How To Figure Mortgage Insurance

Mortgage insurance is an essential component of homeownership, providing protection for both borrowers and lenders in case of default. Understanding how mortgage insurance works is crucial for anyone considering buying a home, as it can significantly impact your monthly payments and overall financial planning. In this comprehensive guide, we will delve into the world of mortgage insurance, exploring its purpose, different types, and how you can calculate and manage it effectively.

Understanding Mortgage Insurance

Mortgage insurance, often referred to as MI or PMI (Private Mortgage Insurance), is a safeguard designed to protect lenders from potential losses in the event that a borrower defaults on their mortgage loan. It serves as a crucial risk-mitigating measure, especially for homebuyers who make a down payment of less than 20% of the home’s purchase price.

The primary purpose of mortgage insurance is to offer lenders confidence and security, knowing that even if a borrower cannot repay the loan, the insurance will cover a portion of the remaining balance. This encouragement is especially beneficial for first-time homebuyers or those with limited savings, as it enables them to access homeownership without the traditional 20% down payment requirement.

Who Needs Mortgage Insurance?

Mortgage insurance is typically required for conventional loans when the borrower’s down payment is less than 20% of the home’s purchase price. However, it’s essential to note that not all loans with low down payments require mortgage insurance. For instance, FHA loans have their own mortgage insurance requirements, which differ from conventional loans.

Additionally, certain loan programs, such as those backed by the Department of Veterans Affairs (VA) or the U.S. Department of Agriculture (USDA), may have unique mortgage insurance requirements or even waive the need for it entirely.

Types of Mortgage Insurance

There are several types of mortgage insurance, each with its own characteristics and requirements:

- Private Mortgage Insurance (PMI): PMI is commonly associated with conventional loans and is typically required when the down payment is less than 20%. It can be canceled once the borrower reaches a certain equity threshold, usually 20% loan-to-value (LTV) ratio.

- FHA Mortgage Insurance: FHA loans require mortgage insurance, known as Mortgage Insurance Premium (MIP). Unlike PMI, MIP is mandatory for the life of the loan and cannot be canceled unless the loan is refinanced.

- VA Mortgage Insurance: Loans backed by the VA have a funding fee, which serves as a form of mortgage insurance. This fee can be financed as part of the loan or paid in cash at closing. The VA funding fee varies based on factors like military status, down payment amount, and whether it's the veteran's first VA loan.

- USDA Mortgage Insurance: USDA loans also have their own mortgage insurance, referred to as an upfront guarantee fee and an annual fee. The upfront fee can be financed, while the annual fee is included in the monthly mortgage payment.

Calculating Mortgage Insurance

Determining the cost of mortgage insurance involves considering various factors, including the loan type, loan-to-value ratio, credit score, and loan term. Here’s a breakdown of how mortgage insurance is typically calculated:

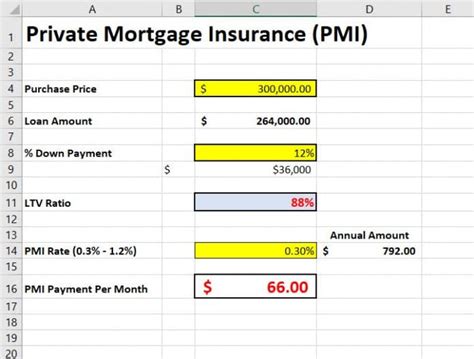

Private Mortgage Insurance (PMI)

PMI rates can vary based on the borrower’s credit score, loan-to-value ratio, and loan term. Generally, PMI premiums are expressed as a percentage of the loan amount and are calculated annually. However, they are typically added to the monthly mortgage payment.

For instance, if your loan amount is $200,000 and your PMI rate is 0.5% annually, your annual PMI premium would be $1,000 ($200,000 x 0.005). Dividing this amount by 12 months gives you a monthly PMI payment of approximately $83.33 ($1,000 / 12). This amount would be added to your monthly mortgage payment until you reach the necessary equity threshold to cancel PMI.

FHA Mortgage Insurance

FHA loans have both an upfront mortgage insurance premium (UFMIP) and an annual mortgage insurance premium (MIP). The UFMIP is typically financed as part of the loan and is calculated as a percentage of the loan amount. For instance, for loans with an LTV of 90% or less, the UFMIP is 1.75% of the loan amount.

The annual MIP for FHA loans also varies based on factors like loan term and LTV. For instance, for a 30-year loan with an LTV of more than 90%, the annual MIP is 0.85% of the loan amount. Similar to PMI, the annual MIP is divided by 12 to determine the monthly MIP payment.

VA and USDA Mortgage Insurance

The VA funding fee is calculated as a percentage of the loan amount and varies based on factors like military status, down payment, and loan purpose. For instance, active-duty military members with no down payment may pay a funding fee of 2.3% of the loan amount. This fee can be financed as part of the loan or paid in cash at closing.

USDA loans have an upfront guarantee fee, which is 1% of the loan amount, and an annual fee, which is 0.35% of the outstanding loan balance. Both fees are typically financed as part of the loan.

Managing Mortgage Insurance

Understanding how to manage mortgage insurance is crucial for borrowers to optimize their financial planning. Here are some key strategies and considerations:

PMI Cancellation

For conventional loans with PMI, borrowers can request cancellation of PMI once they reach a specific equity threshold, typically 20% LTV. However, lenders may have their own requirements, so it’s essential to check with your lender for their specific policies.

