How Much Is Health Insurance Out Of Pocket

Health insurance, a vital component of modern healthcare systems, plays a significant role in safeguarding individuals and families from the financial burdens of medical expenses. While health insurance offers protection, the out-of-pocket costs associated with it are an essential consideration for anyone navigating the healthcare landscape. In this comprehensive guide, we will delve into the intricacies of health insurance out-of-pocket expenses, exploring the various factors that influence these costs and providing valuable insights to help you make informed decisions about your healthcare coverage.

Understanding Health Insurance Out-of-Pocket Costs

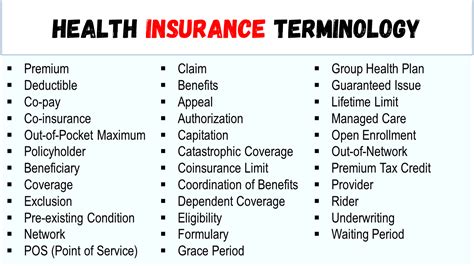

Health insurance out-of-pocket expenses refer to the portion of healthcare costs that an individual is responsible for paying directly, without reimbursement from the insurance provider. These expenses typically include deductibles, copayments, and coinsurance, which can vary depending on the specific insurance plan and the services utilized.

Key Components of Out-of-Pocket Costs

- Deductibles: A deductible is the amount you must pay out of pocket before your insurance coverage kicks in. Deductibles can range from a few hundred dollars to several thousand dollars, and they reset annually.

- Copayments: Copays are fixed amounts you pay for covered services, such as doctor visits or prescriptions. Copay amounts vary based on the service and your insurance plan.

- Coinsurance: Coinsurance is the percentage of the cost you pay for covered services after meeting your deductible. For instance, if your coinsurance is 20%, you pay 20% of the cost, and your insurance covers the remaining 80%.

Factors Influencing Out-of-Pocket Expenses

The amount you pay out of pocket for health insurance can vary significantly and is influenced by several key factors:

Plan Type and Coverage Level

The type of health insurance plan you choose plays a crucial role in determining your out-of-pocket expenses. Generally, plans with lower premiums often have higher deductibles and out-of-pocket maximums. On the other hand, plans with higher premiums may offer lower deductibles and more comprehensive coverage.

Network and Provider Choice

Health insurance plans typically have networks of preferred providers, including doctors, hospitals, and specialists. Utilizing in-network providers can result in lower out-of-pocket costs compared to using out-of-network services, which may incur higher copays or coinsurance.

Medical Needs and Utilization

Your personal medical needs and the frequency of healthcare services you require directly impact your out-of-pocket expenses. Individuals with ongoing medical conditions or those who frequently access healthcare services may incur higher out-of-pocket costs, especially if they haven't met their deductible yet.

Prescription Drug Coverage

Prescription medications can be a significant expense, and the coverage and out-of-pocket costs for prescriptions vary widely among insurance plans. Some plans offer preferred drug lists with lower copays, while others may require higher coinsurance for certain medications.

| Plan Type | Average Out-of-Pocket Costs |

|---|---|

| High Deductible Health Plan (HDHP) | $4,000 - $6,000 annually |

| Preferred Provider Organization (PPO) | $2,000 - $4,000 annually |

| Health Maintenance Organization (HMO) | $1,500 - $3,000 annually |

Maximizing Cost Savings and Coverage

Managing your health insurance out-of-pocket expenses effectively requires a strategic approach. Here are some tips to help you optimize your coverage and minimize costs:

Choose the Right Plan

Consider your medical needs and financial situation when selecting a health insurance plan. If you anticipate significant medical expenses, a plan with a lower deductible and higher premiums may be more suitable. Conversely, if you're generally healthy and want to save on premiums, a plan with a higher deductible and lower premiums could be a better fit.

Utilize In-Network Providers

Staying within your insurance plan's network can significantly reduce your out-of-pocket costs. Check with your insurance provider to confirm which providers are in-network and take advantage of their discounted rates.

Manage Prescription Costs

Prescription medications can be costly, but there are strategies to manage these expenses. Explore generic drug options, which are typically more affordable than brand-name medications. Additionally, some insurance plans offer mail-order pharmacy services, which can provide savings on prescription refills.

Preventive Care and Wellness Programs

Many insurance plans cover preventive care services, such as annual check-ups, screenings, and vaccinations, at no additional cost. Taking advantage of these services can help identify potential health issues early on and potentially reduce future medical expenses.

Review Your Benefits and Exclusions

Familiarize yourself with the benefits and exclusions of your insurance plan. Understanding what services are covered and which ones are not can help you make informed decisions about your healthcare choices and avoid unexpected out-of-pocket expenses.

Future Trends and Considerations

The landscape of health insurance is continually evolving, and several trends and considerations may impact out-of-pocket expenses in the future:

Telehealth and Virtual Care

The rise of telehealth services has made accessing healthcare more convenient and cost-effective. Many insurance plans now cover telehealth visits, reducing the need for in-person appointments and associated travel costs.

High-Deductible Health Plans (HDHPs)

HDHPs, often paired with Health Savings Accounts (HSAs), are becoming increasingly popular. These plans offer lower premiums but higher deductibles, providing individuals with more control over their healthcare spending. HSAs allow you to save money tax-free for medical expenses, further reducing out-of-pocket costs.

Value-Based Care Models

Value-based care models focus on improving patient outcomes and reducing healthcare costs. These models incentivize providers to deliver high-quality, cost-effective care, which can potentially lower out-of-pocket expenses for patients.

Consumer-Directed Health Plans (CDHPs)

CDHPs are designed to give consumers more control over their healthcare choices and costs. These plans typically have higher deductibles and out-of-pocket maximums but offer greater flexibility and the potential for cost savings through informed decision-making.

Frequently Asked Questions

What is the average out-of-pocket maximum for health insurance plans?

+The average out-of-pocket maximum varies depending on the plan type and coverage level. It can range from $4,000 to $8,000 annually for individual plans and may be higher for family plans.

Are there any ways to reduce out-of-pocket costs for prescription medications?

+Yes, exploring generic drug options, utilizing mail-order pharmacies, and considering prescription savings programs or discounts offered by pharmacies can help reduce prescription costs.

Can I negotiate my out-of-pocket expenses with healthcare providers?

+In some cases, it may be possible to negotiate out-of-pocket expenses, especially if you are self-pay or have a high-deductible plan. Contacting your healthcare provider to discuss payment plans or discounts could be an option.

Are there any tax benefits associated with health insurance out-of-pocket expenses?

+Yes, certain out-of-pocket medical expenses, including deductibles, copays, and coinsurance, may be tax-deductible if they exceed a specified threshold. Consult a tax professional for guidance on eligible expenses and deductions.

How can I estimate my annual out-of-pocket expenses for health insurance?

+Estimating annual out-of-pocket expenses involves considering your expected medical needs, the cost of in-network services, and your plan's deductibles, copays, and coinsurance rates. Online tools and calculators can assist in making these estimates.

Understanding the nuances of health insurance out-of-pocket costs is crucial for making informed decisions about your healthcare coverage. By carefully selecting a plan, utilizing cost-saving strategies, and staying informed about evolving trends, you can effectively manage your healthcare expenses and ensure access to the care you need.