How Much Is Insurance For Motorcycles

Insurance Costs for Motorcycles: Factors, Comparisons, and Tips

Motorcycle insurance is an essential aspect of responsible riding, offering financial protection and peace of mind. However, the cost of insurance for motorcycles can vary significantly depending on various factors. In this comprehensive guide, we delve into the world of motorcycle insurance, exploring the key determinants of premiums, providing real-world examples, and offering expert tips to help riders secure the best coverage at the right price.

Understanding the Factors Influencing Motorcycle Insurance Costs

The cost of insuring a motorcycle is influenced by a multitude of factors, each playing a role in determining the final premium. Here’s a breakdown of the primary considerations:

Rider Profile and History

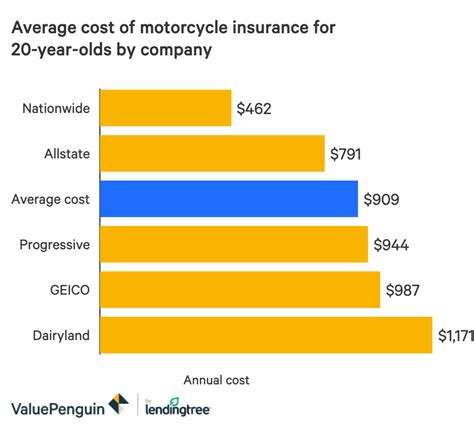

One of the most significant factors is the rider’s profile and history. Insurance providers carefully assess an individual’s age, gender, riding experience, and claim history. For instance, younger riders, especially males, often face higher premiums due to their perceived risk profile. Additionally, a history of traffic violations or accidents can lead to increased insurance costs. On the other hand, experienced riders with a clean record may enjoy more favorable rates.

Motorcycle Type and Usage

The type of motorcycle and its intended usage are crucial factors. High-performance bikes, such as sports models, generally attract higher insurance premiums due to their association with speed and potential for accidents. Conversely, standard or cruiser motorcycles may be more affordable to insure. Furthermore, the primary purpose of the motorcycle, whether for commuting, touring, or leisure, can impact the cost, as insurance providers consider the potential risks associated with different riding styles.

| Motorcycle Type | Average Insurance Cost |

|---|---|

| Sports Bike | $800 - $1,200 annually |

| Cruiser/Standard | $500 - $800 annually |

| Touring Bike | $600 - $900 annually |

Geographic Location and Riding Environment

The geographic location where the motorcycle is primarily ridden can significantly influence insurance costs. Regions with higher population densities, congested traffic, or a history of frequent accidents may result in increased premiums. Additionally, the climate and riding conditions play a role, as adverse weather or challenging terrain can impact the likelihood of accidents.

Coverage Options and Deductibles

The level of coverage chosen by the rider is a key determinant of insurance costs. Comprehensive and collision coverage, which protect against damage to the motorcycle, typically increase premiums. On the other hand, liability-only coverage, which provides protection for property damage and bodily injury to others, may be more affordable. Furthermore, selecting higher deductibles can reduce monthly premiums but require the rider to pay a larger portion out of pocket in the event of a claim.

Comparing Motorcycle Insurance Premiums: Real-World Examples

To illustrate the variability in motorcycle insurance costs, let’s explore some real-world examples. These scenarios provide a glimpse into the factors at play and the potential ranges of premiums.

Scenario 1: Experienced Rider with a Standard Motorcycle

John, a 40-year-old male with 20 years of riding experience, owns a standard motorcycle. He primarily uses it for leisure rides on weekends. With a clean driving record and no previous claims, John’s insurance provider offers him an annual premium of $650 for comprehensive coverage. This competitive rate reflects his responsible riding history and the relatively low-risk profile of his motorcycle type and usage.

Scenario 2: Young Rider with a Sports Bike

Emma, an 18-year-old female, recently purchased her first motorcycle - a high-performance sports bike. Due to her young age and lack of riding experience, insurance providers consider her a higher risk. Despite her clean driving record, Emma’s insurance premium for comprehensive coverage comes in at $1,100 annually. The increased cost reflects the higher potential for accidents associated with sports bikes and the demographic factors.

Scenario 3: Commuter with a Scooter

Michael, a 35-year-old professional, relies on his scooter for daily commuting. Given the low-power nature of his scooter and its primary use for commuting, insurance providers view him as a lower-risk rider. Michael’s insurance premium for liability-only coverage is a reasonable $450 annually, making it an affordable option for his daily transportation needs.

Tips for Securing the Best Motorcycle Insurance at the Right Price

Navigating the world of motorcycle insurance can be complex, but with the right strategies, riders can find coverage that suits their needs and budget. Here are some expert tips to consider:

- Shop Around: Obtain quotes from multiple insurance providers to compare rates and coverage options. Online comparison tools can be a valuable resource for this.

- Bundle Policies: Consider bundling your motorcycle insurance with other policies, such as auto or home insurance, to potentially secure discounts.

- Choose the Right Coverage: Assess your riding needs and financial situation to determine the appropriate level of coverage. Opt for comprehensive coverage if you ride frequently or have an expensive motorcycle.

- Increase Deductibles: Selecting higher deductibles can lower your monthly premiums. However, ensure you have the financial means to cover the deductible in the event of a claim.

- Maintain a Clean Record: A clean driving record and responsible riding behavior can lead to lower insurance costs over time. Avoid traffic violations and accidents to keep your premiums in check.

- Explore Discounts: Many insurance providers offer discounts for various reasons, such as completing a riding safety course, having anti-theft devices, or being a member of certain organizations. Inquire about available discounts to reduce your premiums.

- Review Annually: Regularly review your insurance policy and shop around each year to ensure you're getting the best rate and coverage. Market conditions and personal circumstances can change, so it's essential to stay informed.

Conclusion: Navigating the Road to Affordable Motorcycle Insurance

Motorcycle insurance is a vital aspect of responsible riding, providing financial protection and peace of mind. By understanding the factors that influence insurance costs, comparing real-world examples, and implementing expert tips, riders can navigate the path to securing affordable and comprehensive coverage. Remember, the key is to strike a balance between adequate protection and a budget-friendly premium, ensuring a safe and enjoyable riding experience.

How much does motorcycle insurance typically cost per month?

+The average monthly cost of motorcycle insurance varies depending on several factors, including the rider’s profile, motorcycle type, coverage chosen, and geographic location. As a rough estimate, riders can expect to pay anywhere from 50 to 100 per month for basic liability coverage, while comprehensive coverage could range from 80 to 150 or more per month. However, these figures can vary significantly, and it’s essential to obtain personalized quotes to get an accurate estimate.

Are there any ways to lower motorcycle insurance costs without compromising coverage?

+Absolutely! One effective strategy is to increase your deductible, which can significantly reduce your monthly premiums. Additionally, maintaining a clean driving record and taking advantage of available discounts, such as for completing safety courses or having anti-theft devices, can help lower costs. Bundling your motorcycle insurance with other policies, like auto or home insurance, may also lead to savings.

What factors can cause my motorcycle insurance premiums to increase over time?

+Several factors can lead to increases in motorcycle insurance premiums. These include a history of traffic violations or accidents, changes in your geographic location (e.g., moving to an area with higher accident rates), and increases in the cost of repairs or medical expenses. Additionally, insurance providers may periodically review and adjust rates based on market conditions and claims experience.