How Much Should Car Insurance Cost Per Month

Determining the cost of car insurance per month is a crucial consideration for vehicle owners, as it directly impacts their financial planning and overall budget. The price of car insurance can vary significantly depending on numerous factors, making it essential to understand the influencing variables and how they affect the final cost. This article aims to provide an in-depth analysis of the factors that impact car insurance costs and offer strategies to help drivers find the most cost-effective insurance plans without compromising on coverage.

Understanding the Key Factors that Affect Car Insurance Costs

The cost of car insurance is influenced by a multitude of factors, each playing a unique role in determining the final price. These factors can be broadly categorized into personal, vehicle-related, and environmental factors. By examining each of these categories in detail, we can gain a comprehensive understanding of how car insurance costs are calculated.

Personal Factors

Personal factors are attributes unique to the individual seeking car insurance. These include age, gender, driving history, and credit score. Insurance companies use these factors to assess the level of risk associated with insuring a particular individual. For instance, younger drivers are often considered higher-risk due to their lack of driving experience, leading to higher insurance premiums. Similarly, a history of accidents or traffic violations can result in increased insurance costs. Additionally, a person’s credit score can impact their insurance rates, as it is used as an indicator of financial responsibility.

Vehicle-Related Factors

The type of vehicle you drive and its specific characteristics can significantly influence the cost of your insurance. Make and model, vehicle age, and vehicle usage are key considerations. Sports cars or luxury vehicles, for example, typically attract higher insurance premiums due to their higher replacement and repair costs. Older vehicles, on the other hand, may have lower insurance costs as they are less expensive to repair or replace. The way you use your vehicle also matters; if you primarily use your car for personal use, your insurance costs will likely be lower than if you use it for business or as part of a rideshare service.

Environmental Factors

Environmental factors refer to aspects beyond an individual’s control that can still impact insurance costs. These include location, traffic density, and weather conditions. Living in an area with a high incidence of accidents or theft can lead to increased insurance premiums. Similarly, areas with dense traffic or a high rate of natural disasters may also see higher insurance costs. The weather conditions in a particular region can also play a role; for instance, areas prone to hurricanes or hailstorms may have higher insurance rates due to the increased risk of vehicle damage.

Strategies to Reduce Monthly Car Insurance Costs

While many factors that influence car insurance costs are beyond our control, there are still several strategies that drivers can employ to potentially reduce their monthly insurance expenses. By understanding these strategies and implementing them effectively, drivers can find insurance plans that offer both comprehensive coverage and cost-effectiveness.

Choosing the Right Coverage

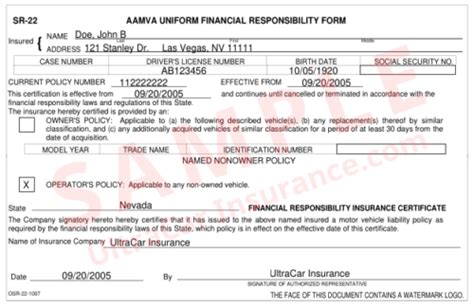

One of the most effective ways to reduce insurance costs is to carefully evaluate your coverage needs and opt for a plan that provides the right amount of coverage for your specific circumstances. This involves understanding the different types of car insurance coverage available, such as liability, collision, comprehensive, and additional coverages like personal injury protection (PIP) or uninsured/underinsured motorist coverage. By choosing a plan that covers only the risks you’re likely to face, you can avoid paying for unnecessary coverage and thereby reduce your insurance costs.

Bundling Insurance Policies

Bundling your insurance policies, such as combining your car insurance with your home or renters insurance, can often lead to significant savings. Many insurance companies offer discounts when you purchase multiple policies from them. By doing so, you not only simplify your insurance management but also potentially reduce your overall insurance costs.

Maintaining a Clean Driving Record

Your driving record is a significant factor in determining your insurance costs. Maintaining a clean driving record, free from accidents and traffic violations, can help keep your insurance premiums low. Insurance companies reward safe drivers with lower rates, so practicing defensive driving and adhering to traffic laws can pay off in the long run.

Comparing Quotes from Multiple Insurers

Shopping around for car insurance quotes from different insurers is a vital step in finding the most cost-effective plan. Each insurance company uses its own formula to calculate premiums, so quotes can vary significantly between providers. By comparing quotes from multiple insurers, you can identify the company that offers the best combination of coverage and cost for your specific circumstances.

Exploring Discounts and Rewards

Insurance companies often offer a variety of discounts and rewards to their policyholders. These can include discounts for safe driving, multi-policy discounts, discounts for taking defensive driving courses, or even rewards for maintaining a long-term relationship with the insurer. By understanding the discounts and rewards available, you can potentially reduce your insurance costs and maximize the value of your insurance plan.

Analyzing Real-World Car Insurance Costs

To better understand the practical implications of the factors that influence car insurance costs, let’s examine some real-world examples. These examples will provide concrete illustrations of how different factors can impact insurance premiums and help drivers make more informed decisions when choosing their insurance plans.

Case Study: Impact of Personal Factors on Insurance Costs

Consider the case of two drivers, both living in the same neighborhood and driving similar vehicles. Driver A is a 25-year-old male with a history of multiple traffic violations and a few accidents. Driver B, on the other hand, is a 35-year-old female with a clean driving record. Despite living in the same area and driving similar cars, Driver A is likely to pay significantly higher insurance premiums than Driver B due to their different personal factors. This example highlights the significant impact that personal factors, such as age and driving history, can have on insurance costs.

