How Much Is Medical Insurance In California

Medical insurance, also known as health insurance, is an essential aspect of healthcare coverage, providing individuals and families with financial protection and access to medical services. In the state of California, healthcare insurance plays a vital role in ensuring residents have access to quality medical care without facing significant financial burdens. This comprehensive guide aims to delve into the world of healthcare insurance in California, exploring the factors that influence policy costs, the different types of plans available, and the steps individuals can take to find affordable coverage tailored to their unique needs.

Understanding the Cost of Medical Insurance in California

The cost of healthcare insurance in California, as with any other state, is influenced by a multitude of factors. These factors contribute to the overall premium rates and can vary significantly depending on individual circumstances. Here’s a breakdown of the key elements that impact healthcare insurance costs in the Golden State:

Demographic Factors

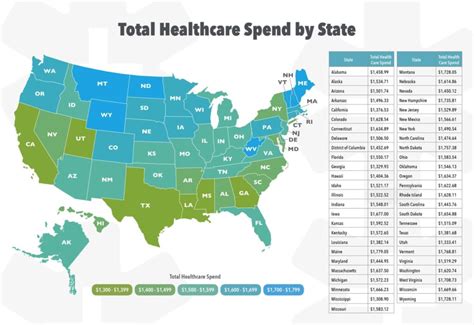

Healthcare insurance premiums are often determined based on an individual’s demographic information. In California, factors such as age, gender, and location play a significant role in policy costs. For instance, younger individuals generally pay lower premiums compared to older adults, as they are statistically less likely to require extensive medical care. Additionally, certain areas within the state may have higher healthcare insurance costs due to the concentration of medical facilities or the prevalence of specific health conditions.

Medical History and Health Status

An individual’s medical history and current health status are crucial considerations when determining healthcare insurance premiums. Pre-existing conditions, such as diabetes or heart disease, can lead to higher policy costs, as these conditions often require ongoing medical treatment and management. Insurers carefully evaluate an applicant’s medical history to assess the potential risk associated with covering their healthcare needs. It’s important to note that, under the Affordable Care Act (ACA), insurers cannot deny coverage or charge higher premiums solely based on pre-existing conditions.

Type of Plan and Coverage Options

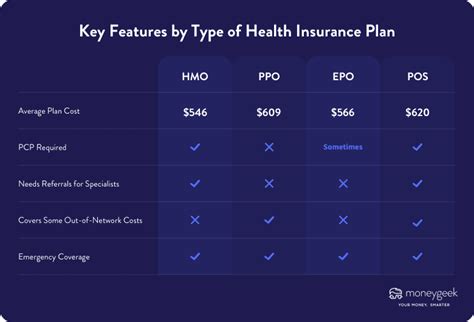

The type of healthcare insurance plan chosen significantly impacts the overall cost. California offers a range of plan options, including Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Exclusive Provider Organizations (EPOs), and more. Each plan type has its own network of healthcare providers and coverage limitations, which can affect the premium rates. Additionally, the level of coverage desired, such as the deductible, copayments, and out-of-pocket maximums, will influence the cost of the policy.

| Plan Type | Description |

|---|---|

| HMO | Offers comprehensive coverage with a network of providers and requires a primary care physician referral for specialist visits. |

| PPO | Provides more flexibility in choosing healthcare providers, often with higher out-of-pocket costs. |

| EPO | Similar to a PPO, but with a more limited network of providers and no out-of-network coverage. |

Subsidies and Tax Credits

For individuals and families with limited financial means, California offers various subsidies and tax credits to make healthcare insurance more affordable. The state’s insurance marketplace, Covered California, provides financial assistance to eligible residents based on their income. This assistance can significantly reduce the cost of monthly premiums, making healthcare insurance more accessible to those who need it most.

