How Much Is The Car Insurance Per Month

Determining the cost of car insurance per month involves considering various factors that contribute to the overall premium. While it is challenging to provide an exact figure without specific details, we can delve into the key aspects that influence insurance rates and provide a comprehensive analysis to offer a clearer understanding of the financial commitment associated with car insurance.

Understanding Car Insurance Premiums

Car insurance premiums, or the monthly cost of insurance, are calculated based on a multitude of factors. These factors are carefully assessed by insurance companies to determine the level of risk associated with insuring a particular driver and vehicle. Here, we explore the critical elements that impact insurance costs.

Driver Profile

The characteristics of the driver play a significant role in determining insurance rates. Insurance companies analyze the following aspects of a driver’s profile:

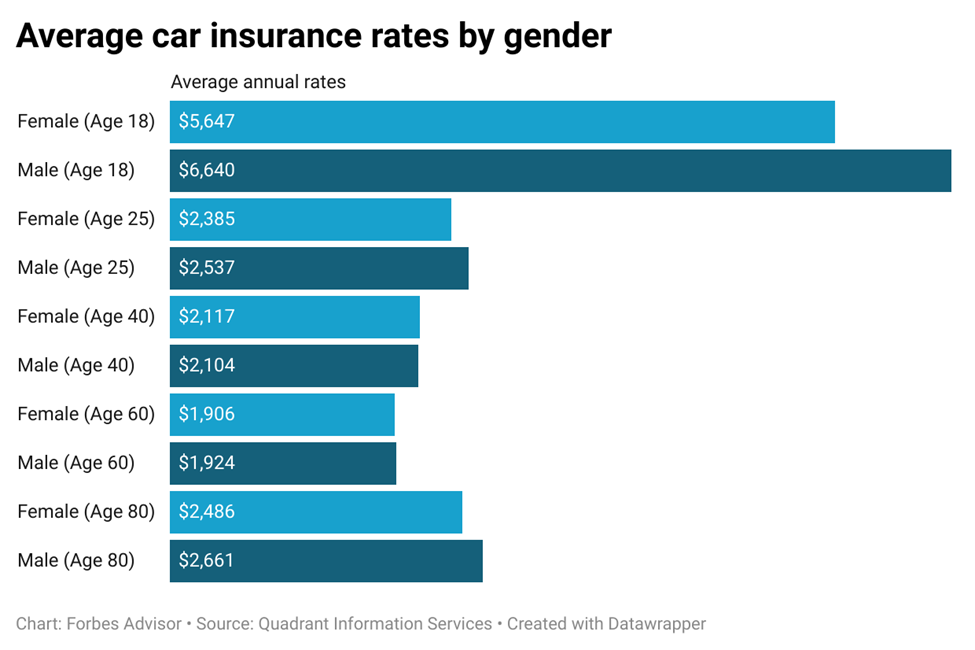

- Age and Gender: Younger drivers, especially males, are often considered higher risk due to their tendency for more aggressive driving. As drivers age, their insurance rates may decrease.

- Driving Record: A clean driving record with no accidents or violations can lead to lower premiums. On the other hand, a history of accidents or traffic violations may result in higher insurance costs.

- Years of Driving Experience: Insurance rates generally decrease as drivers gain more experience on the road.

- Credit Score: Surprisingly, insurance companies may consider credit scores when assessing risk. A higher credit score can sometimes result in lower insurance rates.

Vehicle Details

The type of vehicle and its usage are also crucial factors in determining insurance costs. Here’s what insurance companies take into account:

- Vehicle Make and Model: Some vehicles are more expensive to insure due to their higher repair costs or higher likelihood of theft.

- Vehicle Age and Condition: Older vehicles may have lower insurance costs, while newer, high-end models can be more expensive to insure.

- Vehicle Usage: The purpose of the vehicle’s use, such as personal, business, or pleasure, can impact insurance rates.

- Safety Features: Vehicles equipped with advanced safety features like anti-lock brakes, airbags, and collision avoidance systems may qualify for insurance discounts.

Location and Coverage

The geographic location where the vehicle is registered and garaged can significantly affect insurance rates. Additionally, the level of coverage chosen by the policyholder impacts the monthly premium.

- Location: Insurance rates can vary widely depending on the state, county, or even the specific neighborhood. Factors like crime rates, traffic density, and weather conditions can influence rates.

- Coverage Types and Limits: Car insurance policies typically include liability coverage, comprehensive coverage, and collision coverage. The limits chosen for each coverage type directly impact the monthly premium.

Additional Factors

Several other factors can influence insurance rates. These include:

- Marital Status: Married individuals may receive lower insurance rates, as they are often considered lower-risk drivers.

- Education Level: Some insurance companies offer discounts to individuals with advanced degrees, as they are perceived as lower-risk drivers.

