full coverage insurance provides a robust safety net for vehicle owners, offering comprehensive protection against a wide range of risks. While the cost of such policies can vary significantly, understanding the influencing factors and the potential benefits can help you make an informed decision. By comparing quotes, customizing coverage, and staying updated with industry advancements, you can ensure you have the right full coverage insurance policy for your needs.

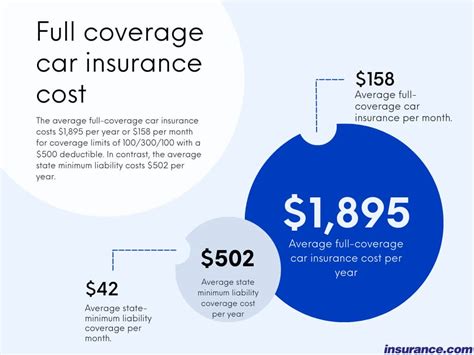

How much does full coverage insurance typically cost per month?

+The monthly cost of full coverage insurance can vary widely, ranging from 100 to 300 or more. Factors such as vehicle type, driver’s profile, location, and coverage options all influence the premium. It’s essential to obtain quotes from multiple insurers to find the best fit for your specific circumstances.

Is full coverage insurance worth the cost for all drivers?

+The value of full coverage insurance depends on individual needs and circumstances. For those with high-value vehicles or who drive in areas with high accident rates, full coverage can provide essential financial protection. However, for drivers with older, less valuable vehicles, liability-only coverage may be more cost-effective.

Can I customize my full coverage insurance policy to save money?

+Yes, customizing your full coverage policy is a great way to save money. You can adjust coverage limits, increase deductibles, or remove optional coverages to reduce your premiums. However, it’s important to ensure that you still have adequate protection for your specific needs and risks.

What factors can I control to potentially lower my full coverage insurance costs?

+Several factors within your control can impact your full coverage insurance costs. Maintaining a clean driving record, taking defensive driving courses, and installing anti-theft devices in your vehicle can all lead to lower premiums. Additionally, shopping around for quotes and comparing coverage options can help you find the most cost-effective policy for your needs.