How To Buy Your Own Health Insurance

Navigating the complex world of health insurance can be daunting, especially when you're looking to purchase coverage for yourself. With a myriad of options, plans, and providers to choose from, it's essential to approach this process with knowledge and strategy. This comprehensive guide aims to demystify the process of buying your own health insurance, offering insights and practical steps to ensure you make informed decisions about your healthcare coverage.

Understanding the Basics: What is Health Insurance?

Health insurance is a contractual agreement between an individual and an insurance company, wherein the individual pays a premium to the insurer, who in turn agrees to cover a portion of their medical expenses. This coverage extends to a wide range of healthcare services, including doctor visits, hospital stays, prescription medications, and more. By spreading the financial risk across a large pool of individuals, health insurance provides access to quality healthcare at an affordable cost.

Key Components of Health Insurance Plans

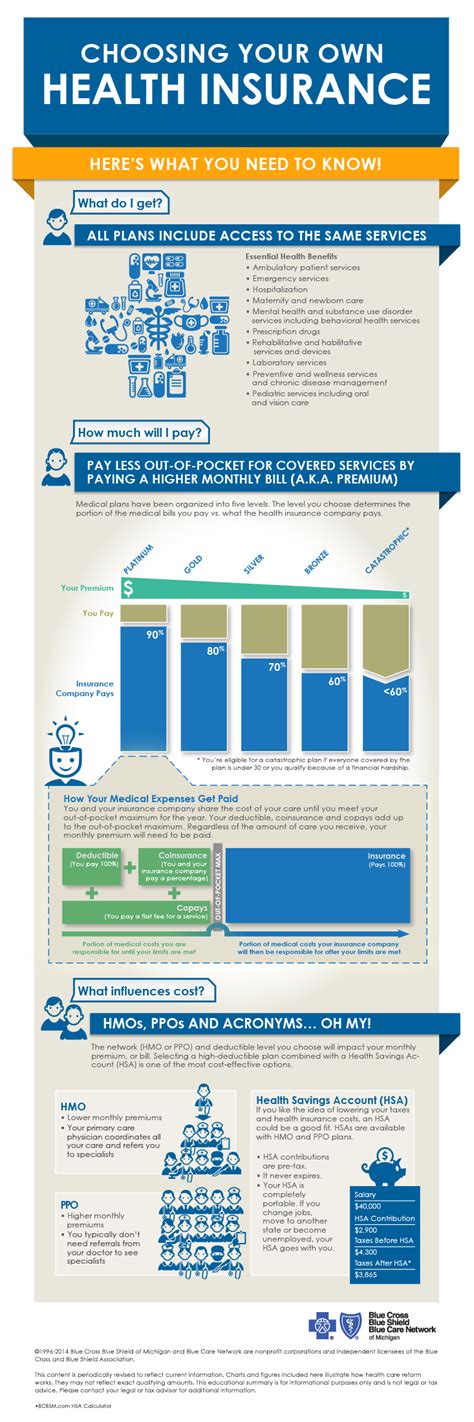

When exploring health insurance options, it’s crucial to understand the fundamental elements of a plan. These typically include:

- Premiums: The amount you pay regularly (usually monthly) to maintain your health insurance coverage.

- Deductibles: The amount you must pay out-of-pocket before your insurance coverage begins.

- Copayments: A fixed amount you pay for a covered medical service, typically at the time of service.

- Coinsurance: Your share of the costs of a covered health care service, calculated as a percent (for example, 20%) of the allowed amount for the service.

- Out-of-Pocket Maximum: The limit on the amount you pay during a policy period (usually a year) before your insurance company starts to pay 100% of the allowed amount for covered services.

Assessing Your Needs: The First Step to Buying Health Insurance

Before you begin shopping for health insurance, it’s essential to assess your individual needs. Consider the following factors:

- Your current health status and any pre-existing conditions.

- The healthcare services you anticipate needing in the near future (e.g., regular doctor visits, prescription medications, mental health services, etc.)

- Your financial situation and ability to pay premiums and out-of-pocket expenses.

- Whether you prefer a more comprehensive plan with higher premiums and lower out-of-pocket costs, or a more limited plan with lower premiums and higher out-of-pocket costs.

Understanding Your Healthcare Utilization

Take some time to reflect on your past and anticipated healthcare needs. Have you had any significant medical issues or surgeries in the recent past? Do you anticipate any upcoming medical procedures or treatments? Understanding your healthcare utilization can help you choose a plan that adequately covers your needs without being overly expensive.

Exploring Your Options: Types of Health Insurance Plans

There are several types of health insurance plans available, each with its own set of features and benefits. The most common include:

Health Maintenance Organizations (HMOs)

HMOs typically provide comprehensive coverage but with more restrictions. You must choose a primary care physician (PCP) within the HMO’s network, who coordinates all your healthcare services. Referrals are required for specialist care. HMOs often have lower out-of-pocket costs but may limit your choice of healthcare providers.

| Pros | Cons |

|---|---|

| Comprehensive coverage | Limited choice of providers |

| Lower out-of-pocket costs | Need for referrals to specialists |

| Preventive care emphasis | More administrative requirements |

Preferred Provider Organizations (PPOs)

PPOs offer more flexibility in choosing healthcare providers. You can see any provider within the PPO’s network without a referral, and you may even visit out-of-network providers for an additional cost. PPOs often have higher out-of-pocket costs but provide more freedom in selecting healthcare professionals.

| Pros | Cons |

|---|---|

| More provider choice | Higher out-of-pocket costs |

| No referral needed for specialists | Limited coverage for out-of-network care |

| Fewer administrative requirements | May not cover all preventive care services |

Exclusive Provider Organizations (EPOs)

EPOs are similar to PPOs in that they offer a network of providers to choose from without the need for referrals. However, EPOs do not cover out-of-network care, making them a more limited option. EPOs often have lower premiums and out-of-pocket costs but provide less flexibility in provider choice.