- Occupation: Certain occupations may qualify for insurance discounts, especially if they involve low-risk activities.

- Anti-Theft Devices: Installing approved anti-theft devices in your vehicle can sometimes lead to insurance discounts.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Covers damages caused to others in an accident. |

| Comprehensive Coverage | Covers damages not caused by collision, such as theft, vandalism, or natural disasters. |

| Collision Coverage | Covers damages to your vehicle in an accident. |

Factors Affecting Monthly Premiums

Now, let’s delve deeper into the factors that can influence the monthly cost of car insurance. Understanding these factors can help you make informed decisions to potentially reduce your insurance premiums.

Claims History

Your claims history is a significant factor in determining insurance rates. Insurance companies use this information to assess your risk level. If you have a history of frequent claims, your insurance premiums are likely to be higher. On the other hand, maintaining a clean claims record can lead to more affordable insurance rates over time.

Deductible Amount

The deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your monthly insurance premiums. For example, increasing your deductible from 500 to 1,000 could result in a significant reduction in your monthly insurance cost. However, it’s important to ensure that you can afford the higher deductible in the event of an accident.

Discounts and Bundling

Insurance companies often offer various discounts to attract and retain customers. These discounts can significantly reduce your monthly premiums. Common discounts include:

- Safe Driver Discount: If you have a clean driving record with no accidents or violations, you may qualify for a safe driver discount.

- Multi-Policy Discount: Bundling your car insurance with other policies, such as homeowners or renters insurance, can lead to substantial savings.

- Good Student Discount: Students with good academic standing may be eligible for insurance discounts.

- Low Mileage Discount: If you drive fewer miles annually, you may qualify for a low mileage discount.

- Anti-Theft Device Discount: Installing approved anti-theft devices in your vehicle can result in insurance discounts.

Payment Plans

Insurance companies offer various payment plans to suit different financial situations. While the most common option is monthly payments, some providers offer quarterly, semi-annual, or annual payment plans. Paying your insurance premiums annually or semi-annually can sometimes result in a discount. However, it’s essential to ensure that you have the financial flexibility to make larger payments upfront.

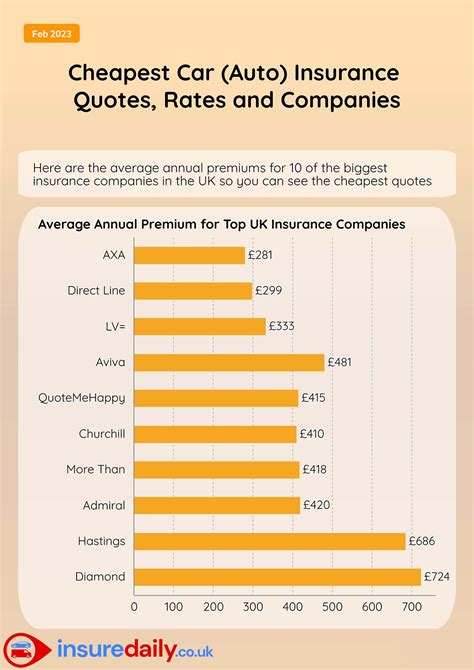

State-Specific Factors

Insurance rates can vary significantly from state to state due to differences in laws, regulations, and the cost of living. Some states have higher insurance premiums due to factors like higher accident rates, stricter liability laws, or higher average repair costs. It’s essential to research the insurance rates in your specific state and understand how these factors impact your monthly premiums.

Analyzing Real-World Insurance Premiums

To provide a more concrete understanding of car insurance costs, let’s analyze some real-world examples. While these examples are based on specific scenarios, they can offer valuable insights into the range of insurance premiums you might encounter.