To determine your LTV, you'll need to know the current value of your home. This can be done through a professional appraisal or by checking recent sales of comparable homes in your area. Once you have the current home value, you can calculate your LTV by dividing your remaining loan balance by the home's value.

If your LTV reaches 80% or less, you can request PMI cancellation. However, some lenders may require an additional appraisal to confirm the home's value before canceling PMI.

Refinancing

Refinancing your mortgage can be an effective way to manage mortgage insurance. By refinancing into a conventional loan with a higher LTV, you may be able to eliminate PMI altogether. Alternatively, if you have an FHA loan, refinancing can allow you to switch to a conventional loan, potentially reducing or eliminating mortgage insurance costs.

It's important to consider the costs and benefits of refinancing, as there may be fees and closing costs associated with the process. Additionally, refinancing may result in a higher interest rate or a longer loan term, so it's crucial to weigh these factors carefully.

Increasing Home Value

Increasing the value of your home can help reduce your LTV and potentially eliminate the need for mortgage insurance. Home improvements, such as remodeling the kitchen or bathroom, adding a deck or patio, or upgrading the landscaping, can boost your home’s value and equity.

It's essential to choose improvements that are likely to provide a good return on investment and to consider the local real estate market when making decisions about home upgrades. Consulting with a real estate professional or home improvement expert can provide valuable insights into which projects are most likely to increase your home's value.

Making Extra Payments

Making extra payments on your mortgage principal can help reduce your loan balance and, consequently, your LTV. By paying down your mortgage faster, you can reach the 20% equity threshold required for PMI cancellation more quickly.

It's important to check with your lender to ensure that extra payments are applied directly to the principal. Some lenders may apply extra payments to future interest or escrow accounts, which may not result in a reduction of your loan balance.

Future Implications and Considerations

Mortgage insurance plays a significant role in the home buying process, and understanding its implications is crucial for long-term financial planning. Here are some key considerations:

Impact on Monthly Payments

Mortgage insurance can significantly impact your monthly mortgage payments. For instance, a 200,000 loan with a 4% interest rate and PMI of 0.5% can result in a monthly payment of approximately 1,007. This includes the monthly PMI premium of 83.33. In comparison, without PMI, the monthly payment would be approximately 921.

It's essential to consider the long-term impact of mortgage insurance on your financial goals. While it may be necessary to pay mortgage insurance to secure a loan, understanding how it affects your monthly budget is crucial for effective financial planning.

Changing Mortgage Insurance Requirements

Mortgage insurance requirements can vary over time and may be subject to changes in government policies or lending regulations. It’s important to stay informed about any updates or modifications to mortgage insurance requirements for different loan types. Keeping abreast of these changes can help you make informed decisions when applying for a mortgage or refinancing.

The Role of Credit Score

Your credit score plays a significant role in determining your mortgage insurance rate. Generally, borrowers with higher credit scores can qualify for lower mortgage insurance rates. Maintaining a good credit score can help you secure more favorable terms and potentially reduce the cost of mortgage insurance.

It's essential to monitor your credit score regularly and take steps to improve it if needed. Paying bills on time, reducing credit card balances, and avoiding unnecessary credit inquiries are some strategies to help boost your credit score.

The Benefits of a Larger Down Payment

Making a larger down payment can have several advantages, including potentially avoiding mortgage insurance altogether. A down payment of 20% or more can eliminate the need for PMI on conventional loans. Additionally, a larger down payment can result in a lower loan-to-value ratio, which may lead to lower interest rates and more favorable loan terms.

While saving for a larger down payment can be challenging, it can provide significant financial benefits in the long run. It's essential to carefully consider your financial situation and savings goals when deciding on the size of your down payment.

Conclusion

Mortgage insurance is an essential aspect of homeownership, providing protection for both borrowers and lenders. Understanding the different types of mortgage insurance, how they are calculated, and strategies for managing them can help you make informed decisions about your home purchase or refinance. By staying informed and proactive, you can navigate the world of mortgage insurance with confidence and ensure a smooth path to homeownership.

Can I avoid mortgage insurance altogether?

+Avoiding mortgage insurance entirely depends on the loan type and your down payment amount. For conventional loans, a down payment of 20% or more can eliminate the need for PMI. However, for government-backed loans like FHA, VA, and USDA, mortgage insurance is typically mandatory and cannot be avoided.

How long do I have to pay mortgage insurance?

+The duration of mortgage insurance payments varies depending on the loan type and your equity in the home. For conventional loans with PMI, you can typically request cancellation once you reach an LTV of 80% or less. FHA loans, on the other hand, require mortgage insurance for the life of the loan unless you refinance into a conventional loan.

Can I refinance to remove mortgage insurance?

+Yes, refinancing can be an effective way to remove mortgage insurance. By refinancing into a conventional loan with a higher LTV, you may be able to eliminate PMI. Additionally, refinancing from an FHA loan to a conventional loan can also reduce or eliminate mortgage insurance costs.

What happens if I can’t afford the mortgage insurance payments?

+If you’re struggling to afford mortgage insurance payments, it’s important to reach out to your lender or a housing counselor for assistance. They can provide guidance on options like loan modification or other programs that may help make your mortgage more affordable.