Exploring Healthcare Insurance Options in California

California boasts a diverse range of healthcare insurance plans and providers, offering residents a wide array of choices to find the coverage that best suits their needs. Here’s an overview of the primary types of plans available in the state:

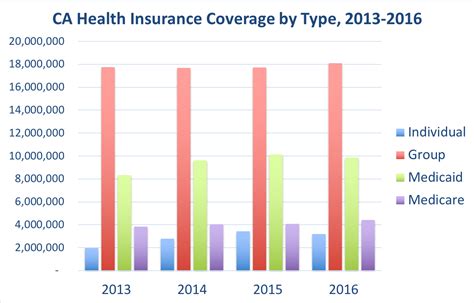

Individual and Family Plans

Individual and family plans are designed to provide healthcare coverage for single individuals or entire households. These plans offer flexibility in terms of coverage options and are ideal for those who are self-employed, work for small businesses that don’t offer group insurance, or are in between jobs. In California, individual and family plans can be purchased directly from insurance companies or through the state’s insurance marketplace, Covered California.

Group Insurance Plans

Group insurance plans are typically offered by employers as a benefit to their employees. These plans are often more cost-effective due to the larger pool of individuals covered. In California, employers with 2 or more full-time equivalent employees are required to offer healthcare insurance or face penalties under the state’s Small Business Health Options Program (SHOP). Group plans provide comprehensive coverage and often include additional benefits such as dental and vision insurance.

Medicaid and Medi-Cal

Medicaid, a federal program, and Medi-Cal, its California counterpart, provide healthcare coverage for low-income individuals and families. These programs offer comprehensive benefits, including doctor visits, hospital stays, prescription drugs, and more. Eligibility for Medicaid/Medi-Cal is determined based on income and family size, with specific guidelines set by the state. California has expanded its Medi-Cal program to cover a larger portion of the population, making healthcare insurance accessible to more residents.

Medicare Advantage Plans

Medicare Advantage plans, also known as Part C, are an alternative to original Medicare (Parts A and B). These plans are offered by private insurance companies and must provide the same benefits as original Medicare. However, Medicare Advantage plans often include additional benefits, such as prescription drug coverage, dental, and vision services. In California, Medicare Advantage plans are a popular choice for individuals eligible for Medicare, providing a more comprehensive and often more cost-effective healthcare insurance option.

Steps to Find Affordable Medical Insurance in California

Navigating the world of healthcare insurance can be daunting, but with the right approach and resources, finding affordable coverage in California is achievable. Here’s a step-by-step guide to help you secure the best healthcare insurance policy for your needs:

Assess Your Needs and Budget

Before diving into the world of healthcare insurance, take the time to assess your specific healthcare needs and financial situation. Consider factors such as your current health status, any pre-existing conditions, and the types of medical services you anticipate requiring. Additionally, evaluate your budget and determine how much you can comfortably allocate towards monthly premiums and out-of-pocket costs.

Explore Your Options

California offers a multitude of healthcare insurance plans and providers. Take the time to research and compare different options to find the best fit for your needs. Consider factors such as coverage limits, provider networks, and any additional benefits offered. You can explore plans through the state’s insurance marketplace, Covered California, or directly through insurance companies. Don’t hesitate to reach out to insurance brokers or agents for personalized advice and guidance.

Utilize Financial Assistance

If you’re eligible for financial assistance, be sure to take advantage of the subsidies and tax credits available through Covered California. These financial aids can significantly reduce your monthly premiums, making healthcare insurance more affordable. To determine your eligibility, you’ll need to provide information about your income and family size. Covered California will then calculate the amount of assistance you qualify for, which can be applied directly to your insurance premiums.

Understand Your Plan’s Coverage

Once you’ve selected a healthcare insurance plan, take the time to thoroughly understand the coverage it provides. Review the plan’s summary of benefits and coverage to familiarize yourself with the specifics. This includes understanding the deductible, copayments, and out-of-pocket maximums. Additionally, confirm the plan’s network of healthcare providers to ensure your preferred doctors and facilities are included. By understanding your plan’s coverage, you can make informed decisions about your healthcare and avoid unexpected costs.

