How Much Is Liability Insurance For A Small Business

Liability insurance is an essential aspect of running a small business, as it provides protection against potential financial losses arising from unexpected events or accidents. While the cost of liability insurance can vary significantly depending on various factors, understanding these variables can help small business owners make informed decisions when it comes to securing adequate coverage.

In this comprehensive guide, we will delve into the world of liability insurance for small businesses, exploring the key factors that influence its cost and providing valuable insights to help business owners navigate this crucial aspect of risk management.

The Impact of Business Type and Size

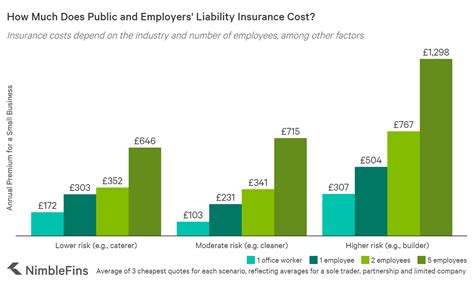

One of the primary factors determining the cost of liability insurance is the nature and size of your business. Different industries carry varying levels of risk, and insurance providers assess these risks when calculating premiums. For instance, a manufacturing business may face higher liability risks due to the potential for workplace accidents or product defects, whereas a consulting firm may have lower risk exposure.

Additionally, the size of your business plays a role. Larger businesses with more employees, assets, and revenue typically attract higher insurance premiums due to the increased potential for liability claims. Small businesses, on the other hand, may enjoy more competitive rates, but it's essential to ensure that the coverage meets their specific needs.

Example: Liability Insurance for a Restaurant

Consider a small restaurant located in a busy urban area. The business owner must account for various liability risks, including slip and fall accidents, food-borne illnesses, or even third-party property damage caused by delivery vehicles. The cost of liability insurance for this restaurant would depend on factors such as the size of the dining area, the number of employees, and the types of food served.

Coverage Limits and Deductibles

The level of coverage you choose directly impacts the cost of your liability insurance. Higher coverage limits, which provide greater financial protection in the event of a claim, generally result in higher premiums. Conversely, opting for lower coverage limits can reduce costs but may leave your business vulnerable to significant out-of-pocket expenses in the event of a major incident.

Deductibles also play a crucial role. A higher deductible means you pay more out of pocket before the insurance coverage kicks in, potentially reducing your premium. However, it's essential to strike a balance, as a high deductible may strain your business's cash flow in the event of a claim.

Comparative Analysis: Coverage Options

| Coverage Limit | Premium | Deductible |

|---|---|---|

| 1,000,000</td> <td>1,200 annually | 500</td> </tr> <tr> <td>2,000,000 | 1,800 annually</td> <td>1,000 |

| 5,000,000</td> <td>3,000 annually | $2,000 |

Historical Claims and Risk Management

Insurance providers closely examine a business’s history of claims and risk management practices when calculating premiums. A business with a history of frequent claims may be seen as a higher risk, leading to increased insurance costs. Conversely, businesses that demonstrate strong risk management strategies, such as comprehensive safety protocols and employee training, may enjoy lower premiums.

Implementing effective risk management measures not only reduces the likelihood of claims but can also improve your insurance rates over time. Regularly reviewing and updating your risk management plan can be a proactive step toward maintaining affordable liability insurance.

Real-World Example: Risk Management Strategies

Imagine a small construction company that has implemented rigorous safety protocols, including regular equipment inspections, thorough employee training, and strict adherence to industry safety standards. By demonstrating a strong commitment to risk management, this company may be rewarded with lower liability insurance premiums, as insurance providers recognize the reduced likelihood of costly accidents.

Location and Geographic Factors

The location of your business can significantly influence the cost of liability insurance. Areas with higher crime rates, natural disaster risks, or a higher density of population and traffic may carry increased liability risks. Insurance providers often consider these geographic factors when assessing premiums.

Additionally, local laws and regulations can impact insurance costs. Some regions may have stricter liability standards or require specific types of coverage, which can affect the overall cost of your policy.

Regional Comparison: Liability Insurance Costs

| Region | Average Annual Premium |

|---|---|

| Urban Center | 2,500</td> </tr> <tr> <td>Suburban Area</td> <td>1,800 |

| Rural Community | $1,200 |

Insurance Provider and Policy Type

The insurance provider you choose can also impact the cost of liability insurance. Different providers offer varying levels of coverage, endorsements, and pricing structures. Shopping around and comparing quotes from multiple insurers can help you find the best value for your small business.

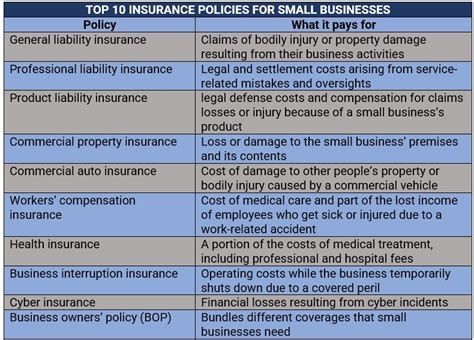

Furthermore, the type of liability insurance policy you select can influence costs. General liability insurance, which covers a broad range of common risks, is often the foundation of a small business's insurance portfolio. However, depending on your industry and specific risks, you may also require specialized policies such as professional liability insurance, product liability insurance, or cyber liability insurance.

Expert Tip: Policy Customization

While it’s tempting to opt for a basic general liability policy, consider the unique risks your business faces. Customizing your policy with relevant endorsements or specialized coverage can provide more comprehensive protection, potentially saving you from significant out-of-pocket expenses in the event of a claim.

The Future of Liability Insurance for Small Businesses

As the business landscape continues to evolve, so too does the world of insurance. Small business owners can expect to see increasing emphasis on data-driven risk assessment and personalized insurance solutions. Insurtech innovations, such as AI-powered risk assessment tools and usage-based insurance models, may offer more affordable and tailored coverage options in the future.

Additionally, the growing awareness of environmental, social, and governance (ESG) factors may influence the liability insurance landscape. Businesses that demonstrate a commitment to sustainability and ethical practices may find themselves rewarded with more favorable insurance terms.

Conclusion

Understanding the factors that influence the cost of liability insurance is crucial for small business owners seeking to protect their ventures without breaking the bank. By carefully assessing their specific risks, implementing effective risk management strategies, and shopping around for the right coverage and provider, small businesses can navigate the world of liability insurance with confidence and ensure their financial stability.

How can I reduce the cost of liability insurance for my small business?

+

To lower your liability insurance costs, consider increasing your deductible, negotiating with your insurer for discounts or endorsements, and implementing robust risk management strategies to demonstrate your commitment to safety and reduce the likelihood of claims.

What are some common exclusions in liability insurance policies for small businesses?

+

Common exclusions may include intentional acts, contract disputes, certain types of professional services, and pollution-related incidents. It’s crucial to review your policy carefully to understand any exclusions that may apply to your business.

How often should I review and update my liability insurance coverage?

+

It’s recommended to review your liability insurance coverage annually or whenever significant changes occur in your business, such as expanding operations, adding new products or services, or hiring additional employees. Regular reviews ensure your coverage remains adequate and aligned with your evolving business needs.