How Much Is Aetna Insurance For A Single Person

Aetna, a well-known name in the health insurance industry, offers a range of plans tailored to meet the diverse needs of individuals and families. When it comes to insurance coverage for a single person, several factors come into play, influencing the overall cost. Understanding these factors is crucial to navigating the complex world of health insurance and finding the most suitable and affordable plan.

Factors Influencing Aetna Insurance Costs for Singles

The cost of Aetna insurance for a single individual can vary significantly based on a multitude of factors. These include the specific plan chosen, the coverage level desired, and the individual's age, location, and overall health status. Additionally, the inclusion of optional benefits and the choice between an HMO or PPO network can impact the overall price.

Let's delve deeper into these factors to gain a clearer understanding of how they affect the cost of Aetna insurance for singles.

Plan Type and Coverage Level

Aetna offers a variety of plan types, each with its own set of features and benefits. The most common plan types include:

- HMO (Health Maintenance Organization): These plans typically offer more comprehensive coverage but require members to choose a primary care physician and obtain referrals for specialist visits. HMO plans often have lower premiums but may have higher out-of-pocket costs.

- PPO (Preferred Provider Organization): PPO plans offer more flexibility in choosing healthcare providers, both in and out of network. They often have higher premiums but may provide lower out-of-pocket costs, especially for in-network care.

- EPO (Exclusive Provider Organization): EPO plans are similar to PPO plans but with a more limited network of providers. They may offer lower premiums and out-of-pocket costs for in-network care.

- POS (Point of Service): POS plans combine elements of HMO and PPO plans. Members can choose between an HMO-like primary care physician model or a PPO-like model for specialist visits. POS plans often provide a balance between cost and flexibility.

Within each plan type, Aetna offers various coverage levels, such as Bronze, Silver, Gold, and Platinum. These levels represent the proportion of healthcare costs that the insurance plan covers. For instance, a Bronze plan may cover 60% of costs, while a Platinum plan may cover up to 90%.

The coverage level chosen significantly impacts the premium, deductible, and out-of-pocket maximum. Higher coverage levels generally result in higher premiums but lower out-of-pocket costs when utilizing in-network providers.

Age and Location

Age and location are two crucial factors that influence the cost of Aetna insurance for singles. As individuals age, their healthcare needs tend to increase, leading to higher insurance premiums. Aetna, like many insurance providers, adjusts its rates based on age to account for this trend.

