How Much Is Insurance For Car

The cost of car insurance is a topic that often sparks curiosity and concern among vehicle owners. With numerous factors influencing insurance premiums, it can be challenging to determine an exact figure without considering individual circumstances. However, understanding the key elements that impact insurance rates can provide valuable insights into the financial commitment associated with insuring a vehicle.

Unraveling the Cost of Car Insurance

The price tag attached to car insurance policies can vary significantly, influenced by a multitude of factors. These include the make and model of the vehicle, the driver’s age and driving history, the coverage limits chosen, and the geographic location. Each of these elements plays a crucial role in determining the final insurance premium.

Vehicle Characteristics and Insurance Premiums

The type of car you drive is a significant determinant of insurance costs. Insurance providers consider factors such as the vehicle’s safety features, repair costs, and its susceptibility to theft or vandalism. Generally, newer and more expensive vehicles tend to attract higher insurance premiums due to the higher costs associated with their repair or replacement.

| Vehicle Make and Model | Average Annual Insurance Premium |

|---|---|

| Toyota Corolla | $1,200 |

| Honda Civic | $1,150 |

| Ford Mustang | $1,450 |

| Tesla Model 3 | $1,800 |

In the table above, you can see how the average annual insurance premiums differ for various vehicle makes and models. It's evident that factors like the vehicle's make, model, and even the specific trim level can significantly impact insurance costs.

Driver Profile and Insurance Rates

The driver’s age and driving history are paramount when insurance providers calculate premiums. Younger drivers, particularly those under 25 years old, tend to face higher insurance costs due to their limited driving experience and higher propensity for accidents. Conversely, drivers with a clean driving record and several years of driving experience often benefit from lower insurance rates.

Additionally, the number of years a driver has been continuously insured can impact their insurance premiums. Insurers view long-term, uninterrupted insurance coverage as a sign of stability and responsibility, which can lead to discounts or lower rates.

Coverage Limits and Additional Features

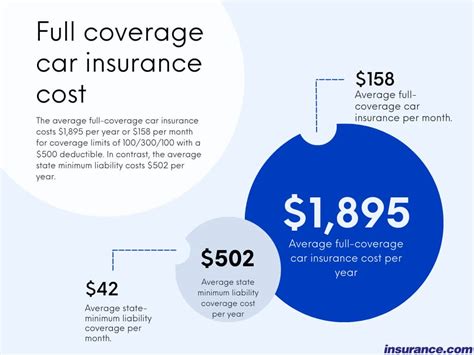

The level of coverage chosen is another critical factor in determining insurance costs. Comprehensive and collision coverage, which provide protection for damages to your vehicle, typically come at a higher cost compared to liability-only coverage. Additionally, optional add-ons like rental car reimbursement or roadside assistance can further increase insurance premiums.

It's essential to strike a balance between the coverage you need and the cost you're willing to pay. While comprehensive coverage offers extensive protection, it may not be necessary for older vehicles or those with low market value.

Location-Based Variations

Insurance rates can vary significantly based on the geographic location of the insured vehicle. Factors such as population density, traffic congestion, crime rates, and even weather conditions can influence insurance premiums. Urban areas, for instance, often have higher insurance costs due to increased risks of accidents and car theft.

Furthermore, the state's insurance regulations and the competition among insurance providers can also impact insurance rates. Some states have stricter insurance requirements, which can lead to higher average premiums.

Tips for Managing Car Insurance Costs

While car insurance is a necessary financial commitment for vehicle owners, there are strategies to help manage and potentially reduce insurance costs.

- Shop Around and Compare Quotes: Obtain quotes from multiple insurance providers to compare rates and coverage options. Online insurance marketplaces or insurance brokers can be valuable resources for this.

- Bundle Policies: Consider bundling your car insurance with other insurance policies, such as home or renters' insurance. Many insurance providers offer discounts for bundling multiple policies.

- Maintain a Clean Driving Record: A clean driving record can lead to significant savings on insurance premiums. Avoid traffic violations and accidents to keep your insurance costs down.

- Consider Higher Deductibles: Opting for a higher deductible (the amount you pay out-of-pocket before insurance coverage kicks in) can lower your insurance premiums. However, ensure that you can afford the deductible in the event of a claim.

- Explore Discounts: Insurance providers often offer discounts for various reasons, such as good student discounts, safe driver discounts, loyalty discounts, or discounts for completing defensive driving courses. Ask your insurance provider about available discounts and consider if you qualify for any.

The Bottom Line

Determining the exact cost of car insurance is a complex process influenced by a myriad of factors. While it’s challenging to provide an exact figure without considering individual circumstances, understanding the key drivers of insurance premiums can help vehicle owners make informed decisions about their insurance coverage and costs.

By considering factors like vehicle characteristics, driver profile, coverage limits, and location, you can gain a clearer understanding of the insurance landscape and make choices that align with your needs and budget. Additionally, implementing strategies to manage insurance costs can help ensure you're getting the best value for your insurance premium.

Frequently Asked Questions

What is the average cost of car insurance in the United States?

+

The average cost of car insurance in the U.S. varies widely based on factors such as location, vehicle type, and driving history. According to recent data, the national average for car insurance premiums is around 1,674 per year, or approximately 140 per month. However, this figure can range significantly, with some states having average premiums as low as 1,000 per year and others surpassing 2,000 per year.

Are there ways to reduce my car insurance premiums?

+

Yes, there are several strategies you can employ to potentially reduce your car insurance premiums. These include shopping around for quotes from different insurers, maintaining a clean driving record, increasing your deductible, bundling your insurance policies, and exploring discounts such as safe driver or loyalty discounts. Additionally, some insurers offer usage-based insurance programs that monitor your driving behavior and reward safe driving habits with lower premiums.

How does my credit score impact my car insurance rates?

+

In many states, insurers are allowed to use credit-based insurance scores when determining car insurance rates. Generally, individuals with higher credit scores tend to receive lower insurance premiums, as they are seen as more financially responsible and less likely to file claims. However, the impact of credit scores on insurance rates can vary, and some states have implemented regulations to limit the use of credit scores in insurance pricing.