How Much Would Home Insurance Cost

The cost of home insurance is a topic that often sparks curiosity among homeowners and prospective buyers alike. While it's challenging to provide an exact figure without considering individual circumstances, we can delve into the factors that influence the cost of home insurance and offer a comprehensive understanding of this essential financial consideration.

Understanding the Cost of Home Insurance

Home insurance premiums can vary significantly based on a multitude of factors, making it difficult to provide a precise universal cost. However, by examining these variables, we can gain insight into the potential range of expenses and make informed decisions regarding our home insurance coverage.

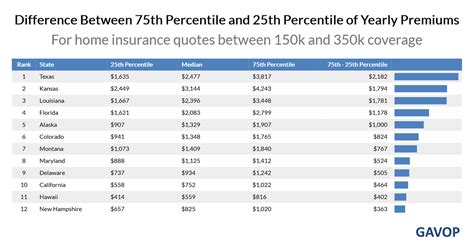

Location, Location, Location

One of the primary determinants of home insurance rates is the location of your property. Insurance providers consider various geographical factors, including the region’s susceptibility to natural disasters, crime rates, and the overall cost of living. Areas prone to hurricanes, earthquakes, or severe weather events typically incur higher insurance premiums due to the increased risk of damage.

For instance, in regions with a history of hurricanes, such as the Gulf Coast or the Atlantic Coast, homeowners may face higher insurance costs to account for the potential devastation these storms can cause. Similarly, areas with high crime rates may require additional coverage for theft or vandalism, impacting the overall insurance premium.

The Value of Your Home

The replacement cost of your home is a significant factor in determining insurance premiums. Insurance companies assess the value of your property, including its structural integrity, the materials used in construction, and any unique features. Homes built with expensive materials or in high-end neighborhoods may attract higher insurance costs to adequately cover the replacement value.

Consider a luxury mansion in an exclusive suburb. The intricate architecture, high-quality materials, and custom finishes would likely result in a substantial replacement cost, leading to higher insurance premiums to protect the homeowner’s investment.

Your Personal Profile

Insurance companies also consider the personal characteristics of the homeowner when calculating premiums. Factors such as age, marital status, and credit score can influence the perceived risk associated with insuring a property. Younger homeowners, for example, may be considered higher risk due to their limited financial history and potential for more impulsive behavior.

Additionally, insurance providers may offer discounts or incentives for homeowners who have a stable financial history, a good credit score, or who have taken steps to improve the security of their home, such as installing an alarm system or reinforcing doors and windows.

Coverage Options and Deductibles

The level of coverage you choose and the associated deductibles can significantly impact your insurance premiums. Home insurance policies typically offer a range of coverage options, including protection for the structure of the home, personal belongings, liability, and additional living expenses in the event of a covered loss.

Opting for a higher level of coverage or lower deductibles will generally result in increased premiums. It’s essential to strike a balance between the coverage you need and the cost of your insurance policy to ensure you’re adequately protected without paying excessive premiums.

| Coverage Type | Description |

|---|---|

| Dwelling Coverage | Protects the physical structure of your home, including repairs or rebuilding costs. |

| Personal Property Coverage | Covers the cost of replacing or repairing your personal belongings, such as furniture, electronics, and clothing. |

| Liability Coverage | Provides protection if someone is injured on your property or if you're found legally responsible for causing property damage or bodily injury to others. |

| Additional Living Expenses | Covers the cost of temporary housing and additional expenses if your home becomes uninhabitable due to a covered loss. |

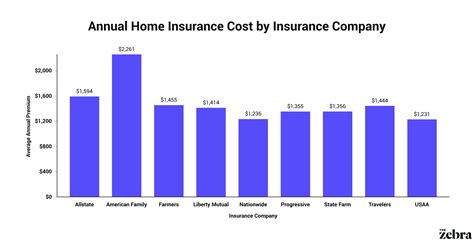

Insurance Provider and Policy Features

The insurance company you choose and the specific policy features can also impact the cost of your home insurance. Different providers offer varying levels of coverage, customer service, and additional benefits, such as discounts for bundling policies or loyalty rewards.

It’s essential to compare quotes from multiple insurance companies to ensure you’re getting the best value for your money. Additionally, reviewing the fine print and understanding the exclusions and limitations of each policy is crucial to avoid any surprises in the event of a claim.

Factors Influencing Home Insurance Costs

Beyond the basic factors outlined above, several other variables can influence the cost of your home insurance policy. These factors may vary depending on your specific circumstances and the insurance provider you choose.

Construction Type and Age of the Home

The construction type and age of your home can impact insurance costs. Older homes may require more extensive repairs or use outdated materials, increasing the risk of damage and potentially resulting in higher premiums. Additionally, certain construction types, such as those with unique architectural features or specialized materials, may attract higher insurance costs due to the increased complexity and cost of repairs.

Past Claims History

Your past claims history is a critical factor in determining insurance premiums. Insurance companies carefully consider the frequency and severity of previous claims when assessing the risk associated with insuring your home. A history of multiple claims, particularly for high-value losses, may lead to increased premiums or even difficulty in finding coverage.

