How Much Is Auto Insurance

Auto insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind to drivers. The cost of auto insurance can vary significantly depending on numerous factors, making it crucial to understand the key determinants and strategies to secure the best coverage at an affordable price. In this comprehensive guide, we will delve into the world of auto insurance costs, exploring the critical elements that influence premiums and offering expert insights to help you navigate this complex landscape.

Understanding Auto Insurance Costs: A Comprehensive Overview

The expense of auto insurance is influenced by a multitude of factors, each playing a unique role in determining the final premium. From individual characteristics to vehicle-specific details, geographical location, and driving behavior, a myriad of elements come into play. By examining these factors, we can gain a clearer understanding of how auto insurance costs are calculated and identify strategies to mitigate these expenses.

The Impact of Personal Factors on Insurance Premiums

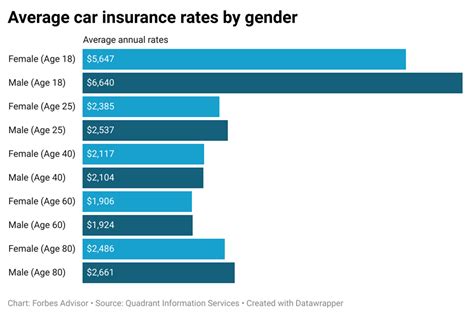

Personal characteristics and demographics are significant determinants of auto insurance costs. Insurance companies consider factors such as age, gender, marital status, and even occupation when calculating premiums. For instance, young drivers, especially males under the age of 25, are often considered high-risk and may face higher insurance costs due to their perceived lack of driving experience and propensity for risky behavior. Similarly, certain occupations that involve extensive driving, like sales or delivery services, may also impact insurance rates.

The insurance company may also consider your driving history. Those with a clean driving record, free from accidents or traffic violations, are generally viewed as lower-risk and may benefit from more affordable insurance rates. On the other hand, individuals with a history of accidents, DUI convictions, or multiple traffic violations are considered high-risk and may face higher premiums as a result.

Furthermore, insurance providers often use credit scores as an indicator of financial responsibility. Individuals with higher credit scores are often rewarded with lower insurance premiums, as they are perceived as more financially stable and less likely to engage in risky behavior. Conversely, those with lower credit scores may be considered higher-risk and face higher insurance costs.

Vehicle-Specific Factors and Their Influence on Insurance Costs

The type of vehicle you drive can significantly impact your insurance premiums. High-performance sports cars, luxury vehicles, and SUVs often carry higher insurance costs due to their expensive repair costs and higher risk of theft. On the other hand, economical cars, hybrids, and vehicles with advanced safety features may be more affordable to insure, as they are typically safer and less costly to repair.

The age and condition of your vehicle also play a role in insurance costs. Older vehicles, especially those with high mileage, may be more affordable to insure as they are typically worth less and have lower repair costs. However, classic or vintage cars may require specialized insurance coverage, which can be more expensive.

Additionally, the safety features and anti-theft devices installed in your vehicle can impact insurance costs. Vehicles equipped with advanced safety features like lane departure warning systems, automatic emergency braking, or anti-theft devices may be eligible for insurance discounts, as they reduce the risk of accidents and theft.

Geographical Location and Its Effect on Insurance Premiums

Where you live and drive your vehicle significantly influences your insurance costs. Insurance rates can vary greatly from one state to another and even within different regions of the same state. This variation is primarily due to differences in traffic density, accident rates, crime rates, and the cost of living.

For instance, urban areas with higher population densities often have higher insurance rates due to increased traffic congestion, higher accident rates, and a greater risk of vehicle theft. On the other hand, rural areas may have lower insurance costs due to less congested roads and lower accident and crime rates.

Additionally, the weather and road conditions in your area can impact insurance costs. Regions with harsh winters, frequent storms, or a high risk of natural disasters may have higher insurance rates due to the increased likelihood of accidents and vehicle damage.