Case Study: Influence of Vehicle-Related Factors on Insurance Premiums

Now, let’s examine the influence of vehicle-related factors on insurance costs. Imagine two drivers, both with clean driving records, living in the same area. Driver C owns a high-performance sports car, while Driver D drives a standard sedan. Due to the higher repair and replacement costs associated with sports cars, Driver C is likely to pay higher insurance premiums than Driver D, even though they have the same driving record and live in the same location. This case study illustrates how the make and model of a vehicle can significantly impact insurance costs.

Case Study: Effect of Environmental Factors on Insurance Rates

Finally, let’s explore the effect of environmental factors on insurance rates. Consider two drivers, both with clean driving records and driving similar vehicles. Driver E lives in an urban area with high traffic density and a history of frequent accidents. Driver F, on the other hand, lives in a rural area with less traffic and a lower incidence of accidents. Given the higher risk of accidents in urban areas, Driver E is likely to pay higher insurance premiums than Driver F, despite having the same driving record and vehicle. This case study underscores the significant impact that environmental factors, such as location and traffic density, can have on insurance costs.

Future Implications and Emerging Trends in Car Insurance

The car insurance landscape is continually evolving, influenced by technological advancements, changing consumer behaviors, and shifts in the regulatory environment. Understanding these emerging trends and their potential impact can help drivers and insurers alike prepare for the future and make informed decisions.

The Rise of Telematics and Usage-Based Insurance

One of the most significant emerging trends in car insurance is the increasing use of telematics and usage-based insurance. Telematics involves the use of technology to monitor a vehicle’s usage and driving behavior, providing insurers with real-time data on factors such as miles driven, driving speed, and braking habits. This data can then be used to tailor insurance premiums to an individual’s actual driving behavior. Usage-based insurance, also known as pay-as-you-drive (PAYD) or pay-how-you-drive (PHYD) insurance, is a type of policy where premiums are determined based on this telematics data. By incentivizing safe driving behavior, telematics and usage-based insurance have the potential to revolutionize the car insurance industry, offering consumers more personalized and cost-effective insurance options.

The Impact of Autonomous Vehicles on Insurance

The advent of autonomous vehicles (AVs) is another significant trend that will likely have a profound impact on the car insurance industry. As AVs become more prevalent, the nature of car accidents and the resulting liability issues are likely to shift. While AVs have the potential to significantly reduce the number of accidents caused by human error, they also introduce new risks and challenges, such as software glitches or cyber attacks. These new risks will require insurers to adapt their policies and pricing models to account for the unique characteristics and risks associated with AVs. The insurance industry will need to carefully consider how to allocate liability in accidents involving AVs and develop appropriate coverage options to meet the needs of this evolving market.

The Role of Digital Transformation in Car Insurance

Digital transformation is another key trend shaping the future of car insurance. With the increasing adoption of digital technologies, insurers are leveraging these tools to enhance their operational efficiency, improve customer experience, and reduce costs. Digital platforms enable insurers to offer more personalized and convenient services, such as online policy management, real-time claims processing, and digital payment options. Additionally, digital transformation is facilitating the integration of advanced analytics and artificial intelligence (AI) into insurance processes, enabling more accurate risk assessment and pricing. By embracing digital transformation, insurers can stay competitive, improve their operational effectiveness, and deliver more value to their customers.

The Future of Car Insurance: A Summary

In conclusion, the future of car insurance is poised for significant transformation, driven by technological advancements, changing consumer behaviors, and evolving regulatory environments. The rise of telematics and usage-based insurance is revolutionizing how insurance premiums are determined, offering consumers more personalized and cost-effective options. The advent of autonomous vehicles is introducing new risks and challenges that insurers must navigate, while digital transformation is enabling insurers to enhance their operational efficiency and deliver more personalized services. As these trends continue to shape the car insurance landscape, insurers and consumers alike will need to stay agile and adapt to these changes to ensure they remain competitive and meet the evolving needs of the market.

How much does the average car insurance cost per month?

+The average cost of car insurance can vary significantly depending on numerous factors, including the driver’s age, gender, driving history, credit score, the type of vehicle, its age and usage, as well as environmental factors such as location, traffic density, and weather conditions. As such, providing an exact average cost is challenging. However, according to data from the Insurance Information Institute, the average annual cost of car insurance in the United States was approximately 1,674 in 2021, which equates to around 139 per month.

What factors can I control to reduce my car insurance costs?

+While many factors that influence car insurance costs are beyond your control, there are several strategies you can employ to potentially reduce your monthly insurance expenses. These include choosing the right coverage, bundling insurance policies, maintaining a clean driving record, comparing quotes from multiple insurers, and exploring discounts and rewards offered by insurance companies.

Are there any ways to get cheaper car insurance for young drivers?

+Yes, there are several strategies that young drivers can employ to potentially reduce their car insurance costs. These include maintaining a clean driving record, choosing a safe and affordable vehicle, considering usage-based insurance policies, and exploring discounts such as good student discounts or multi-policy discounts. Additionally, young drivers can also benefit from bundling their car insurance with other policies, such as homeowners or renters insurance, to potentially save on overall insurance costs.