How Much Is Company Insurance

Company insurance, also known as business insurance or commercial insurance, is an essential aspect of risk management for any business. It provides financial protection against potential losses, liabilities, and unforeseen events that could impact the stability and operations of a company. The cost of company insurance varies significantly based on numerous factors, including the industry, business size, coverage needs, and location. In this comprehensive guide, we will delve into the intricacies of company insurance costs, exploring the factors that influence them and providing insights into how businesses can obtain the right coverage at a reasonable price.

Understanding the Factors That Influence Company Insurance Costs

The cost of company insurance is influenced by a multitude of variables, each playing a crucial role in determining the final premium. By understanding these factors, businesses can make informed decisions when selecting insurance policies and potentially negotiate better rates.

Industry and Business Size

The industry in which a company operates is a significant determinant of insurance costs. Certain industries, such as construction, manufacturing, or transportation, inherently carry higher risks due to the nature of their operations. These high-risk industries often face increased insurance premiums to account for the potential for accidents, injuries, or property damage. Conversely, industries with lower inherent risks, like consulting or software development, may enjoy more affordable insurance rates.

Business size is another critical factor. Generally, larger companies with more employees, higher revenue, and extensive operations are viewed as higher-risk entities by insurance providers. This perception is based on the assumption that larger businesses have more exposure to potential losses and, therefore, require more extensive coverage. As a result, they may face higher insurance premiums.

Coverage Requirements

The scope and extent of coverage needed by a business greatly impact insurance costs. Every business is unique, and its insurance requirements should reflect its specific risks and operations. Common types of business insurance include general liability insurance, property insurance, professional liability insurance (also known as errors and omissions insurance), workers’ compensation insurance, and commercial auto insurance.

General liability insurance, for instance, is a fundamental coverage that protects businesses from a wide range of claims, including bodily injury, property damage, and personal and advertising injury. Property insurance, on the other hand, covers losses related to the business's physical assets, such as buildings, equipment, and inventory. Professional liability insurance is essential for businesses offering professional services, as it provides coverage for errors, omissions, and negligence claims.

The more comprehensive the coverage a business requires, the higher the insurance premiums are likely to be. However, it's crucial for businesses to strike a balance between adequate coverage and cost-effectiveness to ensure they are adequately protected without incurring unnecessary expenses.

