How Much Is Auto Insurance A Month

Auto insurance is a crucial aspect of vehicle ownership, providing financial protection in case of accidents, theft, or other unforeseen events. The cost of auto insurance varies significantly based on numerous factors, and understanding these variables is essential for budgeting and making informed decisions. In this comprehensive guide, we delve into the intricacies of auto insurance costs, exploring the factors that influence premiums and offering insights to help you estimate your monthly insurance expenses accurately.

Understanding Auto Insurance Premiums

Auto insurance premiums are the monthly or annual payments made to an insurance provider in exchange for coverage. These premiums are determined by a complex calculation that takes into account various risk factors. While the exact formula varies among insurance companies, several key elements consistently influence the cost of auto insurance.

Factors Influencing Auto Insurance Costs

The cost of auto insurance is influenced by a multitude of factors, each contributing to the overall risk assessment made by insurance companies. Here's an overview of the primary factors:

- Location: Your geographic location plays a significant role in determining insurance rates. Areas with higher populations, denser traffic, and a history of frequent accidents or thefts often result in higher insurance premiums.

- Vehicle Type and Value: The make, model, and age of your vehicle impact insurance costs. High-performance cars, luxury vehicles, and newer models typically have higher insurance premiums due to their value and potential for higher repair costs.

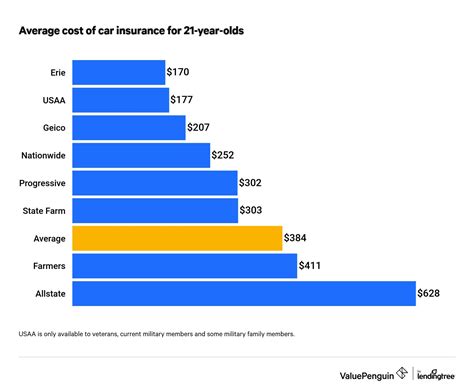

- Driver's Age and Experience: Younger drivers, especially those under 25, are often considered high-risk and face higher insurance premiums. Conversely, experienced drivers with a clean driving record may enjoy lower rates.

- Driving History: Your past driving record is a critical factor. Insurance companies carefully examine your history of accidents, traffic violations, and claims. A clean record can lead to lower premiums, while multiple accidents or violations may result in significantly higher costs.

- Coverage and Deductibles: The level of coverage you choose directly affects your premiums. Comprehensive and collision coverage, for example, can increase costs. Additionally, selecting higher deductibles (the amount you pay out of pocket before insurance coverage kicks in) can lower your monthly premiums.

- Credit Score: In many states, insurance companies consider your credit score when calculating premiums. Individuals with higher credit scores are often seen as lower-risk and may qualify for lower insurance rates.

- Marital Status: Some insurance companies offer discounts to married couples, believing that married individuals tend to have safer driving habits.

- Occupation and Education: Certain professions or educational backgrounds may qualify for discounts. For instance, individuals with advanced degrees or those in specific occupations like teaching or law enforcement may receive lower insurance rates.

It's important to note that insurance companies weigh these factors differently, and the impact of each factor can vary based on individual circumstances and the insurance provider.

Estimating Monthly Auto Insurance Costs

Estimating your monthly auto insurance costs involves considering the aforementioned factors and understanding the average rates in your region. While precise costs can only be determined by obtaining quotes from insurance providers, the following guidelines can help you estimate your monthly insurance expenses:

Average Monthly Auto Insurance Premiums

According to recent industry data, the average monthly auto insurance premium in the United States is approximately $130. However, this average varies significantly based on the factors outlined above. Here's a breakdown of average monthly premiums based on specific categories:

| Category | Average Monthly Premium |

|---|---|

| Young Drivers (Ages 16-25) | $180 |

| Experienced Drivers (Ages 26-60) | $120 |

| Senior Drivers (Ages 61+) | $110 |

| Luxury Vehicles | $200 |

| Standard Vehicles | $120 |

| Safe Driving Record | $110 |

| Multiple Violations/Accidents | $250 |

Please note that these averages are estimates and may not reflect your exact circumstances. The best way to determine your personal insurance costs is to obtain quotes from multiple insurance providers.

Tips for Lowering Auto Insurance Costs

If you're looking to reduce your auto insurance expenses, here are some strategies to consider:

- Shop Around: Compare quotes from multiple insurance companies. Rates can vary significantly, and finding the right provider can lead to substantial savings.

- Review Coverage: Assess your coverage needs and adjust your policy accordingly. Opting for higher deductibles or reducing certain coverages can lower your premiums.

- Safe Driving: Maintain a clean driving record. Avoid accidents and traffic violations, as these can significantly increase your insurance costs.

- Discounts: Take advantage of available discounts. Many insurance companies offer discounts for good students, safe drivers, low mileage, and more. Ask your insurer about potential discounts and consider how you can qualify.

- Bundle Policies: Consider bundling your auto insurance with other policies, such as home or renters insurance. Bundling often results in significant savings.

- Monitor Credit: Improve your credit score. Insurance companies often use credit scores as a factor in determining premiums, so maintaining a good credit score can lead to lower insurance costs.

Conclusion: Auto Insurance Costs

Auto insurance is a necessary expense for vehicle owners, providing financial protection and peace of mind. Understanding the factors that influence insurance premiums and learning how to estimate your monthly costs can help you make informed decisions and budget effectively. Remember that while auto insurance is an essential investment, there are strategies to manage costs without compromising on coverage.

Frequently Asked Questions

How much does auto insurance cost for a new driver?

+New drivers, particularly those under 25, typically face higher insurance premiums due to their lack of driving experience. The average monthly cost for a new driver can range from 150 to 250, depending on various factors such as location, vehicle type, and driving record.

Can I get auto insurance without a license?

+Obtaining auto insurance without a valid driver’s license can be challenging, as most insurance companies require proof of a valid license to provide coverage. However, some providers may offer limited coverage for individuals who are taking steps to obtain their license, such as those enrolled in driving school.

How do insurance companies determine fault in an accident?

+Insurance companies use a combination of factors to determine fault in an accident, including police reports, witness statements, and physical evidence. They also consider the actions and responsibilities of each driver involved. It’s important to cooperate with your insurance company during the claims process and provide accurate information.