How Much Is A Renter Insurance

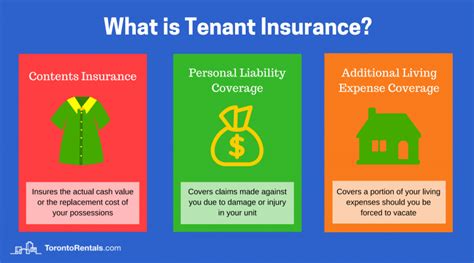

Renter's insurance, also known as tenant insurance, is an essential aspect of financial protection for individuals or families living in rental properties. It provides coverage for personal belongings, liability, and additional living expenses in the event of various unforeseen circumstances. The cost of renter's insurance can vary significantly based on several factors, including the location, coverage limits, and specific policy options chosen. Understanding the factors that influence the price of renter's insurance is crucial for tenants looking to secure adequate protection without breaking the bank.

Factors Affecting the Cost of Renter's Insurance

The price of renter's insurance is determined by a combination of factors, each playing a unique role in calculating the final premium. Here's an in-depth look at the key elements that influence the cost of this essential insurance coverage.

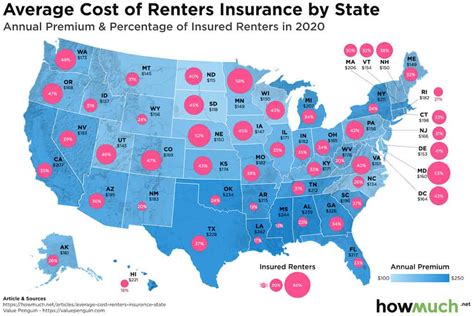

Location and Risk Factors

One of the primary factors affecting the cost of renter's insurance is the location of the rental property. Insurance providers consider various risk factors associated with different regions, including the likelihood of natural disasters, crime rates, and even the proximity to emergency services. Areas with a higher risk profile, such as those prone to hurricanes or with high crime rates, often command higher insurance premiums.

For instance, consider the case of New York City, where renter's insurance policies typically cost more due to the higher risk of theft, property damage, and other potential liabilities. On the other hand, a rental property in a low-crime, rural area may enjoy more affordable insurance rates.

| City | Average Annual Premium |

|---|---|

| New York City | $300 |

| Los Angeles | $250 |

| Chicago | $200 |

| Houston | $180 |

| Phoenix | $160 |

Coverage Limits and Deductibles

The coverage limits you choose for your renter's insurance policy have a direct impact on the premium. Higher coverage limits, which provide more protection for your belongings and liability, will generally result in a higher premium. Similarly, selecting a lower deductible (the amount you pay out of pocket before the insurance coverage kicks in) can increase your premium, as it indicates a higher likelihood of making claims.

Let's illustrate this with an example. If you opt for a $50,000 coverage limit with a $500 deductible, your premium might be around $200 annually. On the other hand, a policy with a $30,000 coverage limit and a $1,000 deductible could cost you $150 per year. The trade-off here is between the amount of protection you desire and the cost you're willing to pay.

Personal Belongings Value and Policy Add-ons

The value of your personal belongings, as well as any additional policy features you choose, can significantly influence the cost of your renter's insurance. If you have high-value items like jewelry, electronics, or artwork, you may need to purchase endorsements or riders to ensure they're adequately covered. These add-ons can increase your premium.

For example, if you have a home office setup worth $10,000 and want to ensure it's fully covered, you might need to add a rider to your policy. This could increase your premium by 10-20% of the additional coverage amount.

Discounts and Bundling Options

Insurance providers often offer discounts to renters who take proactive measures to protect their property. For instance, having a security system installed or smoke detectors in your rental unit can lead to reduced premiums. Additionally, many insurers provide bundling discounts if you combine your renter's insurance with other policies, such as auto insurance.

Let's say you currently have auto insurance with a particular provider. By bundling your auto and renter's insurance policies together, you could save up to 20% on your renter's insurance premium.

Understanding Renter's Insurance Premiums

Renter's insurance premiums can vary significantly based on the aforementioned factors. To provide a clearer picture, here's a table outlining average annual premiums for different coverage scenarios:

| Coverage Scenario | Average Annual Premium |

|---|---|

| Basic Coverage ($20,000 belongings, $100,000 liability) | $150 |

| Standard Coverage ($30,000 belongings, $200,000 liability) | $200 |

| Comprehensive Coverage ($50,000 belongings, $300,000 liability) | $300 |

| High-Value Items Coverage (additional $10,000 for electronics) | $100 - $200 (variable) |

It's important to note that these premiums are average estimates and can vary significantly based on individual circumstances and the insurance provider. To get an accurate quote, it's advisable to obtain multiple quotes from different insurers and compare the coverage, deductibles, and premiums offered.

Maximizing Value and Savings

When it comes to renter's insurance, there are several strategies you can employ to maximize the value of your coverage and potentially save money on your premiums.

Shop Around and Compare Quotes

Insurance rates can vary significantly between providers, so it's essential to shop around and compare quotes from multiple insurers. Online comparison tools can be particularly useful for quickly assessing different policy options and premiums. By taking the time to compare, you can find the best coverage at the most competitive price.

Increase Your Deductible

Opting for a higher deductible can lead to a lower premium. While this means you'll have to pay more out of pocket if you need to make a claim, it can be a cost-effective strategy if you're confident you won't need to make frequent claims. Just be sure to choose a deductible amount you can comfortably afford.

Bundle Policies

If you have other insurance needs, such as auto or homeowners insurance, consider bundling your policies with the same provider. Many insurers offer significant discounts when you combine multiple policies, which can lead to substantial savings on your renter's insurance premium.

Maintain a Good Credit Score

Insurance providers often consider your credit score when determining your premium. Maintaining a good credit score can help you qualify for lower rates, as it indicates a lower risk to the insurer. So, be sure to keep your credit in good standing to potentially save on your renter's insurance.

Choose a Longer Policy Term

Opting for a longer policy term, such as a 2-year or 3-year policy, can sometimes lead to discounts. This is because insurers prefer longer-term commitments, as it reduces the administrative costs associated with frequent policy changes. So, if you're planning to stay in your rental for an extended period, a longer policy term might be a cost-effective option.

Frequently Asked Questions

How much does renter's insurance cost on average per month?

+The average monthly cost of renter's insurance can vary, but it typically ranges from $10 to $30 per month. However, this can be influenced by factors like location, coverage limits, and personal belongings value.

Can I negotiate the price of my renter's insurance policy?

+While insurance premiums are generally non-negotiable, you can often find better rates by shopping around and comparing quotes from different providers. Additionally, you can negotiate by bundling your insurance policies or taking advantage of loyalty discounts if you've been with the same insurer for a while.

Are there any discounts available for renter's insurance policies?

+Yes, many insurance companies offer discounts for renter's insurance policies. Common discounts include multi-policy discounts (when you bundle your renter's insurance with other policies), loyalty discounts (for long-term customers), and safety discounts (for properties with certain safety features like smoke detectors or security systems). It's worth asking your insurer about available discounts to see if you qualify.

By understanding the factors that influence the cost of renter’s insurance and employing strategic cost-saving measures, you can secure the protection you need without straining your budget. Remember, the right renter’s insurance policy should provide peace of mind and financial security, ensuring you’re covered in the event of unforeseen circumstances.