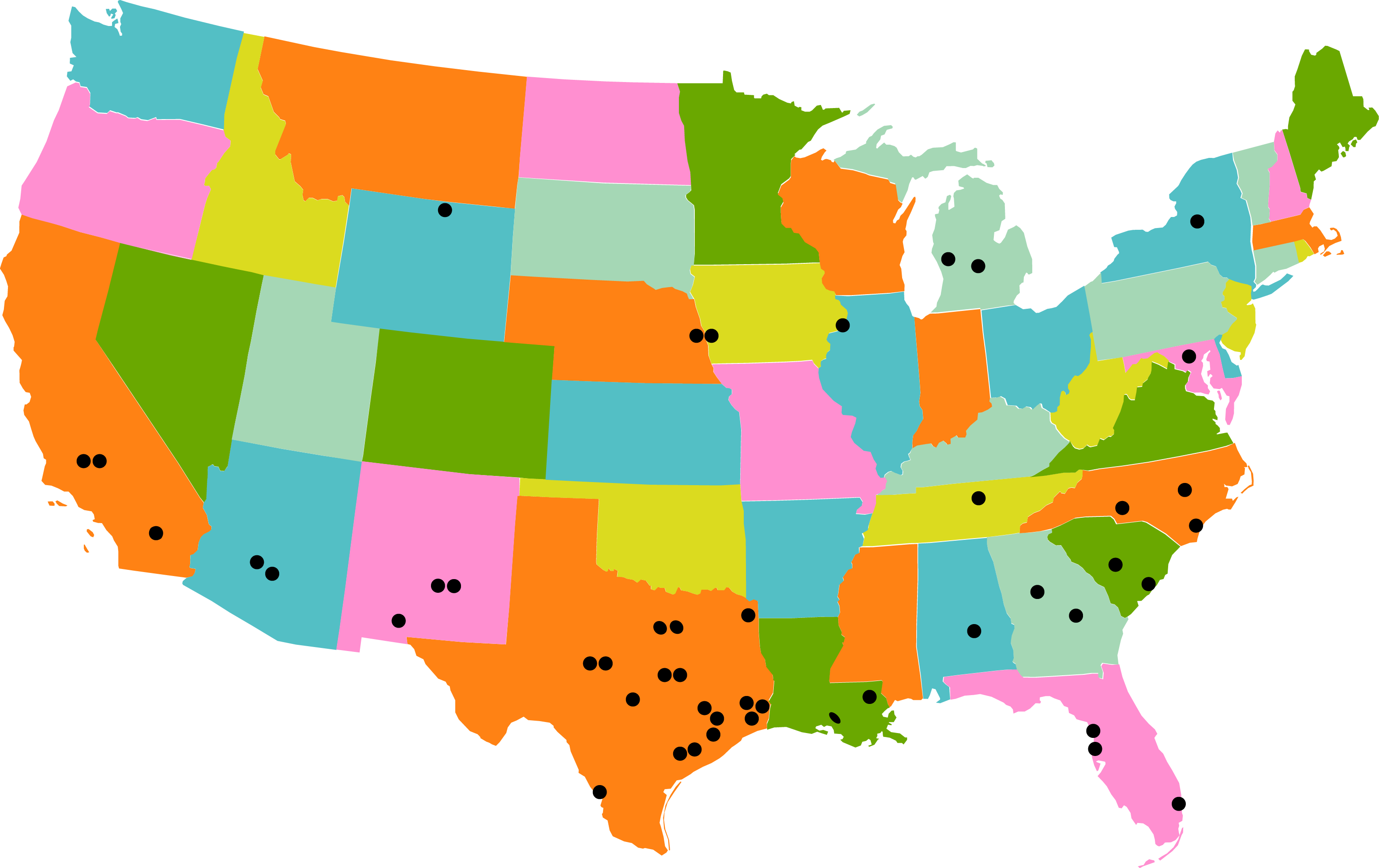

Location also plays a significant role. Healthcare costs can vary widely between different regions, and Aetna may offer different plans and pricing structures based on the state or county where the insured resides. Additionally, the cost of living in a particular area can influence the overall price of insurance, as healthcare providers may charge more in higher-cost areas.

Health Status and Medical History

An individual's health status and medical history are key considerations when determining insurance costs. Aetna, like most insurance providers, assesses an applicant's health status to determine the risk associated with covering their healthcare needs. Those with pre-existing conditions or a history of frequent medical issues may face higher premiums to account for the increased likelihood of claims.

However, it's important to note that thanks to the Affordable Care Act (ACA), insurance companies cannot deny coverage or charge higher premiums solely based on pre-existing conditions. They can, however, consider certain health factors when determining rates, such as age and tobacco use.

Optional Benefits and Additional Coverage

Aetna offers a range of optional benefits and additional coverage options that can be added to a base plan. These include dental, vision, and prescription drug coverage, as well as specialized coverage for specific conditions or needs. While these additions can enhance the overall coverage, they also increase the cost of the insurance plan.

For instance, adding dental coverage to a base plan may increase the premium by a certain percentage, depending on the specific dental plan chosen. Similarly, prescription drug coverage can vary based on the tier of drugs covered and the copay or coinsurance rates.

Network and Provider Choices

The choice between an HMO and PPO network can significantly impact the cost of Aetna insurance for singles. HMO plans generally offer lower premiums but may have higher out-of-pocket costs, especially for out-of-network care. On the other hand, PPO plans provide more flexibility in choosing providers but may have higher premiums.