Location and Historical Claims

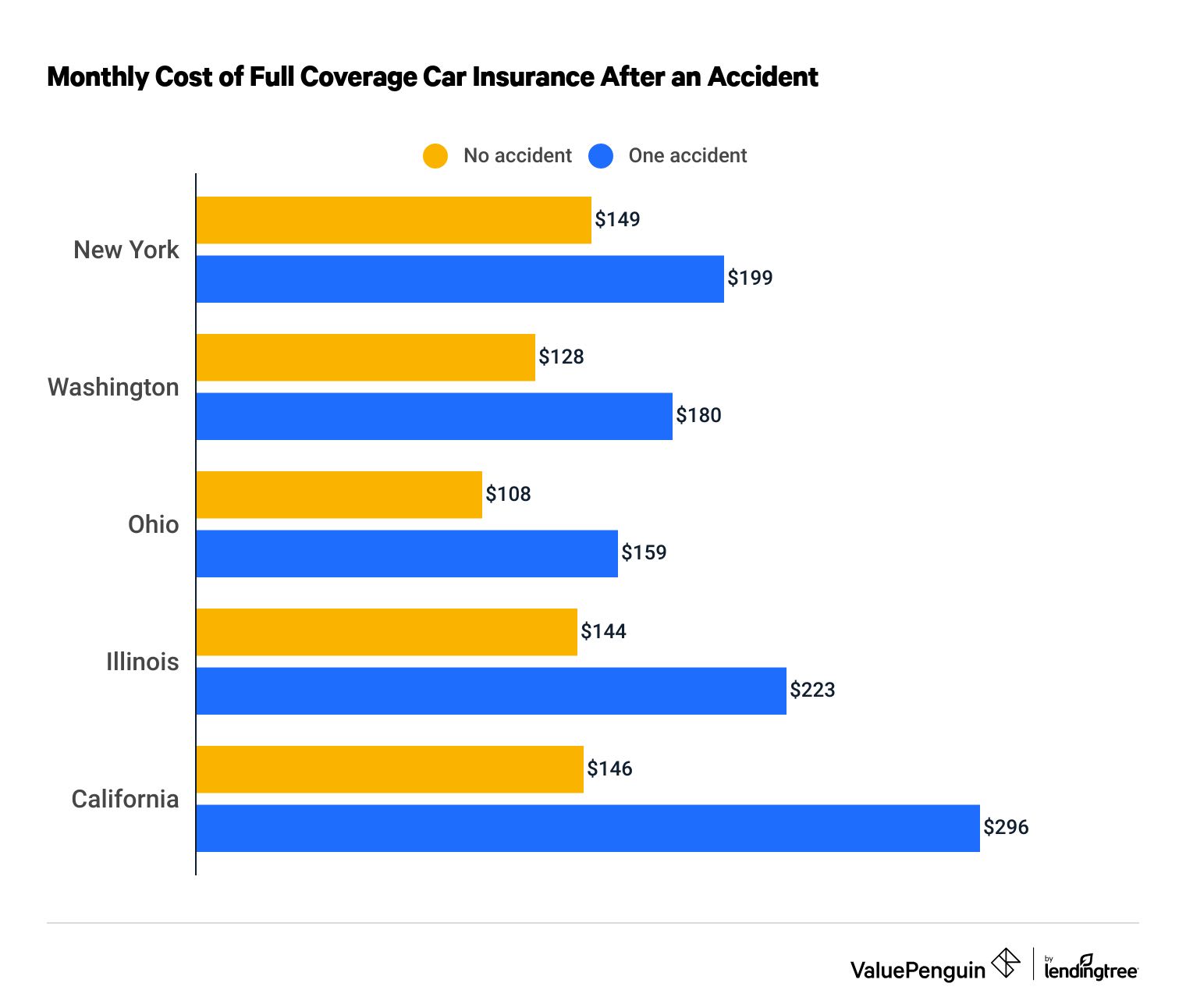

The geographic location of a business is another critical factor in determining insurance costs. Insurance providers assess the risks associated with a specific location, taking into account factors such as crime rates, natural disaster frequency, and the overall economic stability of the area. Businesses located in high-risk areas may face higher insurance premiums to account for the increased likelihood of claims.

Historical claims data is also a significant consideration. Insurance companies analyze a business's claims history to assess its risk profile. If a business has a history of frequent or costly claims, it may be seen as a higher risk and charged higher premiums. Conversely, businesses with a clean claims record may benefit from lower insurance rates.

Additional Factors

Beyond industry, business size, coverage requirements, location, and historical claims, several other factors can influence company insurance costs. These include:

- Business Ownership Structure: Sole proprietorships, partnerships, and corporations may face different insurance rates based on their legal structure and associated risks.

- Credit Rating: Insurance providers may consider a business's credit rating when determining premiums, as a strong credit rating can indicate financial stability and a reduced risk of default.

- Safety Measures: Businesses that implement robust safety measures and practices may be rewarded with lower insurance premiums, as these measures reduce the likelihood of accidents and claims.

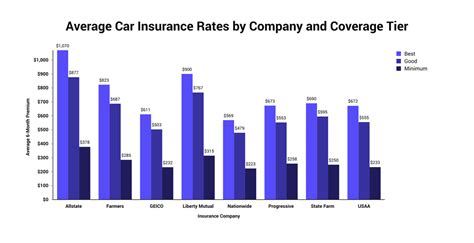

- Insurance Provider and Policy Terms: Different insurance providers offer varying rates and policy terms. Shopping around and comparing quotes from multiple insurers can help businesses find the most competitive rates.

Obtaining the Right Coverage at a Reasonable Price

While the cost of company insurance is influenced by various factors that are often beyond a business’s control, there are strategies that businesses can employ to obtain the right coverage at a reasonable price.

Assessing Coverage Needs

The first step in obtaining cost-effective insurance is accurately assessing a business’s coverage needs. This involves conducting a comprehensive risk assessment to identify the potential risks and liabilities associated with the business’s operations. By understanding these risks, businesses can tailor their insurance coverage to address their specific needs without overpaying for unnecessary protections.

Comparing Quotes from Multiple Insurers

Insurance rates can vary significantly between providers, so it’s essential to shop around and compare quotes from multiple insurers. Requesting quotes from at least three to five reputable insurance companies allows businesses to identify the most competitive rates and potentially negotiate better terms. Online insurance marketplaces and brokers can be valuable resources for obtaining multiple quotes in a single platform.