The Role of Driving Behavior in Determining Insurance Costs

Your driving behavior is a critical factor in determining your insurance costs. Insurance companies use various methods, including telematics and driving behavior monitoring, to assess your risk profile. Safe driving habits, such as maintaining a consistent speed, avoiding sudden braking, and keeping a safe following distance, can result in lower insurance premiums.

On the other hand, risky driving behaviors, such as frequent hard braking, rapid acceleration, or late-night driving, can indicate a higher risk of accidents and may lead to higher insurance costs. Insurance companies may use telematics devices or smartphone apps to monitor your driving behavior and adjust your premiums accordingly.

Furthermore, the number of miles you drive annually can impact your insurance costs. High-mileage drivers, especially those who commute long distances or frequently drive in congested areas, may face higher insurance premiums due to the increased risk of accidents and traffic violations.

Comparative Analysis: Understanding the Cost Variations

The cost of auto insurance can vary significantly between different insurance providers. To ensure you’re getting the best value for your money, it’s essential to compare quotes from multiple insurers. Each provider has its own unique rating system and factors that influence premiums, so getting multiple quotes can help you identify the most affordable option while ensuring you have the coverage you need.

When comparing quotes, pay close attention to the coverage limits and deductibles. While a lower premium may be appealing, it's crucial to ensure that the coverage limits are sufficient to protect you financially in the event of an accident. Additionally, consider the deductible amount. A higher deductible can lead to lower premiums, but it also means you'll have to pay more out of pocket if you need to make a claim.

It's also important to compare the reputation and financial stability of the insurance providers. While cost is a significant factor, you also want to ensure that your insurer is reputable and has a strong financial standing. This can provide peace of mind, knowing that they will be able to pay out claims if needed.

| Insurance Provider | Average Premium | Coverage Limits | Deductible Options |

|---|---|---|---|

| Provider A | $1,200 annually | $50,000 per person, $100,000 per accident | $250, $500, $1,000 |

| Provider B | $1,350 annually | $100,000 per person, $300,000 per accident | $500, $1,000, $2,000 |

| Provider C | $1,100 annually | $30,000 per person, $60,000 per accident | $100, $250, $500 |

In the above table, we can see that Provider A offers the lowest average premium, but it also has lower coverage limits and fewer deductible options. Provider B, on the other hand, has higher coverage limits but a higher premium and more expensive deductible options. Provider C provides a balance between premium and coverage, with average coverage limits and a reasonable range of deductible options.

Expert Insights: Strategies to Lower Your Auto Insurance Costs

While auto insurance costs can vary significantly, there are strategies you can employ to reduce your premiums and ensure you’re getting the best value for your money.

- Shop Around: Don't settle for the first insurance quote you receive. Compare rates from multiple providers to find the best deal. Online comparison tools can be a great starting point, but it's also beneficial to speak directly with insurance agents to understand the nuances of their policies and potential discounts.

- Bundle Policies: If you have multiple insurance needs, such as home and auto insurance, consider bundling your policies with the same provider. Many insurance companies offer significant discounts for customers who bundle multiple policies, as it simplifies their administrative processes and reduces overhead costs.

- Maintain a Clean Driving Record: A clean driving record is one of the most effective ways to lower your insurance costs. Avoid traffic violations and accidents, as they can significantly increase your premiums. If you've had a clean record for a few years, consider requesting a review of your policy to see if you're eligible for a lower rate.

- Increase Your Deductible: Increasing your deductible, the amount you pay out of pocket before your insurance coverage kicks in, can lead to lower premiums. This strategy works best for individuals who are confident in their ability to handle unexpected expenses and have the financial means to cover a higher deductible in the event of an accident.

- Take Advantage of Discounts: Insurance companies offer a variety of discounts to policyholders. Common discounts include safe driver discounts, multi-policy discounts, good student discounts, and loyalty discounts. Be sure to ask your insurance provider about the discounts they offer and see if you're eligible for any of them.