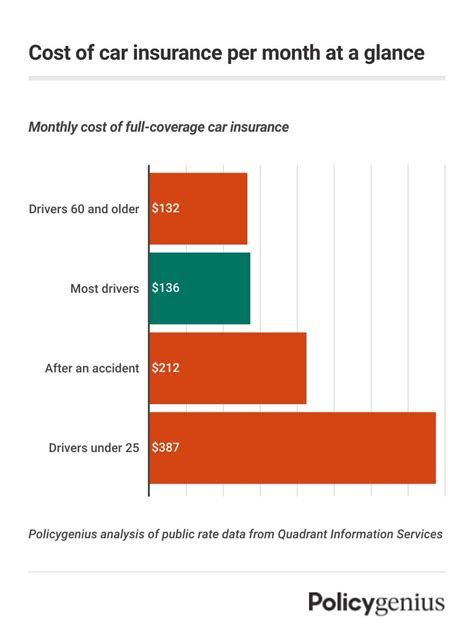

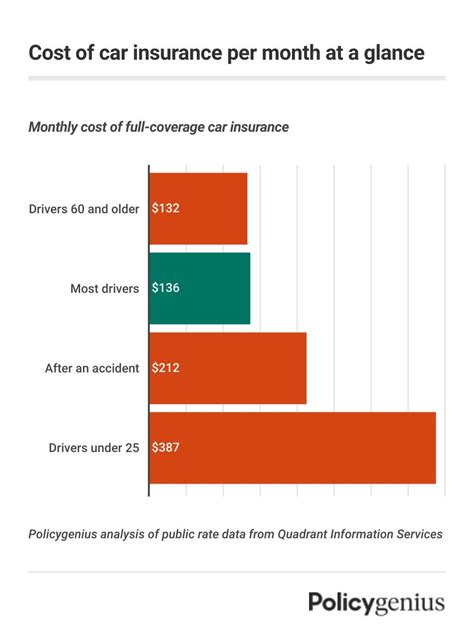

Example 1: Young Driver

John, a 22-year-old male, recently purchased his first car. He has a clean driving record but is considered a higher-risk driver due to his age. John opts for a comprehensive insurance policy with liability limits of 100,000 per person and 300,000 per accident, and a 500 deductible. In this scenario, John's monthly insurance premium could range from 150 to $250, depending on his location and other factors.

Example 2: Middle-Aged Professional

Sarah, a 35-year-old professional, has been driving for over 15 years. She has an excellent driving record with no accidents or violations. Sarah owns a mid-range sedan and chooses a comprehensive insurance policy with liability limits of 250,000 per person and 500,000 per accident, and a 1,000 deductible. In this case, Sarah's monthly insurance premium could be around 100 to $150, depending on her location and other factors.

Example 3: Retired Couple

John and Mary, a retired couple in their 60s, have been married for over 30 years. They own a reliable sedan and have a combined clean driving record. They opt for a basic insurance policy with liability limits of 100,000 per person and 300,000 per accident, and a 500 deductible. The couple's monthly insurance premium could be as low as 75 to $125, depending on their location and other factors.

Future Implications and Strategies

As we navigate the ever-changing landscape of car insurance, it’s essential to stay informed about emerging trends and strategies that can help you optimize your insurance costs. Here, we explore some key considerations for the future.

Telematics and Usage-Based Insurance

Telematics technology, which uses data-collecting devices to monitor driving behavior, is gaining traction in the insurance industry. Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive insurance, is becoming more popular. This type of insurance policy uses telematics data to assess your driving behavior and calculate insurance premiums based on your actual driving habits. If you’re a safe and cautious driver, you may benefit from lower insurance rates through usage-based insurance.

Technology Integration

The integration of technology in the insurance industry is transforming the way policies are priced and managed. Insurtech companies are leveraging artificial intelligence, machine learning, and data analytics to offer more personalized and efficient insurance solutions. These advancements can lead to more accurate risk assessments and potentially lower insurance premiums for policyholders.

Sustainable Practices

The insurance industry is increasingly focusing on sustainability and environmental responsibility. Some insurance companies are offering discounts or incentives for policyholders who adopt eco-friendly practices, such as driving electric vehicles or carpooling. As sustainable practices become more mainstream, insurance companies may further integrate them into their policies, potentially offering additional cost savings to environmentally conscious drivers.

Regulatory Changes

Regulatory changes at the state and federal levels can impact insurance rates. For example, changes in liability laws or mandatory insurance coverage requirements can influence the cost of insurance. Staying informed about any proposed or enacted regulatory changes in your state can help you anticipate potential shifts in insurance premiums and make informed decisions about your coverage.

Conclusion

Understanding the factors that influence car insurance rates is crucial for making informed decisions about your insurance coverage. By considering your driver profile, vehicle details, location, and coverage choices, you can estimate your monthly insurance premiums with greater accuracy. Additionally, exploring discounts, payment plans, and emerging insurance trends can help you optimize your insurance costs and find the best value for your specific circumstances.

FAQ

What is the average cost of car insurance per month?

+The average cost of car insurance per month can vary significantly depending on various factors, including your location, driving record, and the type of vehicle you own. As of [current year], the national average for car insurance premiums is approximately $150 per month. However, it’s important to note that this average can fluctuate based on individual circumstances.

Can I lower my car insurance premiums?

+Yes, there are several strategies you can employ to potentially lower your car insurance premiums. These include maintaining a clean driving record, increasing your deductible, bundling your insurance policies, and taking advantage of available discounts. Additionally, exploring usage-based insurance options and staying informed about industry trends can help you make informed decisions to optimize your insurance costs.

Are there any hidden fees in car insurance policies?

+While car insurance policies typically disclose all applicable fees, it’s essential to carefully review your policy documents and understand any additional charges that may apply. Some common fees include policy administration fees, surcharges for violations or accidents, and state-specific taxes or assessments. It’s advisable to discuss these potential fees with your insurance provider to ensure you have a clear understanding of your overall insurance costs.