It's important to consider the specific healthcare providers and facilities one prefers when choosing a network. If a single individual has established relationships with certain doctors or hospitals, ensuring they are in-network can help minimize out-of-pocket costs.

| Plan Type | Premium Range | Out-of-Pocket Costs |

|---|---|---|

| HMO | $250 - $500/month | Higher for out-of-network care |

| PPO | $300 - $600/month | Lower for in-network care |

| EPO | $275 - $550/month | Lower for in-network care |

| POS | $280 - $520/month | Balanced between HMO and PPO |

The table above provides a general range of premiums and out-of-pocket costs for different plan types. However, it's important to note that actual costs can vary significantly based on the factors discussed earlier, such as age, location, and coverage level.

Understanding Aetna Insurance Costs: A Real-World Example

Let's consider a real-world example to illustrate how these factors come into play when determining the cost of Aetna insurance for a single person.

Meet Sarah, a 30-Year-Old Single Professional

Sarah, a 30-year-old single professional, is in the market for health insurance. She has no major health concerns and is primarily looking for coverage for routine check-ups, occasional doctor visits, and potential emergency care.

Factors Influencing Sarah's Insurance Costs

Here's how the various factors discussed earlier might impact Sarah's insurance costs with Aetna:

- Plan Type and Coverage Level: Sarah opts for a PPO plan, as she values the flexibility to choose her healthcare providers. She chooses a Silver coverage level, which provides a balance between cost and coverage.

- Age and Location: Being 30 years old, Sarah falls into a relatively lower-cost age bracket. Additionally, she lives in a metropolitan area with a competitive healthcare market, which can help keep insurance costs more affordable.

- Health Status and Medical History: Sarah has no major health concerns and a clean medical history. This factor works in her favor, as she is considered a low-risk individual, resulting in more affordable premiums.

- Optional Benefits and Additional Coverage: Sarah decides to add dental and vision coverage to her base plan, as she values the convenience of having all her healthcare needs covered under one insurance plan. This decision increases her overall premium.

- Network and Provider Choices: Sarah ensures that her preferred primary care physician and a nearby hospital are in-network with her chosen PPO plan. This decision helps minimize her out-of-pocket costs for routine care.

Sarah's Estimated Insurance Costs

Based on the factors above, Sarah's estimated insurance costs with Aetna might look something like this:

- Premium: $350/month (including dental and vision coverage)

- Deductible: $2,000

- Out-of-Pocket Maximum: $4,000

These estimated costs reflect the balance Sarah has chosen between cost and coverage. It's important to note that actual costs can vary based on individual circumstances and the specific Aetna plan chosen.

Conclusion: Navigating Aetna Insurance Costs for Singles

Understanding the various factors that influence Aetna insurance costs for singles is crucial for making informed decisions about health insurance coverage. By considering plan type, coverage level, age, location, health status, optional benefits, and network choices, individuals like Sarah can navigate the complex world of health insurance and find a plan that meets their unique needs and budget.

While the cost of Aetna insurance for singles can vary widely, the information and insights provided in this article can serve as a valuable guide for anyone seeking to understand and manage their insurance costs effectively.

How do I choose the right Aetna insurance plan for my needs?

+When selecting an Aetna insurance plan, consider your healthcare needs and preferences. Assess whether you prioritize cost, coverage, or flexibility. Research the different plan types (HMO, PPO, EPO, POS) and coverage levels (Bronze, Silver, Gold, Platinum) to find the best fit. Additionally, evaluate your preferred healthcare providers and their network status to ensure they are covered by your chosen plan.

Can I switch Aetna insurance plans during the year?

+Generally, you cannot switch Aetna insurance plans outside of the annual Open Enrollment Period, unless you experience a qualifying life event (e.g., marriage, birth of a child, job loss). However, it’s important to review your coverage regularly and assess whether your current plan still meets your needs. If you find that your plan is no longer suitable, you may be able to make changes during the next Open Enrollment Period or through a Special Enrollment Period triggered by a qualifying event.

What happens if I need to see a specialist outside my Aetna network?

+If you need to see a specialist outside your Aetna network, you may be responsible for higher out-of-network costs. However, some plans may allow for out-of-network coverage with higher copays or coinsurance. It’s important to check your specific plan details and understand the costs associated with out-of-network care. Consider discussing your situation with your primary care physician, who may be able to refer you to an in-network specialist if needed.