- Consider Usage-Based Insurance: Usage-based insurance, also known as pay-as-you-drive insurance, uses telematics devices or smartphone apps to monitor your driving behavior and adjust your premiums accordingly. This type of insurance can be beneficial for safe drivers, as it rewards them for their responsible driving habits with lower premiums. However, it may not be suitable for individuals who frequently engage in risky driving behaviors.

Future Implications: The Evolving Landscape of Auto Insurance Costs

The landscape of auto insurance is constantly evolving, driven by technological advancements, changing consumer behaviors, and emerging trends in the automotive industry. As self-driving vehicles, electric cars, and shared mobility services become more prevalent, the traditional models of auto insurance are likely to undergo significant transformations.

Self-driving vehicles, for instance, have the potential to dramatically reduce the number of accidents on the road, leading to lower insurance costs for policyholders. However, the introduction of this technology also raises new questions and challenges for the insurance industry, such as liability issues and the need for specialized coverage. As self-driving vehicles become more common, insurance providers will need to adapt their policies and pricing models to accommodate these new technologies.

The rise of electric vehicles (EVs) is another factor that could impact auto insurance costs. EVs often have lower maintenance costs and are equipped with advanced safety features, which could lead to reduced insurance premiums. However, the high cost of repairing or replacing damaged EV batteries may offset some of these savings. Insurance companies will need to carefully consider the unique risks and benefits associated with EVs when setting premiums.

Shared mobility services, such as ride-sharing and car-sharing platforms, are also transforming the auto insurance landscape. With more people opting for shared mobility options instead of traditional car ownership, insurance providers are developing new products and pricing models to cater to this changing market. For example, usage-based insurance, where premiums are calculated based on the actual miles driven, could become more prevalent as a way to insure shared vehicles.

Additionally, the growing focus on sustainability and environmental concerns is likely to influence auto insurance costs in the future. As governments and consumers increasingly prioritize eco-friendly practices, insurance providers may offer incentives or discounts to policyholders who drive electric or hybrid vehicles, or who adopt other sustainable practices. This shift could lead to a more nuanced approach to pricing, with premiums reflecting not only the risk of accidents but also the environmental impact of the insured vehicle.

In conclusion, the cost of auto insurance is influenced by a complex interplay of personal factors, vehicle characteristics, geographical location, and driving behavior. By understanding these factors and employing strategic approaches, such as shopping around for quotes, bundling policies, maintaining a clean driving record, and taking advantage of discounts, individuals can potentially reduce their insurance costs and ensure they have the coverage they need. As the auto insurance landscape continues to evolve, staying informed about emerging trends and technologies will be key to navigating this complex and ever-changing industry.

What is the average cost of auto insurance in the United States?

+The average cost of auto insurance in the United States varies significantly based on various factors such as location, age, driving record, and vehicle type. As of 2023, the national average cost of car insurance is approximately 1,674 per year, or around 140 per month. However, this is just an average, and actual costs can range from a few hundred dollars to several thousand dollars per year, depending on individual circumstances.

How can I lower my auto insurance costs?

+There are several strategies you can employ to lower your auto insurance costs. These include shopping around for quotes from different insurers, bundling your policies (such as home and auto insurance) with the same provider, maintaining a clean driving record, increasing your deductible, taking advantage of discounts (such as safe driver discounts or multi-policy discounts), and considering usage-based insurance if you’re a safe driver. It’s always a good idea to consult with a licensed insurance agent to understand the best options for your specific circumstances.

What factors influence auto insurance costs the most?

+Several factors significantly influence auto insurance costs. These include your age, gender, marital status, occupation, driving history, credit score, the type of vehicle you drive, its age and condition, the safety features and anti-theft devices it has, your geographical location, the weather and road conditions in your area, your driving behavior, and the number of miles you drive annually. Each of these factors plays a unique role in determining your insurance premiums, and understanding them can help you make informed decisions to potentially lower your costs.