Bundling Insurance Policies

Bundling multiple insurance policies with a single insurer can often lead to cost savings. Many insurance providers offer discounts when businesses purchase multiple policies, such as combining general liability insurance with professional liability insurance or workers’ compensation insurance. Bundling can provide comprehensive coverage while reducing the overall insurance costs.

Improving Risk Management Practices

Implementing robust risk management practices can not only mitigate potential losses but also lead to lower insurance premiums. By demonstrating a commitment to safety, businesses can reduce the likelihood of claims and, consequently, lower their insurance costs. This may involve investing in employee training, implementing safety protocols, and regularly reviewing and updating risk management strategies.

Maintaining a Clean Claims Record

A business’s claims history is a critical factor in determining insurance premiums. To keep insurance costs down, it’s essential to maintain a clean claims record. This involves promptly reporting and resolving claims, as well as taking steps to prevent future claims. By demonstrating responsible claims management, businesses can signal to insurers that they are a low-risk entity, potentially leading to more favorable insurance rates.

Seeking Professional Guidance

Navigating the complex world of company insurance can be challenging, especially for businesses that are new to the process or have unique insurance needs. In such cases, seeking guidance from insurance professionals, such as brokers or consultants, can be invaluable. These experts can help businesses assess their coverage needs, compare quotes, and negotiate the best possible rates. They can also provide ongoing support and advice to ensure that a business’s insurance coverage remains adequate and cost-effective over time.

Case Studies: Real-World Examples of Company Insurance Costs

To illustrate the variations in company insurance costs and the factors that influence them, let’s explore some real-world examples:

Example 1: Construction Company

A small construction company based in a high-risk urban area faces significant insurance costs due to the inherent risks associated with the industry. The company requires comprehensive coverage, including general liability insurance, workers’ compensation insurance, and commercial auto insurance. With a history of frequent claims, the company’s insurance premiums are relatively high, averaging $10,000 annually.

Example 2: Software Development Startup

A software development startup operating in a low-risk suburban area enjoys more affordable insurance rates. The company’s primary insurance needs include general liability insurance and professional liability insurance to protect against potential errors and omissions. With a clean claims record and robust safety measures in place, the startup pays approximately $2,500 annually for its insurance coverage.

Example 3: Retail Store Chain

A large retail store chain with multiple locations across the country faces complex insurance needs. The chain requires general liability insurance, property insurance, and product liability insurance to protect against a wide range of potential risks. With a strong safety record and a commitment to risk management, the chain is able to negotiate competitive insurance rates, paying an average of $50,000 annually for its comprehensive coverage.

Conclusion: Navigating the World of Company Insurance Costs

The cost of company insurance is a critical consideration for any business, as it directly impacts a company’s financial health and stability. By understanding the factors that influence insurance costs and employing strategic approaches to obtaining coverage, businesses can navigate the complex world of insurance with confidence. Whether it’s assessing coverage needs, comparing quotes, or implementing robust risk management practices, businesses can ensure they are adequately protected while maintaining a cost-effective insurance strategy.

As the business landscape continues to evolve, staying informed about insurance trends and best practices is essential. By staying proactive and adaptable, businesses can secure the insurance coverage they need to thrive, even in the face of changing risks and challenges.

How can businesses reduce their company insurance costs without compromising coverage?

+Businesses can explore various strategies to reduce insurance costs without sacrificing coverage. These include conducting a thorough risk assessment to identify essential coverage needs, comparing quotes from multiple insurers, bundling policies with a single provider, and implementing robust risk management practices to mitigate potential losses. Additionally, maintaining a clean claims record and seeking professional guidance from insurance brokers or consultants can help businesses negotiate more favorable rates.

Are there any government programs or subsidies available to help businesses with insurance costs?

+Some governments offer programs or subsidies to support businesses with insurance costs, particularly for small businesses or those in specific industries. These programs may provide grants, tax incentives, or reduced insurance rates. It’s advisable for businesses to research and inquire about such programs at the local, state, or federal level to determine their eligibility and potential benefits.

How often should businesses review and update their insurance coverage?

+Businesses should review their insurance coverage regularly, ideally on an annual basis or whenever significant changes occur in their operations, risk profile, or coverage needs. Regular reviews ensure that businesses remain adequately protected and can identify opportunities to optimize their insurance strategies. It’s essential to stay up-to-date with industry trends, regulatory changes, and emerging risks to make informed decisions about insurance coverage.