How Much Is Medical Insurance For 1 Person

The cost of medical insurance for an individual can vary significantly based on numerous factors, including age, location, coverage needs, and the chosen insurance plan. Understanding the variables that impact insurance rates is crucial for individuals seeking comprehensive healthcare coverage at a reasonable cost.

Factors Influencing Medical Insurance Costs

Several key factors contribute to the cost of medical insurance for individuals:

Age and Health Status

Insurance premiums often increase with age, as older individuals generally require more healthcare services. Additionally, pre-existing health conditions or chronic illnesses can impact insurance costs, as insurers may offer higher rates to cover the potential risks associated with these conditions.

Geographical Location

The cost of living and the availability of healthcare services in a specific area can influence insurance rates. Urban areas with higher healthcare costs may result in more expensive insurance plans.

Coverage Level and Deductibles

The level of coverage an individual chooses, including the type of healthcare services covered and the annual or lifetime maximums, directly affects insurance costs. Additionally, selecting a plan with a higher deductible can lower monthly premiums but may require more out-of-pocket expenses when accessing healthcare services.

Insurance Company and Plan Type

Different insurance companies offer various plans with unique features and price points. The chosen insurer and plan type, such as PPO, HMO, or EPO, can significantly impact the overall cost of medical insurance.

Lifestyle and Risk Factors

Certain lifestyle choices and risk factors, such as smoking or engaging in high-risk activities, can increase insurance premiums. Insurers may assess these factors when determining an individual’s insurance rates.

Estimating Medical Insurance Costs for an Individual

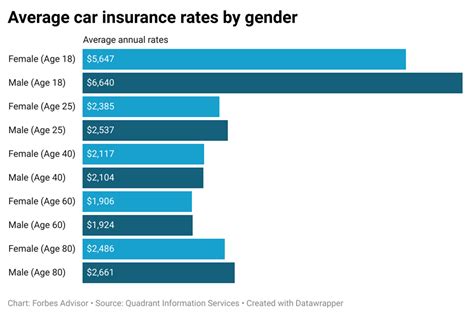

While it’s challenging to provide an exact cost estimate without specific details, we can explore average insurance rates and factors that influence these costs. According to recent data, the average annual premium for individual medical insurance in the United States ranges from approximately 4,500 to 7,500, with significant variations based on the factors mentioned earlier.

For example, a young adult in good health living in a metropolitan area may expect to pay around $3,000 to $5,000 annually for a basic health insurance plan. In contrast, an older individual with pre-existing health conditions in the same area might pay upwards of $10,000 or more per year for comprehensive coverage.

| Age Group | Average Annual Premium |

|---|---|

| Young Adult (18-29) | $3,000 - $5,000 |

| Adult (30-49) | $4,000 - $6,500 |

| Senior (50+) | $5,500 - $10,000 |

Maximizing Cost-Effectiveness in Medical Insurance

To obtain the most cost-effective medical insurance coverage, individuals can consider the following strategies:

- Comparing quotes from multiple insurance providers to find the best rates for their needs.

- Exploring government-sponsored insurance programs like Medicaid or Medicare if eligible.

- Reviewing insurance plans annually and considering switching to a more suitable or cost-effective option.

- Understanding the impact of deductibles and choosing a plan that aligns with their healthcare needs and budget.

- Taking advantage of employer-sponsored insurance plans, which often offer competitive rates.

Conclusion: The Importance of Personalized Insurance Solutions

Determining the cost of medical insurance for an individual is a complex process influenced by numerous factors. While averages provide a general understanding, personalized quotes and comprehensive research are essential to finding the most suitable and cost-effective insurance plan. By considering individual needs, lifestyle, and financial circumstances, individuals can make informed decisions to secure comprehensive healthcare coverage at a reasonable cost.

How do insurance companies determine premiums for individuals?

+Insurance companies use a variety of factors, including age, health status, location, and coverage needs, to assess the risk associated with an individual. This risk assessment is then used to determine the premium for the insurance plan.

Are there any government programs that offer medical insurance for individuals?

+Yes, in the United States, there are government-sponsored programs like Medicaid and Medicare that provide medical insurance for eligible individuals. These programs offer affordable or free healthcare coverage to specific demographic groups.

What is the difference between PPO, HMO, and EPO insurance plans?

+PPO (Preferred Provider Organization) plans offer more flexibility, allowing individuals to choose healthcare providers within or outside the network. HMO (Health Maintenance Organization) plans typically require individuals to select a primary care physician and receive referrals for specialist care. EPO (Exclusive Provider Organization) plans limit coverage to a specific network of providers, similar to PPOs but without the option for out-of-network care.