Maintain Open Communication

Healthcare insurance can be complex, and it’s essential to maintain open lines of communication with your insurance provider. If you have any questions or concerns about your plan, coverage, or billing, don’t hesitate to reach out to your insurer’s customer support team. They can provide clarification and guidance to ensure you fully understand your coverage and rights as a policyholder. Additionally, stay informed about any changes or updates to your plan, as this can impact your healthcare decisions and financial responsibilities.

The Future of Medical Insurance in California

The landscape of healthcare insurance in California is continually evolving, driven by legislative changes, technological advancements, and shifts in the healthcare industry. Here’s a glimpse into the potential future of healthcare insurance in the Golden State:

Expansion of Coverage Options

California has been at the forefront of expanding healthcare insurance coverage, and this trend is expected to continue. The state’s commitment to ensuring access to quality healthcare for its residents is likely to result in the development of innovative coverage options. This may include the expansion of Medicaid/Medi-Cal eligibility, the introduction of new plan types, and the exploration of alternative payment models to make healthcare more affordable and accessible.

Integration of Technology

Technology is playing an increasingly significant role in the healthcare industry, and this trend is expected to accelerate in the future. The integration of technology into healthcare insurance plans can enhance efficiency, improve patient experiences, and reduce costs. This may involve the use of telemedicine services, mobile health applications, and digital health records, all of which can streamline healthcare delivery and improve overall patient outcomes.

Focus on Preventive Care

Preventive care is a key aspect of maintaining good health and reducing the need for costly medical interventions. California’s healthcare insurance plans are likely to place an even greater emphasis on preventive care in the future. This may include the expansion of coverage for preventive services, such as vaccinations, health screenings, and wellness programs. By prioritizing preventive care, healthcare insurance plans can help individuals stay healthy, detect potential health issues early on, and reduce overall healthcare costs.

Collaborative Care Models

The future of healthcare insurance in California may involve the adoption of collaborative care models, which bring together different healthcare providers to deliver comprehensive care. This approach can improve coordination and communication between healthcare professionals, leading to better patient outcomes. Collaborative care models may include integrated teams of primary care physicians, specialists, and mental health professionals, all working together to provide holistic care to patients.

Addressing Social Determinants of Health

Social determinants of health, such as access to healthy food, safe housing, and economic stability, play a significant role in an individual’s overall health. California’s healthcare insurance plans may increasingly focus on addressing these social determinants to improve health outcomes. This may involve the development of partnerships with community organizations, the integration of social services into healthcare plans, and the promotion of healthy lifestyle choices to prevent chronic diseases.

What is the average cost of medical insurance in California for an individual?

+The average cost of healthcare insurance for an individual in California can vary significantly based on factors such as age, location, and the type of plan chosen. According to recent data, the average monthly premium for an individual plan in California ranges from approximately 400 to 600. However, this can be significantly reduced with the help of financial assistance through Covered California.

Are there any discounts or subsidies available for medical insurance in California?

+Yes, California offers various discounts and subsidies to make healthcare insurance more affordable. Through Covered California, eligible individuals and families can receive financial assistance based on their income. This assistance can significantly reduce monthly premiums, making healthcare insurance more accessible.

How can I find the best medical insurance plan for my needs in California?

+To find the best healthcare insurance plan for your needs in California, it’s important to assess your specific healthcare requirements and budget. Explore different plan options, compare coverage and costs, and consider factors such as provider networks and additional benefits. You can utilize resources like Covered California or seek guidance from insurance brokers to make an informed decision.

What happens if I can’t afford medical insurance in California?

+If you’re unable to afford healthcare insurance in California, there are still options available. The state’s Medicaid/Medi-Cal program provides healthcare coverage for low-income individuals and families. Additionally, Covered California offers financial assistance to eligible residents, which can make healthcare insurance more affordable. It’s important to explore these options and seek guidance to ensure you have access to the healthcare coverage you need.