It’s essential to maintain a clean claims history by taking steps to prevent potential losses, such as regularly maintaining your home and addressing any potential hazards promptly. Additionally, understanding your policy’s coverage limits and deductibles can help you make informed decisions when filing a claim, ensuring you only claim for significant losses that are covered by your policy.

Discounts and Bundling Opportunities

Insurance providers often offer discounts and bundling opportunities to attract and retain customers. These incentives can significantly reduce your insurance premiums and make home insurance more affordable.

Some common discounts include:

- Multi-Policy Discount: Bundling your home insurance with other policies, such as auto insurance, can result in substantial savings.

- Safety Discounts: Installing security systems, smoke detectors, or fire sprinklers may qualify you for discounts, as these measures reduce the risk of theft and fire-related claims.

- Loyalty Discounts: Staying with the same insurance provider for an extended period may result in loyalty discounts or rewards.

- New Homeowner Discounts: Some insurance companies offer incentives to new homeowners, recognizing the effort and investment involved in purchasing a home.

Insurance Score and Risk Assessment

Insurance companies use a variety of methods to assess risk and determine premiums. One common approach is the insurance score, which is based on your credit score and other financial information. A higher insurance score generally indicates a lower risk and may result in lower premiums.

Additionally, insurance providers may use risk assessment tools to evaluate the likelihood of various types of losses, such as fire, theft, or natural disasters. These assessments help insurance companies accurately price the risk associated with insuring your home and ensure they can provide the necessary coverage.

Tips for Lowering Home Insurance Costs

While the cost of home insurance can vary significantly, there are several strategies you can employ to potentially lower your premiums and make your insurance more affordable.

Shop Around and Compare Quotes

One of the most effective ways to find the best home insurance rate is to shop around and compare quotes from multiple insurance providers. Each company uses its own methodology to assess risk and price policies, so obtaining quotes from several sources can help you identify the most competitive rates.

Online insurance comparison tools can be a convenient way to quickly gather quotes from multiple providers. However, it’s essential to carefully review the coverage details and policy exclusions to ensure you’re comparing apples to apples.

Increase Your Deductible

Choosing a higher deductible can significantly reduce your insurance premiums. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. By selecting a higher deductible, you’re accepting more financial responsibility in the event of a covered loss, which can result in lower premiums.

However, it’s crucial to ensure you can afford the increased deductible in the event of a claim. Carefully consider your financial situation and choose a deductible that strikes a balance between affordability and potential savings.

Bundle Policies and Explore Discounts

Bundling your home insurance with other policies, such as auto insurance, can result in substantial savings. Many insurance providers offer multi-policy discounts, recognizing the convenience and loyalty of customers who choose to consolidate their insurance needs.

Additionally, explore other potential discounts, such as safety discounts for installing security systems or loyalty discounts for long-term customers. By taking advantage of these incentives, you can reduce your insurance costs without sacrificing coverage.

Maintain a Clean Claims History

As mentioned earlier, your past claims history is a critical factor in determining insurance premiums. By maintaining a clean claims history, you can avoid the potential for increased premiums or difficulty in finding coverage.

It’s essential to understand your policy’s coverage limits and deductibles to ensure you only file claims for significant losses that are covered by your policy. Additionally, regularly maintaining your home and addressing potential hazards promptly can help prevent future claims and keep your insurance costs in check.

Improve Your Home’s Security

Investing in home security measures can not only provide peace of mind but also potentially lower your insurance premiums. Insurance providers often offer discounts for homes equipped with security systems, smoke detectors, or fire sprinklers, as these measures reduce the risk of theft and fire-related claims.

Consider installing a monitored security system, reinforcing doors and windows, or adding motion-activated lighting to enhance your home’s security. These improvements not only protect your property but may also result in savings on your insurance policy.

Conclusion: The Value of Home Insurance

While the cost of home insurance can vary significantly based on a multitude of factors, it’s essential to recognize the value and importance of this coverage. Home insurance provides financial protection in the event of a covered loss, ensuring you can rebuild and recover from unforeseen events such as natural disasters, theft, or accidents.

By understanding the factors that influence insurance premiums and employing strategies to lower your costs, you can find a balance between adequate coverage and affordable premiums. Regularly reviewing your policy, comparing quotes, and taking advantage of discounts and bundling opportunities can help you make informed decisions and ensure your home insurance remains a valuable investment.

How often should I review my home insurance policy?

+It’s recommended to review your home insurance policy annually to ensure it aligns with your current needs and circumstances. Life changes, such as renovations, additions to your home, or significant personal property acquisitions, may require adjustments to your coverage limits or policy features.

Can I negotiate my home insurance premiums?

+While insurance premiums are primarily based on risk assessment and predetermined rates, you can still negotiate with your insurance provider to explore potential discounts or coverage adjustments. Discussing your specific circumstances and needs with your insurance agent may help identify opportunities to lower your premiums.

What should I do if I’m denied home insurance coverage?

+Being denied home insurance coverage can be a challenging situation. If this occurs, it’s essential to understand the reason for the denial and explore alternative options. Consider reaching out to insurance brokers who specialize in high-risk properties or explore the FAIR plan (Fair Access to Insurance Requirements) in your state, which provides basic property insurance coverage for homeowners who cannot obtain coverage through standard means.