Point of Service (POS) Plans

POS plans combine features of HMOs and PPOs. You choose a primary care physician (PCP) and receive comprehensive coverage within the network. However, you can also visit out-of-network providers for an additional cost, similar to a PPO. POS plans offer flexibility but may have higher out-of-pocket costs.

High Deductible Health Plans (HDHPs)

HDHPs are often paired with Health Savings Accounts (HSAs) and have high deductibles, meaning you pay more out-of-pocket before your insurance coverage kicks in. However, HDHPs often have lower premiums, and the HSA allows you to save money pre-tax for medical expenses.

Researching Insurance Providers

Once you have a basic understanding of the types of health insurance plans available, it’s time to start researching insurance providers. Consider the following factors:

- Reputation and financial stability of the insurance company.

- Network of healthcare providers (doctors, hospitals, specialists) in your area.

- Customer service ratings and reviews.

- Coverage options and plan details (e.g., deductibles, copays, covered services, etc.)

- Additional benefits or perks, such as wellness programs or travel coverage.

Comparing Plan Costs and Benefits

When comparing health insurance plans, it’s essential to look beyond just the premiums. Consider the overall cost of the plan, including deductibles, copays, and any out-of-pocket maximums. Evaluate the plan’s coverage for your anticipated healthcare needs, and assess whether the plan includes your preferred healthcare providers.

| Plan A | Plan B |

|---|---|

| Monthly Premium: $300 | Monthly Premium: $250 |

| Deductible: $2,000 | Deductible: $3,000 |

| Copay: $20 | Copay: $30 |

| Out-of-Pocket Max: $5,000 | Out-of-Pocket Max: $6,000 |

Applying for Health Insurance

Once you’ve narrowed down your options and chosen a health insurance plan, it’s time to apply. The application process typically involves providing personal and health-related information, including:

- Personal details (name, date of birth, address, etc.)

- Health information (current and past medical conditions, medications, etc.)

- Employment status and income (for tax credit eligibility)

- Social Security number (for verification and tax credit purposes)

Open Enrollment and Special Enrollment Periods

In the United States, health insurance plans typically have an Open Enrollment Period, a set time each year when anyone can apply for or change their health insurance plan. Outside of this period, you may only be able to enroll or change plans if you have a Qualifying Life Event, such as marriage, birth of a child, or loss of other health coverage.

Managing Your Health Insurance

Once you’ve purchased your health insurance plan, it’s important to understand how to use it effectively. This includes understanding your benefits, knowing how to access care, and staying informed about any changes to your plan or coverage.

Understanding Your Benefits

Take the time to carefully review your policy documents and understand your benefits. Know what services are covered, what your out-of-pocket costs will be, and how to access your insurance provider’s member services or online portal for additional information and support.

Choosing a Primary Care Physician (PCP)

If your plan requires a PCP, choose a doctor who is convenient for you and accepts your insurance. Your PCP will be your main point of contact for healthcare services and can guide you through your healthcare journey.

Using Your Insurance for Healthcare Services

When seeking medical care, be sure to provide your insurance information to the healthcare provider. Understand your financial responsibility (copays, deductibles, etc.) and know your rights as a patient. If you have any questions or concerns about your coverage or billing, reach out to your insurance provider’s member services for assistance.

Staying Informed and Engaged

Keep yourself informed about changes to your plan, such as updates to your network of providers, changes in covered services, or increases in premiums. Engage with your insurance provider and healthcare professionals to ensure you’re getting the most out of your health insurance coverage.

Frequently Asked Questions (FAQ)

What happens if I miss the Open Enrollment Period and don’t have a Qualifying Life Event?

+

If you miss the Open Enrollment Period and don’t have a Qualifying Life Event, you may have to wait until the next Open Enrollment Period to enroll in a new plan. However, some states and insurance companies offer Special Enrollment Periods for specific circumstances, so it’s worth checking with your state’s insurance department or the insurance provider.

Can I switch health insurance plans during the year?

+

In most cases, you cannot switch health insurance plans during the year unless you experience a Qualifying Life Event, such as getting married, having a baby, or losing other health coverage. These events typically trigger a Special Enrollment Period, allowing you to enroll in a new plan outside of the regular Open Enrollment Period.

What if I can’t afford the health insurance premiums?

+

If you’re struggling to afford health insurance premiums, you may be eligible for financial assistance. The Affordable Care Act (ACA) provides tax credits to help individuals and families with low to moderate incomes afford coverage. These tax credits can lower your monthly premium and are based on your income and family size. Check with your state’s insurance department or the insurance provider to see if you qualify.

How do I know if a healthcare provider is in-network with my insurance plan?

+

You can typically check a provider’s in-network status by searching their name on your insurance provider’s website or member portal. You may also call the provider’s office directly to inquire about their network participation. Remember, using in-network providers can result in lower out-of-pocket costs.

What happens if I don’t have health insurance and need medical care?

+

If you don’t have health insurance and need medical care, you may be responsible for paying the full cost of your treatment. This can be very expensive, and you may face financial hardship. It’s always best to have health insurance to protect yourself from unexpected medical expenses. If you’re facing an emergency and need immediate medical attention, you should still seek care, even if you don’t have insurance. Many hospitals and clinics offer financial assistance programs for those without insurance.